U.S. Bancorp

Latest U.S. Bancorp News and Updates

Consumer Chilton Investment Company buys stake in TransDigm in 4Q13

Chilton started a new position in aerospace engineering company TransDigm Group Inc. (TDG) that accounts for 0.76% of the fund’s fourth quarter portfolio.Financials Must-know: Determining a bank’s value

The first challenge is that banks are highly regulated and any change in regulations has a huge impact on the valuation of a bank—the second challenge is that it’s difficult to determine cash flow for a bank because both debt and reinvestment are difficult to calculate.

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.Financials Why Wells Fargo has the highest net interest margin

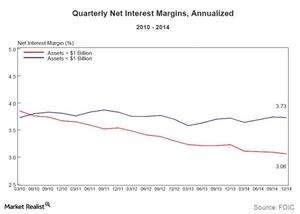

Maintaining a high net interest margin has always been part of Wells Fargo’s (WFC) strategy. Wells Fargo has consistently been better than the industry’s average net interest margin.

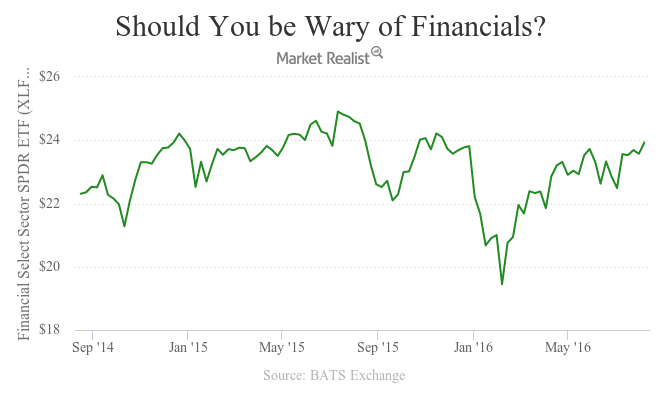

Which Sectors to Avoid if Inflation Rises

Telecom services and utilities, the traditional dividend stars, have provided a fillip to US equities in 2016.

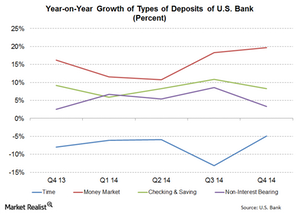

Low-cost deposit growth is a key strength for U.S. Bank

U.S. Bank does well in increasing its low-cost deposit base. In 4Q14, money market deposits grew the fastest at 19.7%—compared to 4Q13.

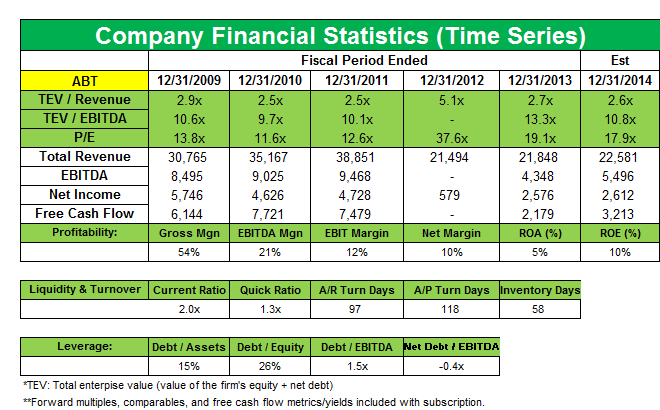

Chilton opens a new position in Abbott Laboratories in 4Q13

Abbott Laboratories (ABT) is a brand new position that accounts for 1.19% of Chilton’s fourth quarter 2013 portfolio.

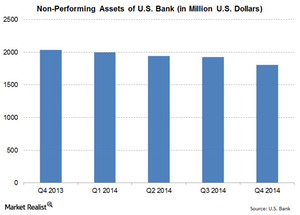

U.S. Bank’s non-performing assets declined in 4Q14

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13.

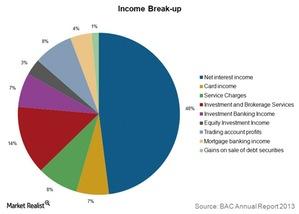

How does Bank of America make money?

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

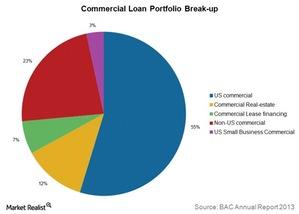

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

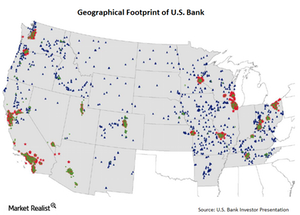

A brief overview of U.S. Bank

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

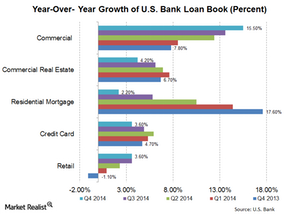

Why U.S. Bank’s loan growth showed interesting trends

You need to understand loan categories better in order to see some very interesting trends in U.S. Bank’s loan growth. Its loans are divided into five main categories.

Soros Exits, Buffet Increases: Who Is Right on Apple?

In Q4 2018, legendary investor George Soros sold all his holding in Apple (AAPL). In Q3 2018, Apple represented around 0.2% of his total portfolio.

Berkshire Hathaway 13F: Warren Buffett Played It Safe

There weren’t any real surprises in Berkshire Hathaway’s 13F for the second quarter. In some ways, the 13F replicated the first quarter.

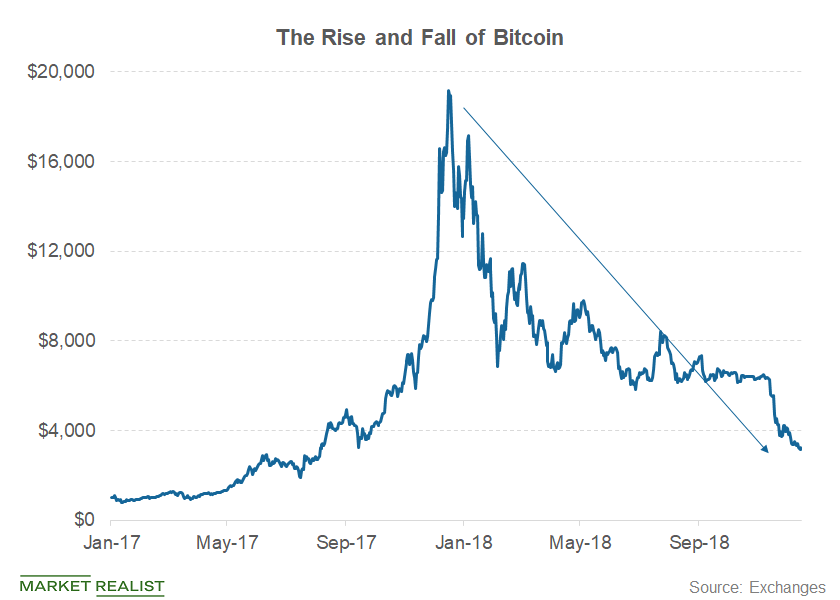

Could Warren Buffett’s Views on Bitcoin Change?

Berkshire Hathaway (BRK-B) chair Warren Buffett has never been a fan of cryptocurrencies like bitcoin.

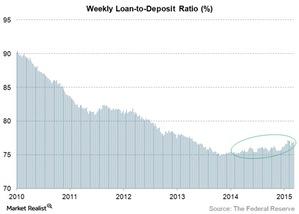

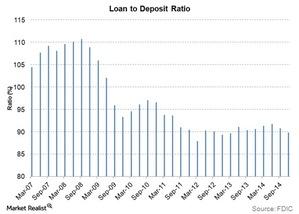

Loan-to-Deposit Ratio Moves in the Right Direction for Banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios.

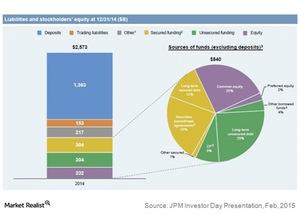

J.P. Morgan and Its Diversified Funding Sources

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings.

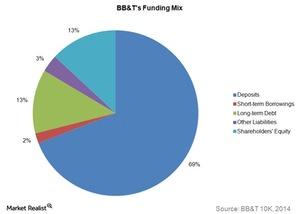

Why BB&T Has Low Funding Costs Compared to Its Peers

Deposits are the cheapest funding source. Since deposits fund a major chunk of BB&T’s assets, the overall funding costs are low.

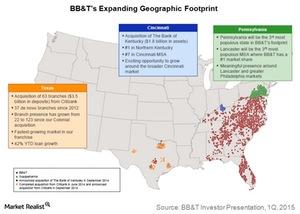

BB&T to Expand Its Footprint in Ohio and the Mid-Atlantic Region

BB&T’s Susquehanna acquisition will significantly expand BB&T’s Mid-Atlantic footprint. The deal is valued at ~$2.5 billion. It will close in the second half of 2015.

Why Is the Loan-to-Deposit Ratio Declining for US Banks?

The industrywide loan-to-deposit ratio has declined over the last few years, largely due to the increase in non-interest-bearing bank deposits.

Why Lower Funding Costs Impact Net Interest Margins

Lower funding costs determine a bank’s net interest margin. A bank has funding cost advantage when it pays less interest on borrowed funds and deposits.

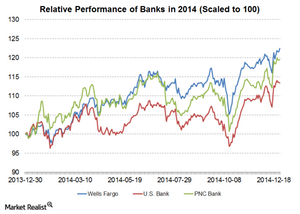

Valuation of PNC Bank is close to historical mean

PNC stock was trading at a PBV ratio of 0.75 in November 2012. Since then, the stock has seen a smart move up and trades at a PBV multiple of ~1.08.

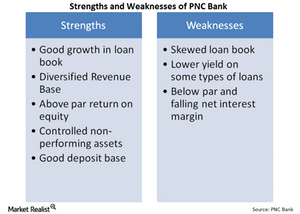

PNC Bank’s financial strengths outweigh its weaknesses

PNC Bank has done a good job at reducing its non-interest expenses, but the bank’s efficiency ratio still remains above 60%.

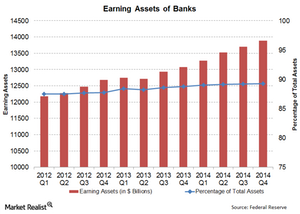

Why earning assets are an important indicator for the banking sector

The banking sector has shown a trend of increasing earning assets, because banks have focussed on becoming leaner and improving operational efficiency.

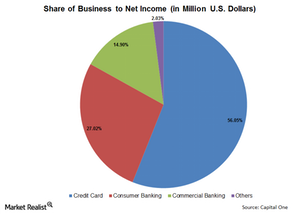

Analyzing Capital One’s business segments

Capital One (COF) can be understood best by breaking it into different business segments—Credit Card, Consumer Banking, and Commercial Banking.

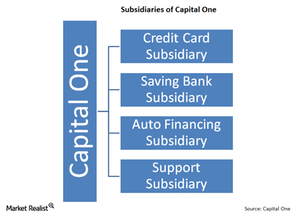

What are Capital One’s three main subsidiaries?

Capital One is organized into subsidiaries. Capital One’s principal subsidiary is a limited purpose credit card bank. It’s chartered in Virginia.

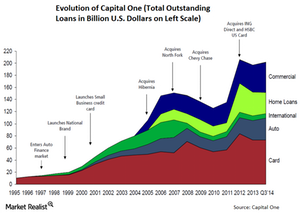

Capital One’s history: From credit cards to a diversified bank

Capital One’s history is shorter than other banks. In 1994, Signet Financial Corp. spun off its credit card business into a separate subsidiary—Capital One.

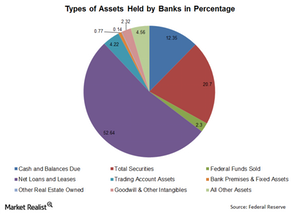

Why the composition of banking assets matters

The two main types of banking assets are loans and securities held.

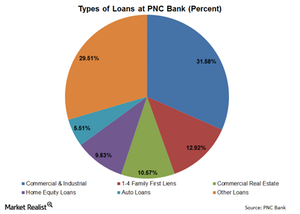

PNC Bank loan book carries some risks

PNC Bank’s loan book is skewed toward a few types of loans: commercial and industrial loans and 1–4 Family First Liens, about 44.5% of its total loans.

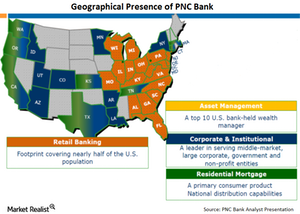

Does PNC Bank remain a strong long-term play?

With a strong presence in the East, South, and Midwest, PNC Bank offers community banking, wholesale banking, corporate banking, and asset management.Financials Why Wells Fargo’s strategy is different from other banks

“Strategy” can be defined in many ways. Generally, strategy is a long-term plan. There are two main aspects to strategy—operational level strategy and human resource level strategy.

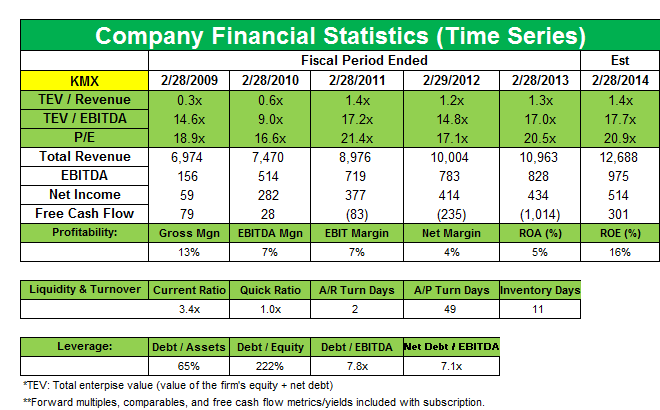

Chilton Investment Company sells its shares in CarMax in 4Q13

Chilton liquidated its position in CarMax Inc. (KMX) in the fourth quarter that had accounted for 0.71% of the fund’s third quarter portfolio.