Goldman Sachs Group Inc

Latest Goldman Sachs Group Inc News and Updates

Goldman Sachs Employees Brace for a Round of Layoffs

Goldman Sachs may be laying off a small percentage of its workforce due to a lowered need for deal-makers after interest rates have risen.

Goldman Sachs Is Bullish on Crypto, Executes First Crypto OTC Options Transaction

As Goldman Sachs executed its first OTC crypto options trade, what is Goldman Sachs’ crypto prediction? Why is the bank bullish on crypto?

Goldman Sachs’ First Crypto Options Transaction Goes Through

Goldman Sachs completed an over-the-counter crypto options trade, which makes it the first bank to do so. Here’s what to know about the move.

Goldman Sachs Is Bullish on Metaverse, But Is Hedging Its Bet

Investment bank Goldman Sachs is bullish on the metaverse. However, the company just led a $227 million investment round in IRL events startup Fever.

Meet David Solomon: Goldman Sachs CEO by Day, EDM DJ by Night

What’s David Solomon’s net worth? After rising to the top ranks at Goldman Sachs, where he now serves as CEO, Solomon launched a DJ career.

Goldman Sachs Lists Its Semiconductor Stocks: Should You Buy?

Admid the semiconductor shortage, these Goldman Sachs-stock picks could help you profit from the high demand. Should investors buy them?

When Is Goldman Sachs Launching Its BNPL Platform With Apple?

The race is on for BNPL (buy now, pay later) platforms. With its planned partnership with Apple, will Goldman Sachs catch up?

Goldman Sachs CEO David M. Solomon Makes a Mint Despite Controversies

Despite multiple controversies under his belt, David M. Solomon relishes in his high-paying role as the Goldman Sachs CEO.

Goldman Sachs Puts Tesla and VW At the Top of EV Stock Picks

Goldman Sachs isn't always on the nose, but their analysts hold a lot of expertise—including in the EV space.

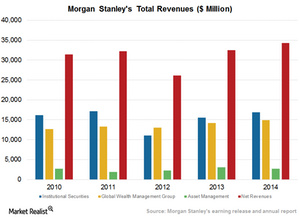

Morgan Stanley’s Strong Revenue Model

Morgan Stanley charges fixed fees and performance fees for asset management services, products and services, and administration of accounts.

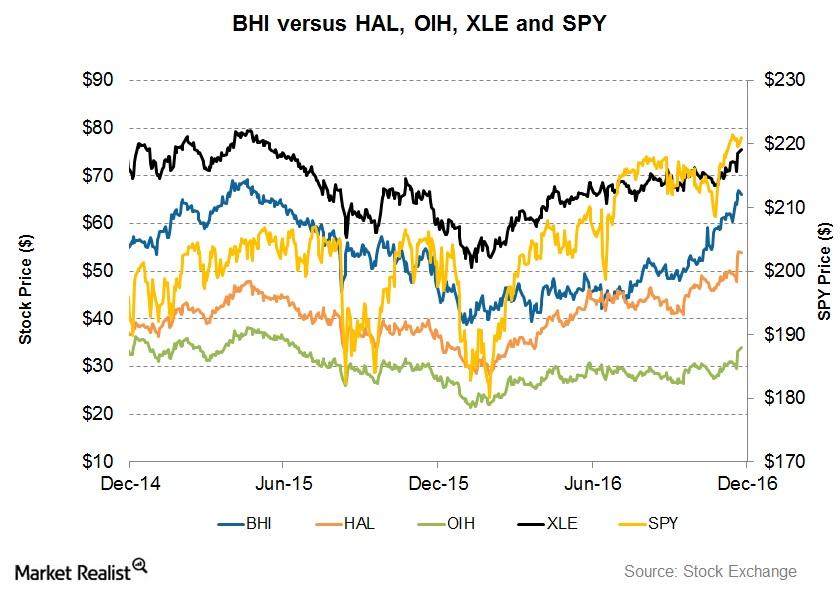

Will a Partnership with GE Improve BHI’s Returns?

Between December 2014 and December 2016, Baker Hughes (BHI) stock hit its peak in April 2015. It troughed at ~$39 in January 2016.

Lack of Rate Hike in September Leads US Stocks Down

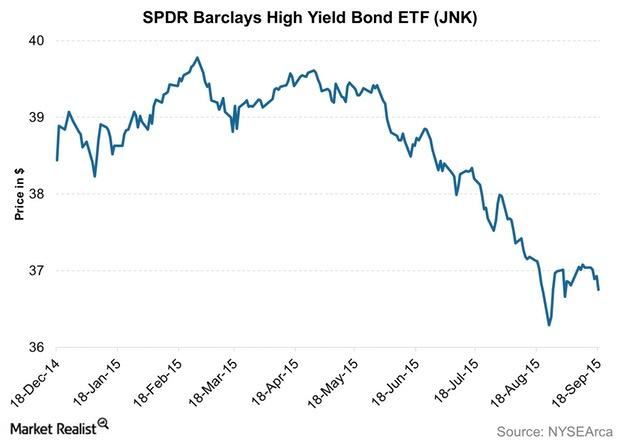

The US Federal Reserve met on September 16 and 17 in one of the most anticipated monetary policy meetings in recent memory.

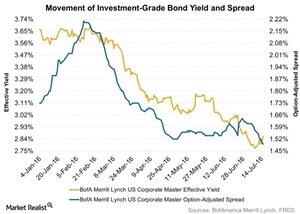

High-Grade Bond Yields Rose as Spreads Touched Their Lowest Level

Last week, high-grade bond yields rose after upbeat US inflation and retail sales data raised the possibility of a rate hike by the year’s end.

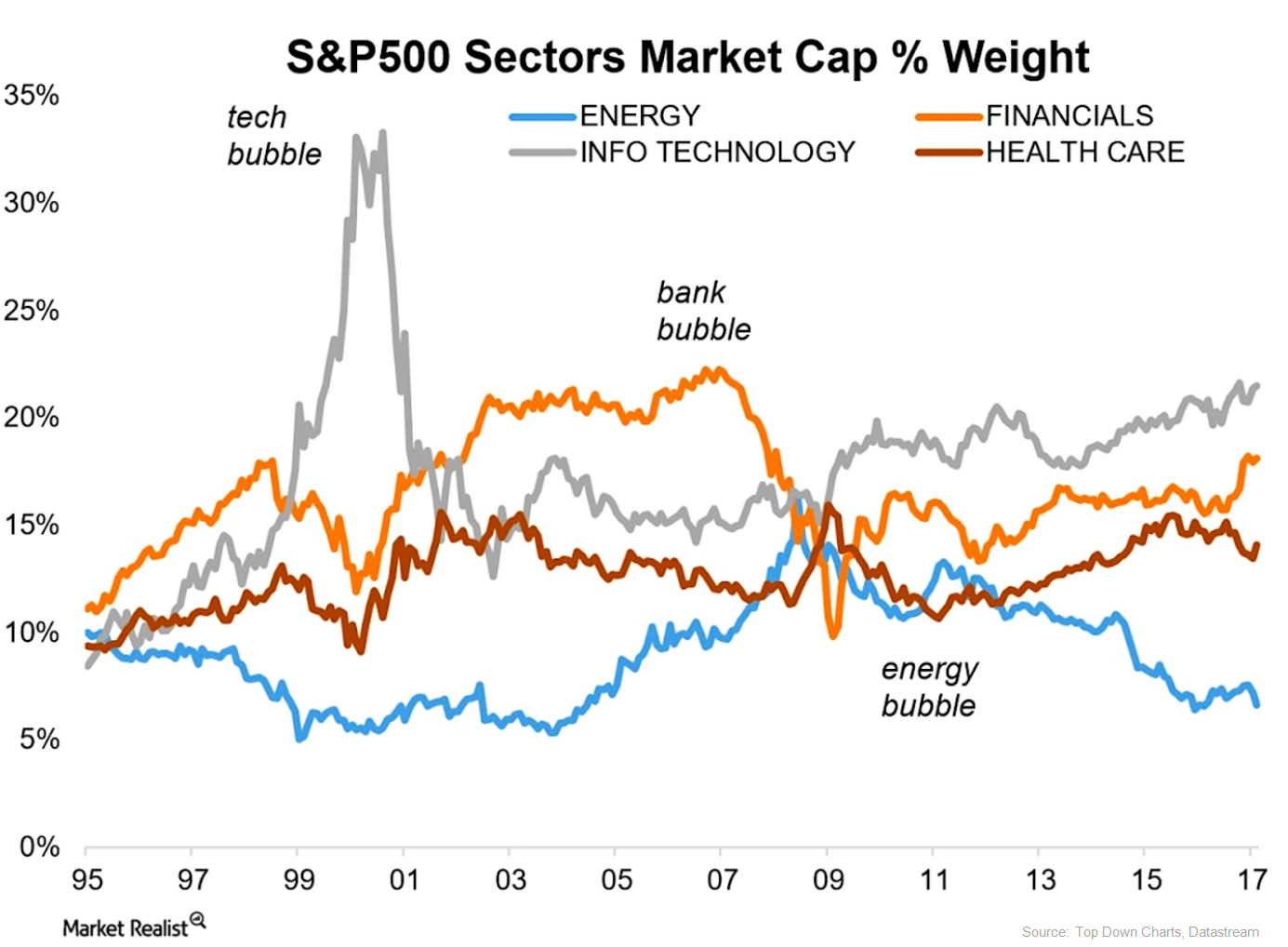

Why Investors Are Optimistic about Tech Stocks

The tech sector’s competitive edge So far in this series, we’ve discussed the potential effects of Trump’s proposed tax reform on prominent tech stocks such as Apple (AAPL), Microsoft (MSFT), IBM (IBM), and Amazon (AMZN). Tech companies continue to be preferred by investors due to their proprietary technological expertise and large cash balances. Their technical […]Financials Must-know: Determining a bank’s value

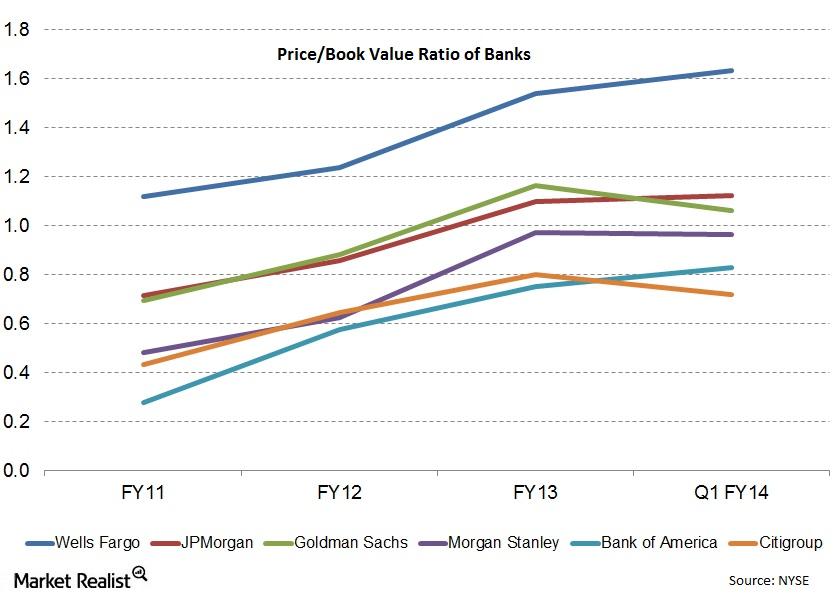

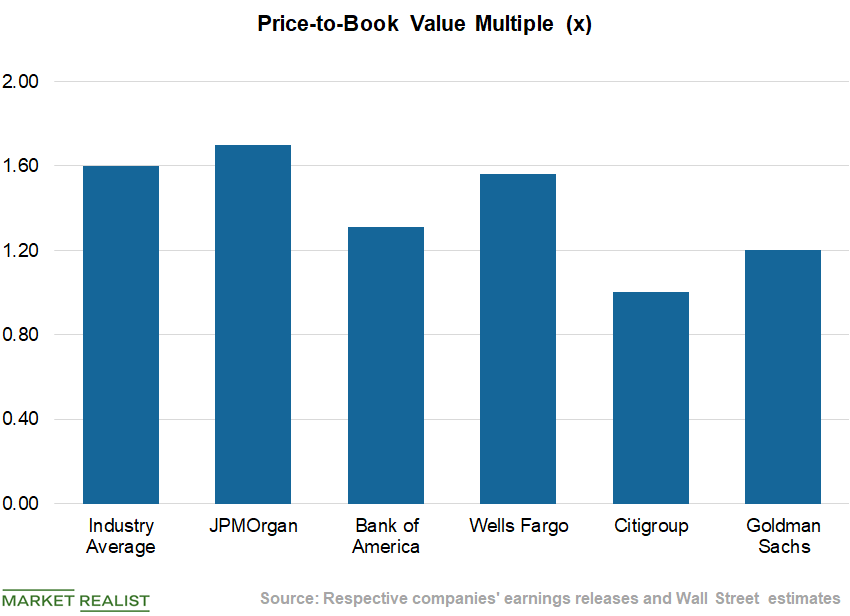

The first challenge is that banks are highly regulated and any change in regulations has a huge impact on the valuation of a bank—the second challenge is that it’s difficult to determine cash flow for a bank because both debt and reinvestment are difficult to calculate.Financials Must-know: Putting the price–to-book value ratio in perspective

We explored the most commonly used valuation metric for financial companies—the price-book value. We also understood the relation between price-book value and return on equity.

Goldman Sachs Favors Chevron Compared to ExxonMobil

Chevron and ExxonMobil stocks have provided almost flat returns in the current quarter. As a result, Goldman Sachs favors Chevron over ExxonMobil.

Morgan Stanley and Goldman have bigger bond exposure than Bank of America and Citi

Bond underwriting exposure could be risky for investment banking departments, as interest rates begin to rise and refinancing slows.

How Is GoPro Enhancing Customer Experiences?

During GoPro’s 4Q16 earnings call, the firm stated that it wants to make GoPro products central to the smartphone experience.

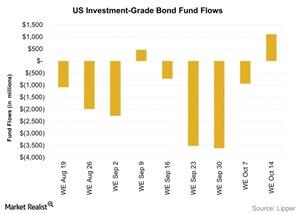

Investment-Grade Bond Funds Witness Inflows

Flows into investment-grade bond funds were positive for the week ending on October 14 after witnessing four consecutive weeks of outflows.

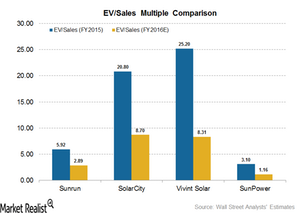

Understanding SolarCity’s Valuation Compared to Peers: Who’s Trading at a Discount?

Among the downstream solar companies, SolarCity (SCTY) has the highest EV-to-sales value of 8.70x, which is closely followed by Vivint Solar at 8.31x.

Understanding Banks’ Market and Reputational Risks

All banks face risks. Two key areas to understand are banks’ market risk and reputational risk. Here’s a summary of each type.

Understanding a Bank’s Operational and Business Risks

Banks experience operational risk in all daily bank activities, such as a check incorrectly cleared or a wrong order punched into a trading terminal.

Is It Pointless to Look at Big Banks’ Q1 Earnings?

JPMorgan Chase will announce its first-quarter results before the markets open on April 14. Analysts expect the bank to post revenues of $29.7 billion.

Goldman Sachs’ Best Stock Picks for 2020

Strategists at Goldman Sachs (GS) project Netflix (NFLX), T-Mobile (TMUS), and Coca-Cola (KO) to be among the best stock picks for 2020.

Walmart Coin: A Bigger Deal than FB’s Libra and Bitcoin?

Retail giant Walmart (WMT) had applied for a digital coin patent. The news comes just as Facebook (FB) is pushing for its own cryptocurrency, Libra.

These 2 Tech Stocks Gained Big in November

In this article, we take a look at two growth tech stocks that have gained momentum recently. They’ve both outperformed the broader markets.

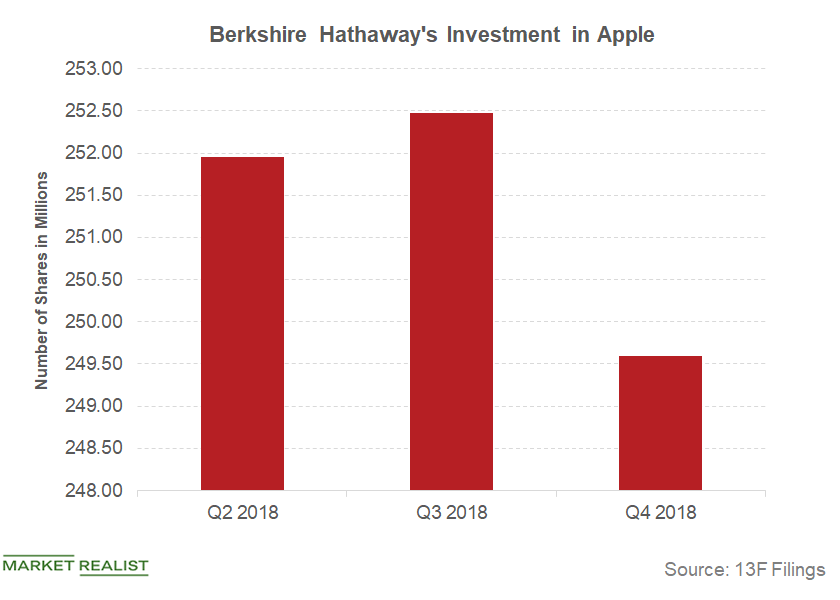

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.Financials What’s the Dow Theory?

The Dow Theory was developed by Charles Dow. It identifies and signals the change in the stock market trends. It’s useful for trading and investing. The Dow Theory has six components.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

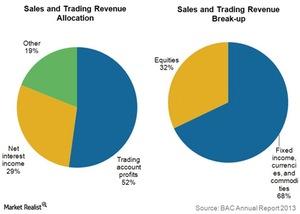

Bank of America’s Global Markets operations

Bank of America’s (BAC) Global Markets segment offers sales and trading services across asset classes to institutional clients.

Apple Card in Hot Water Over Alleged Credit Limit Bias

The Apple Card is currently under regulatory scrutiny related to gender-biased credit limit approvals, according to a Bloomberg report on November 9.Financials Why do investors continue to prefer floating-rate notes?

Last week’s Treasury auctions included $13 billion two-year Treasury FRNs auctioned on May 28. The FRNs were indexed to the May 19 13-week Treasury bill auction high rate,.

Why the price-to-book value ratio’s the most used valuation

The price-book value ratio is the ratio of the market value of equity to the book value of equity. Price stands for the current market price of a stock. Book value is the total assets minus liabilities, or net worth, which is the accounting measure of shareholders’ equity in the balance sheet.

Must-Know: Credit and Liquidity Risks in Banking

The top risks that every bank faces are credit risk and liquidity risk. We’ll look at the banks that managed this risk safely, and those that didn’t.

Why Apple Services Are Overshadowing the iPhone

By 2020, Apple aims to double its Services revenue from 2016. Meanwhile, the iPhone is looking less and less important for the company.

How Apple Stock Performed Last Week

Apple stock rose 2.6% last week. Its performance was a tad volatile, with its shares rising 4.6% in the first four days and falling 2% on Friday.

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Bank of America Posts Mixed Q2 Results Amid Rate Cut Concerns

On Wednesday, Bank of America (BAC) reported mixed second-quarter results. The bank’s profitability beat analysts’ expectation.

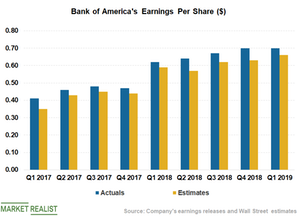

Bank of America’s Asset Quality, Efficiency, and Earnings

Bank of America’s (BAC) credit quality across its consumer and commercial portfolios remained stable at the end of the first quarter.

Could NIO Be on Warren Buffett’s Radar after Recent Stock Fall?

Chinese electric carmaker NIO (NIO) continued to burn cash in the fourth quarter.

Bank of America Stock: Analyzing the Uptrend

Bank of America (BAC) has impressed investors with its financial performance. We expect Bank of America to sustain the momentum in 2019.

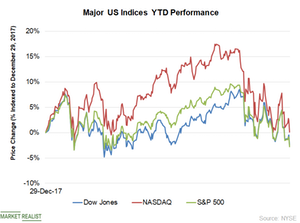

What Triggered the Broader Market Sell-Off in December?

The broader market sell-off started on December 1 when Huawei Technologies’ CFO Meng Wanzhou was arrested by Canadian authorities.

A Look at the Top Five US Banks’ Valuations

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

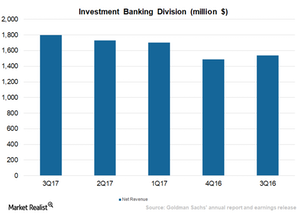

Goldman Sachs and Its Commanding Investment Banking Division

Goldman Sachs’s (GS) Investment Banking segment generated revenues of $1.8 billion in 3Q17, which was a 4% rise compared to 2Q17.

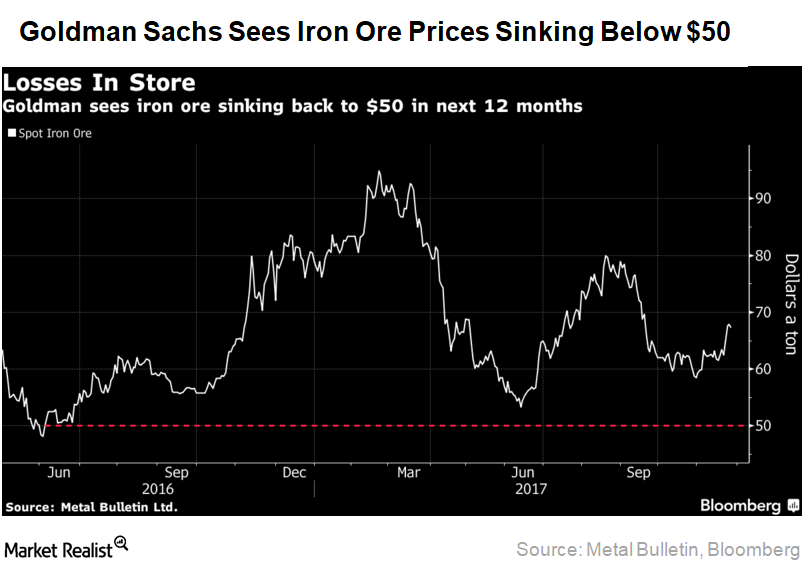

What Are Analysts Predicting for Iron Ore Prices in 2018?

Goldman Sachs (GS) believes that iron ore prices should sink back to $50 per ton in 2018.

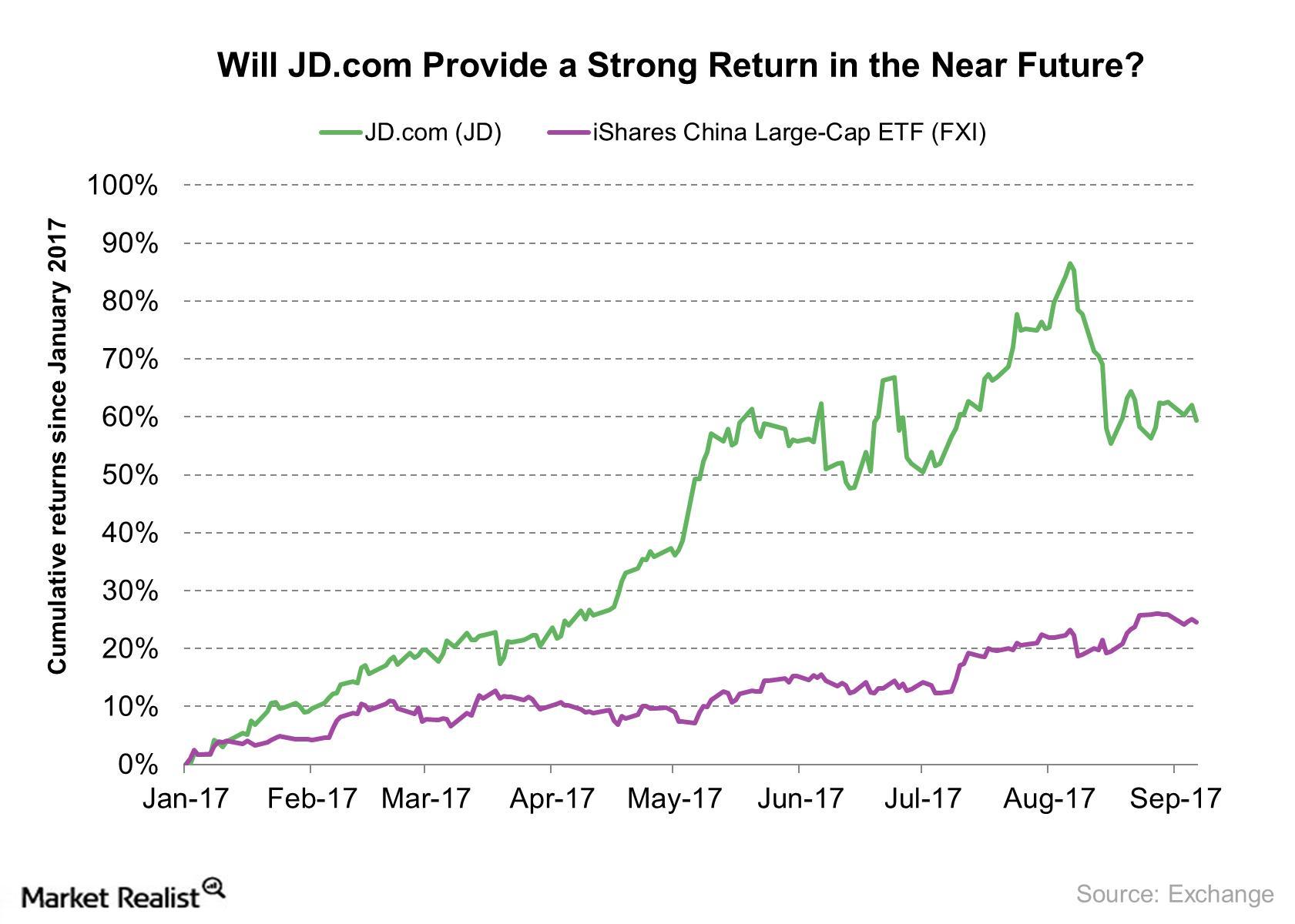

Goldman Sachs Increased JD.com’s Target Price to $56

Goldman Sachs (GS) has a positive outlook on JD.com (JD).

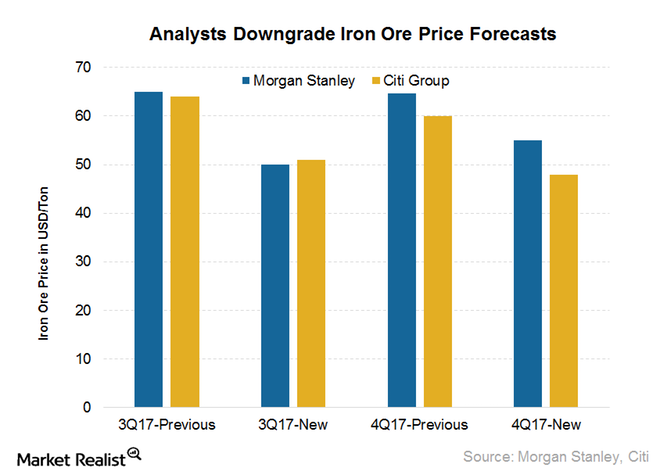

Why Analysts Are Rethinking Their Near-Term Iron Ore Price Forecasts

Goldman Sachs is bullish Although Goldman Sachs (GS) is bullish on the near-term price forecasts for iron ore, it believes that the pressure could return in the long run. In the near term, it believes that prices could be supported by the better-than-expected demand in China. Goldman Sachs believes that the supply pressure could build […]

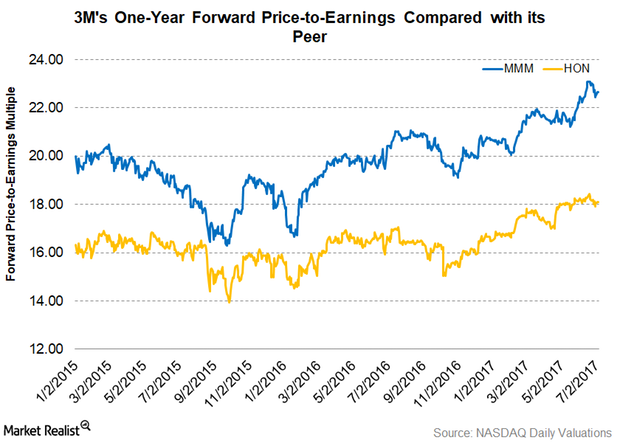

Why 3M Is Trading at a Premium Compared to Its Peers

In this article, we’ll look at MMM’s latest valuations and compare them to its peers’. On July 3, 2017, MMM was trading at a one-year forward PE of 22.70x.