Why Ammonia Prices Are Falling

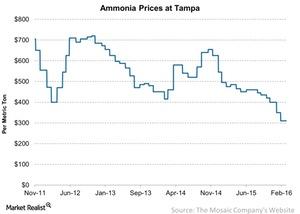

The average price of ammonia for the week ending March 4, 2016, stood at $310 per metric ton compared to $311 per metric ton a week ago.

Nov. 20 2020, Updated 11:12 a.m. ET

Ammonia

To produce one metric ton of DAP (diammonium phosphate), about 0.23 metric tons of ammonia are required. Ammonia is used along with phosphoric acid for the production of DAP and MAP (monoammonium phosphate).

Most global ammonia production is upgraded to other fertilizer products such as urea, UAN (urea ammonium nitrate), DAP, and MAP.

The average price of ammonia for the week ending March 4, 2016, stood at $310 per metric ton compared to $311 per metric ton a week ago. Ammonia fell primarily due to lower natural gas costs.

Natural gas prices

Natural gas hit a four-year low of $1.49 per MMBtu (million British thermal units) this past week. It fell from a high of $2.53 in early January 2016. The recent price crossed below the low of $1.53 around the end of December 2015.

Low natural gas prices benefit the margins of companies such as CF Industries (CF), Terra Nitrogen (TNH), and Agrium (AGU). You can gain exposure to agricultural fertilizer companies without investing directly in a company’s stock by investing in the iShares U.S. Basic Materials ETF (IYM), which invests 12.5% in agricultural chemicals companies, including 1.9% in phosphate producer Mosaic Company (MOS).

EIA expectations

The EIA (U.S. Energy Information Administration) expects prices of natural gas to rise to an average of $2.65 per MMBtu in 2016 and an average of $3.22 per MMBtu in 2017. These rises are anticipated to come from the industrial sector, mainly driven by new nitrogen fertilizer capacities that are expected to come online in 2016 and 2017, according to the EIA.

The EIA also expects natural gas consumption to rise from 76.4 Bcf (billion cubic feet) per day in 2016 to 77.3 Bcf per day in 2017. These rises are anticipated to come from the industrial sector, mainly driven by new nitrogen fertilizer capacities. These factors may put pressure on ammonia prices and thus phosphate and nitrogen fertilizer producers.

To get more updates on fertilizer companies, visit Market Realist’s Agricultural Fertilizers page.