What Really Drove Shake Shack’s Revenue in 1Q16?

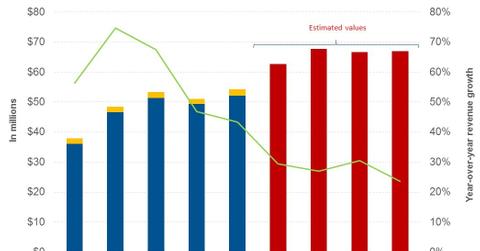

In 1Q16, Shake Shack saw a 43.3% rise in revenue over $37.8 million in 1Q15, driven by unit growth and same-store sales growth.

May 16 2016, Published 4:43 p.m. ET

Revenue sources

Shake Shack (SHAK) earns its revenue through company-owned restaurant sales and franchisee fees and royalties collected from domestic and international franchised restaurants.

In 1Q16, revenue from company-owned restaurants formed 96% of SHAK’s total revenue.

1Q16 performance

In 1Q16, Shake Shack (SHAK), which forms 0.02% of the holdings of the iShares Russell 2000 Growth ETF (IWO), saw a 43.3% rise in revenue over $37.8 million in 1Q15. SHAK’s revenue rise was driven by unit growth and same-store sales growth.

For 1Q16, SHAK reported revenue of $52.2 million from its company-owned restaurants, a rise of 44.7% compared to $36 million in 1Q15. The revenue rise was driven by 9.9% same-store sales growth and an increase of 13 company-owned restaurants.

In 1Q16, SHAK’s revenue from franchised restaurants stood at $2 million, a rise of 14.3% compared to $1.8 million in 1Q15. Compared to 1Q15, SHAK increased its franchised restaurant count by nine, which was a major driver of revenue growth in the segment.

However, SHAK experienced a slowdown in energy-related markets such as the Middle East. The strong dollar also negatively affected SHAK’s revenue from its international operations.

Peer comparison

In 1Q16, Panera Bread (PNRA) posted a revenue rise of 5.7%. SHAK’s other peers Chipotle Mexican Grill (CMG) and Jack in the Box (JACK) posted falls of 23.4% and 2%, respectively.

Outlook

Strong 1Q16 results have prompted SHAK’s management to raise its revenue guidance for 2016 to $245 million–$249 million from its earlier guidance of $237 million–$242 million. However, analysts have forecast SHAK’s revenue to be $251.1 million, a rise of 31.8% compared to $190.6 million in 2015.

In the next few articles, we’ll discuss SHAK’s revenue drivers.