Can 2Q16 Results Drive McDonald’s Valuation Multiple Up?

Valuation multiple Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its […]

Dec. 4 2020, Updated 10:53 a.m. ET

Valuation multiple

Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its high visibility in McDonald’s (MCD) earnings. The forward PE ratio is calculated by dividing the current share price by the forecast earnings per share for the next 12 months.

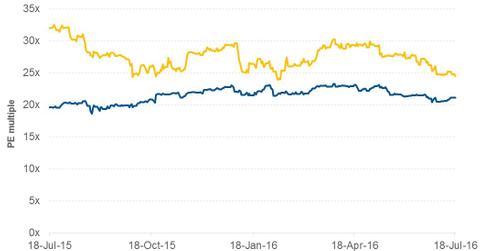

MCD’s PE multiple

Since April 22, 2016, McDonald’s PE multiple has fallen from 22.2x to 21.2x. The deceleration in same-store sales growth in the US burger industry and analysts’ expectation that it will be hard for McDonald’s to post same-store sales growth led to a decline in McDonald’s share price. This drop, in turn, has brought PE multiple down. On July 18, 2016, McDonald’s peers Jack in the Box (JACK), Wendy’s Company (WEN), and Restaurant Brands International (QSR) were trading at 21x, 24.5x, and 29.1x, respectively.

Due to its lower growth rate, McDonald’s has been trading below its peers’ median value. However, since the reorganization strategy adopted in July 2015, the gap between McDonald’s PE multiple and its peers’ median has reduced.

Risks and uncertainties

Encouraged by the positive response from the all-day breakfast initiative, the company is expanding its breakfast menu items. It will be interesting to see its impact on same-store sales growth and operating efficiency, with kitchen operations being stretched. This may have already been factored into the earnings per share estimate of $5.70 for the next four quarters. This represents growth of 7.5%. If the company’s results come in lower, the stock could face selling pressure. That could bring the PE ratio down, and vice versa.

In the final part of this series, we’ll look at analysts’ recommendations for McDonald’s prior to 2Q16 earnings.