JPMorgan Chase & Co

Latest JPMorgan Chase & Co News and Updates

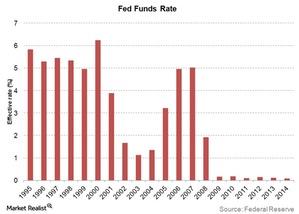

Why Are Interest Rates at an All-time Low?

The quantitative easing policy adopted by the Federal Reserve at the end of 2008 to boost economic growth included a drastic reduction in interest rates.

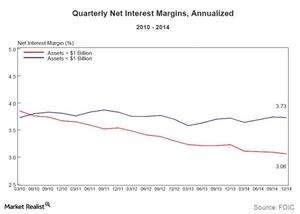

Why Lower Funding Costs Impact Net Interest Margins

Lower funding costs determine a bank’s net interest margin. A bank has funding cost advantage when it pays less interest on borrowed funds and deposits.

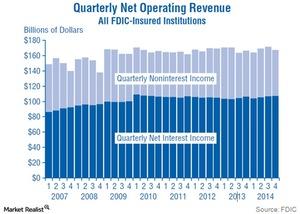

Why Is Interest Income Important to Banks?

Interest income typically contributes more than 60% to a bank’s total operating income.

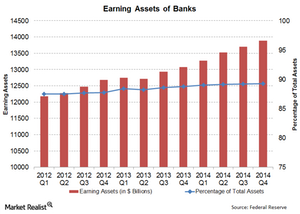

Why earning assets are an important indicator for the banking sector

The banking sector has shown a trend of increasing earning assets, because banks have focussed on becoming leaner and improving operational efficiency.

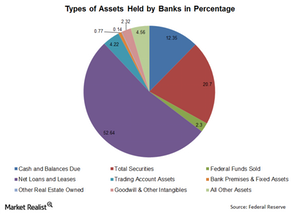

Why the composition of banking assets matters

The two main types of banking assets are loans and securities held.

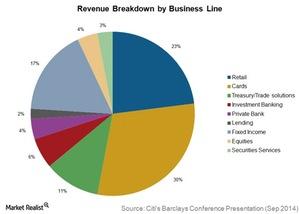

Citigroup: Number 3 US bank has $1.9 trillion in assets

Citigroup provides a broad range of financial products and services, including consumer banking, corporate and investment banking, among other things.Financials Must-know: Wells Fargo is strongly capitalized for future growth

A bank’s growth can be limited if it doesn’t have enough regulatory capital. If the bank doesn’t have enough capital, it will be forced to dilute its equity to raise capital.Financials Why Wells Fargo’s strategy is different from other banks

“Strategy” can be defined in many ways. Generally, strategy is a long-term plan. There are two main aspects to strategy—operational level strategy and human resource level strategy.Financials Why commercial lending is important to Wells Fargo strategy

The bank’s strategy is to not focus on any particular segment of industry. This helps it mitigate risk because the bank’s earnings and delinquencies are not dependent on any particular sector.Financials Why Basel II.5 corrected Basel II to improve banking regulations

Basel II.5 was essentially a revision of Basel II norms, as the existing norms often failed to correctly address the market risks that banks took on their trading books. Basel II.5’s main aim was to strengthen the capital base, and so the banks’ ability to withstand risk, by increasing banks’ capital requirements.Financials Why Basel II wasn’t good enough for reducing bank risks

Basel II was a comprehensive regulation that covered major sources of risks for banks. But it had a few major drawbacks. Firstly, it provided incentive to a bank’s management to underestimate credit risk.Financials Must-know: Why capital ratio is an important bank ratio

Capital ratio is also known as capital adequacy ratio or capital-to-risk-weighted assets ratio. Capital ratio is nothing but the ratio of capital a bank has divided by its risk-weighted assets. The capital includes both tier one and tier two capital.Financials Must-know: Why Basel I wasn’t a good fit for all banks

Although Basel I brought a worldwide standard in regulations, introduced the risk-weighted assets concept, and segregated capital, it had a few deficiencies.Financials Must-know: Understanding risk-weighted assets in banks

The second most important technical parameter used in banking regulations is risk-weighted assets (or RWA). If you’ve seen bank financial statements, then you might have noticed the “RWA” term there.Financials Must-know: Why capital in banking is important

Capital is important because it’s that part of an asset which can be used to repay its depositors, customers, and other claimants in case the bank doesn’t have enough liquidity due to losses it suffered in its operations.Financials Must-know: The different types of banking capital

The most important types of banking capital are common stock (or shareholders’ equity), preferred stock (or preferred equity), revaluation reserve, general provision, and hybrid instrument.Financials Overview: The basics of banking regulations

Banking regulations aim to ensure that the risks are minimized. If any unforeseen event occurs, then the interests of bank customers are protected. On a wider scale, the regulations also seek to absorb and minimize shock in the economy.Financials Must-know: The consequences of imprudent risk-taking by banks

We stated earlier that most banks are highly leveraged financial risk-takers. When things go awry, the results can be catastrophic, leading to huge losses or even to a bank closure.Financials Must-know: A thorough look at defining banking risk

Banking risk can be defined as exposure to the uncertainty of outcome. It’s applicable to full-service banks like JPMorgan (JPM), traditional banks like Wells Fargo (WFC), investment banks like Goldman Sachs (GS) and Morgan Stanley (MS), or any other financials included in an ETF like the Financial Select Sector SPDR Fund (XLF).Financials Overview: What you need to know about banking risks

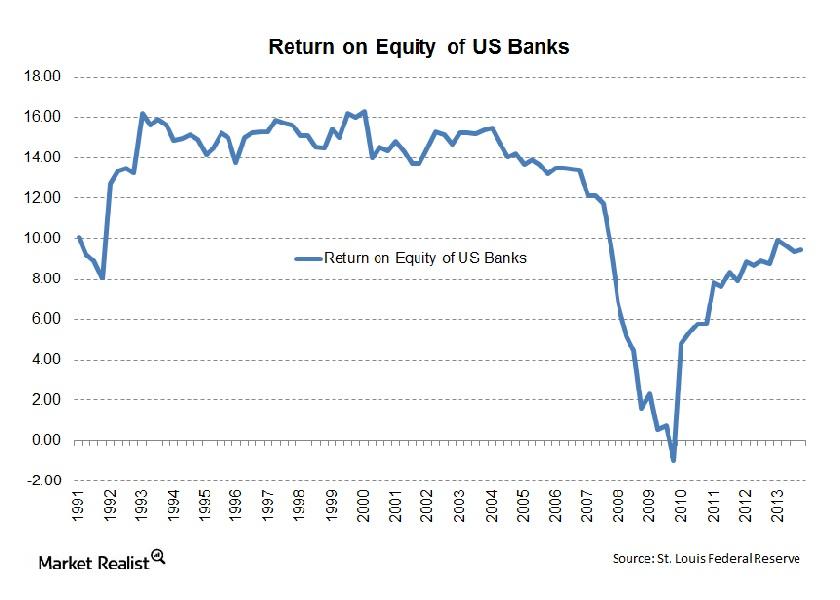

Whenever we analyze any banking company, we’re looking at two main variables—the return a bank earns and the amount of risk. To understand any bank, you need to understand these two parameters well.

Why the price-to-book value ratio affects returns on equity

Historical analysis has shown that return on equity has a strong impact on banks’ value creation in the long run. So financials that have high price-book value ratios should also have high returns on equity.Financials Overview: What makes custodian banks different from other banks?

Custodian banks like a warehouse and store other financial institutions’ and individuals’ assets—they help in keeping financial instruments safe.

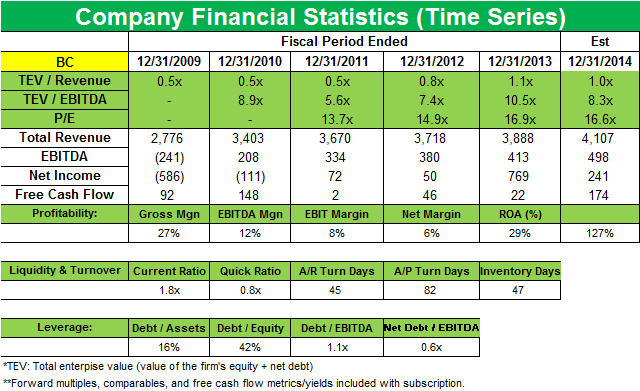

Why Davidson Kempner initiates new position in Brunswick Corp.

Brunswick is a leading global designer, manufacturer, and marketer of recreation products including marine engines, boats, fitness equipment, and bowling and billiards equipment.Financials The relationship between interest rates and credit spreads

Examining credit spreads gives investors an idea of how cheap (a wide credit spread) or expensive (a narrow credit spread) the market for a particular bond category or a particular bond is.

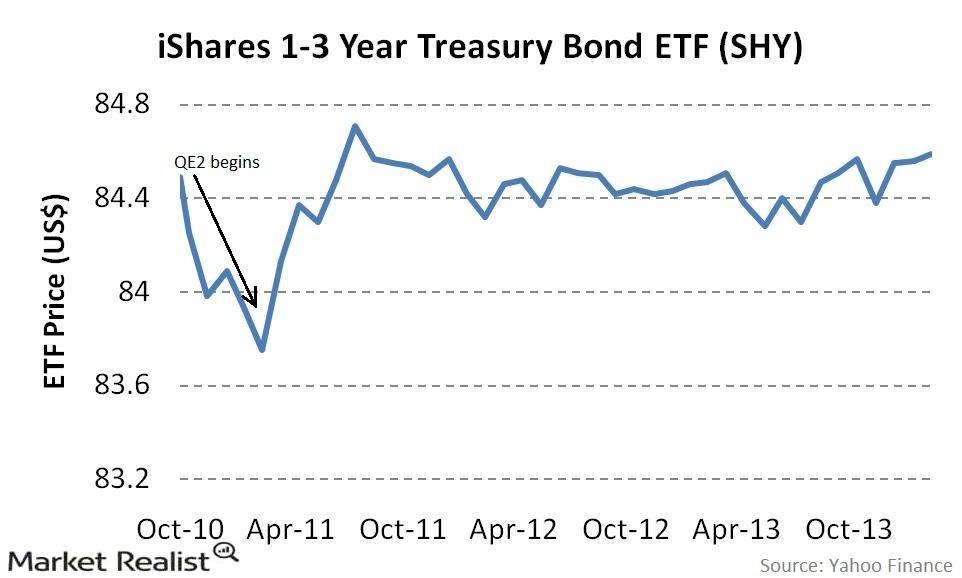

Must know: How the Fed’s monetary policy affects short-term yields

The Fed directly influences the short-term yields by either buying or selling short-term Treasuries or affecting the Fed funds rate.

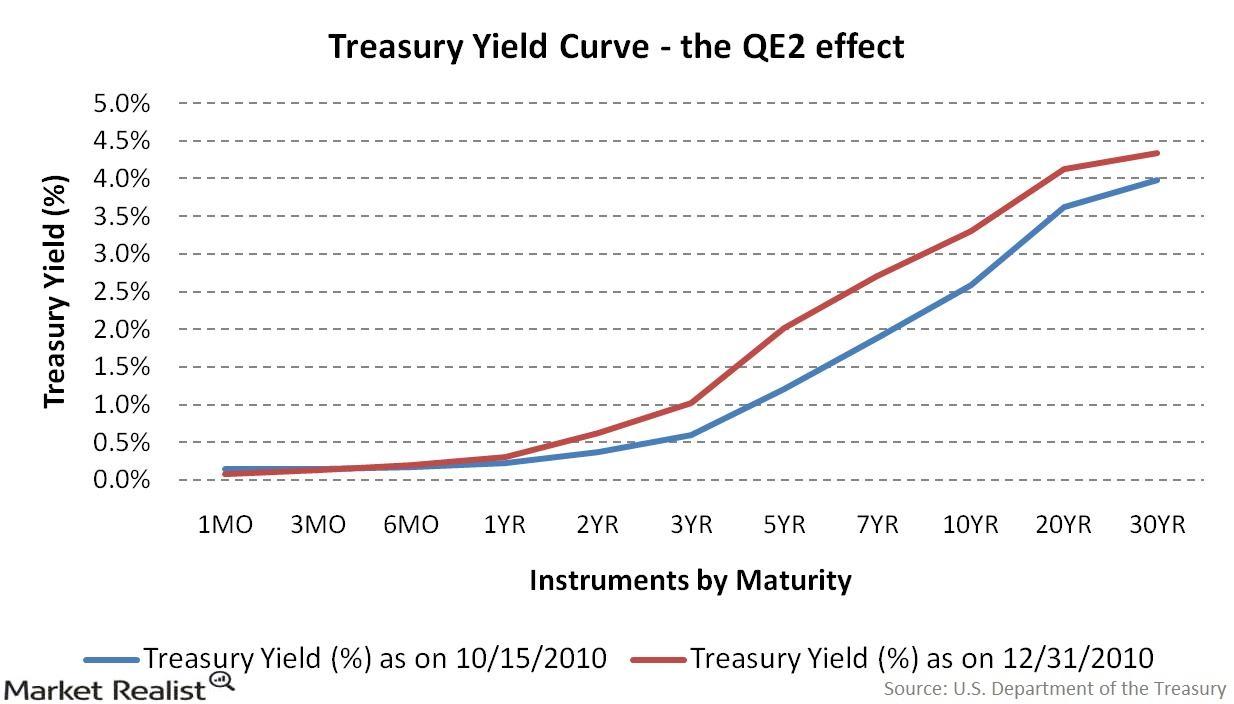

How does the Fed’s monetary policy affect the yield curve?

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve.

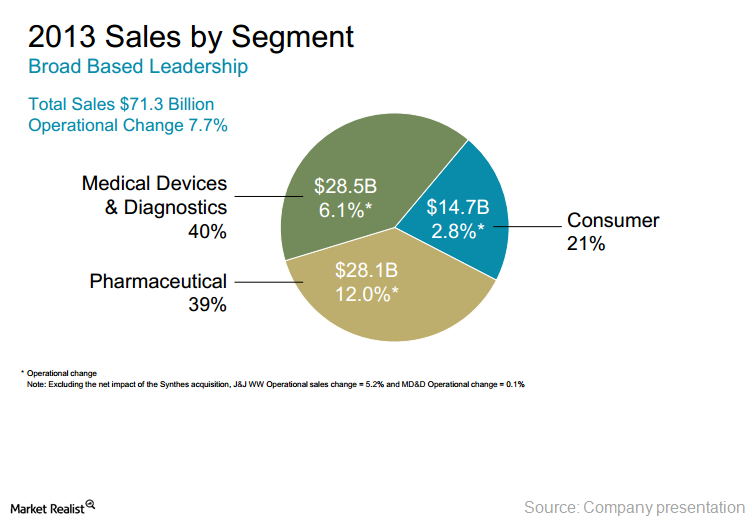

Why George Soros sold his fund’s position in Johnson & Johnson

Soros sold its 1.20% position in Johnson & Johnson (JNJ) last quarter. Johnson & Johnson’s reported 37% increase in adjusted net earnings in 4Q was mainly driven by its pharmaceutical segment.