Nasdaq Composite

Latest Nasdaq Composite News and Updates

Why Are Tech Stocks Dropping and Will They Rebound?

Fed Chair Jerome Powell likely has something to do with stock futures and tech stocks dropping, but why? Will tech stocks rebound?

What’s Leon Cooperman’s Largest Position?

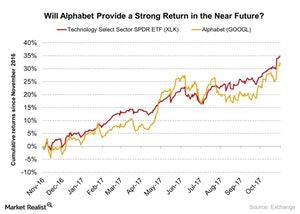

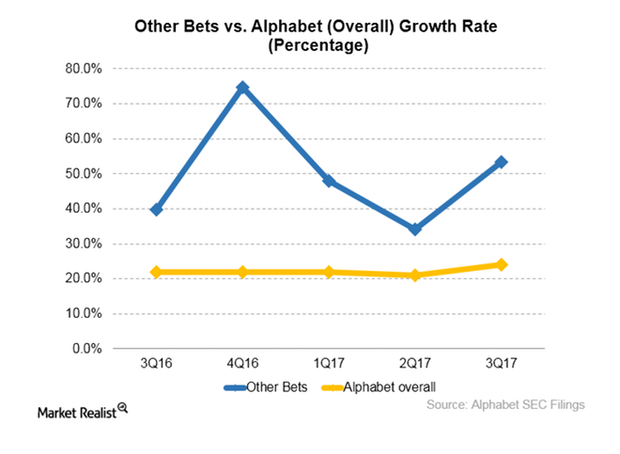

Alphabet reported its 3Q17 earnings on October 26, 2017. The company posted EPS (earnings per share) of $9.57, which beat analysts’ estimates of $8.33.

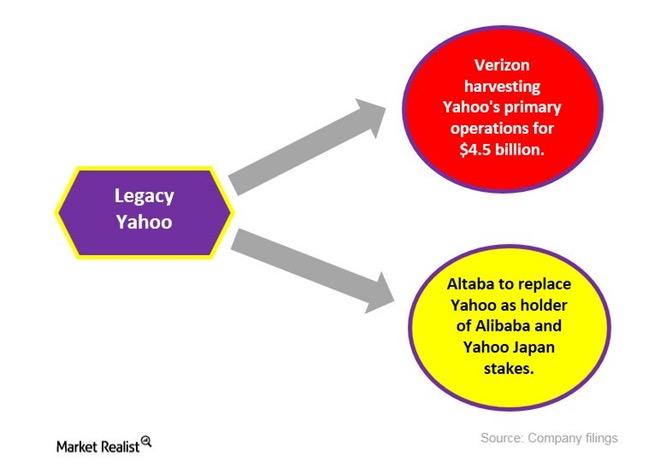

Verizon Aims Higher with Yahoo Acquisition

After 11 long months of uncertainty and many negotiations, Verizon (VZ) has completed its $4.5 billion acquisition of Yahoo’s core Internet assets. Let’s look at what’s in store for the US telecom space.

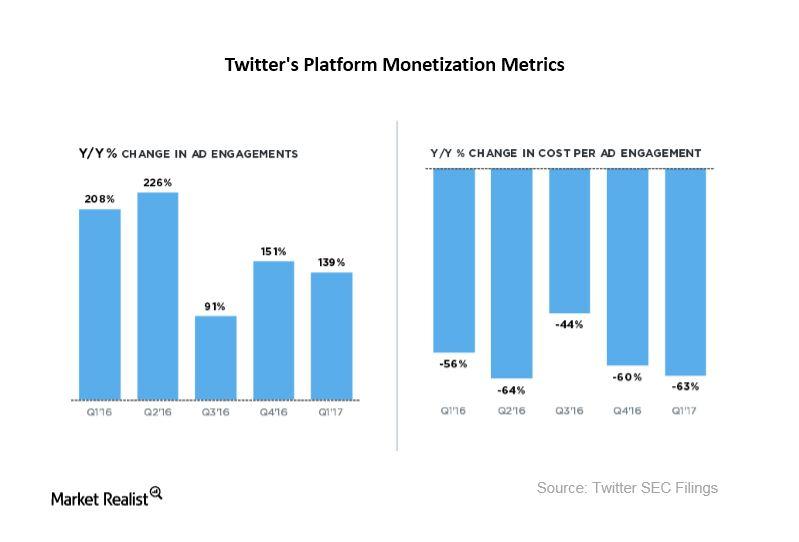

Potential Dangers: Twitter and Fake News

Twitter (TWTR) is considering rolling out a feature that could empower its users to report misleading or deceitful news stories, according to a Washington Post report.

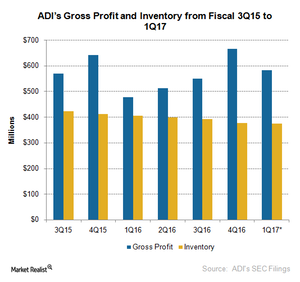

ADI’s Plan for a High Gross Margin in Slow Quarters

Analog Devices’ fiscal 1Q17 revenues will likely see seasonal declines, and this seasonality is something that it can’t escape.

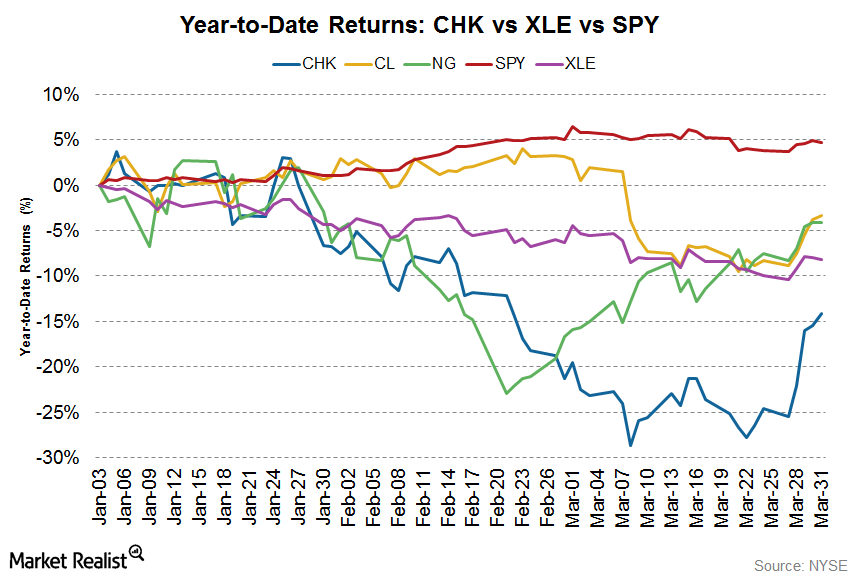

Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

Why George Soros Compares Facebook and Google to Casinos

Billionaire investor George Soros recently shared his views on social media companies Facebook and Google.

Why Marc Faber Thinks These Stocks Are Vulnerable

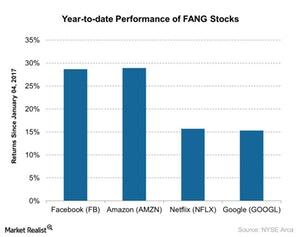

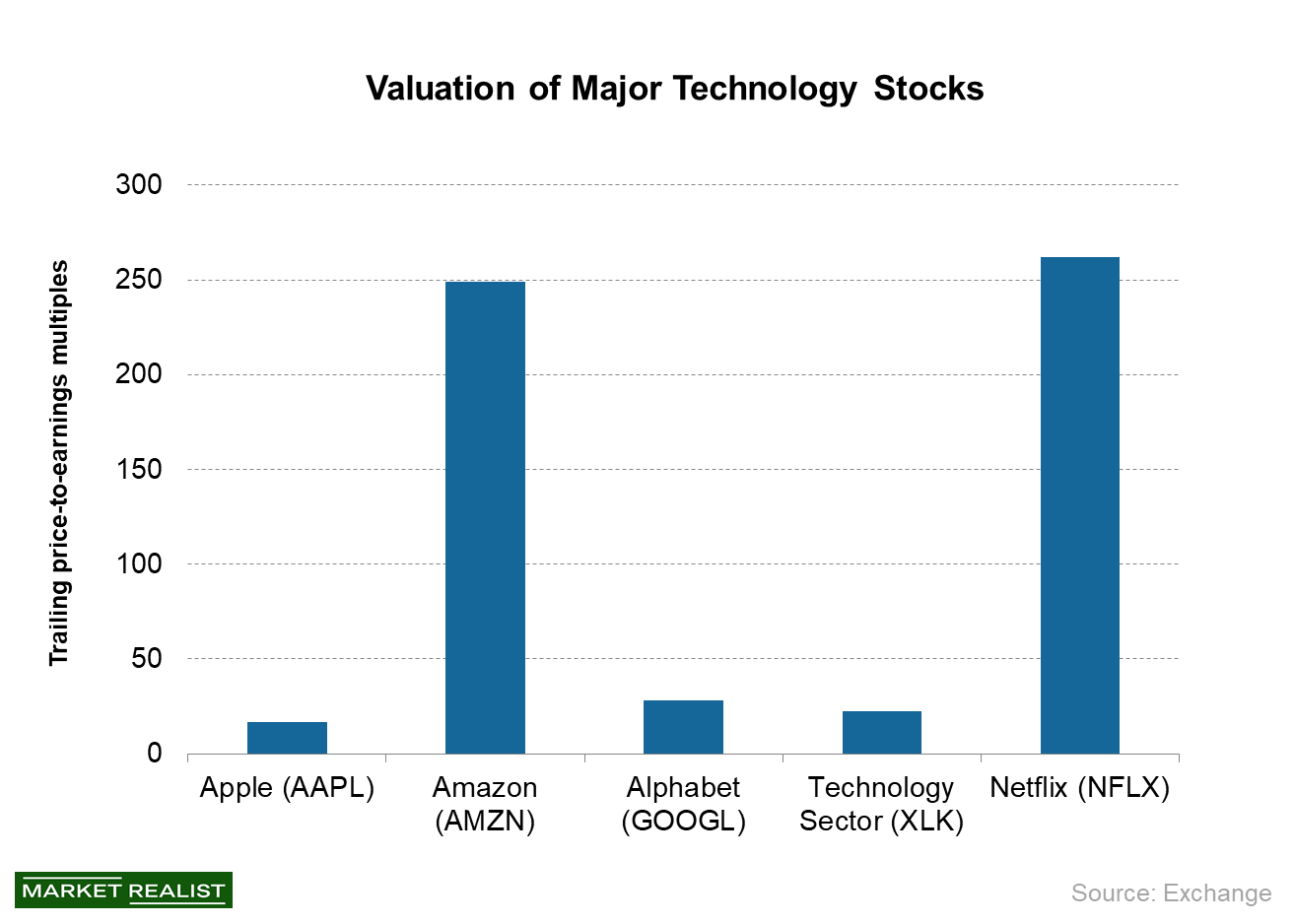

Facebook, Amazon, Netflix, and Google returned nearly 388%, 345%, 1,157%, and 217%, respectively, in the last five years.

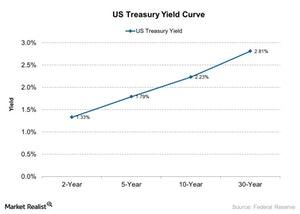

Miller: Bond Bear Market to ‘Propel Stocks Significantly Higher’

Legendary value investor Bill Miller has an optimistic view on the equity market.

Gundlach on Higher Yield: Watching the Copper-to-Gold Ratio

Billionaire investor and bond guru Jeffrey Gundlach also shared his view on bond yields in an interview with CNBC.

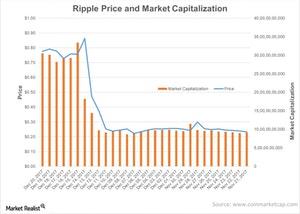

Ripple Crosses $1 for the First Time on December 21

For the first time in history, the price of ripple has surpassed $1.

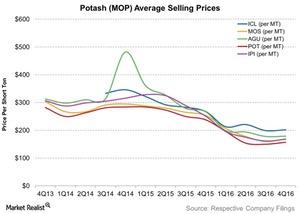

Potash on the Barrel: Prices for Five Major Producers

On average, potash prices for these five producers fell ~33% YoY in 4Q16. Excess supply and weak demand added downward pressure.

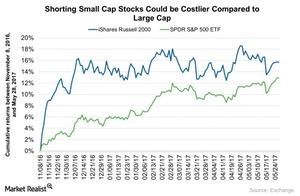

Will George Soros’s Position in IWM Provide a Strong Return?

According to the recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter.

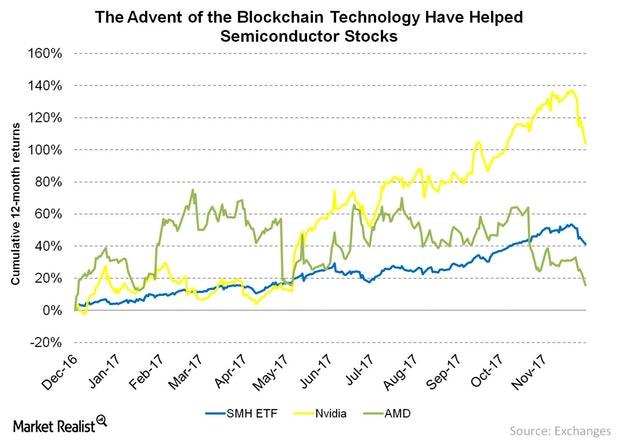

Semiconductor Stocks Have Soared on Blockchain Technology

Despite recent declines, the SMH ETF has risen over 41% in the last 12 months. Meanwhile, NVIDIA has risen a whopping 186.7% in the same period, while AMD has returned 15.5% in that period.

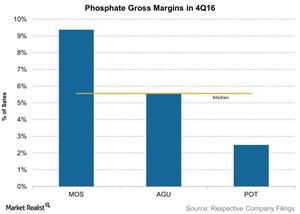

Why Phosphate Matters: Margins Among the Biggest Producers

The median gross margin for these companies’ phosphate segments was 14%, as a percentage of segment sales in 4Q15.

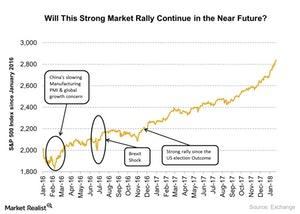

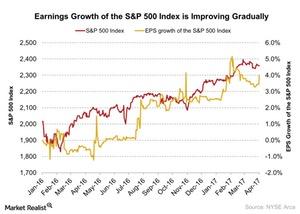

Jurrien Timmer’s Take on What Will Drive Markets the Most in 2017

When asked in a recent interview his thoughts about the short-term and medium-term investment story, Jurrien Timmer said that the main issue for the market other than geopolitical risks is its valuation.

Why David Einhorn Is Betting against Amazon

On a YTD (year-to-date) basis, Amazon has returned nearly 40% as of November 3, 2017.

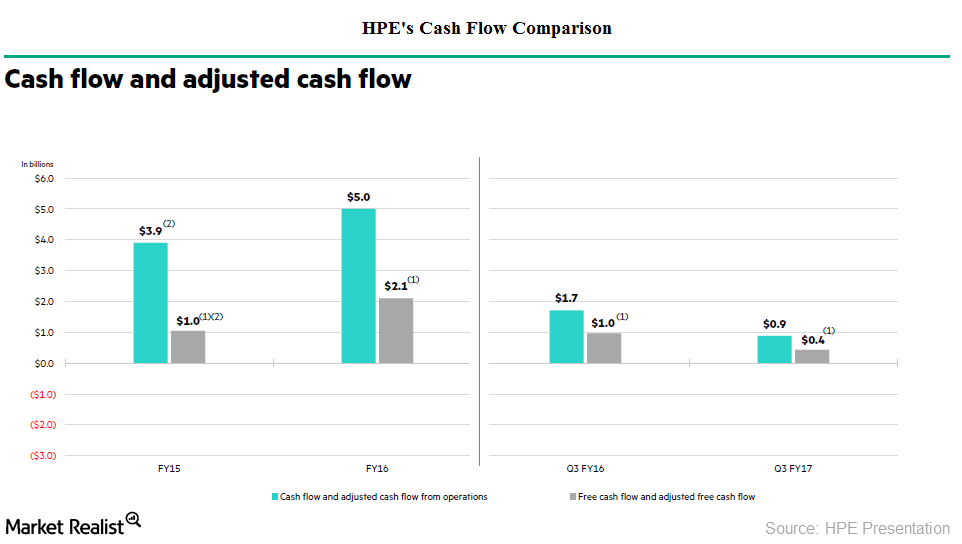

How Hewlett Packard Enterprise Is Increasing Shareholder Value

By the end of fiscal 3Q17, HPE had returned $107 million to shareholders in the form of dividends and $625 million through share repurchases.

Why GoPro Is So Optimistic about HERO5

Although GoPro missed revenue estimates in 4Q16, it was still the firm’s second-best-performing quarter in revenue, primarily driven by HERO5 sales.

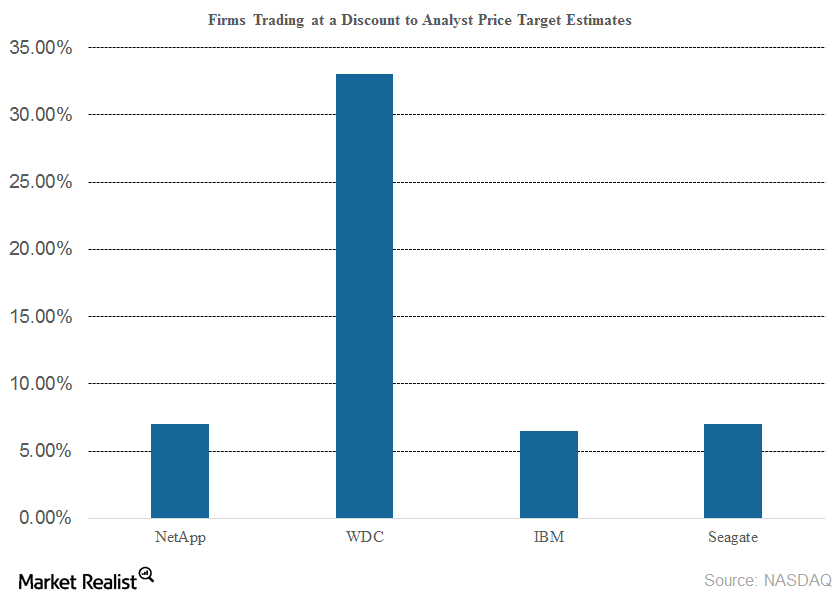

What Analysts Recommend for NetApp

Of the 27 analysts covering storage technology (QQQ) company NetApp (NTAP), 13 gave it a “buy” recommendation, two recommended a “sell,” and 12 recommended a “hold.”

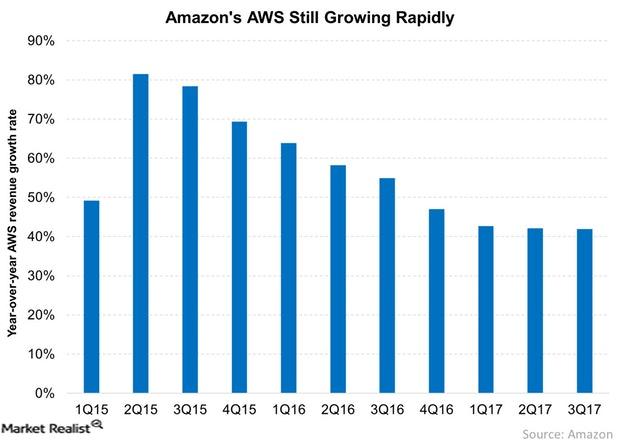

How Amazon Keeps Growing

Amazon.com (AMZN) posted its fiscal 3Q17 numbers last week, handily beating its earnings and revenue estimates.

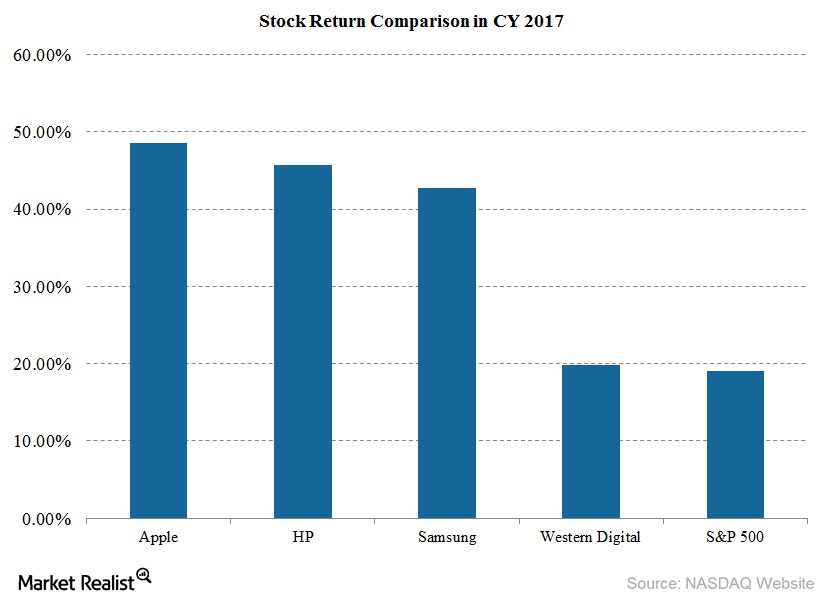

How Apple Stock Performed in 2017

Technology heavyweight Apple’s (AAPL) stock rose 48.5% in 2017 to close the year at $169.23. Its stock has fallen 3.3% in the last five trading days.

Investing Defensively Can Lose You a Fortune

I bet you may have heard a lot about investing defensively while the market faded.

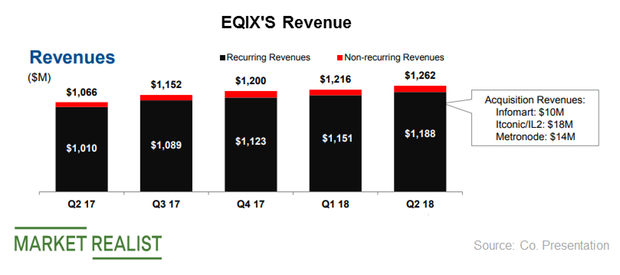

Equinix’s Latest Performance and Future Projections

Equinix’s (EQIX) revenue rose at a four-year CAGR (compound annual growth rate) of 19% to $4.4 billion in 2017.

Is the Market Worried about an Overheating US Economy?

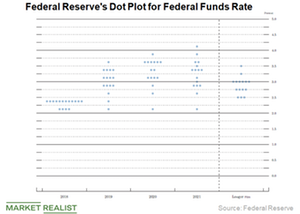

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Why George Soros Bought Amazon and Netflix

Legendary billionaire investor George Soros made some changes in his firm, Soros Fund Management LLC’s, portfolio in the first quarter.

Inflation and Retail Sales: Their Effect on the Economy

In this series, we’ll analyze UK inflation and US inflation for January 2018. We’ll also analyze retail sales for that month.

How Alphabet Is Diversifying Its Business

Alphabet (GOOG) announced on January 25, 2018, that it is launching its 13th unit—cybersecurity company Chronicle.

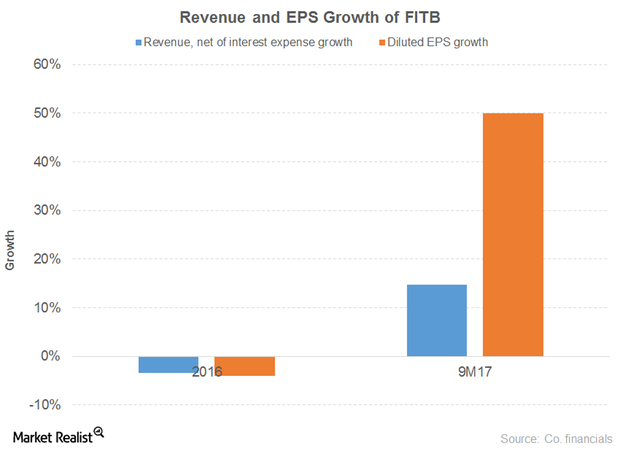

How Fifth Third Bancorp Has Performed Recently

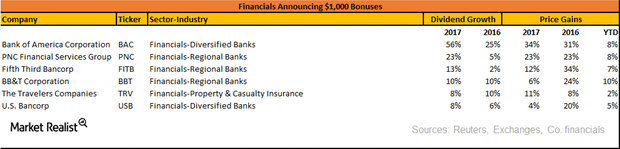

Fifth Third Bancorp has an impressive free cash flow position.

A Look at Bank of America’s Key Growth Drivers

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and PE of 20.7x.

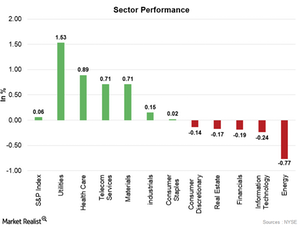

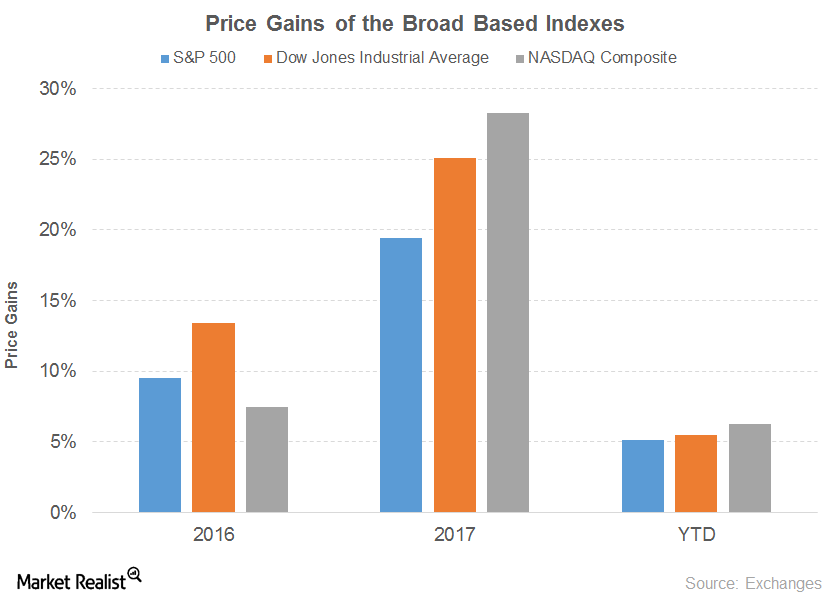

How Did the S&P 500, NASDAQ, and Dow Perform on January 25?

On January 25, six out of the S&P 500’s 11 major sectors moved higher. Strength in the utilities and health care sectors pushed the market higher.

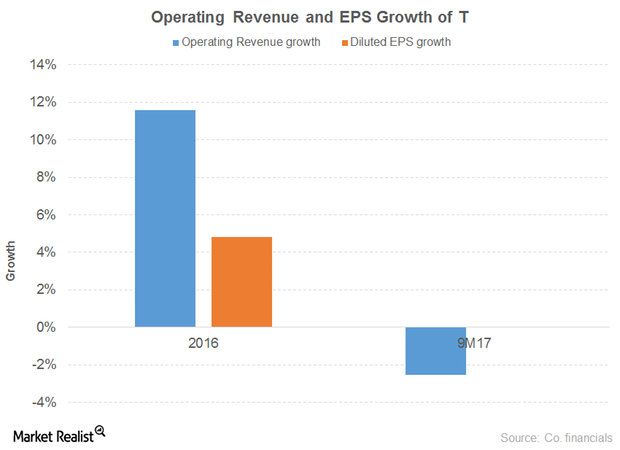

How AT&T Is Preparing for the Price War

AT&T’s cost of revenue rose 15% in 2016 before decreasing 1% in 9M17. That led to a 9% growth in gross profit for 2016 before falling 4% in 9M17.

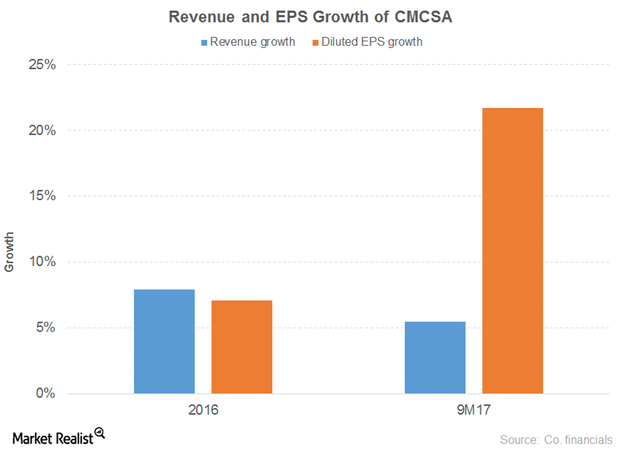

A Look at Comcast’s Strategy

Comcast’s (CMCSA) revenue grew 8% and 5% in 2016 and 9M17, respectively. The broadcast of the Rio Olympics in 3Q16 drove the 2016 numbers.

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

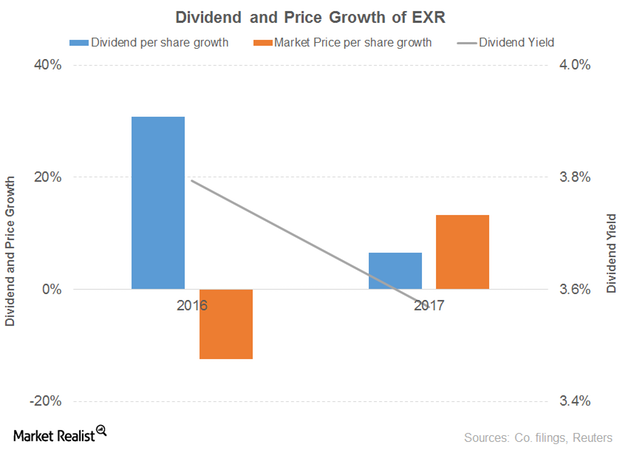

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

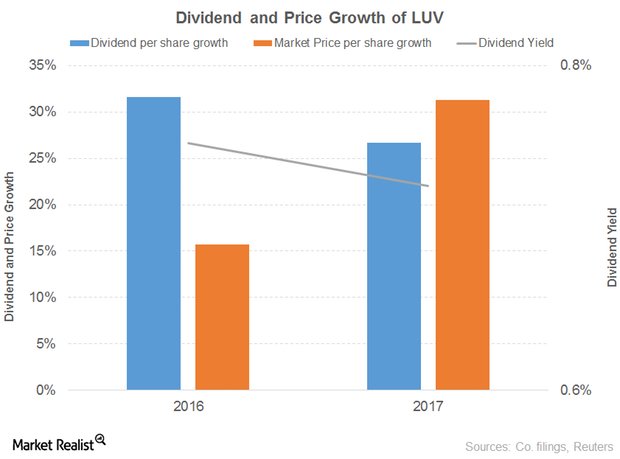

Here’s What Influenced the Outlook for Southwest Airlines

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

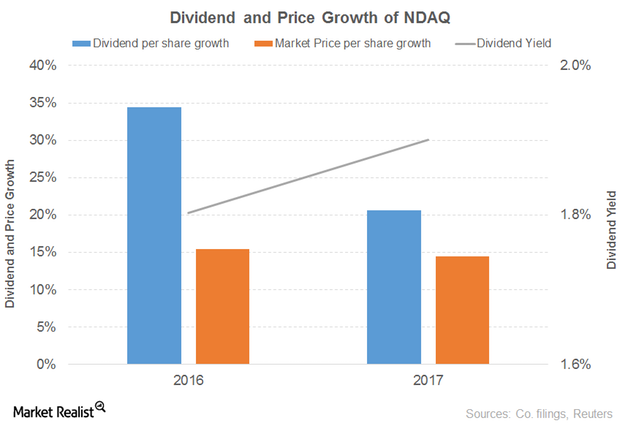

What’s behind the Outlook for Nasdaq?

Nasdaq (NDAQ) revenue rose 9% and 8% in 2016 and 9M17, respectively.

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

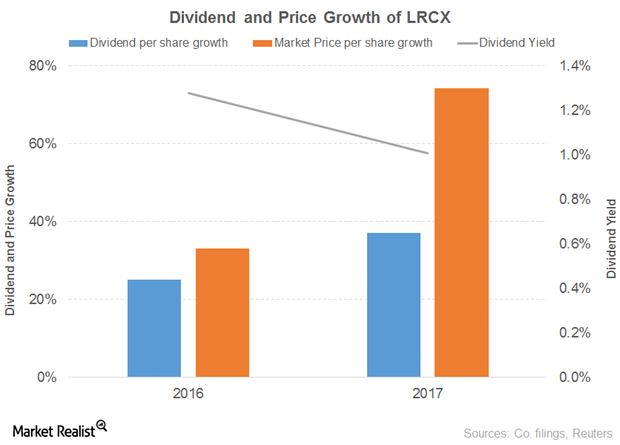

What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

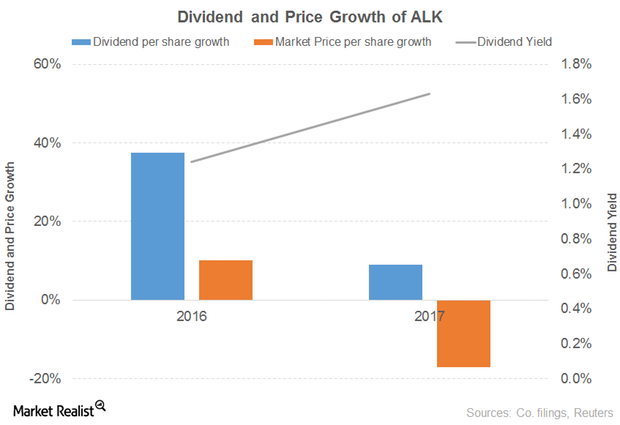

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

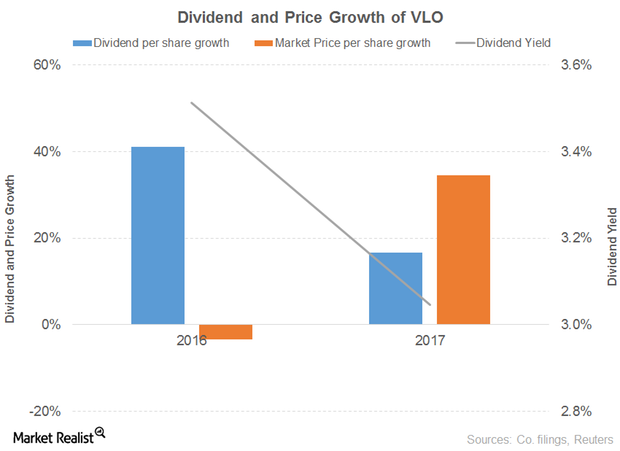

What Has Influenced the Outlook for Valero Energy?

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues.

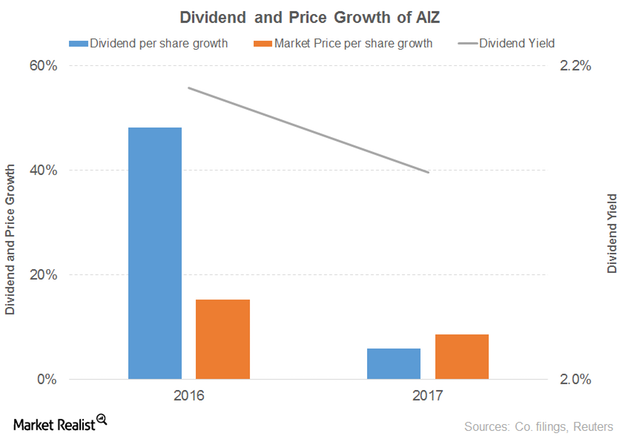

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

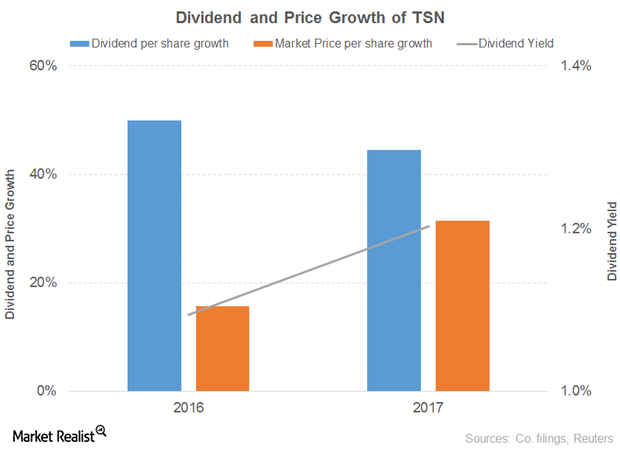

What’s the Outlook for Tyson?

Tyson Foods’ (TSN) sales dropped 11% in 2016 before gaining 4% in 2017.

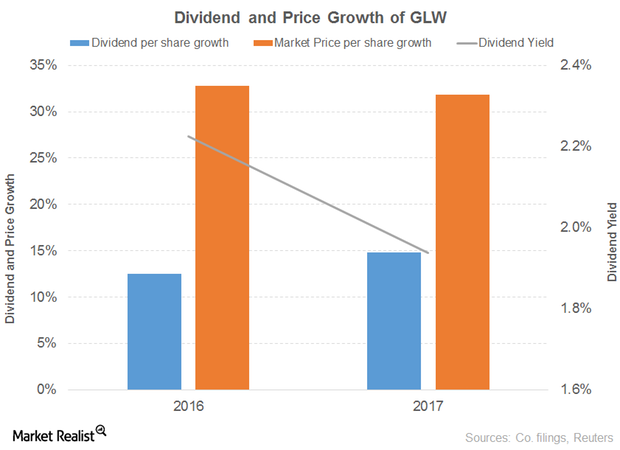

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

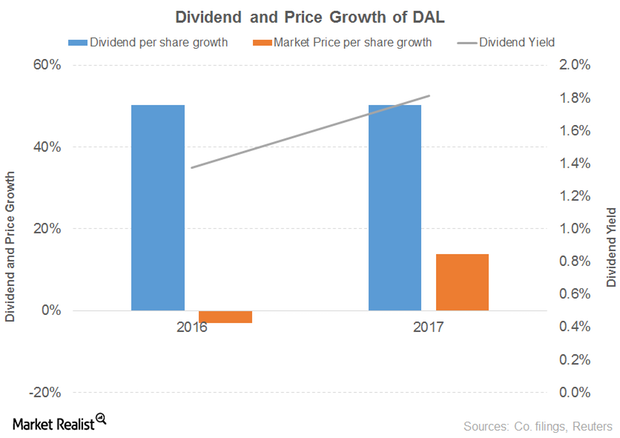

What to Expect from Delta Air Lines

Delta Air Lines’ (DAL) operating revenue fell 3% in 2016 before gaining 3% in 9M17 (or the first nine months of 2017).

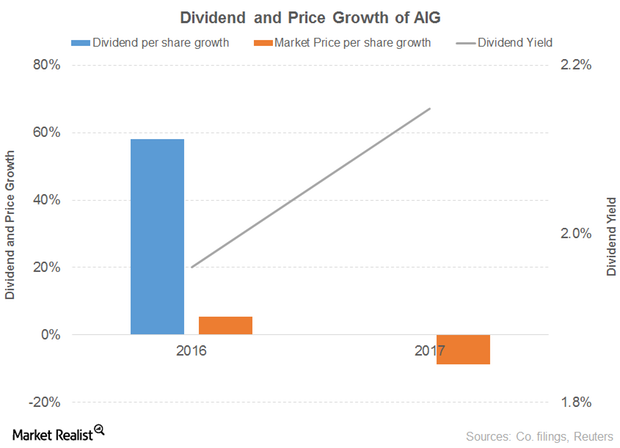

What’s the Outlook for American International Group?

American International Group’s dividend per share rose 58% in 2016 and was flat in 2017.

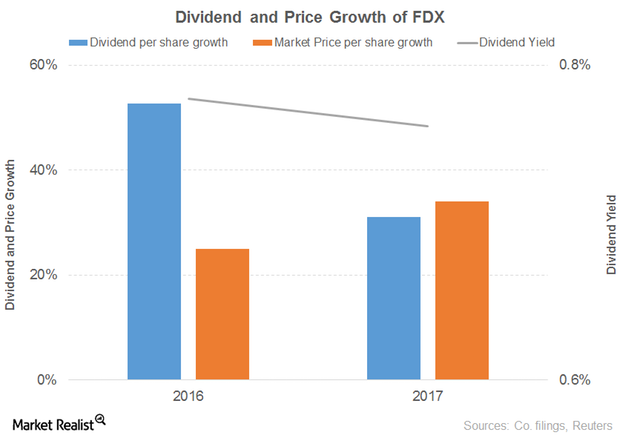

How FedEx’s Performance Influenced Its Outlook

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

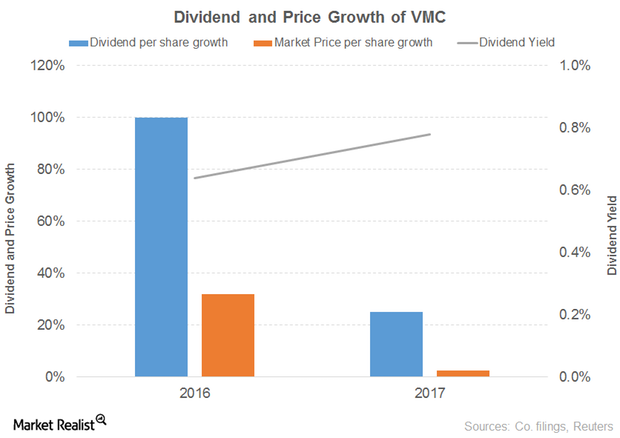

The Outlook for the Vulcan Materials Company

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.

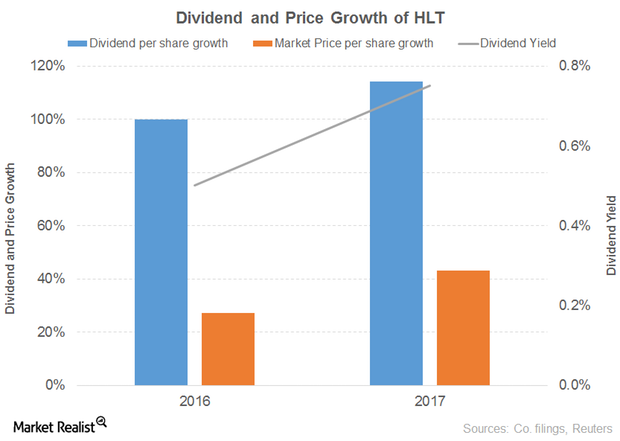

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

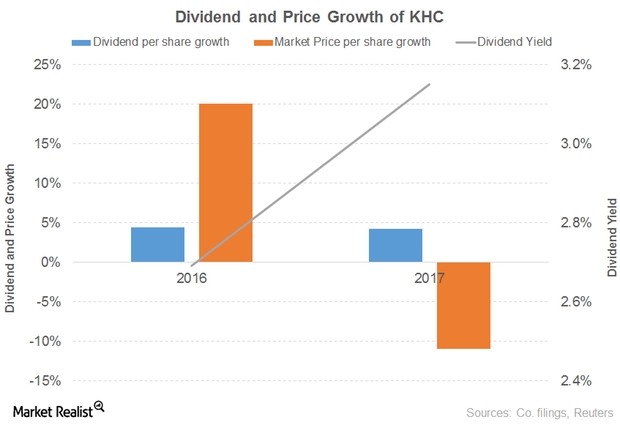

Why The Kraft Heinz Company’s Outlook Still Seems Promising

The Kraft Heinz Company’s (KHC) net sales grew 44% in 2016 before falling 1% in 9M17. Every product category drove the growth in 2016, offset by a decline in the infant and nutrition segments.