McDonald's Corp

Latest McDonald's Corp News and Updates

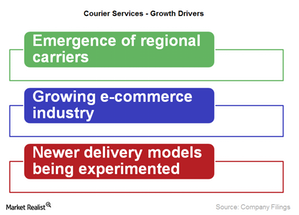

The Key Trends that Could Shape the Courier Industry in 2015

The US has witnessed the emergence of a number of regional carriers such as OnTrac and Eastern Connection, which are providing cheaper, faster delivery options.

How Starbucks Is Leveraging Its Star Rewards Program

According to Starbucks (SBUX) management, the company’s My Starbucks Reward program helps increase customer loyalty.

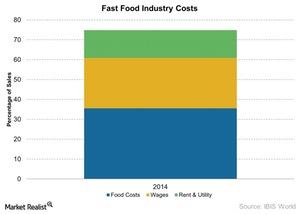

How Commodities Play an Important Role in the Restaurant Industry

Agricultural and livestock commodities such as corn, coffee, beef, pork, chicken, and cheese play an important role in the restaurant business, as demand and supply factors impact prices.

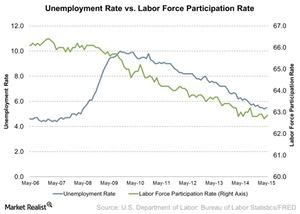

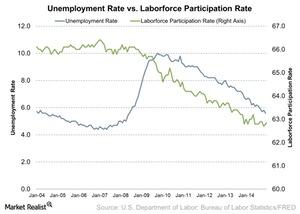

How Unemployment and Labor Participation Rates Affect Restaurants

A tight labor market with low unemployment and participation rates puts pressure on restaurant companies to raise wages to retain their employees.

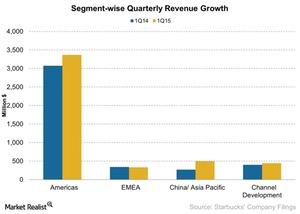

Starbucks Makes China Another Feather in Its Cap in 2015

There’s strong acceptance of the Starbucks loyalty program in China, with 40% of transactions completed using the Starbucks card.

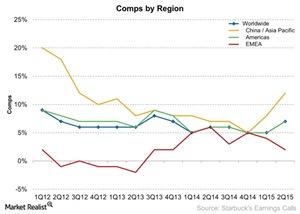

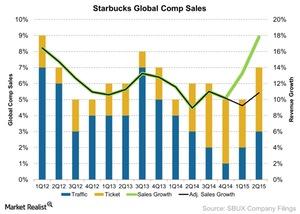

Starbucks Relies on Comps to Drive Revenue Growth

The Americas and the CAP (China, Asia-Pacific) segments have been the biggest contributors toward Starbucks global comps growth.

Factors That Influence the Restaurant Industry

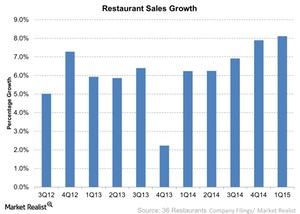

Over the past 12 months, the restaurant industry has experienced significant sales growth. In this series, we’ll look at certain indicators that investors in this sector should track.

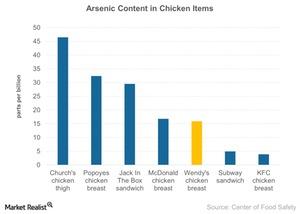

Healthy Food: Antibiotic-Free Chicken Is Gaining Importance

According to a study by researchers at John Hopkins University, the arsenic in served chicken isn’t healthy. It could increase consumers’ cancer risk.

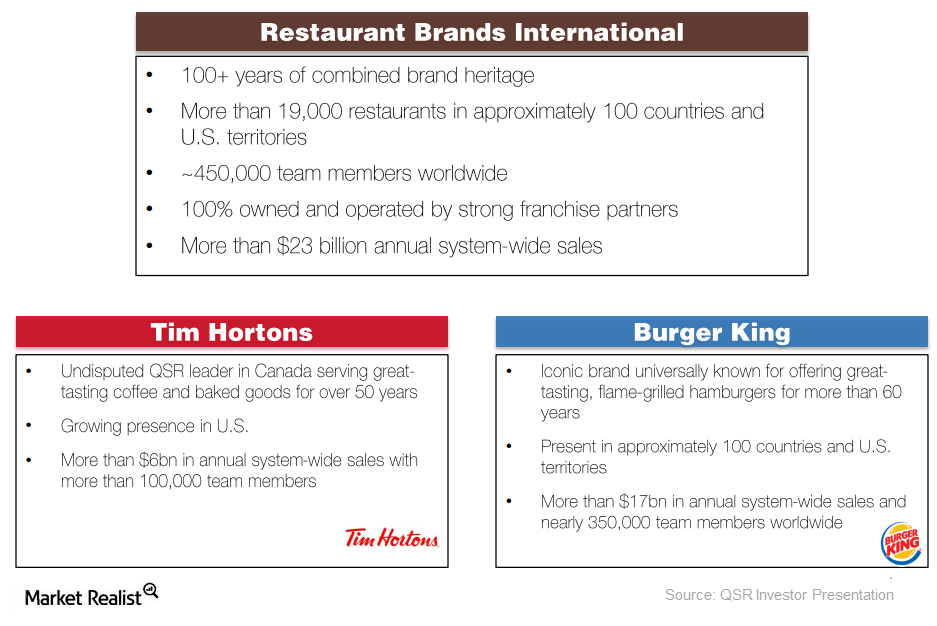

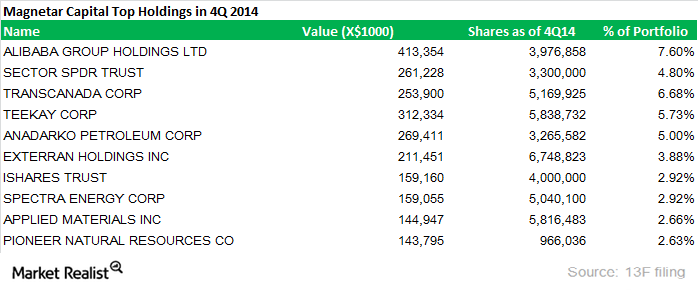

Magnetar Purchases New Stake in Restaurant Brands International

Magnetar Capital added new stake in Restaurant Brands International (QSR) in 4Q14. The position represented 0.73% of its holdings at the end of the year.

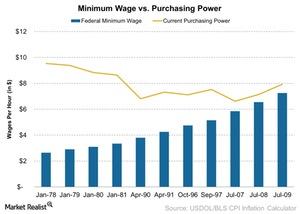

The Eroding Purchasing Power of the Minimum Wage Worker

While the absolute minimum wage has increased, when adjusted for inflation in 2015, its purchasing power has declined.

Magnetar Capital Initiated New Positions in 4Q14

Magnetar Capital was established in 2005 by Alec Litowitz and Ross Laser. Currently, the hedge fund manages assets in excess of $12 billion.

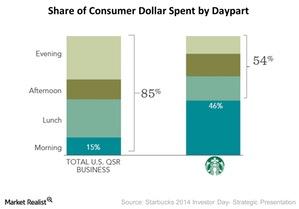

Dunkin’ Brands Diversifies Its Daypart Focus

Dunkin’ Brands is now expanding into the afternoon daypart in order to win customers in a different daypart and improve sales leverage.

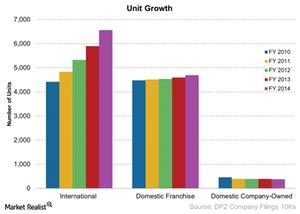

Domino’s Pizza and Its Master Franchise Model

The master franchise agreement gives the master franchisee operating rights to a supply chain in a given international region.

How Dunkin Donuts Is Embracing Technology

Dunikin’ is embracing technology with a phone app that allows you to search Dunkin’ Donuts locations, see nutritional information, and gift Dunkin’ treats.

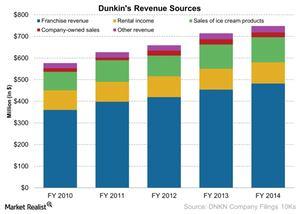

What are Dunkin’ Brands’ Five Sources of Revenue?

Dunkin’ Brands’ (DNKN) sources of revenue include franchise revenue, sale of ice cream products, company-owned sales, rental income, and other income.

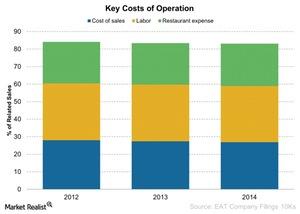

Brinker International’s Key Costs of Operations

Brinker incurs key costs of operations to run its company-owned restaurants, including cost of sales, labor and related costs, and rent and other costs.

Dunkin’ Brands’ International Development Plan

As of December 2013, Dunkin’ Brands had 5,736 points of distribution (or POD). In its International Development Plan, it plans to expand that to 9,500.

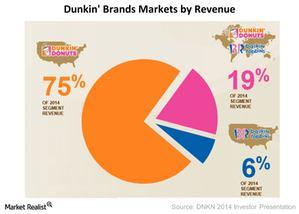

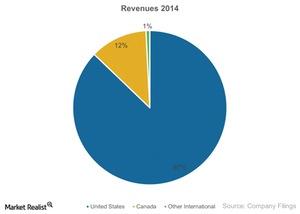

US Market Still the Biggest for Dunkin’ Brands

Dunkin’ Donuts is Dunkin’ Brands’ most important brand, with 77% of the revenue or $568 million in 2014. Of this, $548 million was from the US market.

Domino’s Wants to Entertain You at Its ‘Pizza Theater’

Domino’s plans to have all its stores remodelled according to the Pizza Theater design by the end of fiscal 2017.

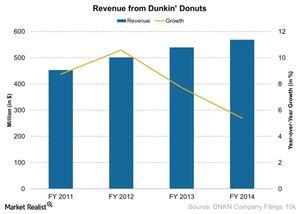

Dunkin’ Donuts’ National and International Sales

Dunkin’ Donuts’ combined revenue from national as well as international units was $569 million in 2014. Of that, $548 million came from the US market alone.

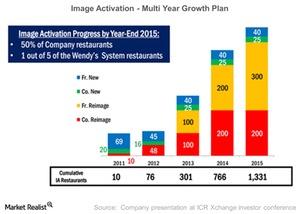

Why Did Wendy’s Start Its Image Activation Program?

From 2011 to 2012, Wendy’s (WEN) started its Image Activation program. It’s a program to remodel restaurants. It plans to remodel almost 1,331 restaurants.

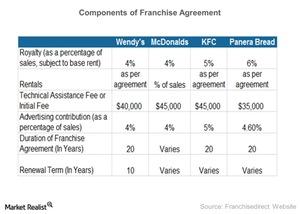

Analyzing Wendy’s Franchise Agreements

Wendy’s franchise agreements are only renewable after ten years. Wendy’s rental income from franchisees grew from $27 million in 2013 to $68 million in 2014.

Emerging Markets: Wendy’s International Expansion Plans

Wendy’s performance has been based on the economy, consumers’ preferences, and spending patterns in the US. International expansion will have its own complexities.

QSCC: Wendy’s Supply Chain Management

QSCC (Quality Supply Chain Co-op, Inc.) is an independent non-profit organization that’s responsible for the Wendy’s (WEN) supply chain management.

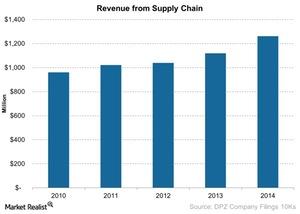

Domino’s Pizza Enjoys the Dual Benefits of Vertical Integration

Because Domino’s Pizza sells dough and ingredients to its own franchises, the company derives dual benefits from the supply chain segment.

Domino’s Pizza Relies on its Supply Chain to Get It Right

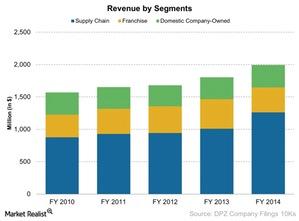

Supply chain segment In terms of revenue, the supply chain is Domino’s Pizza’s (DPZ) most important segment. In fiscal 2014, it contributed 63%, or $1.26 billion, toward the company’s total revenue. Domino’s international master franchises have the right to operate a supply chain in their respective regions. The facilities The supply chain segment consists of the […]

Which of Domino’s Pizza’s Three Business Segments Performs Best?

Of its three main business segments, Domino’s Pizza earns least revenue from its company-owned stores.

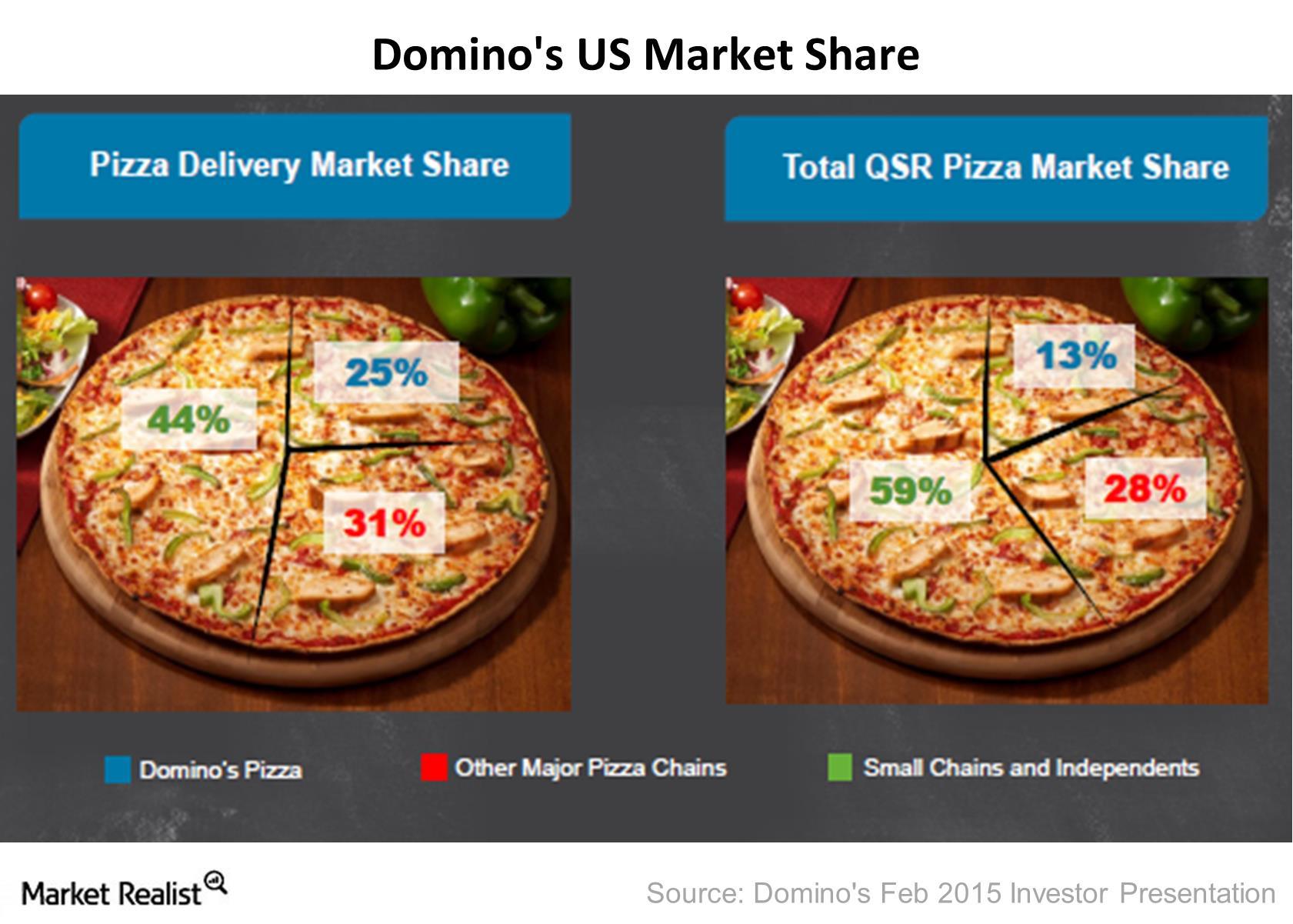

Domino’s Pizza: Serving 1.5 million Pies a Day

Domino’s Pizza had a 13% market share of the quick service restaurant industry in the US as of December 2014.

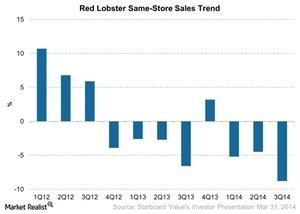

Why Darden Restaurants Sold Red Lobster

Activist investor Starboard Value opposed Red Lobster’s sale, stating that Darden management could do more to turn the undervalued brand around.

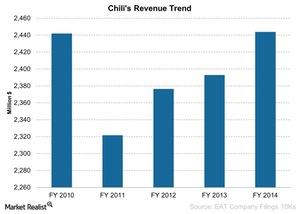

Why Chili’s Matters the Most to Brinker International

Chili’s is the most important restaurant under the Brinker (EAT) umbrella. Chili’s contributed 86%, or $2,443 million, to the company’s sales in 2014.

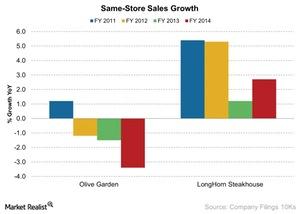

Olive Garden and LongHorn Steakhouse’s Same-Store Sales Growth

LongHorn Steakhouse’s same-store sales increased to 2.7% in 2014 year-over-year from 1.2% in 2013. This is lower compared to fiscal 2012 and fiscal 2011.

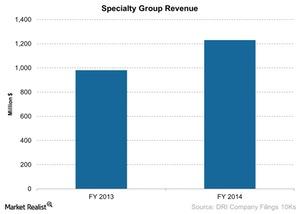

Darden’s Specialty Restaurant Group: The Capital Grille

As of fiscal 2014, revenue from Specialty Restaurant Group was $1,230 million, or 19.5% of the total revenue for Darden Restaurants.

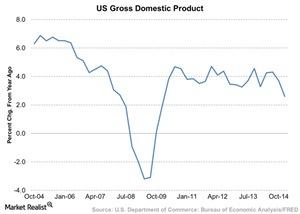

Why US Gross Domestic Product Growth Impacts Restaurants

The restaurant industry is part of the consumer discretionary sector. This sector does well when the economy is expanding.

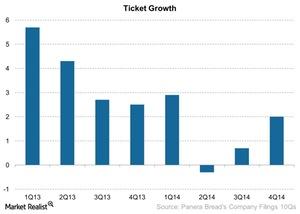

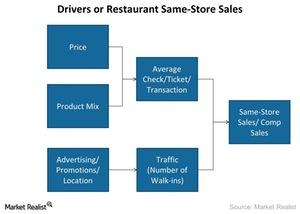

Panera Bread’s Traffic And Ticket Impact Same-Store Sales Growth

Traffic is the increase in the number of customers that visit the stores and make a transaction or purchase. Panera Bread’s traffic grew 1.3%.

How Unemployment Rate, Labor Participation Affect Restaurants

The unemployment rate for December 2014 was 5.6%, showing a month-over-month decrease from 5.8% in November.

Starbucks China and Asia-Pacific Segment Reports Record Sales

The Starbucks China and Asia-Pacific segment grew 85% to $495 million, up from $266 million year-over-year.

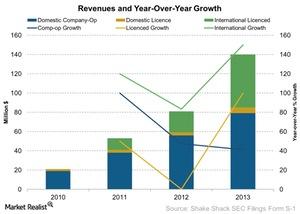

Where Does Shake Shack Get Its Revenue Sources?

Domestic means all of the restaurants in Shake Shack’s domestic market—the US. Revenue from this segment was $78.5 million in 2013.

Why Should You Care About Shake Shack’s AUV?

Shake Shack (SHAK) calculates its AUV (average unit volume) by dividing the total company-operated sales by the total company-operated units.

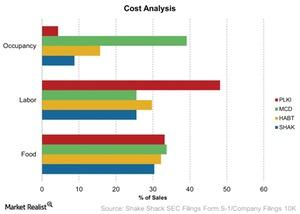

Understanding Shake Shack’s Three Key Costs

We’ve looked at Shake Shack’s (SHAK) revenues and drivers. It’s also important to understand how the company has been managing its key costs.

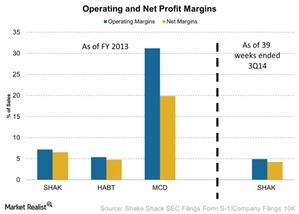

Analyzing Shake Shack’s Profitability

We’ll look at Shake Shack’s profitability in terms of its operating and net profit margins. In 2013, it had an operating profit of $5.9 million.

Starbucks Strategically Targets Its Teavana Business

By opening Teavana Fine Teas and Tea Bars, Starbucks has shown how it’s focused on generating revenues from relevant products.

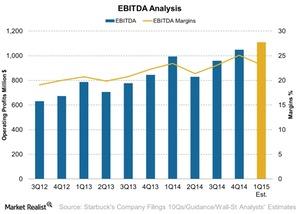

An Analysis Of Starbucks’s EBITDA

Starbucks’s EBITDA is lowest in second quarters, which shows the seasonality of the business. Adverse weather conditions can also affect EBITDA.

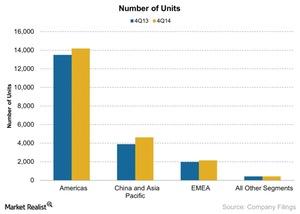

Starbucks’s Geographic Segment Update

The following are Starbucks’s geographic segments: Americas; China and Asia Pacific; and Europe, the Middle East, and Africa.

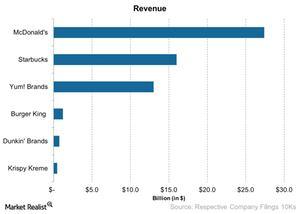

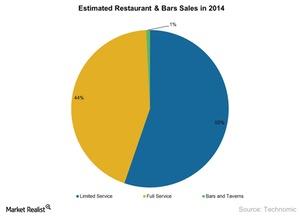

An overview of the US restaurant industry

Consumer confidence in the United States is at an all-time high in seven years, and people are spending more on food prepared outside the home.

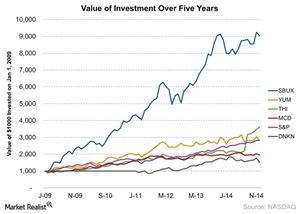

Starbucks’ 5-Year Stock Performance

Now, we’ll discuss SBUX’s stock performance over the past few years. SBUX returned $9,037 on $1,000 invested on January 1, 2009. The fourth quarter earnings announcement is approaching.

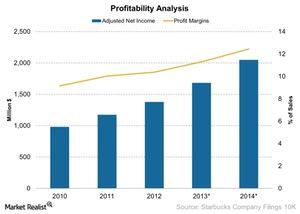

Starbucks’ Net Profit Margins Improve Over 5 Years

SBUX’s net income and net profit margins have been on an uptrend since 2010. At the end of fiscal year 2014, SBUX’s adjusted net income was $2.05 billion.

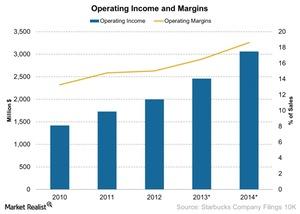

Starbucks’ Operating Profit Margin Increases

At the end of fiscal year 2014, SBUX’s operating income was $3.1 billion. Its operating profit margins increased to 19% in 2014—compared to 17% in 2013.

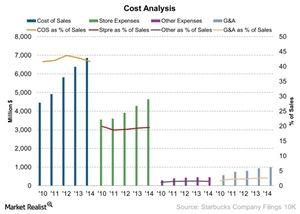

Starbucks’ Key Operating Costs

SBUX wants to grow sales. It’s also important to manage the operating costs. In this part of the series, we’ll take a look at four key operating costs.

Starbucks Is Expanding Dayparts To Grow Sales

SBUX is also expanding its offerings in different dayparts. The expanded offerings cater to a wider customer base. They increase the wallet share.

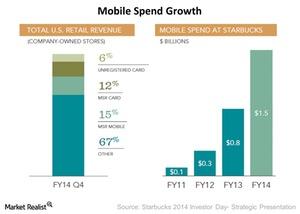

Analyzing Starbucks’ Successful Mobile Ecosystem

Once the card is registered on the Starbucks (SBUX) website, the data is available on other ecosystems—for example, a mobile app. It helps a customer keep track of rewards.