iShares Russell 2000 Growth

Latest iShares Russell 2000 Growth News and Updates

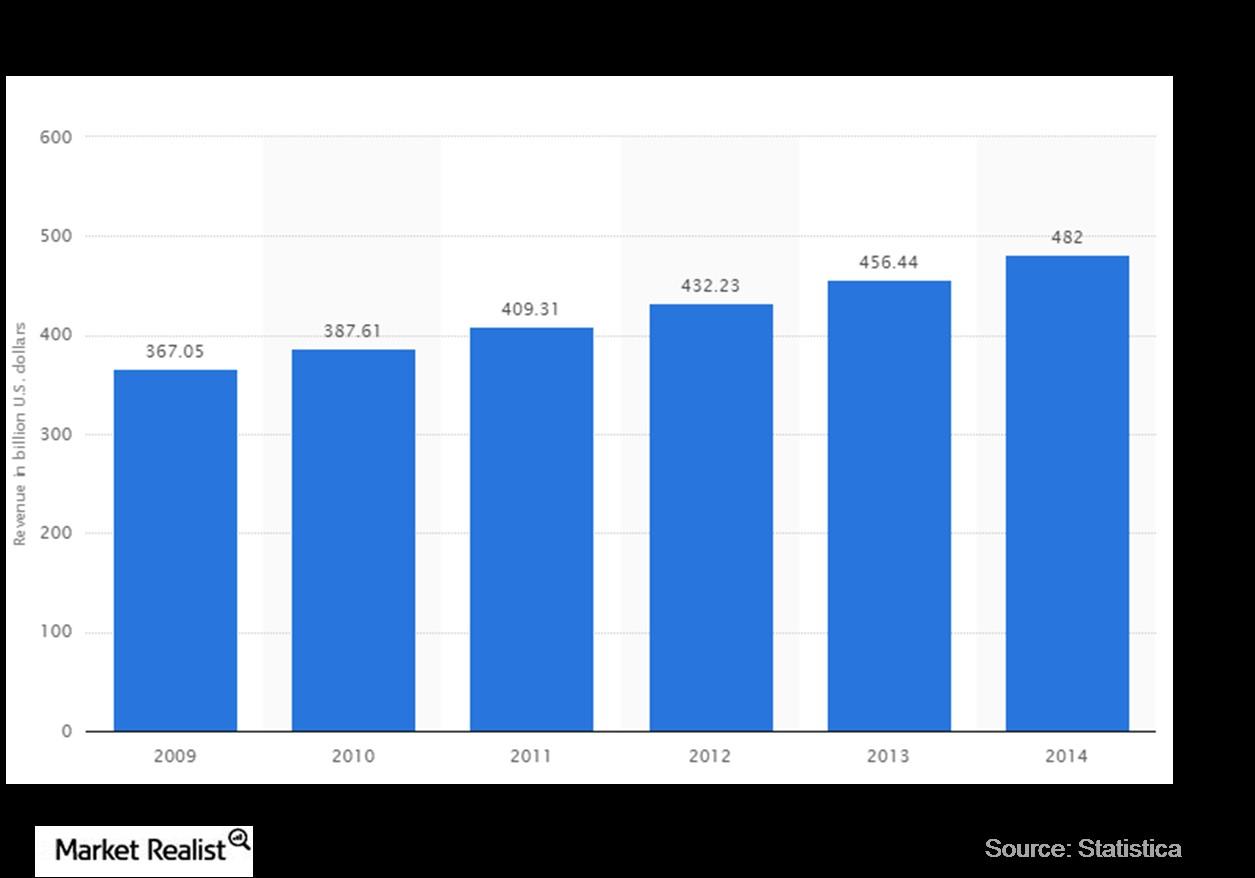

An Overview of US Gas Stations with Convenience Stores

Casey’s, as per the North American Industry Classification System (NAICS), falls under the sub-category of gas stations with convenience stores.

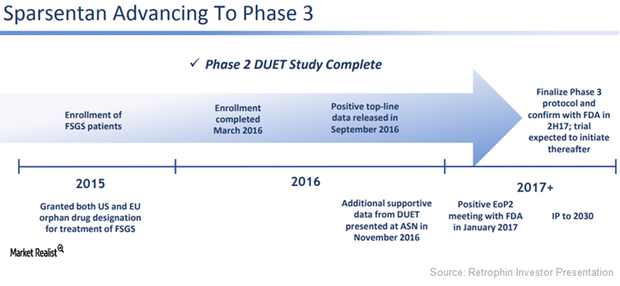

Sparsentan May Be Solid Near-Term Growth Driver for Ligand

With Sparsentan, Retrophin and Ligand Pharmaceuticals could become major nephrology players similar to peers such as Amgen (AMGN), AstraZeneca (AZN), and Bristol-Myers Squibb (BMY).

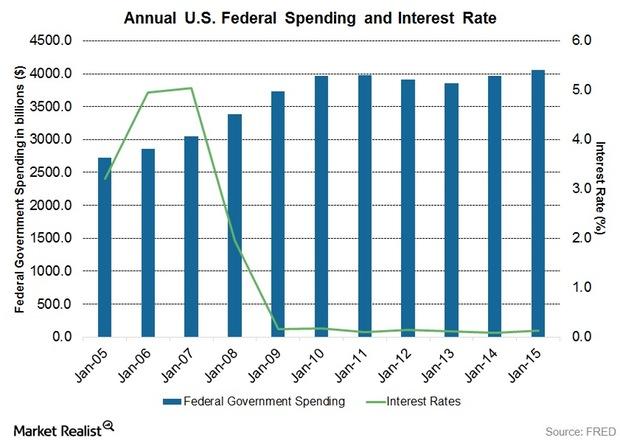

Federal Spending and Interest Rates: Analyzing the Connection

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates.

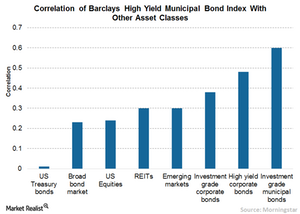

Municipal Bonds Are the Ballast to Equity Risk

Historically, investment-grade and high-yield municipal bonds (MUB) have a very low correlation with most other asset classes.

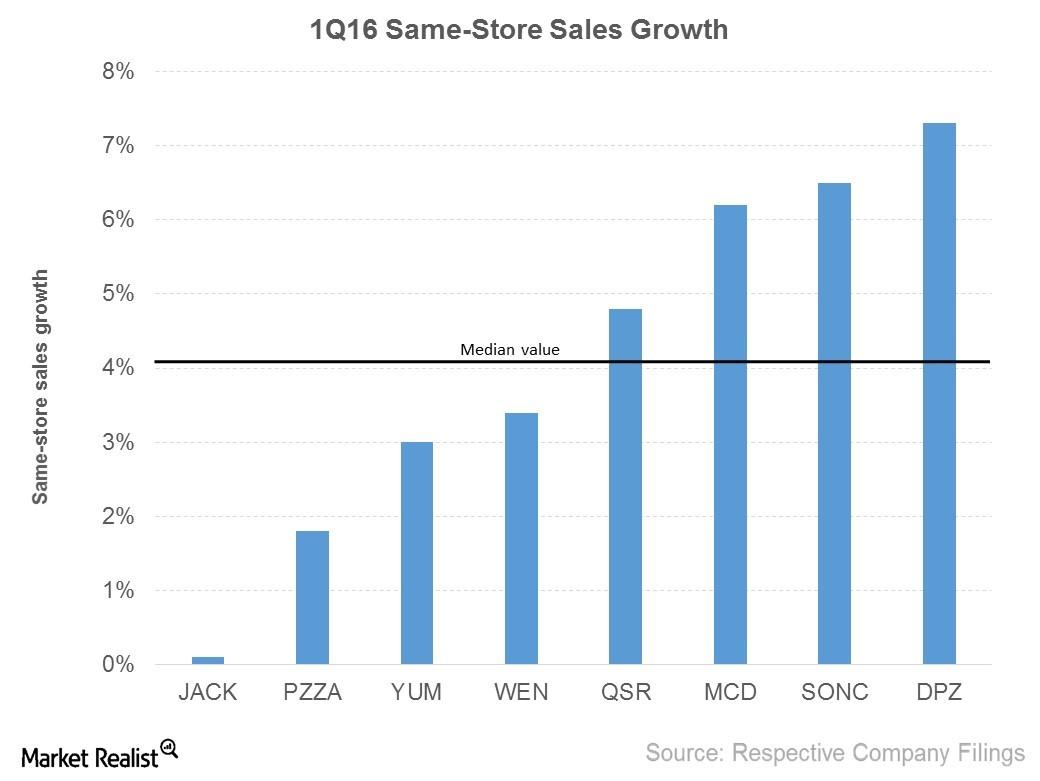

Why Domino’s Outperformed Other Fast-Food and Pizza Companies in Same-Store Sales Growth in 1Q16

SSSG is an important metric for investors to monitor because it increases a fast-food company’s revenue without increasing capital investment.

Getting to Know The Cheesecake Factory’s Management

A company is greatly impacted by its management’s decisions. In this article, we’ll discuss The Cheesecake Factory’s (CAKE) management and its achievements.

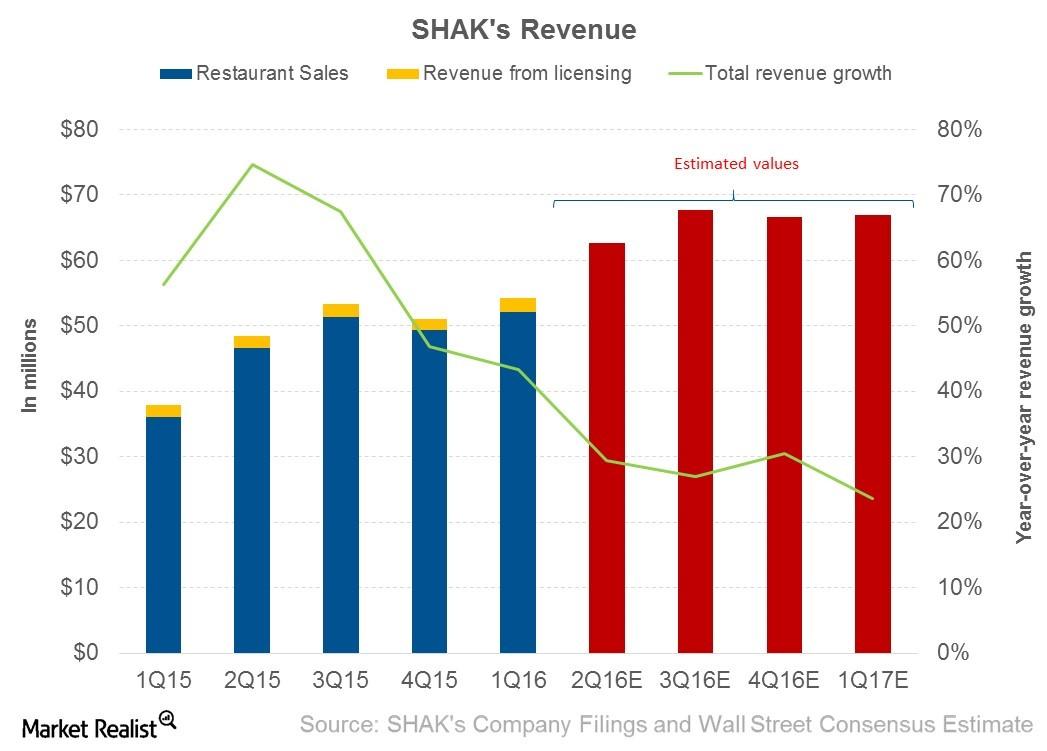

What Really Drove Shake Shack’s Revenue in 1Q16?

In 1Q16, Shake Shack saw a 43.3% rise in revenue over $37.8 million in 1Q15, driven by unit growth and same-store sales growth.

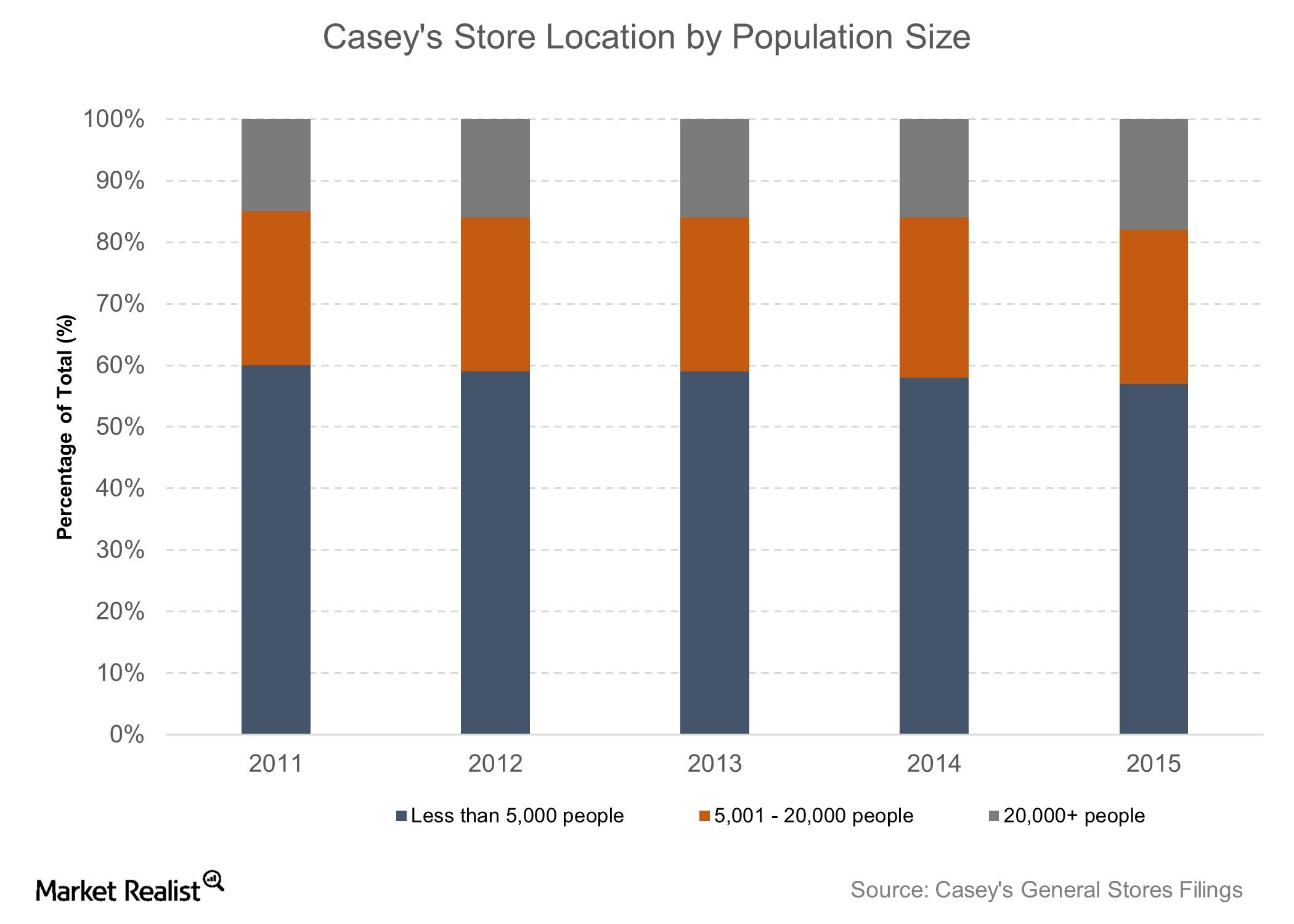

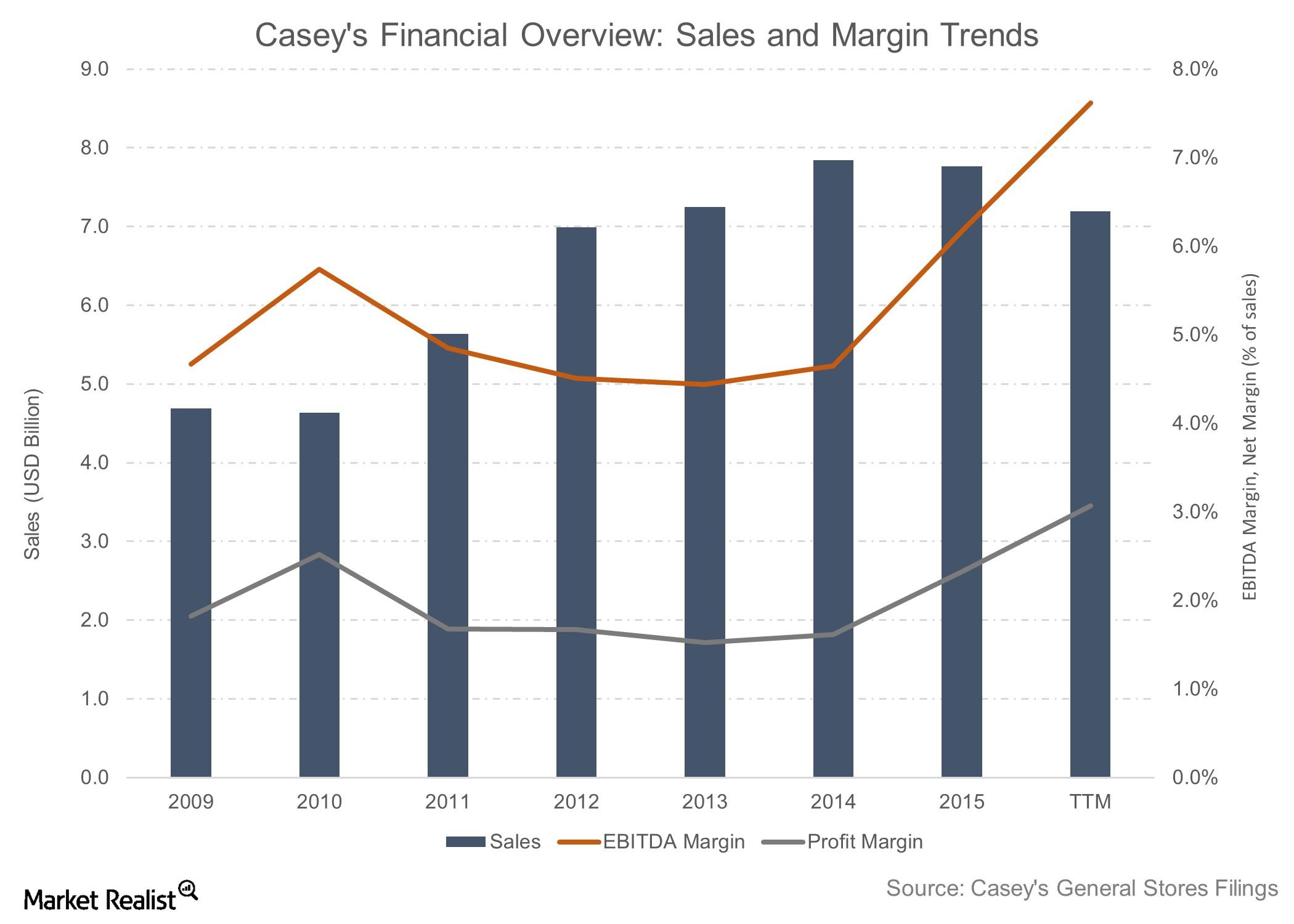

A Quick Look at Casey’s Business Model

Casey’s business model focuses on opening stores in smaller towns, where the population is lower and competition is minimal.

Company Overview: An Introduction to Casey’s General Stores

Casey’s General Stores’ strong and differentiated business model has resulted in the company’s delivering total returns of 27% in the last year.

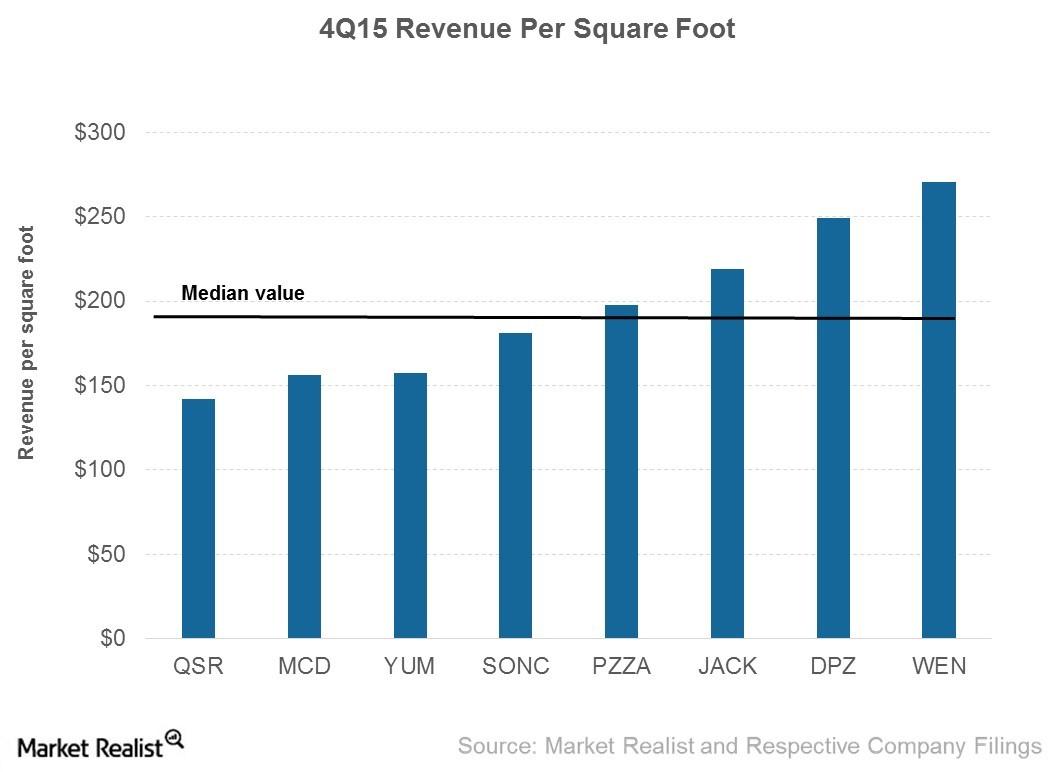

Which Fast Food Restaurant Led in 4Q15 Revenue Per Square Foot?

In 4Q15, MCD, YUM, WEN, QSR, JACK, SONC, PZZA, and DPZ generated an average revenue of $189 per square foot.

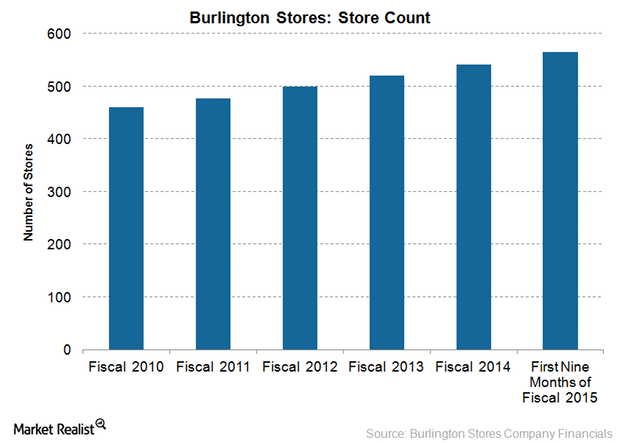

Why Smaller Stores Provide a Better Growth Option for Burlington Stores

Burlington has been focusing on opening smaller stores. The average size of the new stores opened in 2013 and 2014 was a little over 60,000 square feet.

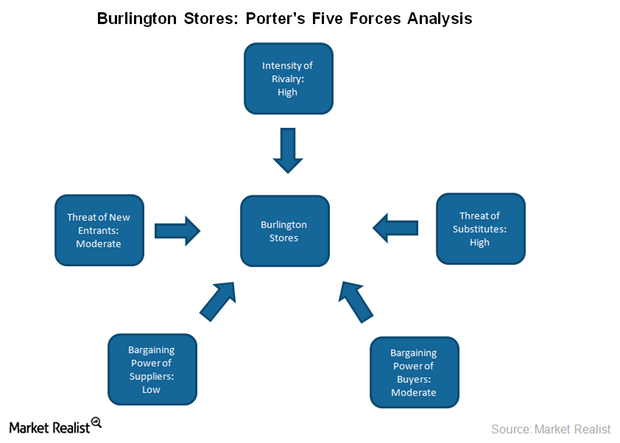

Burlington Stores’ Market Positioning in 2015 and Beyond

Burlington Stores targets the value-conscious, middle-class consumer. The number of customers making purchases at the company’s stores is large.

What are alternative investments?

Alternative investments seek to provide a hedge against various market risks by following hedge fund-like strategies.