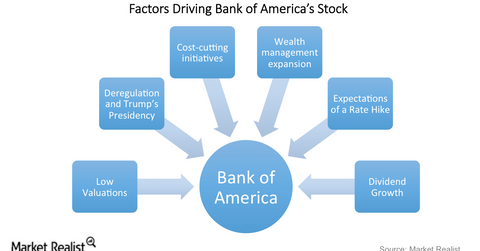

What Are Bank of America’s 2017 Growth Drivers?

Bank of America’s CEO has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years.

Jan. 31 2017, Published 11:53 a.m. ET

Interest rate hikes

Bank of America (BAC), like most other banks (XLF), stands to benefit from an interest rate hike. According to company data, BAC will earn an additional $5.3 billion in net interest income if short- and long-term interest rates rise 1%.

Net interest income forms ~50% of BAC’s revenue. In this way, rising interest rates are a strong growth driver for the company’s share price.

Cost-cutting initiatives

Bank of America’s CEO, Brian Moynihan, has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years. Bank of America has an expense target of $53 billion for 2018. This target is $3.3 billion lower than its total expenses in the last year.

Wealth management expansion

Bank of America plans to expand its Wealth Management business in order to strengthen its top line. Low interest rates and uncertain macroeconomic conditions have hurt banks’ revenue-generating capabilities in terms of investment banking and trading activities. Therefore, banks are focusing on wealth management to boost their earnings.

Deregulation and Trump’s presidency

President Donald Trump’s expressed policies regarding fewer banking regulations could drive Bank of America to new highs. Trump has been critical of the banking regulations and safeguards put in place after the financial crisis of 2009 as well as of the Federal Reserve’s role in keeping interest rates low.

Dividend growth

Moynihan wants freedom for BAC to raise its dividends. The Dodd-Frank Act requires that banks have their capital plans approved by the Federal Reserve during their annual stress tests, restricting their abilities to increase their payouts. Bank of America is looking forward to Trump’s relaxing these rules so it can increase its dividends.

Low valuations

Currently, Bank of America is trading at a discount of ~14% to its book value. Its peers JPMorgan Chase (JPM), Wells Fargo (WFC), and Goldman Sachs (GS) are trading between one and two times their book values. The main reason Bank of America’s shares are cheap is that the company’s profitability has been poor. In 2016, BAC posted a return on assets of 0.82%, well below its target of 1%. However, its profits have been improving rapidly.

In the following articles of this series, we’ll discuss these growth drivers in detail.