Matthew Krikorian

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Matthew Krikorian

Opportunities and risks that Dunkin’ Brands investors must know

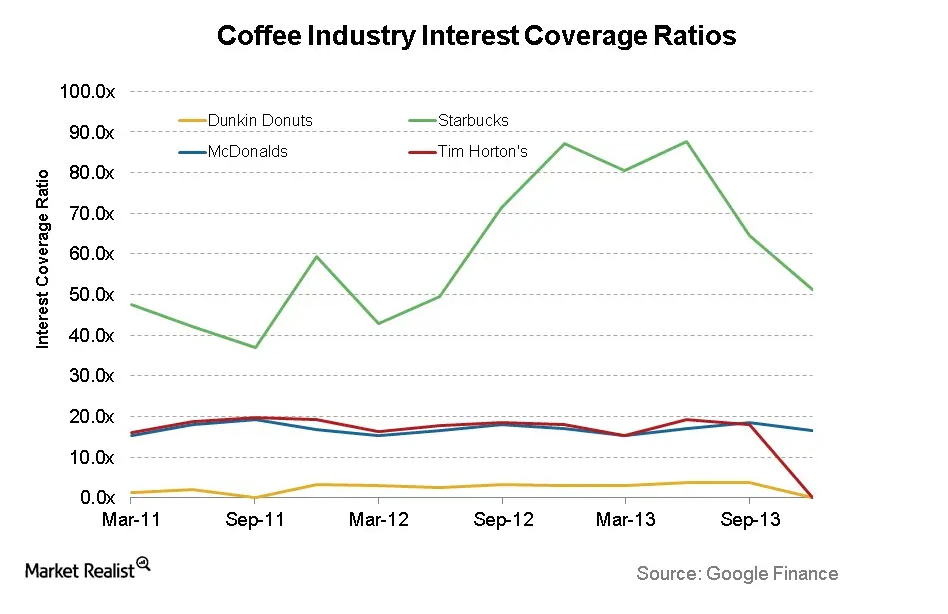

It’s no big secret that Dunkin’ Donuts has the highest relative leverage in the industry. Leverage comes with a number of risks— a substantial risk is the interest paid on debt.

Understanding Starbucks’ cost structure and operating expenses

Starbucks’ main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends.Consumer Why Dunkin’ Brands is a unique player in a maturing industry

Dunkin’ Donuts’ main competitor on the coffee sales front is Starbucks, which sells coffee from its company-owned fleet of retail locations.Consumer Starbucks revenues: Why customers are willing to pay a premium

Starbucks’ revenue mix is weighted in favor of beverages. This should come as no shock, considering the firm’s roots trace back to a single coffee shop at Pike’s Place Market in Seattle.Consumer An industry advantage: Dunkin’ Brands’ operating costs are dieting

Dunkin’ Brands has a very low capital requirement relative to the rest of the coffee retail industry. This is due to its business model, centered around establishing franchises across the world.Consumer Must-know: Dunkin’ Brands is innovating the supply chain

Dunkin’ Brands Group doesn’t typically supply products to its franchises. Revenues derive from royalty fees as opposed to product distribution.Consumer Must-know risks: Why Starbucks should hedge its shrubs

Starbucks indicates that it uses derivative contracts to hedge commodity price risks. These contracts typically don’t have a lifespan longer than five years.Consumer A Starbucks on every corner: A guide to the SBUX business model

This business model has allowed Starbucks to be the first coffee firm to put retail locations in each of the BRIC nations and many more.Consumer Business overview: Why Starbucks deserves your attention

Starbucks began in 1971 as a single coffee shop in Seattle. Today, it’s the world largest coffee retailer, with over 19,000 locations in more than 60 countries (as of FY2013 end).