Panera Bread Co Inc

Latest Panera Bread Co Inc News and Updates

Panera Bread’s Unlimited Sip Club—A Look at the Rules and How To Join

For $10.99 per month, the Panera Unlimited Sip Club program offers unlimited refills on your favorite Panera drinks.

How to Buy Upcoming Panera Bread Stock and Whether You Should

Can an investment in Panera Bread stock make you more money than you spend on paninis? Here's how to buy Panera stock.

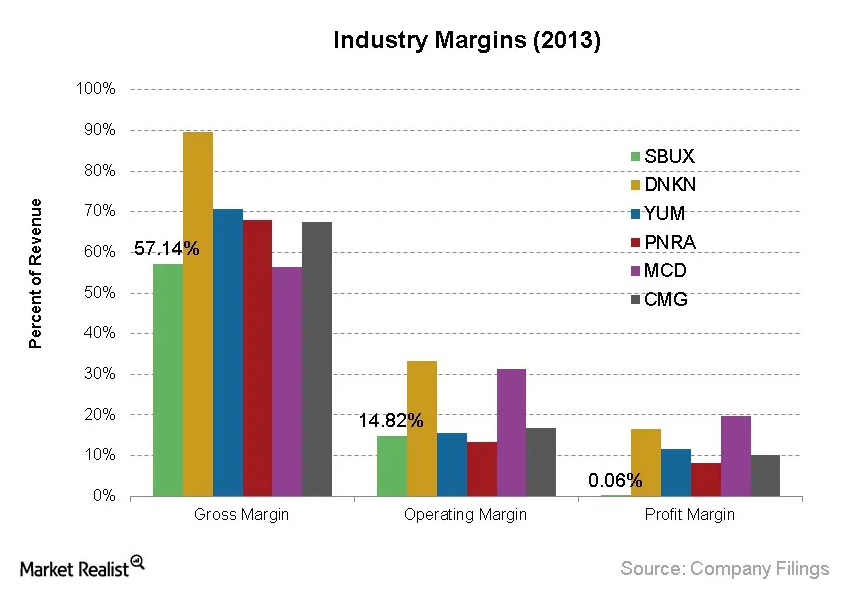

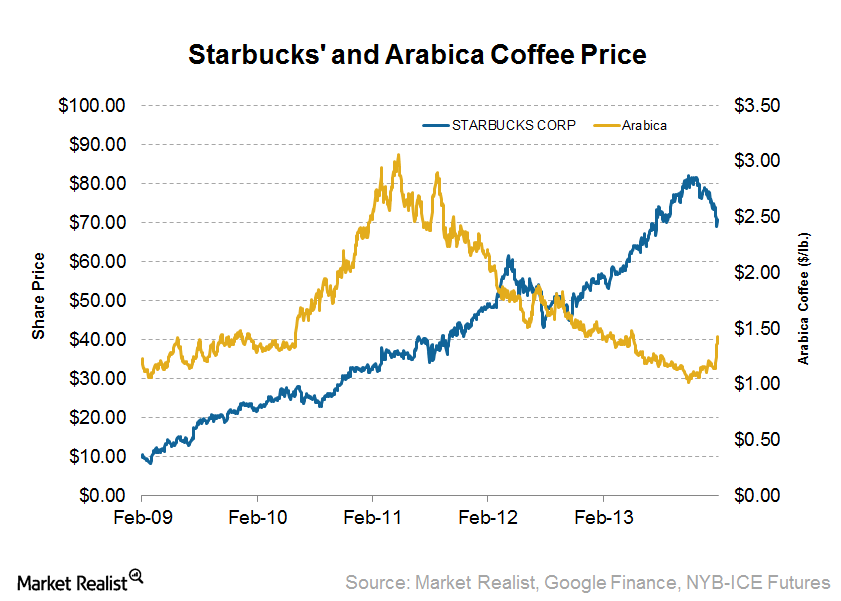

Understanding Starbucks’ cost structure and operating expenses

Starbucks’ main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends.

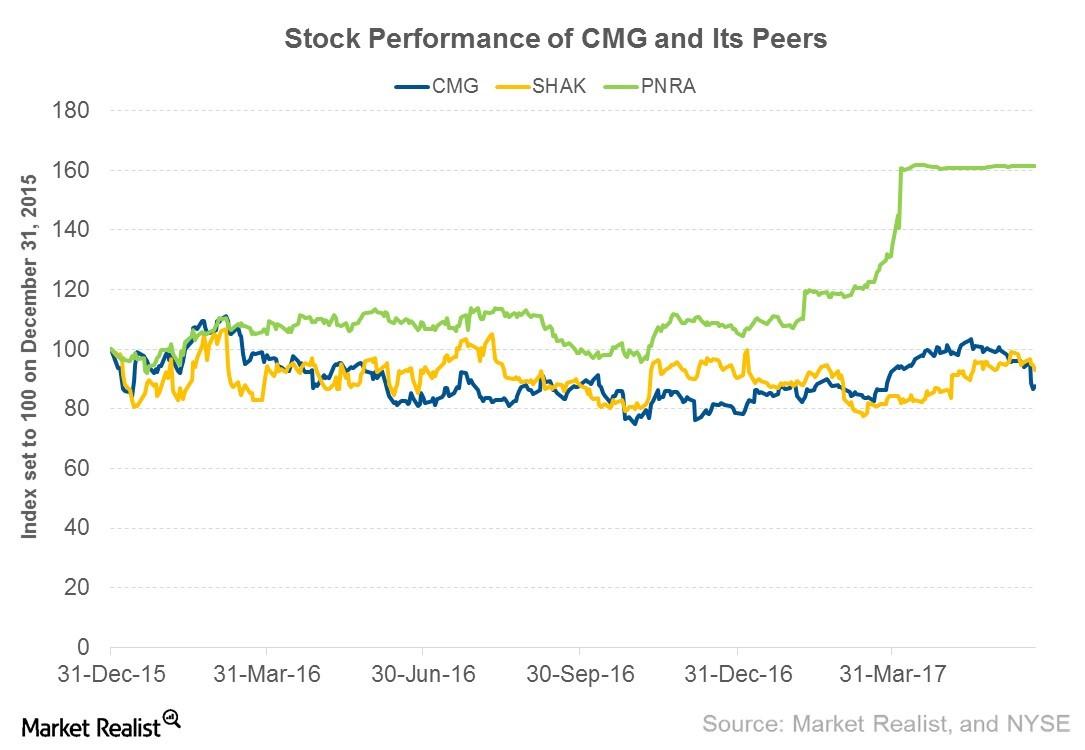

Why Chipotle Has A Lot Of Room For Unit Growth

Unit growth isn’t the only factor that drives revenue. A restaurant can keep adding more restaurants. Eventually, it can capture newer markets. This is what Chipotle is doing.

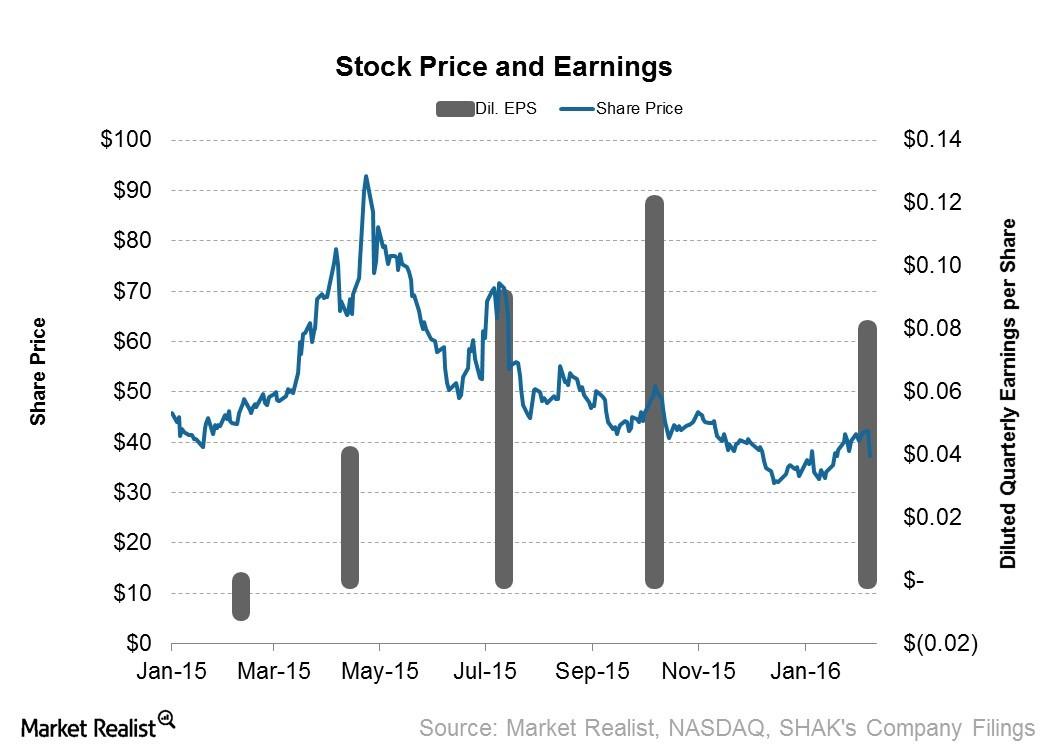

What Is the Outlook for Shake Shack in 2016?

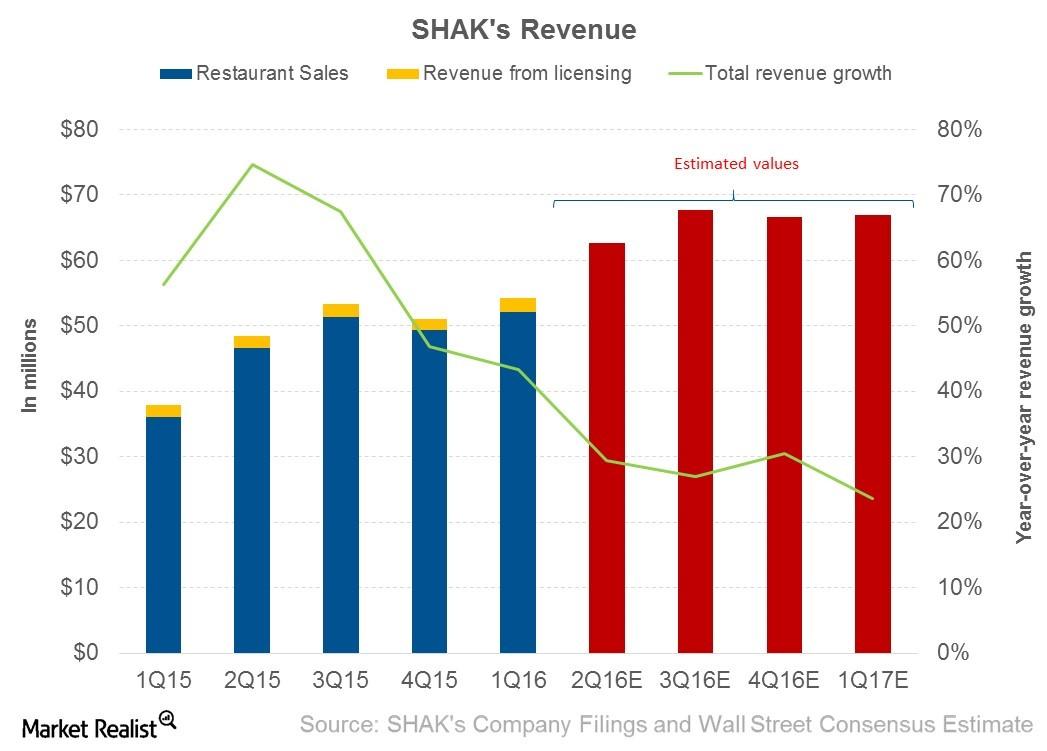

A New York–based fine casual restaurant chain, Shake Shack (SHAK) announced its 4Q15 results on March 7, 2016. SHAK reported an overall revenue of $51.1 million and earnings per share of $0.08.

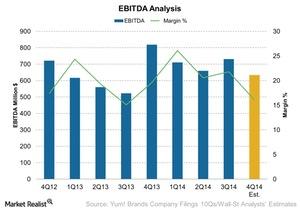

Why Yum! Brands Is Expected To Report Lower EBITDA

Wall Street analysts’ estimated EBITDA for the fourth quarter is $633 million—compared to $918 million in the same quarter last year.

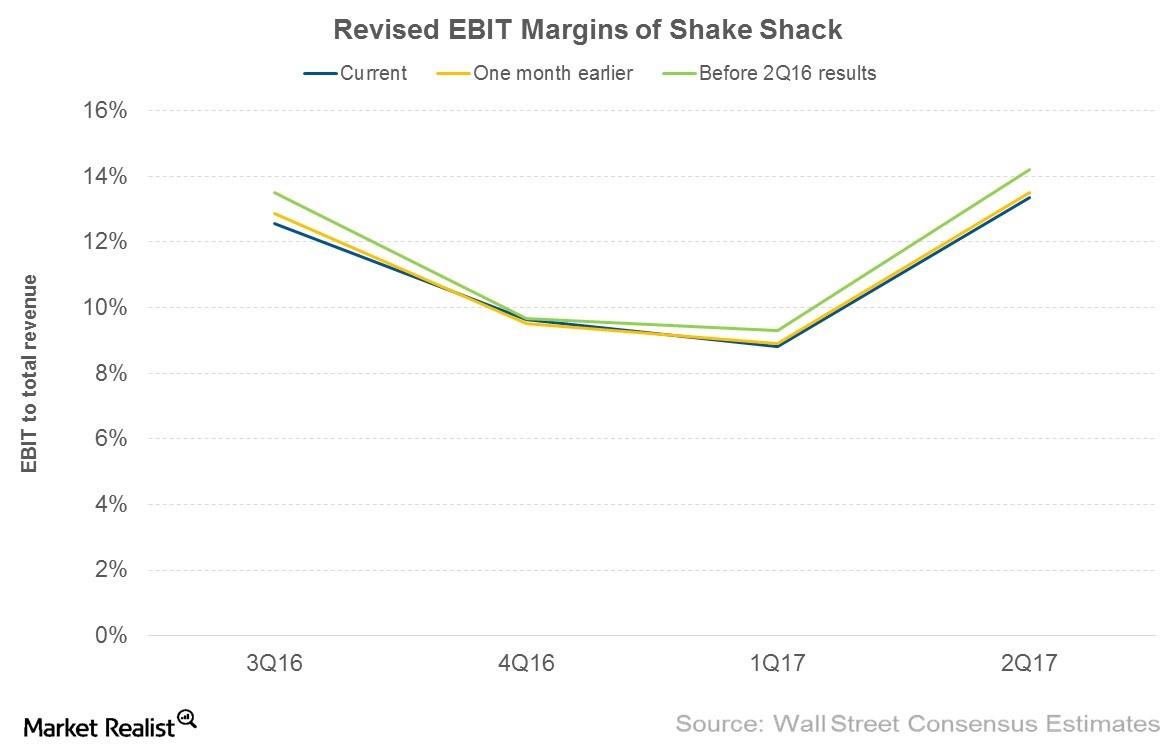

Why Analysts Dropped Their Estimates for Shake Shack’s Earnings

Currently, analysts are expecting Shake Shack (SHAK) to post EBIT margins of 12.6%, 9.6%, 8.8%, and 13.3% in 3Q16, 4Q16, 1Q17, and 2Q17, respectively.

Why high valuation and coffee prices drove Starbucks down ~13%

As store count grew over the past few years, Starbucks’ forward P/E valuation metric also expanded. What used to be just 17x gradually grew to roughly 27x, a 58% based solely on expansion in the valuations.

Analyzing Shake Shack’s Fine-Casual Concept

Shake Shack is conceptualized as a “new fine-casual” restaurant format. The fine-casual restaurant is a hybrid of the fine dining and fast-casual dining formats.

Has Chipotle’s Stock Price Bottomed Out?

After posting better 1Q17 earnings on April 25, Chipotle’s stock price rose to $496.14 by May 16, 2017. Since then, it has experienced downward momentum.

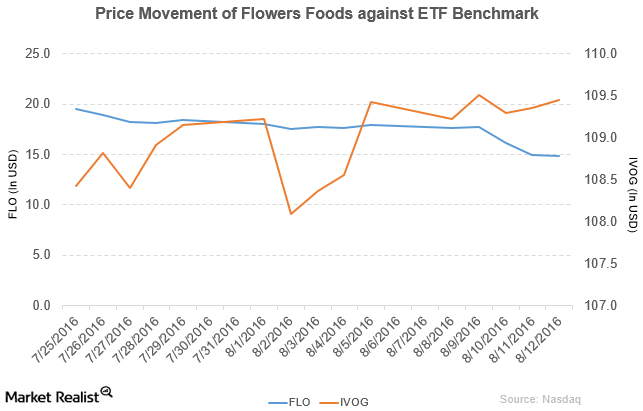

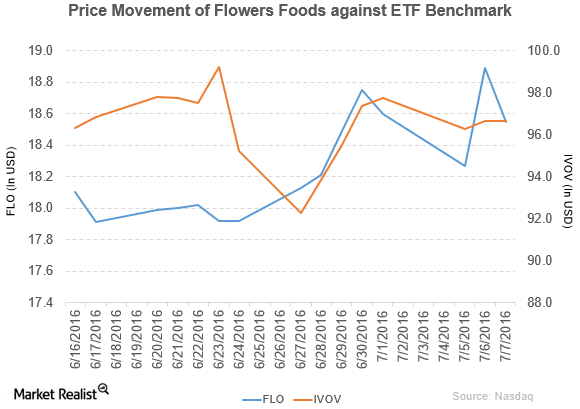

Stephens Reduces Flowers Foods’ Price Target to $14 per Share

Flowers Foods (FLO) has a market cap of $3.1 billion. It fell by 0.67% to close at $14.85 per share on August 12, 2016.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.Consumer Starbucks revenues: Why customers are willing to pay a premium

Starbucks’ revenue mix is weighted in favor of beverages. This should come as no shock, considering the firm’s roots trace back to a single coffee shop at Pike’s Place Market in Seattle.Consumer Must-know: Chipotle Mexican Grill’s 3 key risks

Chipotle Mexican Grill (CMG) is exposed to three primary risks: price risk, interest rate risk, and currency risk.

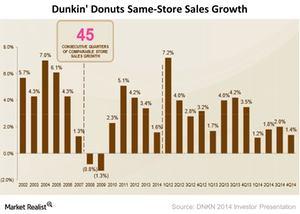

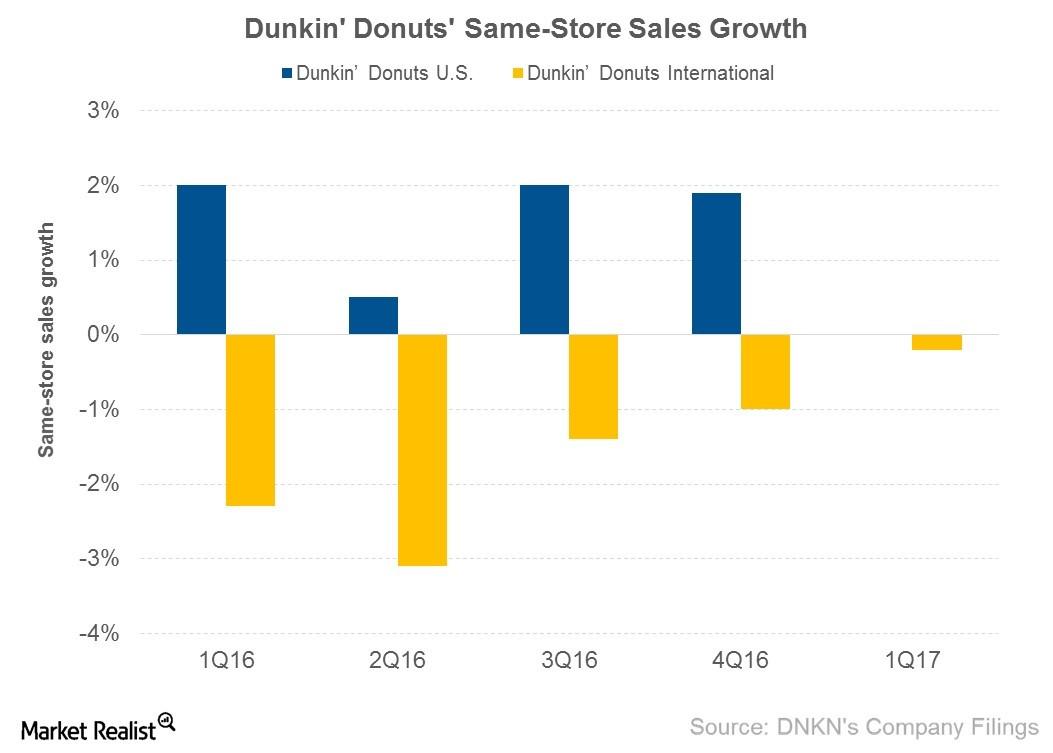

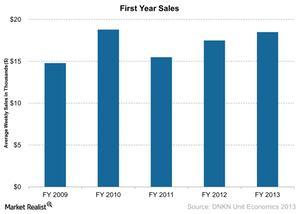

How Is Dunkin’ Donuts Doing in Same-Store Sales Growth?

Overall same-store sales growth for Dunkin’ Donuts has been declining. The company had negative same-store sales growth in 2008 and 2009.

Why Noodles and Company has short and long-term goals

Noodles & Company (or NDLS) has a few initiatives and tactics to drive short-term traffic. It also drives longer-term brand and customer loyalty building.Consumer Why it’s important to understand Noodles and Co.

Noodles & Company (or NDLS) was founded in 1995. It’s a fast-casual restaurant chain that serves classic noodle and pasta dishes.Consumer Why Chipotle’s labor, occupancy, and other costs are important

Chipotle Mexican Grill (CMG) reported $230 million in labor costs, $59 million in occupancy costs, and $111 million in other operating costs in 3Q14.

Dunkin’ Donuts: Same-Store Sales Growth Lower Than Estimates

In 1Q17, SSSG for Dunkin’ Donuts, which operates under the umbrella of Dunkin’ Brands (DNKN), was flat in the United States.

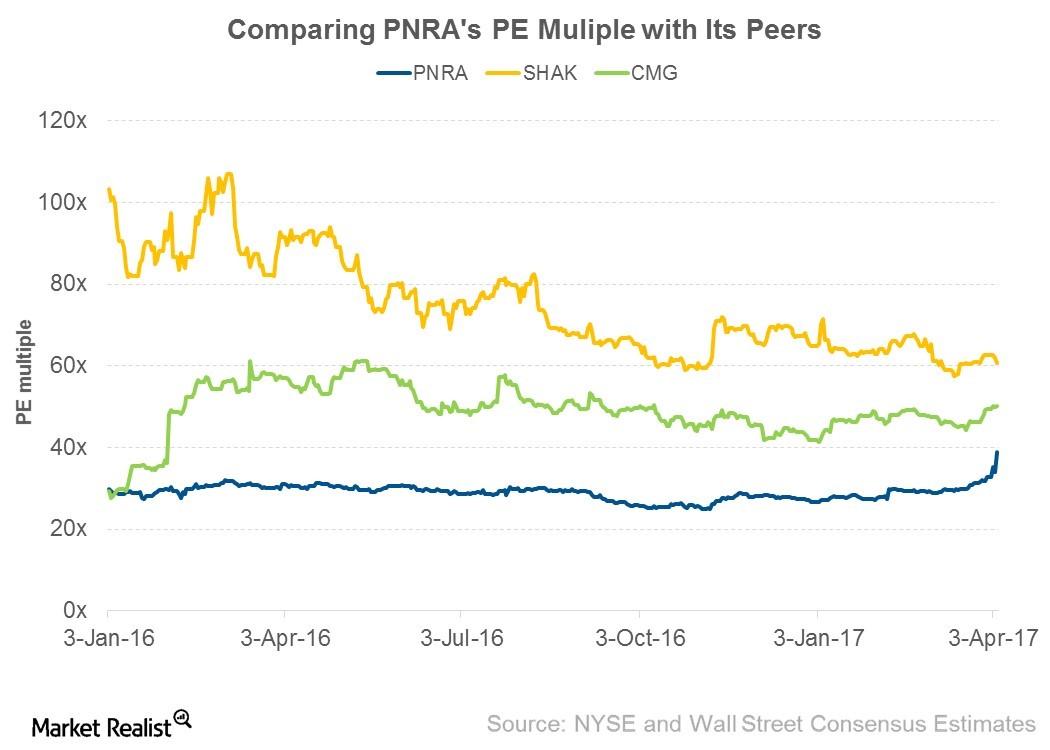

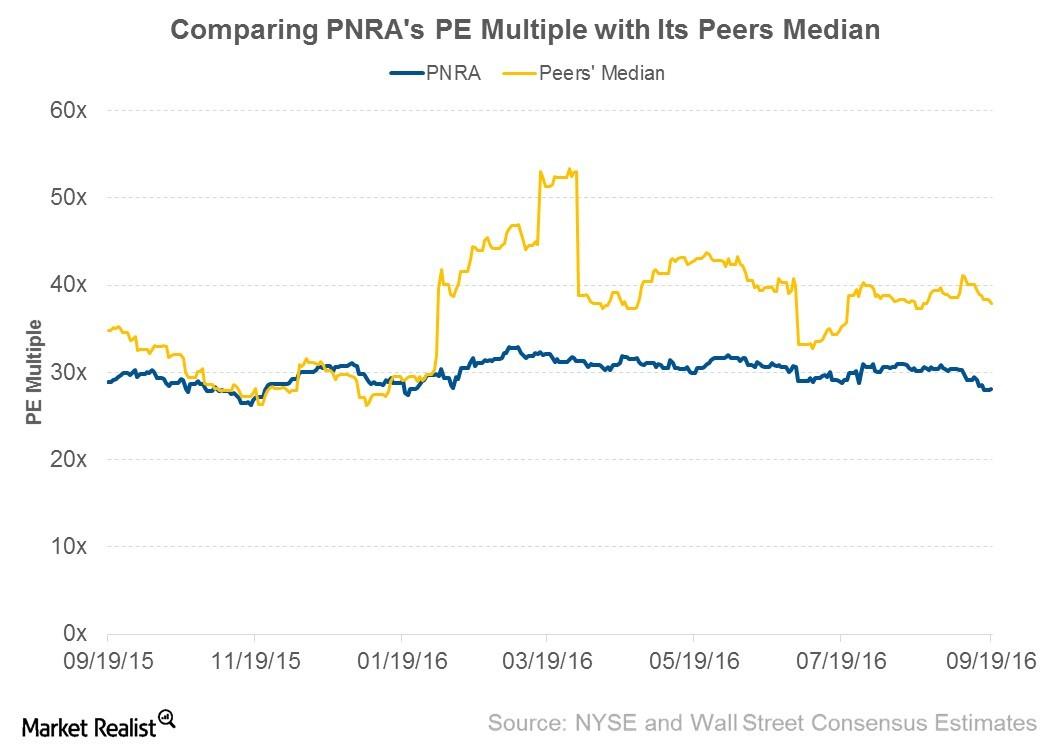

Why Panera’s Valuation Multiple Rose after JAB’s Offer

As of April 5, 2017, Panera was trading at a forward PE multiple of 38.8x—compared to 32.6x before the acquisition rumor started to surface on April 3.

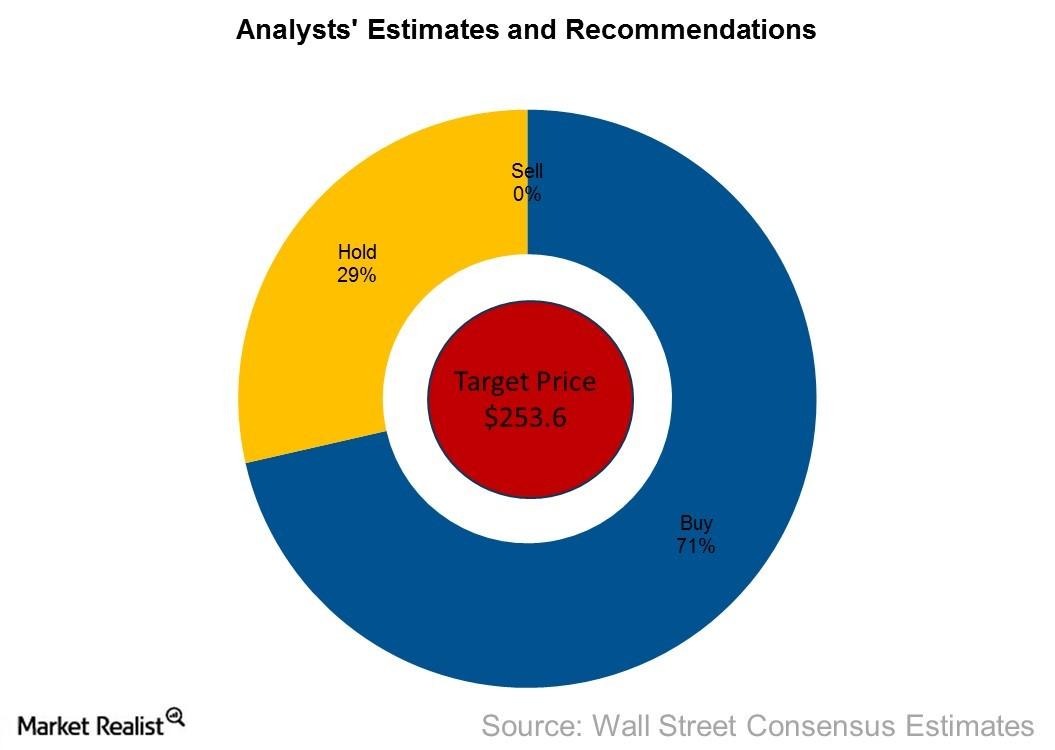

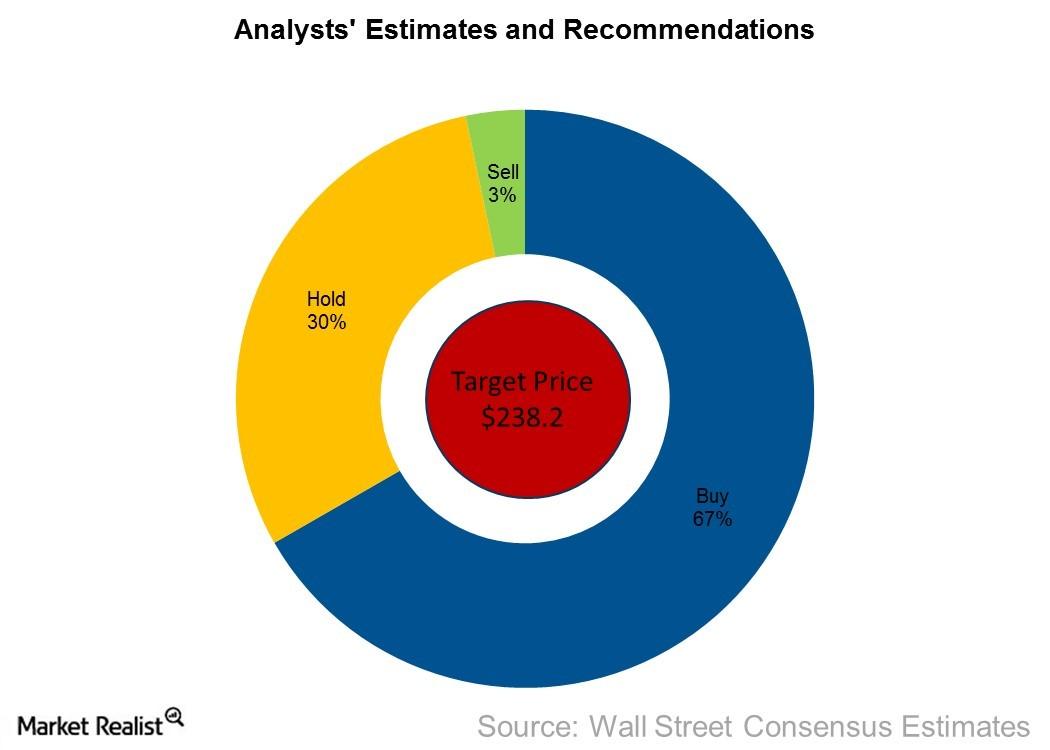

Recommendations for Panera: Why Analysts Favor a ‘Buy’

Of the 28 analysts covering Panera (PNRA), 71.4% have given it a “buy” recommendation, and 28.6% have given it a “hold.”

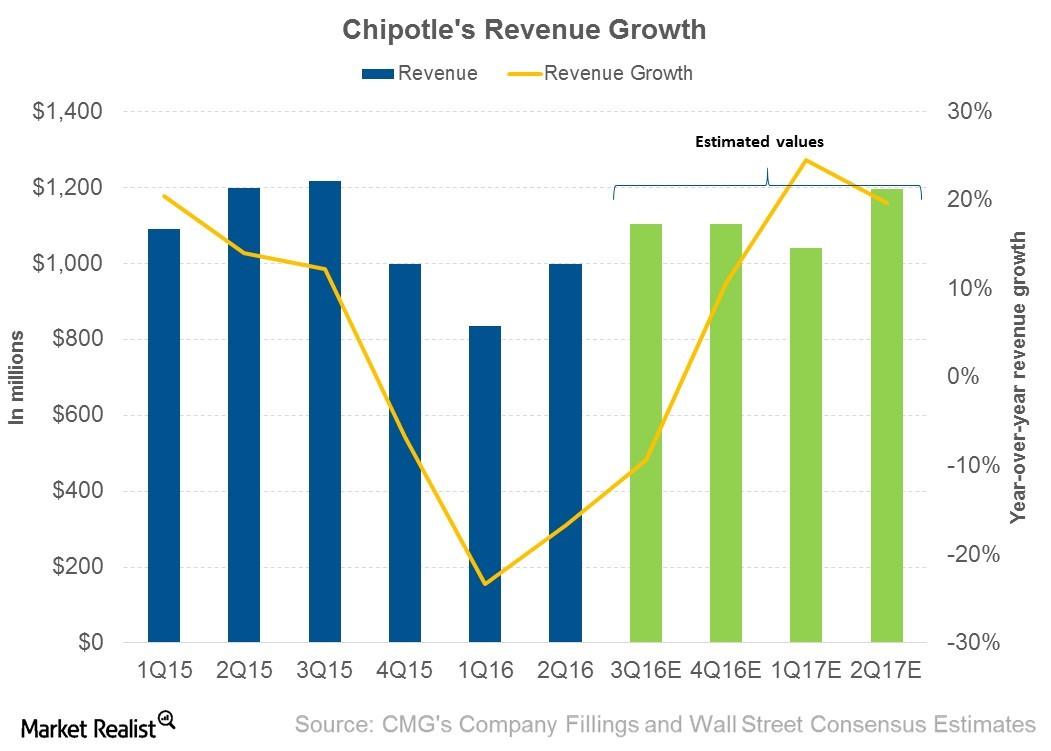

Will Europe Be Key to Chipotle Stemming Its Falling Revenue?

Since the E. coli outbreak in October 2015, Chipotle Mexican Grill’s (CMG) same-store sales growth has been falling. This led to negative revenue growth.

What Are Analysts’ Recommendations for Panera Bread?

Despite the recent fall in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next year—a return potential of 18.5%.

Analyzing Panera Bread’s Valuation Multiples

Lower revenue and EPS estimates made investors skeptical about investing in Panera. As of September 19, it was trading at 28.1x—down from 30.9x on July 28.

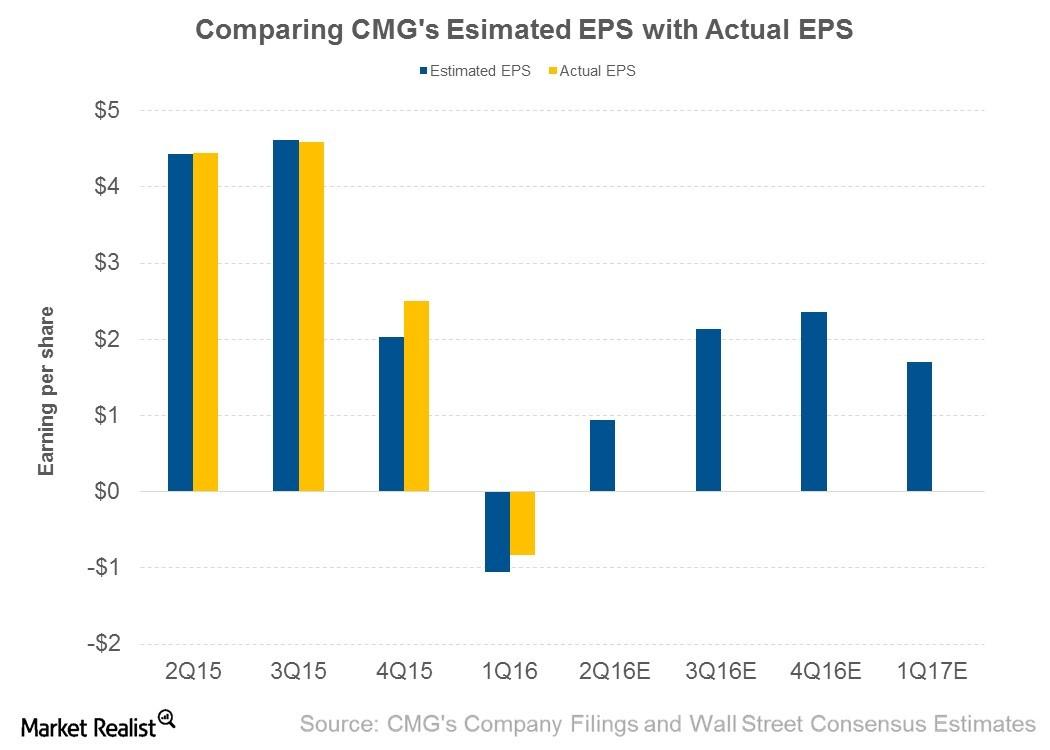

What Analysts Are Expecting from Chipotle’s 2Q16 Earnings

In last four quarters, Chipotle has beaten analysts’ estimates three times. Usually, when the company beats analysts’ estimates, the share price rises.

What Do Analysts Expect from Chipotle’s Revenue in 2Q16?

Revenue sources By the end of 1Q16, Chipotle Mexican Grill (CMG) owned and operated all of its 2,066 restaurants. In 2Q16, analysts are expecting the company to register revenue of $1.05 billion, a decline of 12.1% from $1.2 billion in 1Q15. Factors affecting Chipotle’s revenue Although Chipotle’s management had undertaken several measures to counter the […]

Flowers Foods Made Changes in Its Management

Flowers Foods fell by 1.8% to close at $18.55 per share on July 7. The stock’s weekly, monthly, and YTD price movements were 0.32%, 0.32%, and -12.2%.

Exploring The Cheesecake Factory’s Other Brands

The Cheesecake Factory (CAKE) created the Grand Lux Cafe brand at the request of Venetian Resort Hotel Casino in Las Vegas in 1999.

What Really Drove Shake Shack’s Revenue in 1Q16?

In 1Q16, Shake Shack saw a 43.3% rise in revenue over $37.8 million in 1Q15, driven by unit growth and same-store sales growth.

How Is Panera Bread Expanding Its Business?

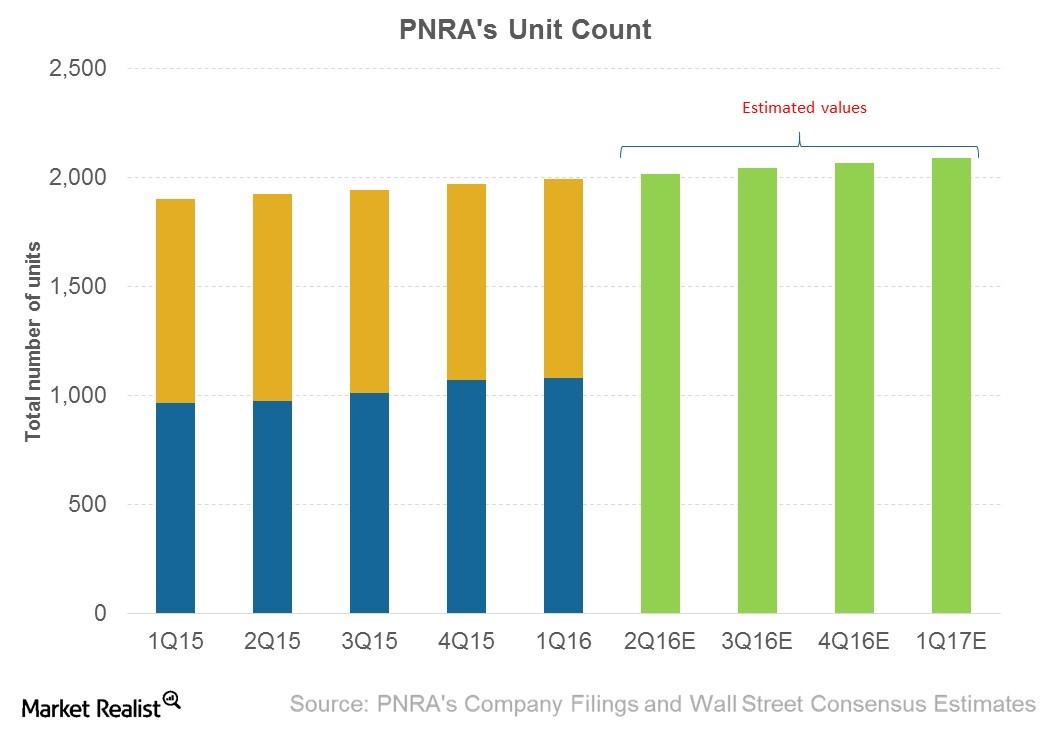

From the beginning of 2Q15 to the end of 1Q16, Panera Bread (PNRA) increased its unit count by 96, of which 25 units were added in 1Q16.

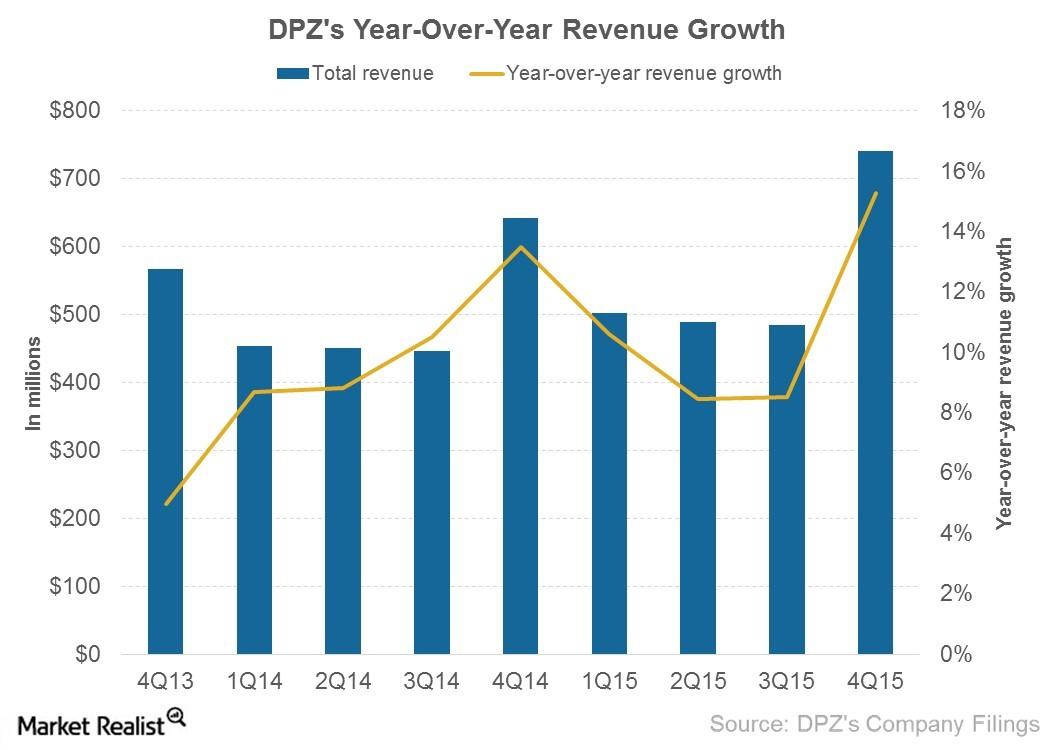

What Contributed to Domino’s Pizza’s Revenue Expansion in 4Q15?

In 4Q15, Domino’s Pizza (DPZ) recorded an overall revenue growth of $98.2 million from its 4Q14 revenues of $643 million.

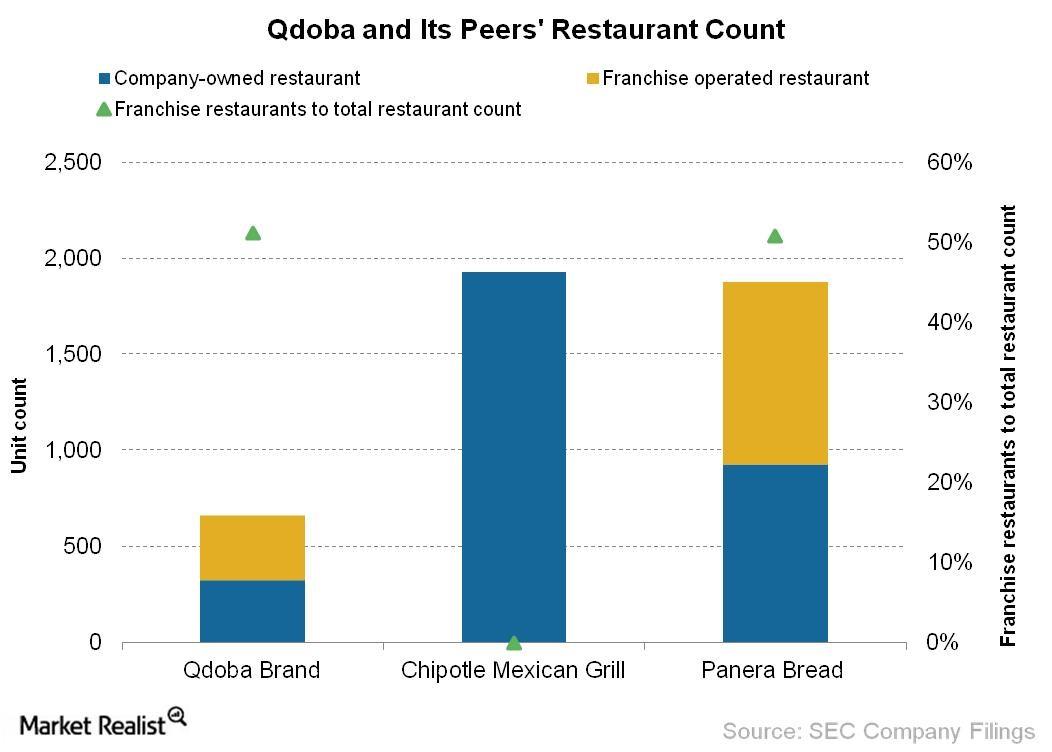

Understanding Qdoba Mexican Eats’ Franchisee Model

Since Jack in the Box’s acquisition of brand Qdoba Mexican Grill, now named Qdoba Mexican Eats, the brand has grown from a mere 85 restaurants to 661.

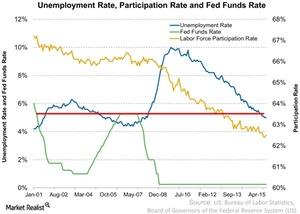

Why Unemployment Rate Matters to Restaurants

While the latest unemployment rate indicates that the US economy is healthy, it’s important to remember that the labor force participation fell over time.

Will Chipotle Report Low Same-Store Sales Growth in 3Q15?

Chipotle (CMG) experienced tremendous same-store sales growth in 2014, with most of its quarters reporting a double-digit growth.

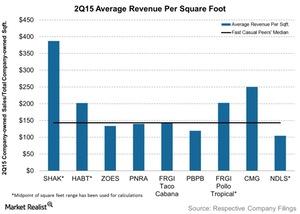

Comp: Average Revenue per Square Foot of Fast Casual Restaurants

Average revenue per square foot gives us insight into how efficiently a company is able to generate sales. Naturally, the higher the number, the better.

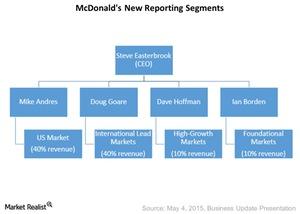

Is McDonald’s Turnaround Plan Working?

McDonald’s (MCD) turnaround plan, which went into effect on July 1, 2015, will take several months to yield results as far as the company’s performance goes.

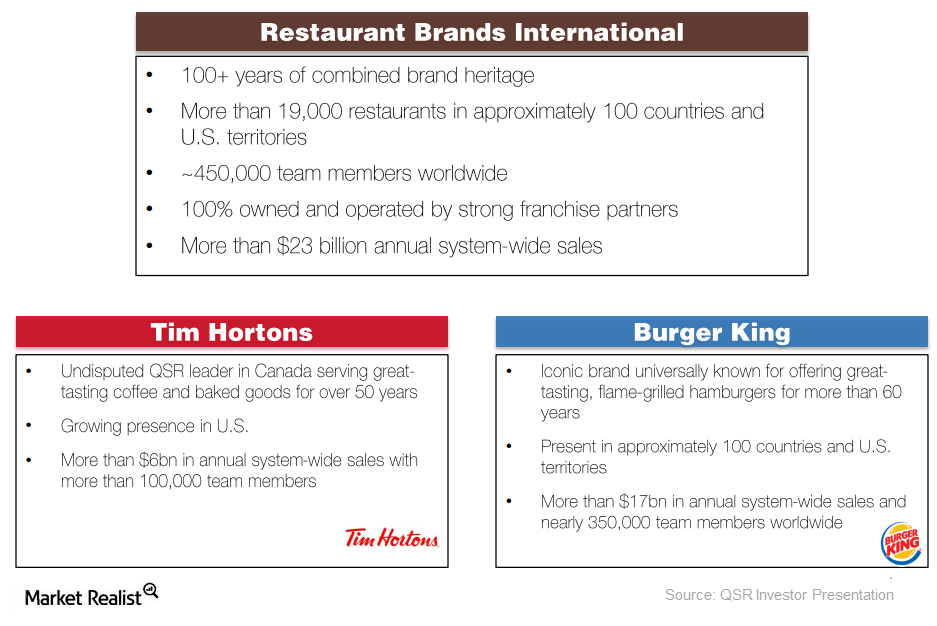

Magnetar Purchases New Stake in Restaurant Brands International

Magnetar Capital added new stake in Restaurant Brands International (QSR) in 4Q14. The position represented 0.73% of its holdings at the end of the year.

Dunkin’ Brands Diversifies Its Daypart Focus

Dunkin’ Brands is now expanding into the afternoon daypart in order to win customers in a different daypart and improve sales leverage.

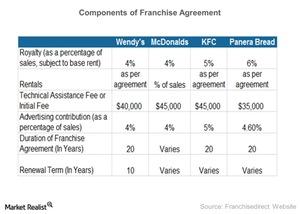

Dunkin’ Brands Has a Nearly 100% Franchise Model

Benefits to a franchise model include low need for capital, more focus on brand in marketing and menus, and a potential to penetrate faster into the market.

Domino’s Wants to Entertain You at Its ‘Pizza Theater’

Domino’s plans to have all its stores remodelled according to the Pizza Theater design by the end of fiscal 2017.

Analyzing Wendy’s Franchise Agreements

Wendy’s franchise agreements are only renewable after ten years. Wendy’s rental income from franchisees grew from $27 million in 2013 to $68 million in 2014.

QSCC: Wendy’s Supply Chain Management

QSCC (Quality Supply Chain Co-op, Inc.) is an independent non-profit organization that’s responsible for the Wendy’s (WEN) supply chain management.

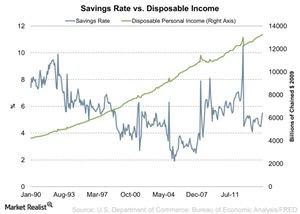

Higher Disposable Income: A Reason for Restaurants to Cheer

Disposable income increased by 40 basis points month-over-month in January. On a YoY (year-over-year) basis, disposable income increased 9.5%.

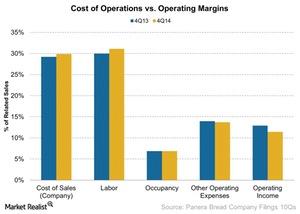

Panera Bread’s Cost Of Operations – Food Inflation And Labor

Labor expenses increased by 1.15% to 31.11% as a percentage of related sales from last year. The increase affected the company’s bakery operating margins.

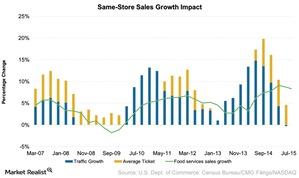

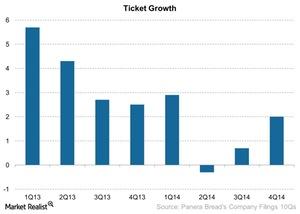

Panera Bread’s Traffic And Ticket Impact Same-Store Sales Growth

Traffic is the increase in the number of customers that visit the stores and make a transaction or purchase. Panera Bread’s traffic grew 1.3%.

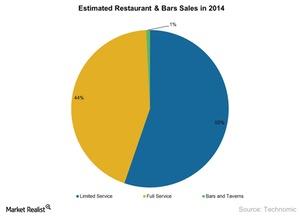

An overview of the US restaurant industry

Consumer confidence in the United States is at an all-time high in seven years, and people are spending more on food prepared outside the home.Company & Industry Overviews What is a company-operated restaurant model?

In a company-owned restaurant, the company takes ownership of the operation at the restaurant location. The company uses its own financial resources to get the location ready for business.Company & Industry Overviews What is a limited-service restaurant?

Limited-service restaurants can be classified into fast food or quick service, fast-casual restaurants, pizza restaurants, and cafés.Consumer Overview: Assessing the restaurant industry business model

Restaurants are simple businesses. Because we have to eat every day, people often think the restaurant industry is a safe one to invest in.

Why food will become more important to Starbucks’ future growth

As a primary coffee retailer, food has been a relatively minor part of Starbucks Corp.’s (SBUX) focus in the past. But lately, Starbucks has been expanding its product offerings for food.