What Is the Outlook for Shake Shack in 2016?

A New York–based fine casual restaurant chain, Shake Shack (SHAK) announced its 4Q15 results on March 7, 2016. SHAK reported an overall revenue of $51.1 million and earnings per share of $0.08.

Dec. 4 2020, Updated 10:52 a.m. ET

4Q15 performance

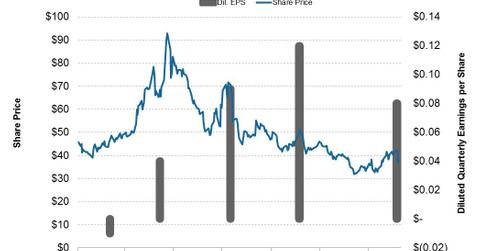

A New York–based American fine casual restaurant chain, Shake Shack (SHAK) announced its 4Q15 results on March 7, 2016. The company reported overall revenues of $51.1 million and earnings per share (or EPS) of $0.08. SHAK’s 4Q15 revenue grew by over 47% compared to 4Q14’s $34.8 million, while EPS appreciated from -$0.03.

Market response

Although Shake Shack’s 4Q15 results beat the analysts’ estimates of $50.3 million in revenue and $0.07 in EPS, the outlook for 2016 failed to cheer the market as the stock closed March 8, 2016, with a stock price of $37.30. This was a decline of over 11% from the previous day’s closing price of $42.20. The decline was also aided by weakness in the broader equity market as the NASDAQ Composite (IXIC) was down by 1.3%.

Year-to-date, Shake Shack’s stock prices have declined by 5.9%. During the same period, SHAK’s peers Chipotle Mexican Grill’s (CMG) delivered returns of 9.1%, Panera Bread (PNRA) returned 8%, Jack in the Box (JACK) returned -11.7%, and the Consumer Discretionary Select Sector SPDR ETF (XLY), which is the comparative benchmark index, fell by more than 3%