Weak Fiscal 3Q17 Sales Lower Starbucks’s Valuation Multiple

Valuation multiple We’ve used the forward PE (price-to-earnings) multiple for our analysis, due to its high visibility in Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for the next four quarters. Starbucks’s forward PE multiple Starbucks’ lower-than-expected SSSG (same-store sales growth) in fiscal 3Q17, lowering of […]

Dec. 4 2020, Updated 10:53 a.m. ET

Valuation multiple

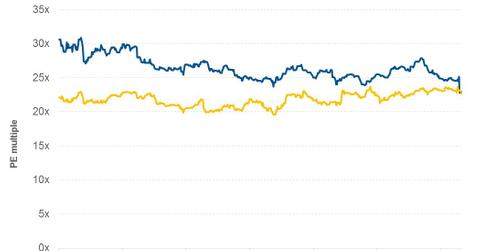

We’ve used the forward PE (price-to-earnings) multiple for our analysis, due to its high visibility in Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for the next four quarters.

Starbucks’s forward PE multiple

Starbucks’ lower-than-expected SSSG (same-store sales growth) in fiscal 3Q17, lowering of fiscal 2017 EPS (earnings per share) guidance, and announcement of the closing of all 379 of its Teavana stores appear to have made investors skeptical about Starbucks’s future earnings, impacting its stock price and forward PE multiple. As of July 31, 2017, Starbucks was trading at a forward PE multiple of 22.9x, compared with 25.2x before the announcement of its fiscal 3Q17 earnings.

As shown in the above graph, Starbucks is trading above its peer median. However, the gap has closed recently due to lower-than-expected SSSG in the last three quarters. On the same day, peers Dunkin’ Brands (DNKN), McDonald’s (MCD), and Domino’s Pizza (DPZ) were trading at forward PE multiples of 20.7x, 22.7x, and 29.4x, respectively.

Growth prospects

To enhance customer experience and improve its SSSG, Starbucks has implemented technological advancements, such as Digital Order Manager and Mobile Order & Pay, during busy hours. Management is also focusing on the development of new and remodeled stores with greater spacing and production capacity, an enhanced labor scheduling platform, and new production sequencing software. These initiatives are expected to boost the company’s expenditure. If these initiatives fail to generate sales as expected, the increased expenses could put pressure on the company’s margins, lowering its EPS.

For the next four quarters, analysts expect the company’s EPS to rise by 9.1%, which could have been factored into its current stock price. If Starbucks posts earnings lower than analysts’ estimates, selling pressure could lower its stock price and valuation multiple. Next, we’ll look at analysts’ recommendations for Starbucks.