JPMorgan Chase & Co

Latest JPMorgan Chase & Co News and Updates

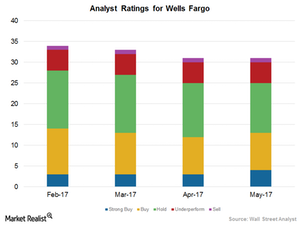

What Do Analysts’ Ratings Suggest for Wells Fargo in 2017?

In May, 13 of the 31 analysts covering Wells Fargo rated the stock as a “buy,” 12 analysts rated it as a “hold,” and six analysts rated it as a “sell.”

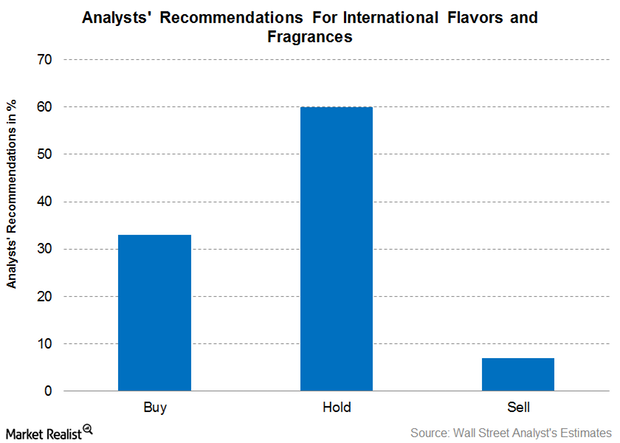

Analysts’ Recommendations for IFF after Its 1Q17 Earnings

As of May 9, about 33% of the analysts recommended a “buy” for International Flavors & Fragrances, 60% recommended a “hold,” and 7% recommended a “sell.”

Will Argentina Be Upgraded to an Emerging Market in 2017?

The recent rally in Argentina’s Merval Index (ARGT) reflects improved access to Argentina’s markets with a host of reforms adopted by President Mauricio Macri.

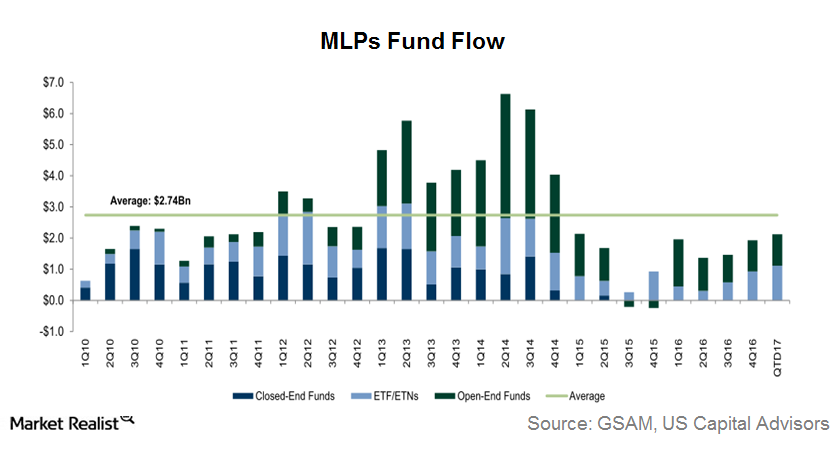

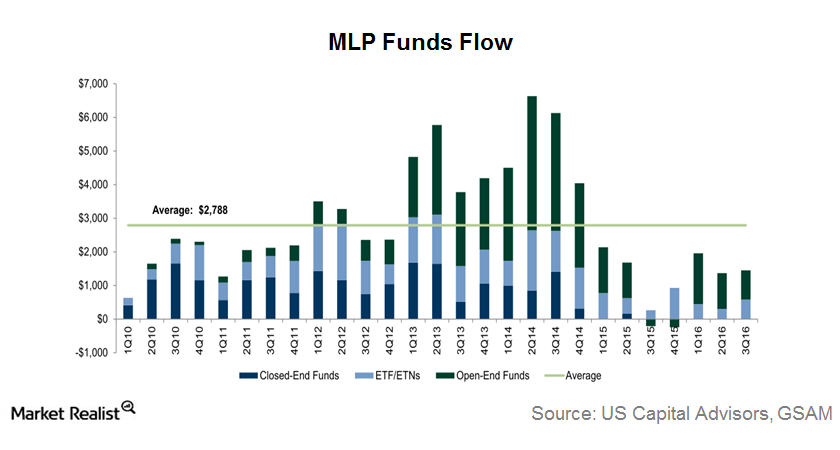

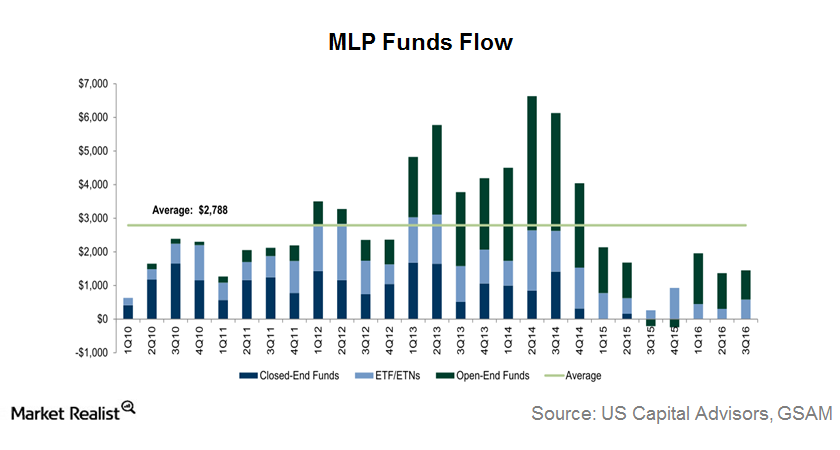

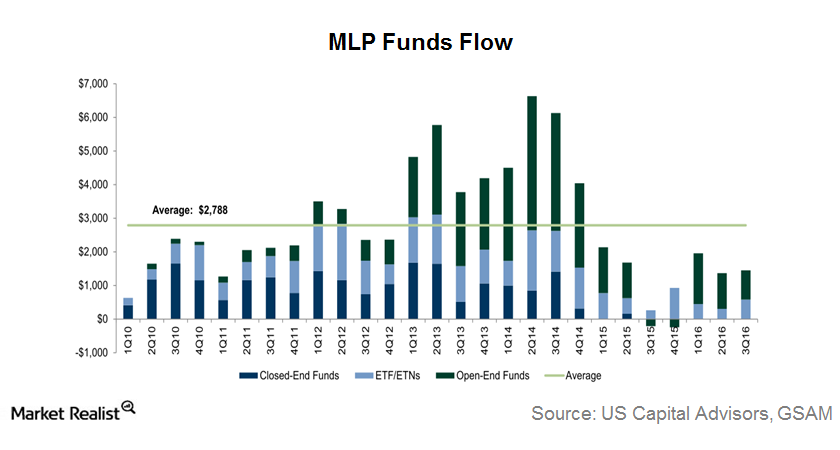

How MLP Funds’ Capital Inflow Improved in 1Q17

MLP funds’ capital inflow has recovered slightly in recent quarters compared to the second half of 2015.

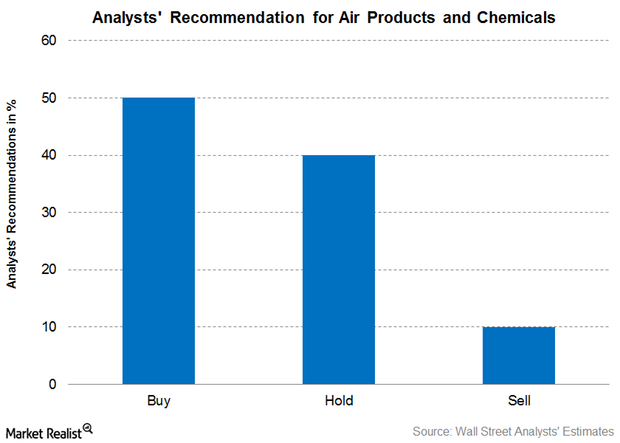

Analysts’ Latest Recommendations for Air Products & Chemicals

As of March 29, 2017, 20 brokerage firms were actively tracking Air Products & Chemicals (APD). About 50.0% of them recommended a “buy” for the stock.

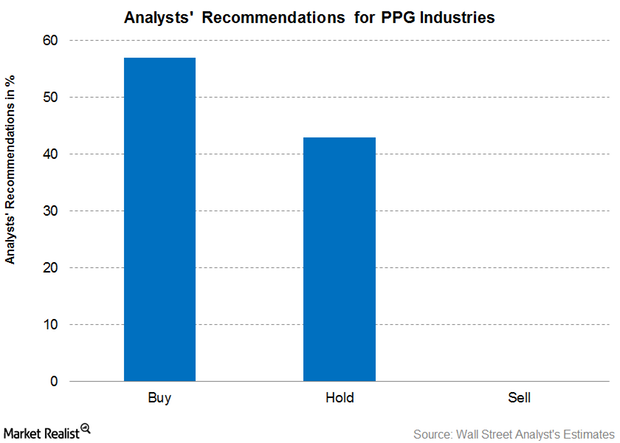

What Analysts Recommend for PPG Industries

As of March 23, 2017, 21 brokerage firms were actively tracking PPG Industries (PPG) stock.

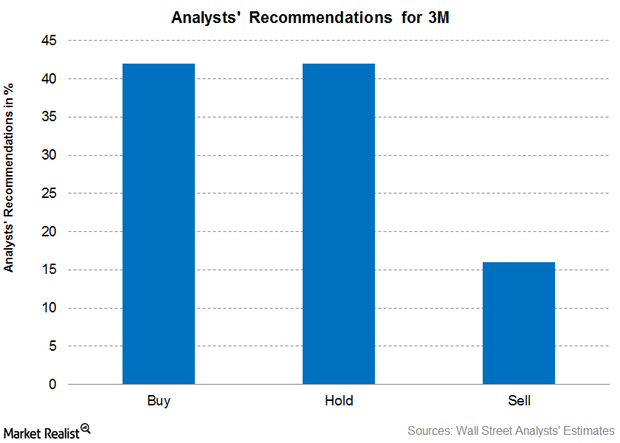

Analysts’ Latest Recommendations for 3M

As of March 8, 18 brokerage firms were tracking 3M stock—42% of the analysts rated it as a “buy,” 42% rated it as a “hold,” and 16% rated it as a “sell.”

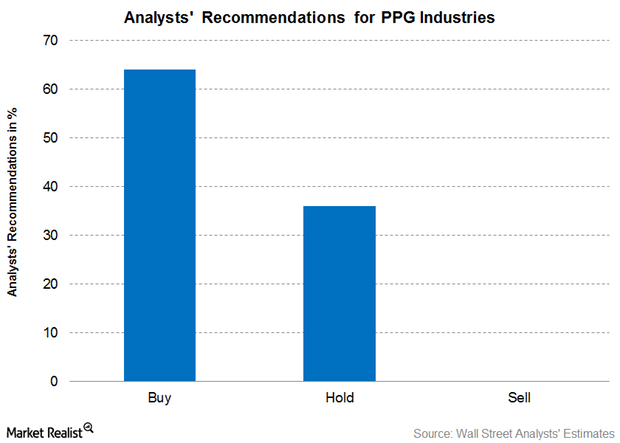

Analysts’ Recommendations and Target Price for PPG Industries

As of March 1, 2017, 22 brokerage firms were actively tracking PPG Industries (PPG) stock. About 64.0% of them have recommended a “buy” for the stock.

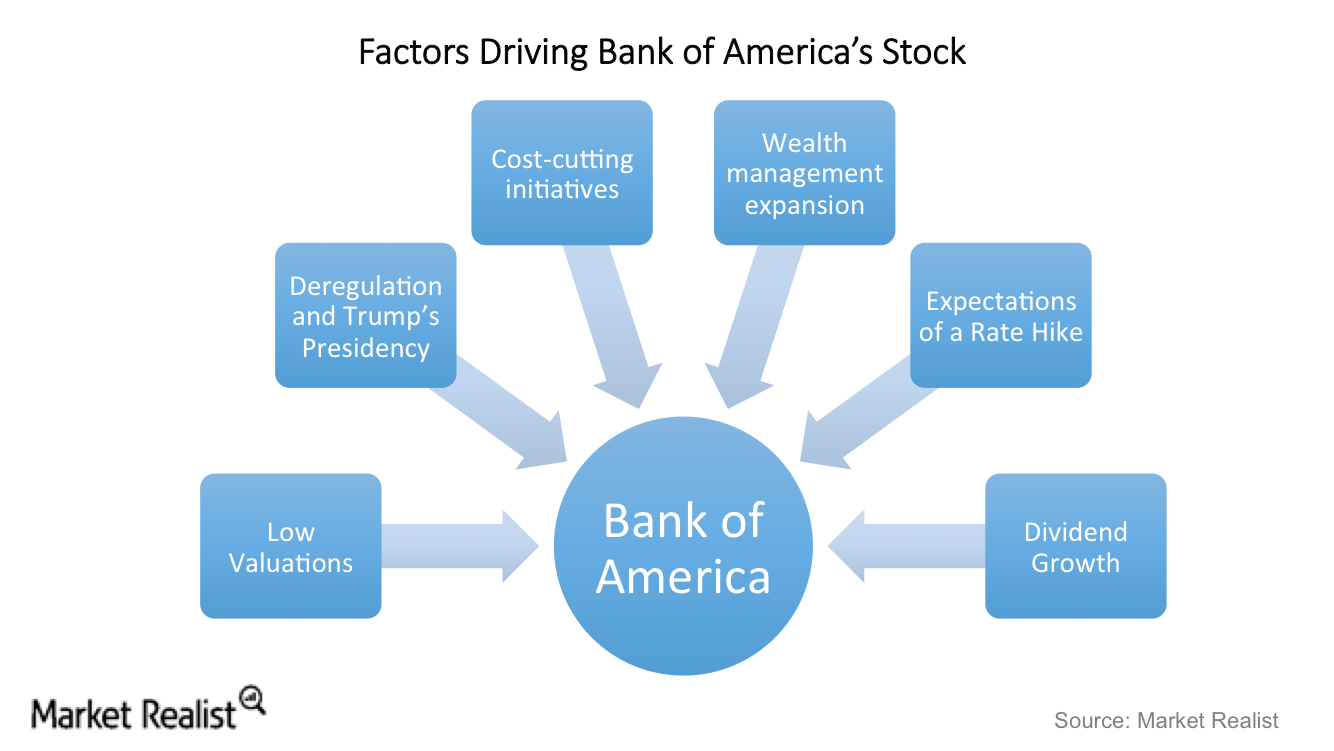

What Are Bank of America’s 2017 Growth Drivers?

Bank of America’s CEO has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years.

Why Institutional Investors Seem Bullish on MLPs in 2017

MLP funds’ capital inflow recovered slightly in 2016 compared to their levels during the second half of 2015.

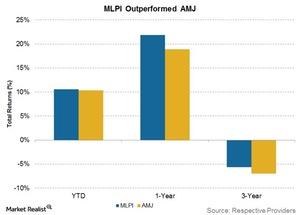

Why Did MLPI Outperform AMJ?

The ETRACS Alerian MLP Infrastructure Index ETN (MLPI) and the JPMorgan Chase Alerian MLP Index ETN (AMJ) are two of the largest MLP ETNs.

What Does the MLP Funds Market Look Like?

MLP funds’ capital inflows have recovered slightly in 2016 compared to 2H15. However, their overall capital inflow is still lower than their seven-year average.

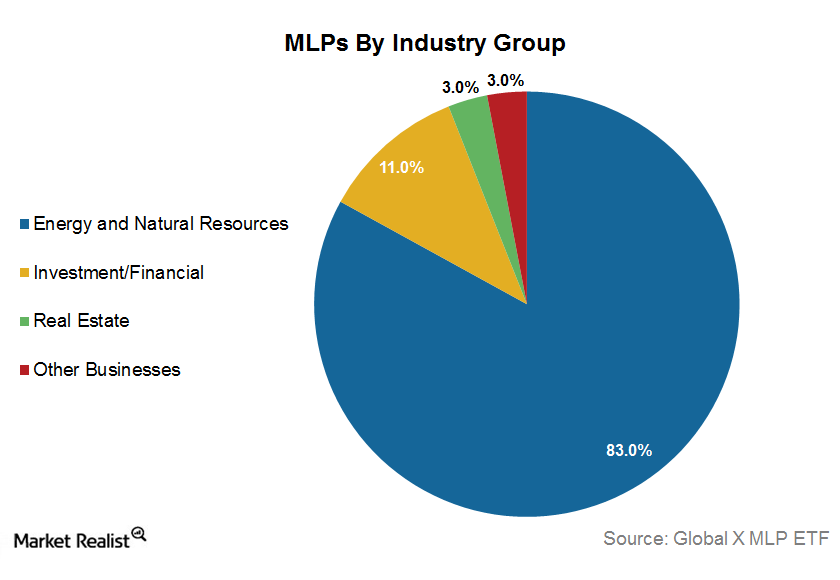

What You Should Know about Master Limited Partnerships

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

How Much Have MLP Fund Inflows Improved in 2016?

MLP funds’ capital inflows have recovered in 2016 from levels in 2H15. But overall capital inflows are lower than the seven-year average of $2.8 billion.

Analysts Are Truly Divided on Chemours after Its 3Q16 Earnings

Among the analysts covering Chemours’ stock, 33.33% analysts recommended a “buy,” while 33.33% issued a “hold,” and the remaining 33.33% issued a “sell.”

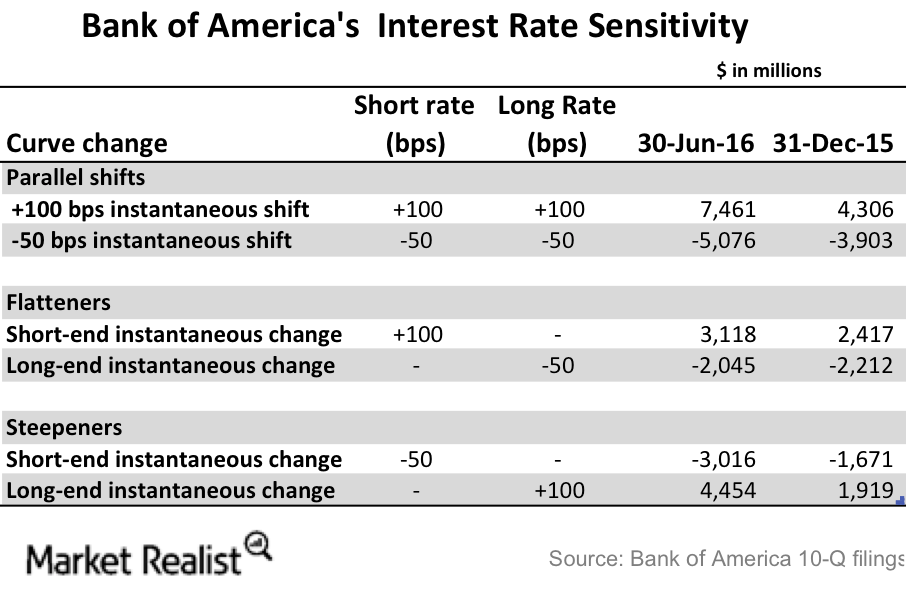

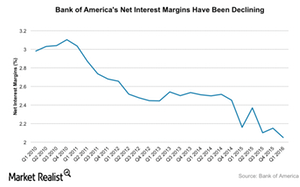

What’s Bank of America’s Interest Rate Risk?

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q15.

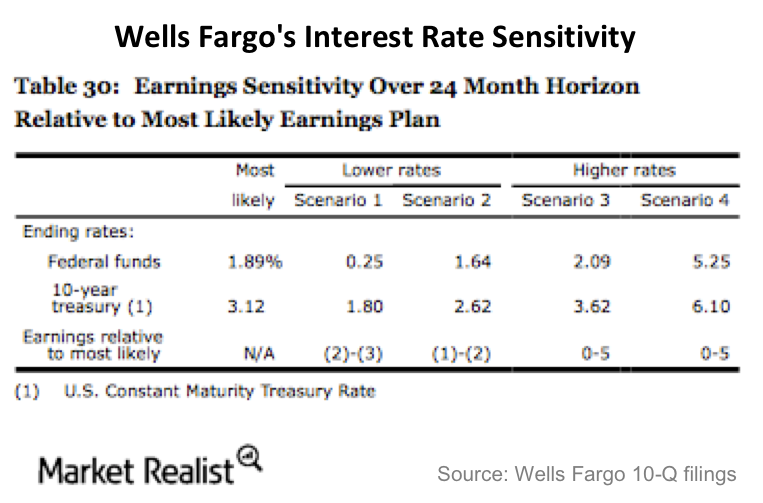

How Sensitive Are Wells Fargo’s Earnings to Interest Rates?

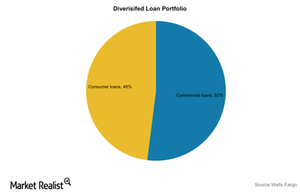

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion.

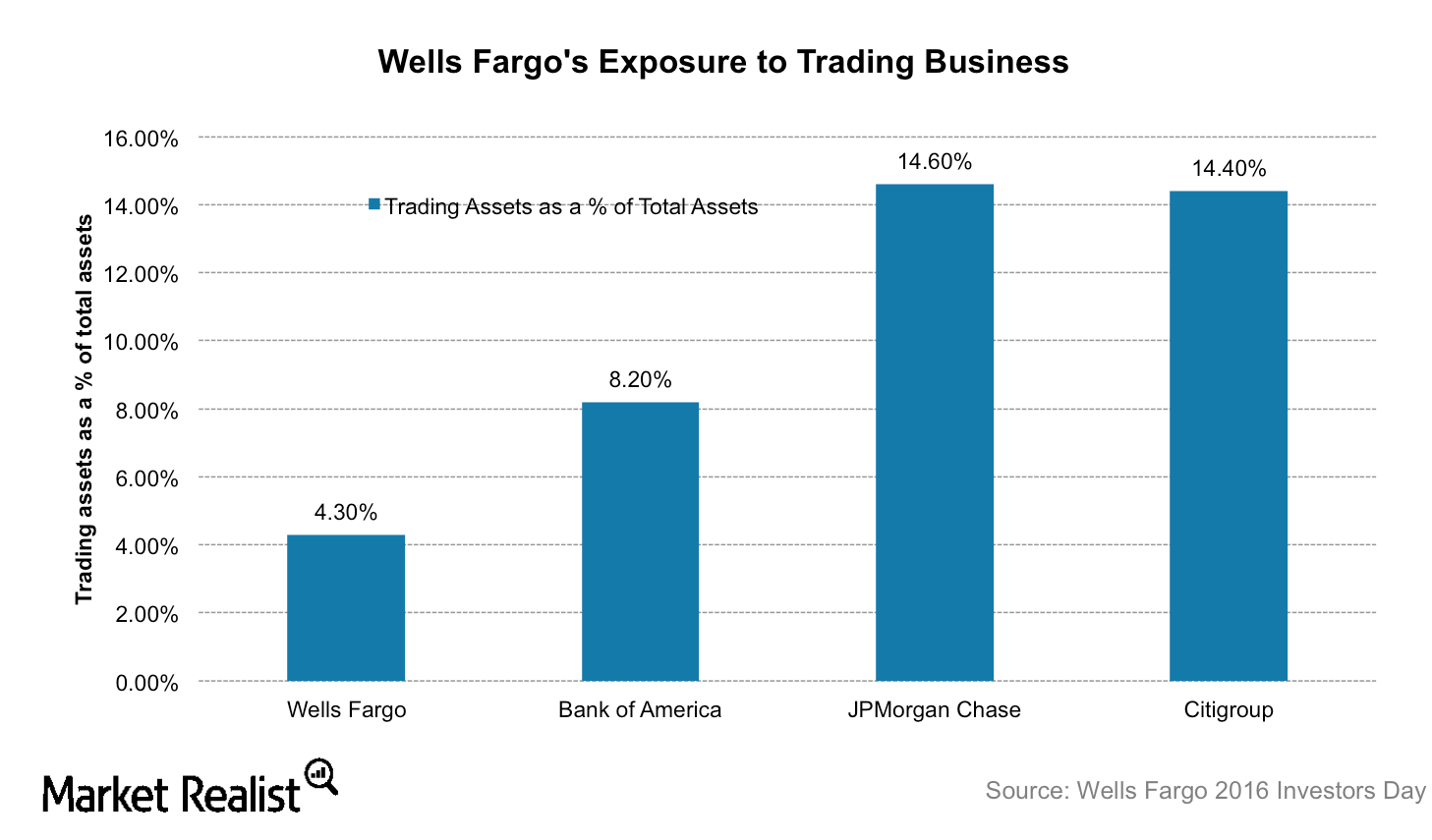

Why Wells Fargo Has a Less Risky Business Model than JPMorgan Chase

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC).

Interest Rate Sensitivity: JPMorgan Chase versus Wells Fargo

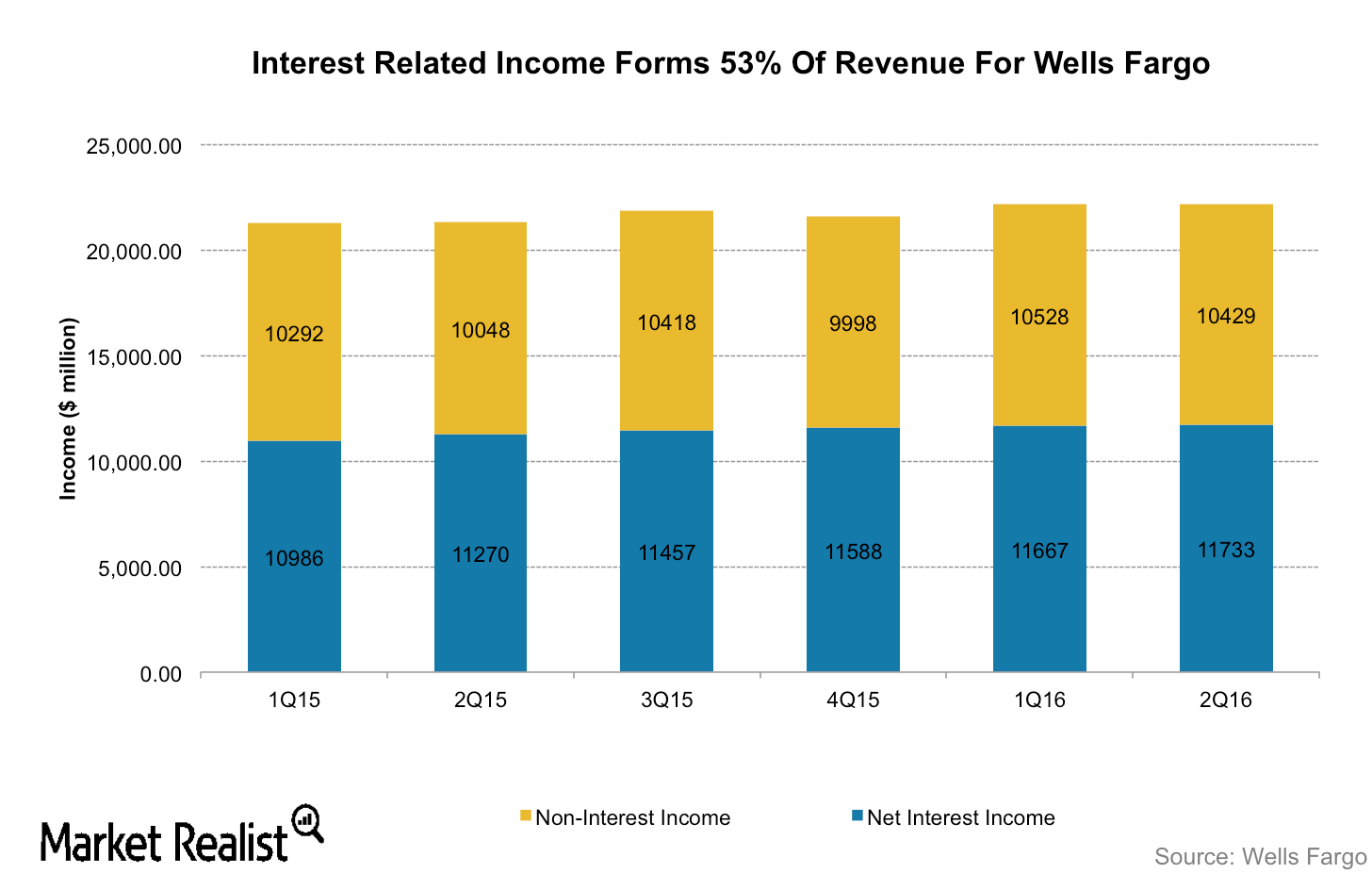

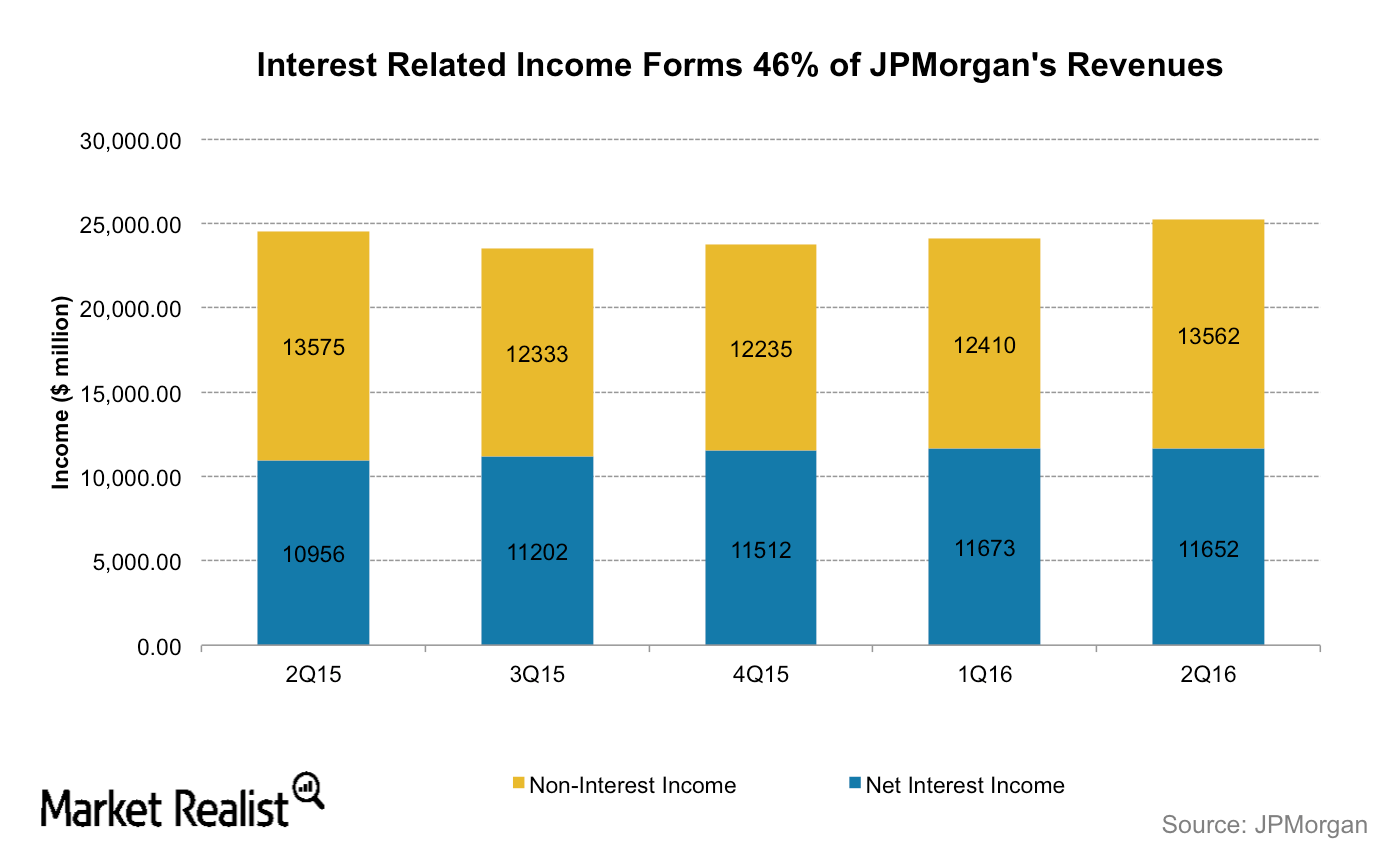

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

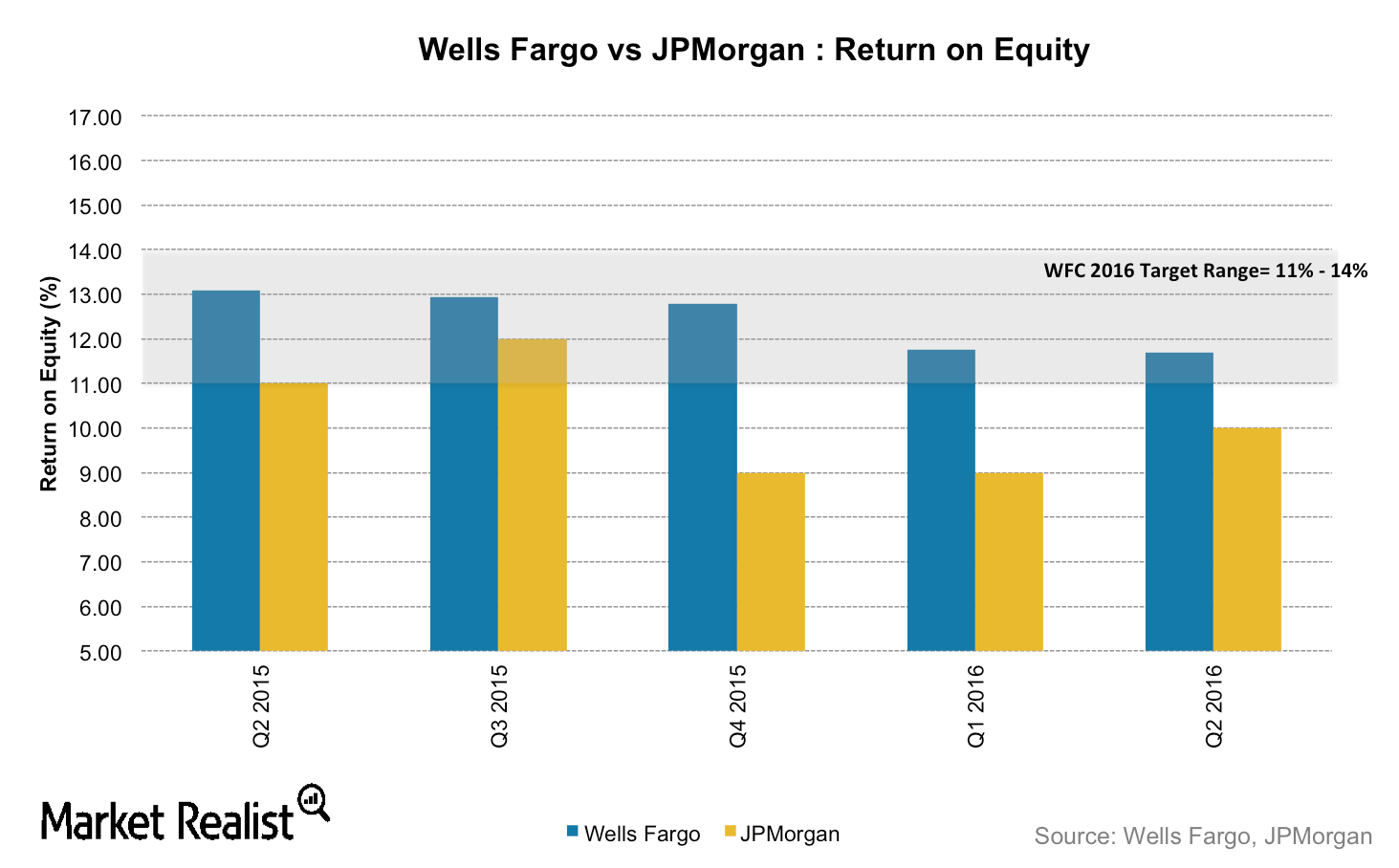

How Does Wells Fargo Compare with JPMorgan Chase on Profitability?

JPMorgan Chase (JPM) and Wells Fargo (WFC) reported profits of $6.2 billion and $5.6 billion, respectively, in the most recent quarter.

Why BAC Is Better Positioned to Gain from a Rate Hike Than JPM

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). It’s more sensitive to interest rate changes.

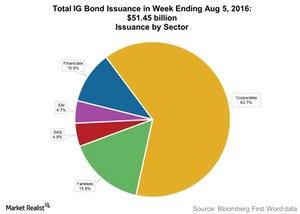

Microsoft Issued the Most High-Grade Bonds Last Week

Microsoft (MSFT) issued Aaa/AAA rated high-grade bonds worth $19.8 billion through seven parts on August 1, 2016.

How Fallen Angels Could Reward Investors

Fallen angel bonds—high-yield bonds originally issued with investment grade credit ratings—are generally known for offering potential value. A big source of this value has been the tendency of fallen angels to be oversold below what may be considered fair value, leading to a downgrade to high yield. A less obvious source of value for fallen angels […]

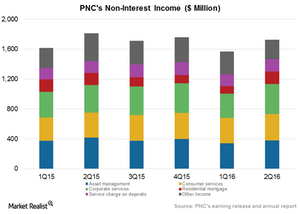

PNC Financials’ Non-Interest Income Ratio Continues to Expand

PNC Financial’s non-interest income for 2Q16 increased by 10% over the previous quarter, mainly due to higher fee income growth.

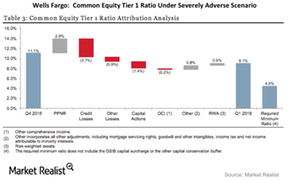

Did Wells Fargo Pass the Fed’s Stress Test?

The Federal Reserve’s stress test results indicate that Wells Fargo (WFC) has sufficient capital to absorb the estimated $25 billion in losses it is projected to incur under the test’s worst-case scenario.

Wells Fargo Benefits from a Solid Business Model

Wells Fargo (WFC) has been considered the strongest and most steady among the “too big to fail” banks in the United States for years.

How Sensitive to Interest Rates Has Bank of America Really Become?

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line.

Why Is JPMorgan Chase Positive on Gold?

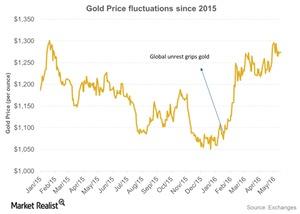

After seeing three straight years of losses, gold (GLD) performed extremely well at the beginning of 2016.

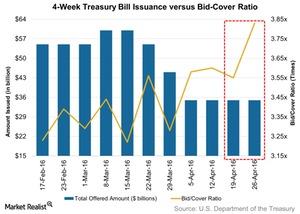

Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.

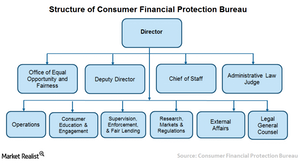

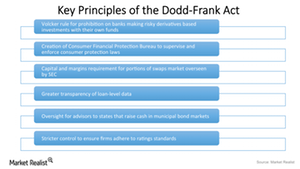

A Look at the Role of the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau was established to protect consumers’ interests by implementing federal consumer financial laws.

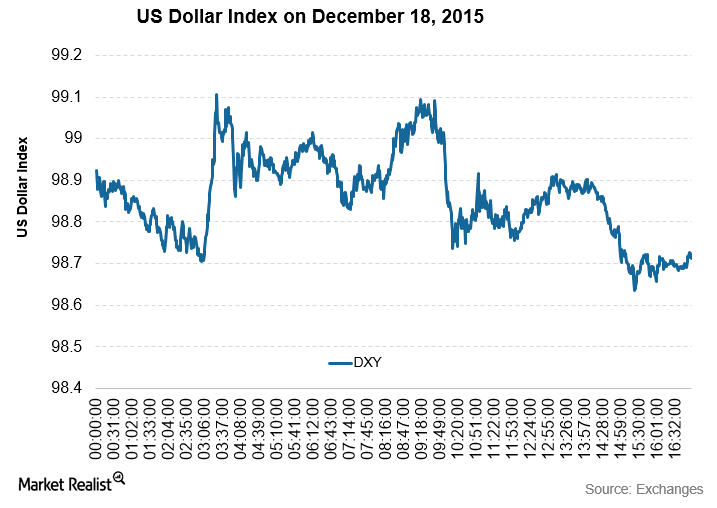

Dollar Index and Services PMI Both Fell

The US Dollar Index measures the strength of the US dollar against other major currencies. It fell by 0.58% on December 18, 2015. It was on a correction mode.

What Is the Dodd-Frank Act?

Analysts who favor the Dodd-Frank Act believe it will protect the investing community and consumers. Critics believe it will hamper economic growth and hurt competitiveness.

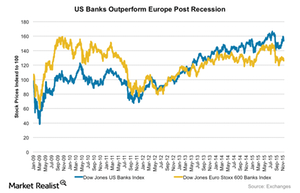

US Banks Played a Pivotal Role in the 2008 Financial Crisis

During the period between September 2008 and March 2009, US stock markets plunged, and the financial sector fell 60% in value.

What Is the Dodd-Frank Act?

The Dodd-Frank Act is a financial reform legislation passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

Understanding the Fed’s Financial Regulations Post-2008 Crisis

Since the financial crisis, the Fed has enforced regulations for the capital strength and liquidity of 16 systematically important financial institutions.

Analyzing US and European Banks’ Leverage Ratios

On average, European banks have higher leverage than US banks. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy.

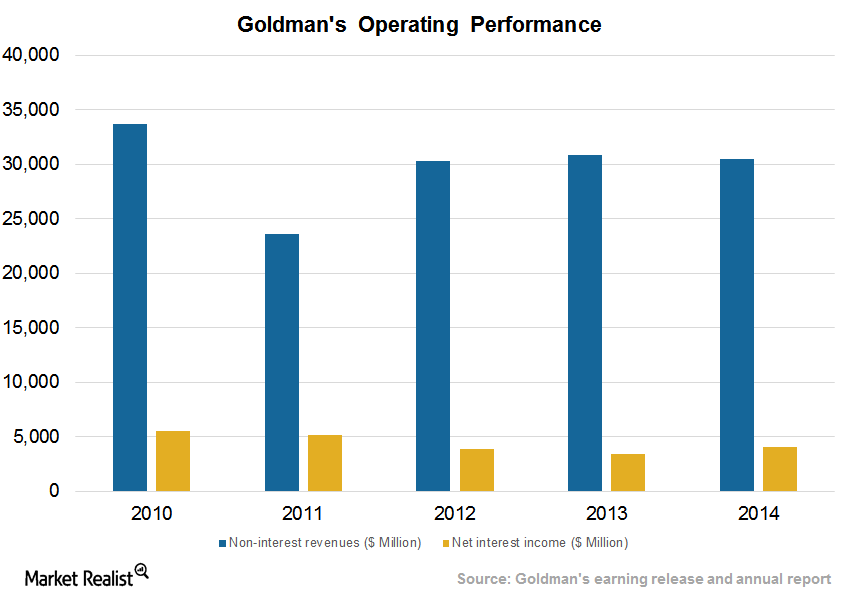

Goldman Sachs’ Revenue Model

Goldman Sachs engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions.

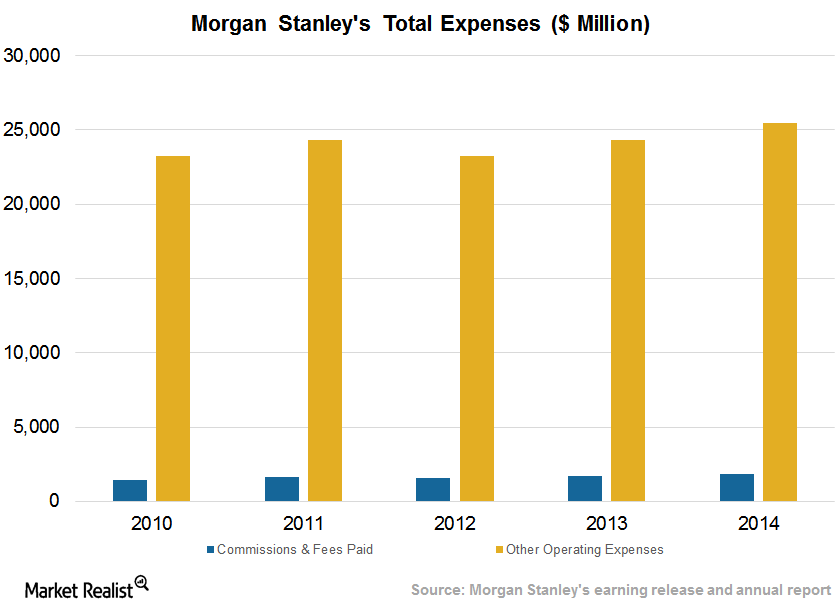

Morgan Stanley’s Careful Attention to Compensation Expenses

Morgan Stanley divides its non-interest expenses into compensation and non-compensation. It’s compensation expenses (and benefits) are ~80% of this class.

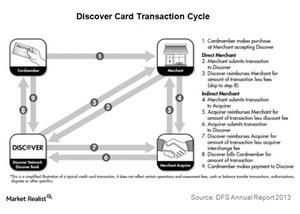

Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

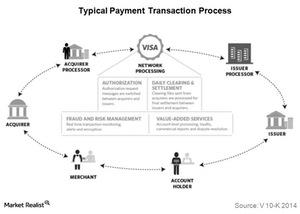

What Happens When You Swipe a Visa Card?

Visa’s open-loop payments network connects and manages the exchange of information between issuers and acquirers.

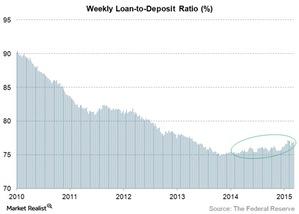

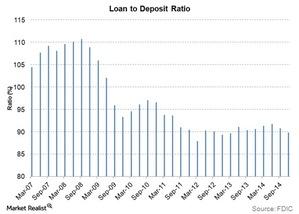

Loan-to-Deposit Ratio Moves in the Right Direction for Banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios.

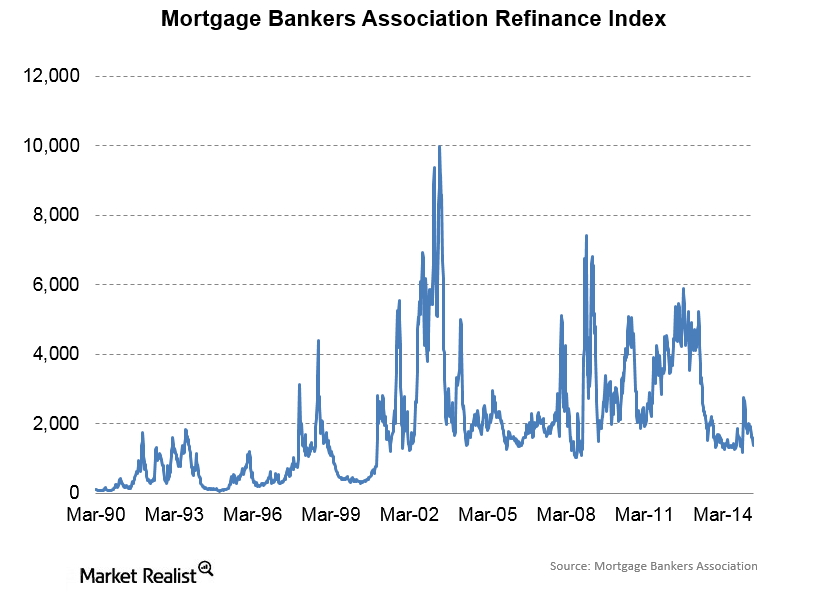

Mortgage Refinances Are Hit by Prepayment Burnout

Refinancing activity affects prepayment speeds. Prepayment speeds occur because homeowners are allowed to pay off their mortgages early and without penalty.

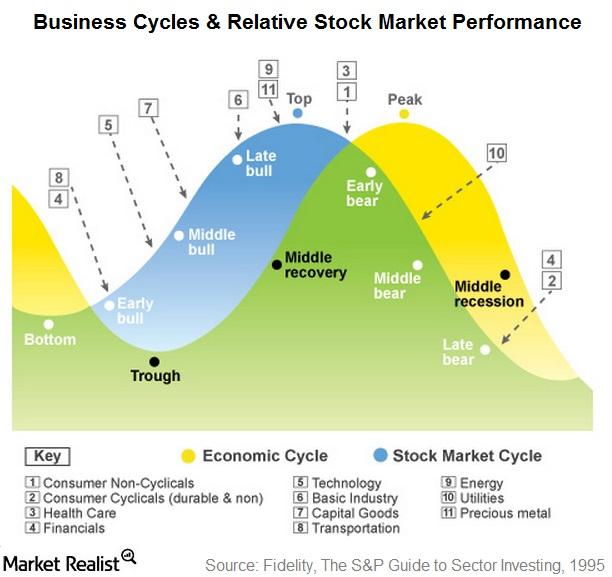

ETFs That Outperform in Late Stage, Recession, and Trough

Certain industries typically outperform at various phases of business cycles. This provides important clues to investors and helps them manage their portfolios.

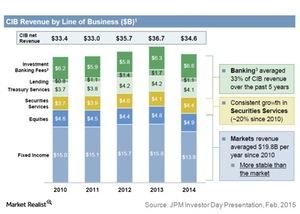

How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.

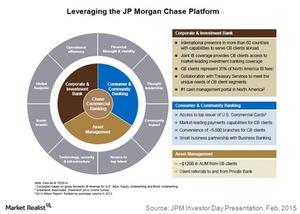

J.P. Morgan: Commercial Banking and Firm-Wide Synergies

J.P. Morgan Commercial Banking clients can access the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network.

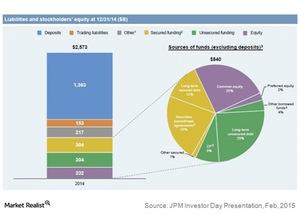

J.P. Morgan and Its Diversified Funding Sources

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings.

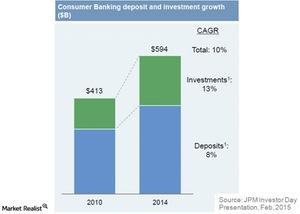

J.P. Morgan Looks to Deepen Customer Relationships

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As a result, the bank is adapting its digital capabilities.

J.P. Morgan’s 4 Operating Segments

Consumer and Community Banking is the biggest of J.P. Morgan’s four segments. Corporate and Investment Banking follows, with 34% of revenues.

J.P. Morgan: The Banking Giant

In this series, you’ll learn what value J.P. Morgan holds for its shareholders, about its various businesses, and how it compares with other big banks.

Why Is the Loan-to-Deposit Ratio Declining for US Banks?

The industrywide loan-to-deposit ratio has declined over the last few years, largely due to the increase in non-interest-bearing bank deposits.