Why earning assets are an important indicator for the banking sector

The banking sector has shown a trend of increasing earning assets, because banks have focussed on becoming leaner and improving operational efficiency.

March 5 2015, Updated 12:19 p.m. ET

What are earning assets?

Loans and securities are the most important types of assets that banks hold, because they earn income for the bank. There may be a few other earning assets for a bank, like a leased or rented building that earns income. So, the higher the earning assets, the better it is for a bank. In an era of increasing technology-enabled services, a bank should have a high level of earning assets. Let’s see how banks have fared on this parameter.

Earning assets of banks have increased

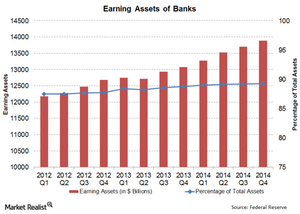

The banking sector has shown a trend of increasing earning assets. This is because over the years, banks have focused on becoming leaner and improving operational efficiency. Earning assets in the banking sector stood at 89.25% of total assets at the end of 2014. At the beginning of 2012, this ratio was close to 87.5%. This growth is a big improvement.

Though 1.75% may not appear to be a big improvement, it’s important to consider the large asset book banks have. Assets run into hundreds of billions for large banks and tens of billions for mid-size banks. If you assume yields to be constant on assets, the effect it would have on revenues would be large.

Some interesting trends emerge when you look at earning assets. There are also divergences among popular banks such as Wells Fargo (WFC), JP Morgan (JPM), Bank of America (BAC), and US Bank (USB). Smaller banks, such as those with small weights in the portfolio of the Financial Select Sector SPDR (XLF), differ from big banks in this indicator.