Understanding Starbucks’ cost structure and operating expenses

Starbucks’ main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends.

May 4 2021, Updated 10:10 a.m. ET

The beans

Starbucks’ (SBUX) main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends, which Starbucks sources from numerous continents to keep up with demand. Arabica is the most consumed coffee bean species due to its milder flavor compared to Robusta. Starbucks primarily purchases Arabica beans because the weaker flavor mixes more easily to create the 30 blends used across all product platforms.

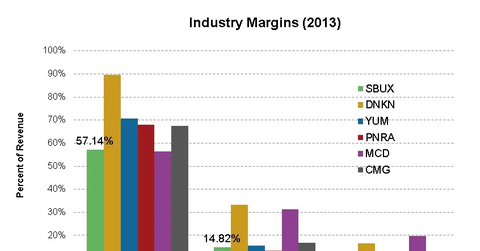

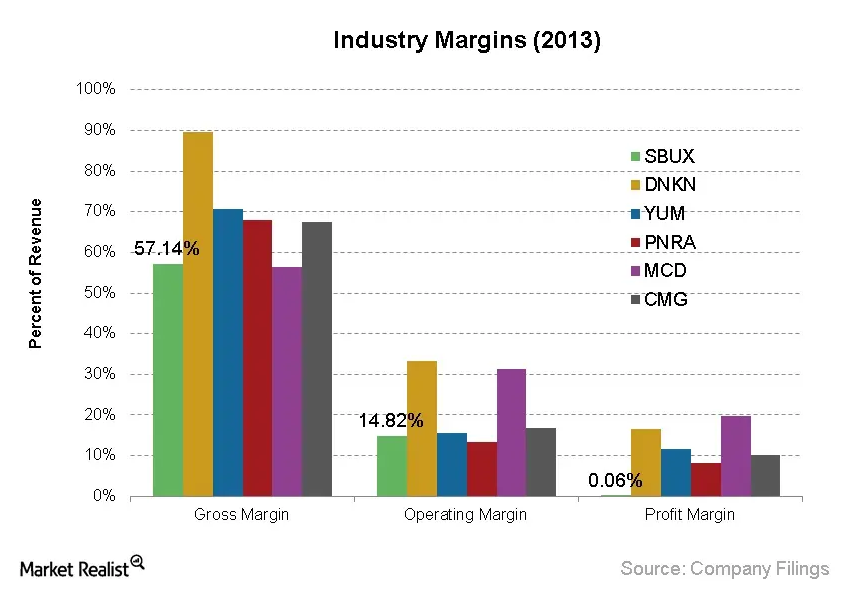

Starbucks’ massive market capitalization allows it to leverage economies of scale. Unfortunately, there are no accurate dollar amounts available concerning the cost Starbucks pays to produce one cup of regular coffee. Amateur speculative estimates range from $0.20 to $0.75. Starbucks’ cost structure is relatively straightforward, resembling those of typical “high-end” fast-casual restaurants, such as Panera (PNRA) or Chipotle (CMG). This means slim margins attributable to industry competition (SBUX’s 2013 profit margin is 0.06% due to an unfavorable litigation outcome involving Kraft Foods). Healthy companies in this industry boast strong operating cash flows and high capital expenditures attributable to kitchen maintenance and vertical integration efforts. Cash flows from financing activities differ at firms’ discretion. Starbucks has recently been repurchasing its own shares and paying dividends to increase returns to investors. Others seek capital to fund international expansion attempts and capital expenses.

Operations

Starbucks initially appears weaker than its main domestic rival, Dunkin’ Donuts (DNKN), in terms of costs and operating margins. However, Dunkin’ doesn’t incur the full cost of beans on its income statements (which Starbucks does) due to the nature of its business model. Dunkin’s revenue largely comprises royalties that its franchises pay to the company. Franchise owners are responsible for managing costs of goods sold. Dunkin’ simply instructs the owners where to purchase inputs and lays claim to a percentage of their profits. This accounting trick benefits Dunkin’ in the eyes of the untrained investor, but Dunkin’s performance depends on bean commodity prices as much as Starbucks’ performance.

Starbucks’ historical operating costs have been declining (2013 operating expenses have been normalized and exclude the $2.8 billion litigation charge mentioned above). The costs of goods sold, depreciation and amortization expenses, and store operating expenses have declined over the last six years, with only general and administrative expenses rising. This translates into improving margins over time due to business growth and efficient cost management.