Goldman Sachs Group Inc

Latest Goldman Sachs Group Inc News and Updates

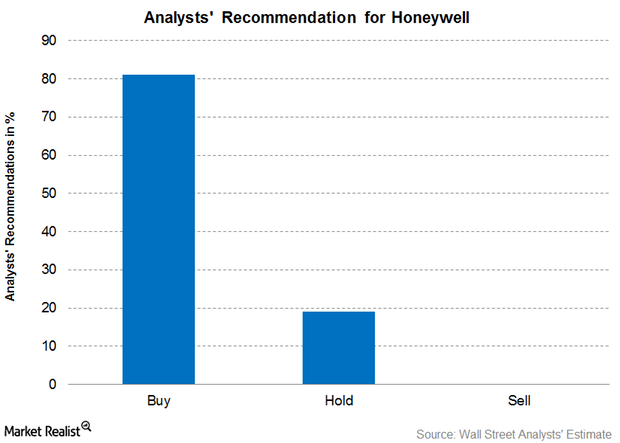

What Analysts Recommend for Honeywell

On April 24, 2017, 21 brokerage companies were actively tracking Honeywell (HON) stock. 81% of these analysts recommended a “buy” on the stock, and 19% recommended a “hold.”

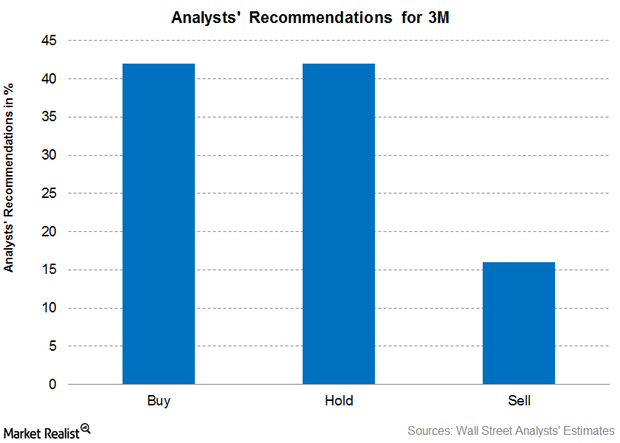

Analysts’ Latest Recommendations for 3M

As of March 8, 18 brokerage firms were tracking 3M stock—42% of the analysts rated it as a “buy,” 42% rated it as a “hold,” and 16% rated it as a “sell.”

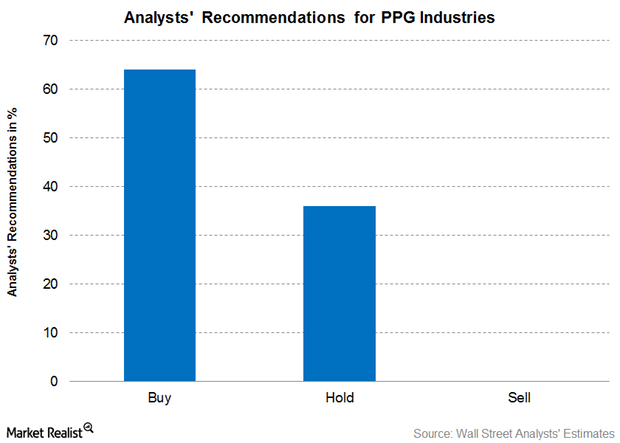

Analysts’ Recommendations and Target Price for PPG Industries

As of March 1, 2017, 22 brokerage firms were actively tracking PPG Industries (PPG) stock. About 64.0% of them have recommended a “buy” for the stock.

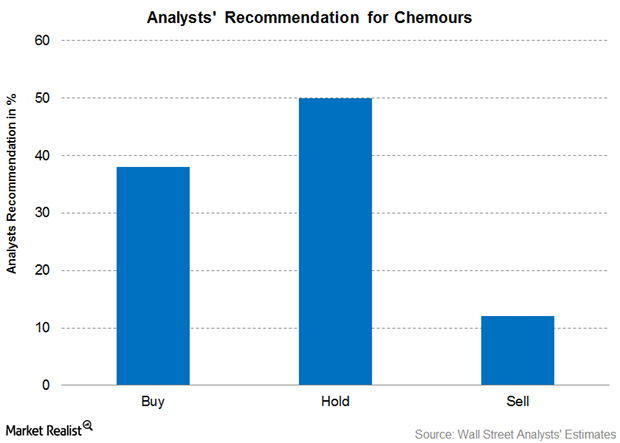

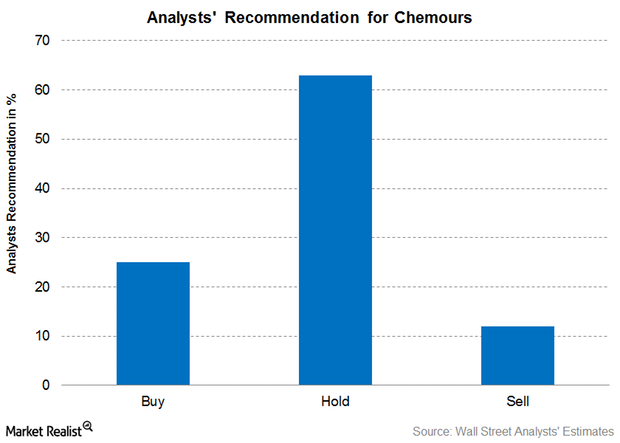

What Are Analysts’ Recommendations for Chemours?

After Chemours’ 4Q16 earnings, 38.0% of the analysts recommended a “buy” for the stock, 50.0% recommended a “hold,” and 12.0% recommended a “sell.”

What Are Analysts Recommending for Chemours ahead of 4Q16?

As of February 9, 2017, eight brokerage firms are actively tracking Chemours (CC) stock. About 25.0% of them have recommended a “buy” for the stock.

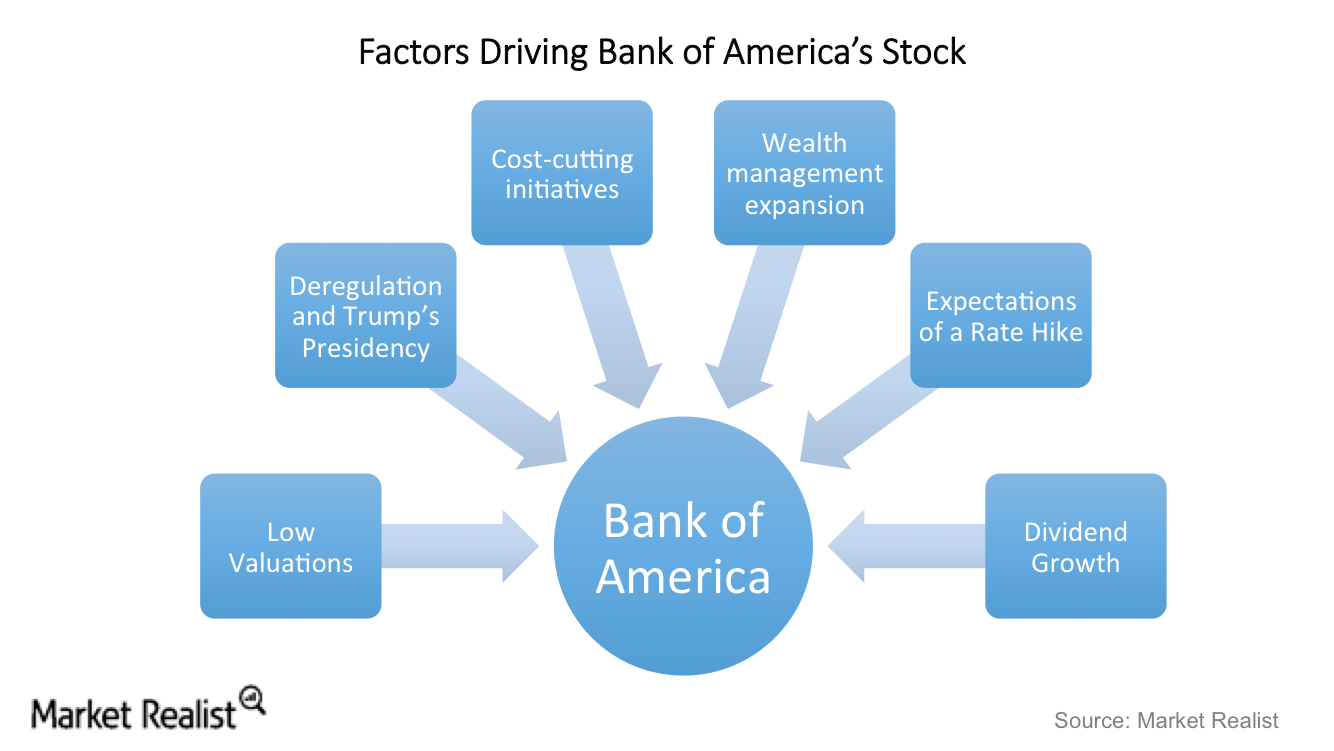

What Are Bank of America’s 2017 Growth Drivers?

Bank of America’s CEO has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years.

Goldman Sachs Gets Bullish on Commodity Prices

Goldman Sachs has gone bullish on commodities. The finance major, which is the biggest commodities dealer (in sales), has advised clients to go overweight.

Analysts Are Truly Divided on Chemours after Its 3Q16 Earnings

Among the analysts covering Chemours’ stock, 33.33% analysts recommended a “buy,” while 33.33% issued a “hold,” and the remaining 33.33% issued a “sell.”

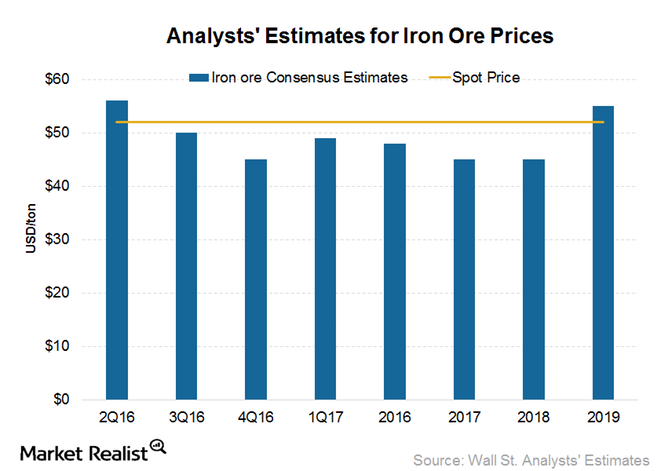

What Analysts Have to Say about Iron Ore Prices

Analysts have increased their short-term iron ore price forecasts due to stronger-than-expected temporary factors.

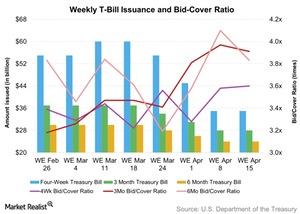

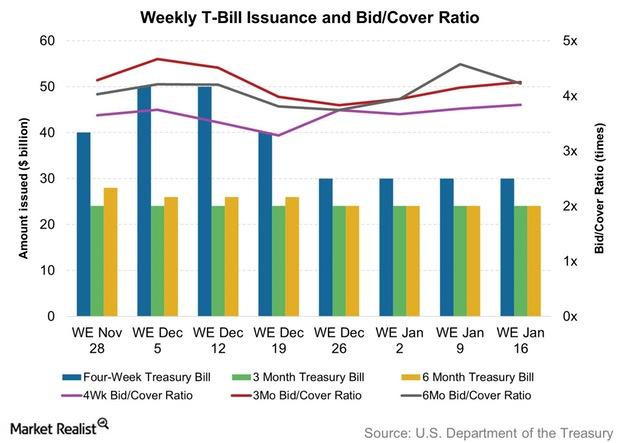

Indirect Bidders Participated in the 13-Week T-Bills Auction

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

How Was Market Demand for the 13-Week Treasury Bill Auction?

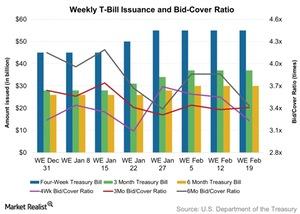

The U.S. Department of the Treasury conducted the weekly auction of 13-week Treasury bills on February 16, 2016. The total issuance was worth $37 billion.

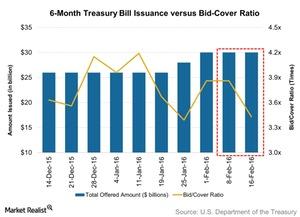

Bid-to-Cover Ratio Fell for 26-Week Treasury Bill Auction

The U.S. Department of the Treasury held the weekly 26-week Treasury bill auction on February 16, 2016. T-bills totaling $30 billion were on offer.

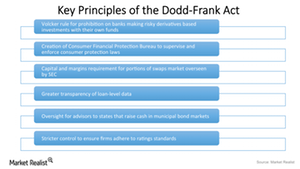

What Is the Dodd-Frank Act?

The Dodd-Frank Act is a financial reform legislation passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

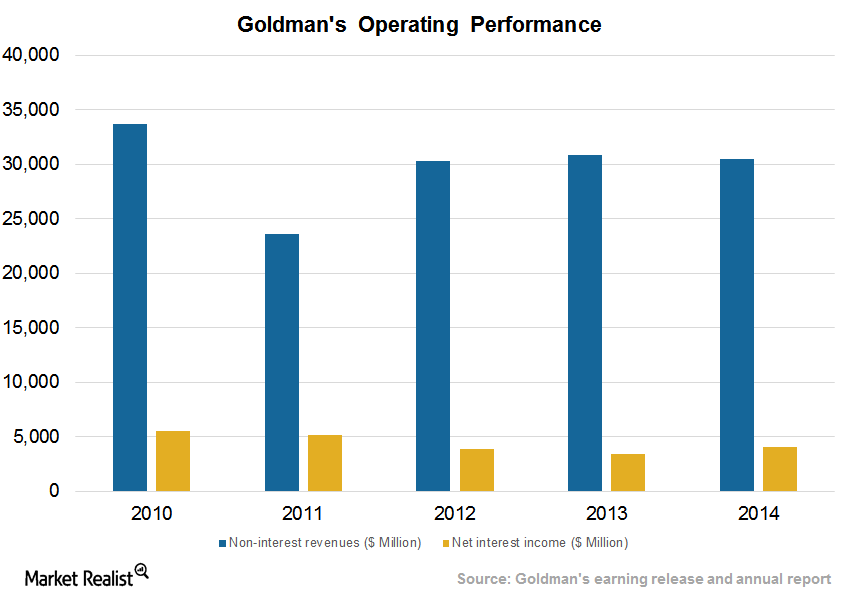

Goldman Sachs’ Revenue Model

Goldman Sachs engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions.

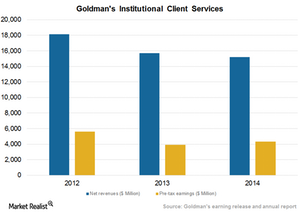

Goldman Sachs’ Institutional Client Services Posts Highest Profit

Goldman Sachs’ major services in the division include offerings related to interest rate products, credit products, mortgages, currencies, and commodities.

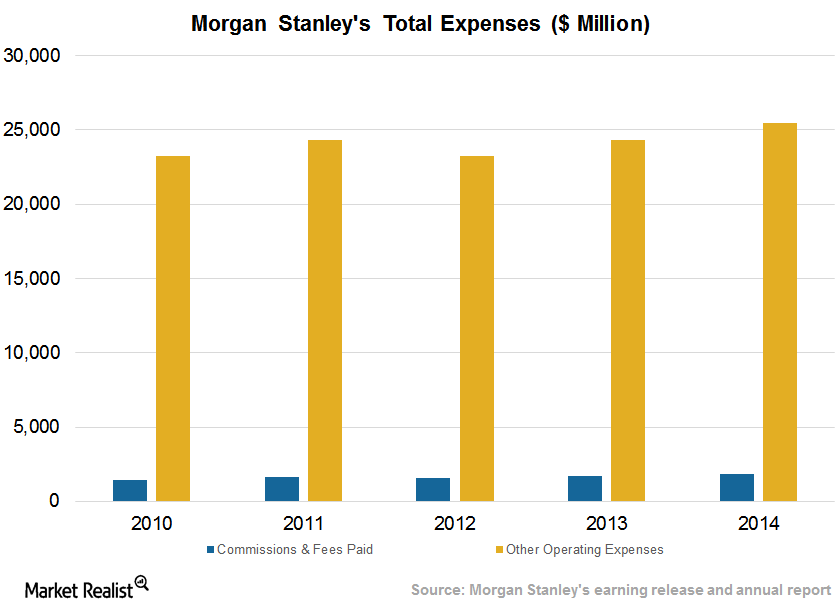

Morgan Stanley’s Careful Attention to Compensation Expenses

Morgan Stanley divides its non-interest expenses into compensation and non-compensation. It’s compensation expenses (and benefits) are ~80% of this class.

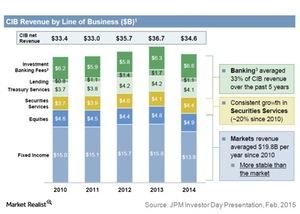

How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.

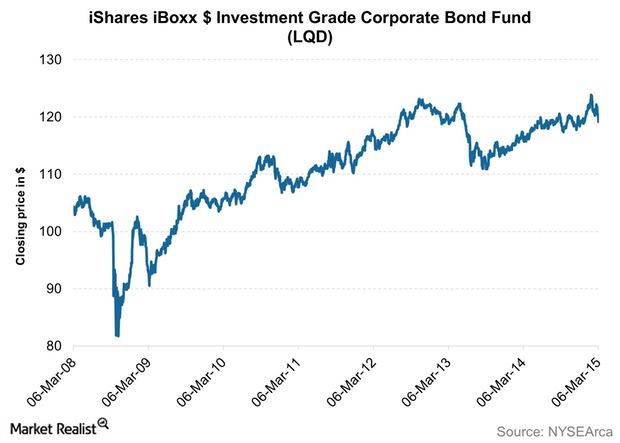

What are investment-grade bonds?

Investment-grade bonds are both U.S. Treasuries issued by the U.S. Treasury Department and corporate bonds issued by high-quality corporate borrowers.

The bid-to-cover ratio rose at the 13-week T-bills auction

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12.Financials Must-know: Basel III’s shortcomings

Basel III addresses most of Basel II and II.5’s deficiencies. But it still has some shortcomings. Firstly, the increased regulatory capital required under Basel III will increase barriers to enter into the sector.Financials Why Basel II.5 corrected Basel II to improve banking regulations

Basel II.5 was essentially a revision of Basel II norms, as the existing norms often failed to correctly address the market risks that banks took on their trading books. Basel II.5’s main aim was to strengthen the capital base, and so the banks’ ability to withstand risk, by increasing banks’ capital requirements.Financials Why Basel II wasn’t good enough for reducing bank risks

Basel II was a comprehensive regulation that covered major sources of risks for banks. But it had a few major drawbacks. Firstly, it provided incentive to a bank’s management to underestimate credit risk.Financials Must-know: Why Basel I wasn’t a good fit for all banks

Although Basel I brought a worldwide standard in regulations, introduced the risk-weighted assets concept, and segregated capital, it had a few deficiencies.Financials Must-know: Why capital in banking is important

Capital is important because it’s that part of an asset which can be used to repay its depositors, customers, and other claimants in case the bank doesn’t have enough liquidity due to losses it suffered in its operations.Financials Must-know: The different types of banking capital

The most important types of banking capital are common stock (or shareholders’ equity), preferred stock (or preferred equity), revaluation reserve, general provision, and hybrid instrument.Financials Overview: The basics of banking regulations

Banking regulations aim to ensure that the risks are minimized. If any unforeseen event occurs, then the interests of bank customers are protected. On a wider scale, the regulations also seek to absorb and minimize shock in the economy.Financials Must-know: The consequences of imprudent risk-taking by banks

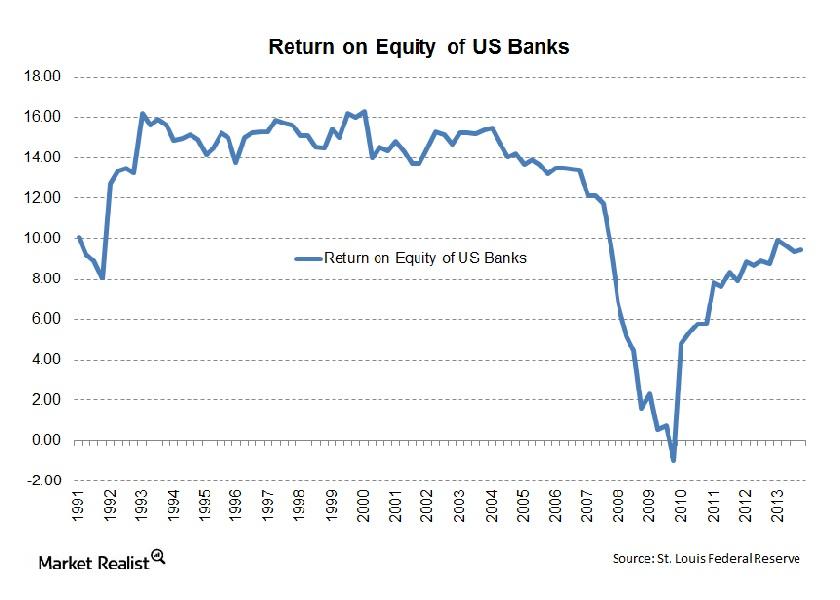

We stated earlier that most banks are highly leveraged financial risk-takers. When things go awry, the results can be catastrophic, leading to huge losses or even to a bank closure.Financials Must-know: A thorough look at defining banking risk

Banking risk can be defined as exposure to the uncertainty of outcome. It’s applicable to full-service banks like JPMorgan (JPM), traditional banks like Wells Fargo (WFC), investment banks like Goldman Sachs (GS) and Morgan Stanley (MS), or any other financials included in an ETF like the Financial Select Sector SPDR Fund (XLF).Financials Overview: What you need to know about banking risks

Whenever we analyze any banking company, we’re looking at two main variables—the return a bank earns and the amount of risk. To understand any bank, you need to understand these two parameters well.

Why the price-to-book value ratio affects returns on equity

Historical analysis has shown that return on equity has a strong impact on banks’ value creation in the long run. So financials that have high price-book value ratios should also have high returns on equity.

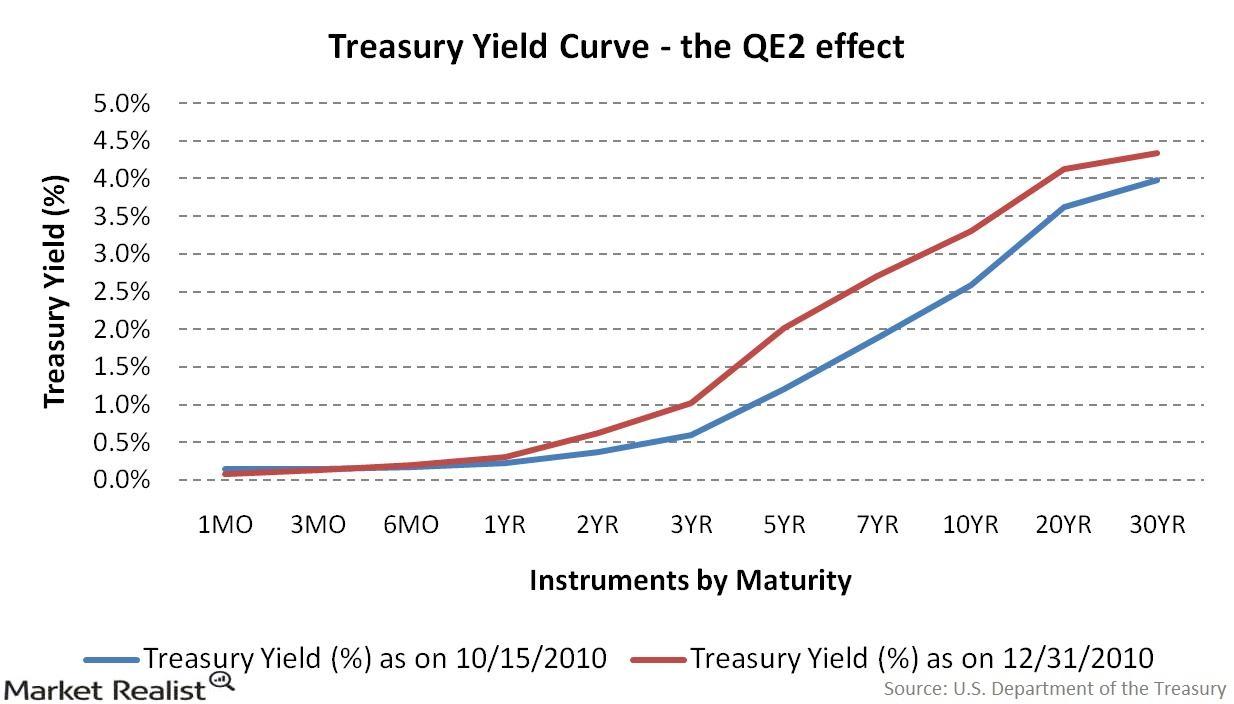

How does the Fed’s monetary policy affect the yield curve?

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve.

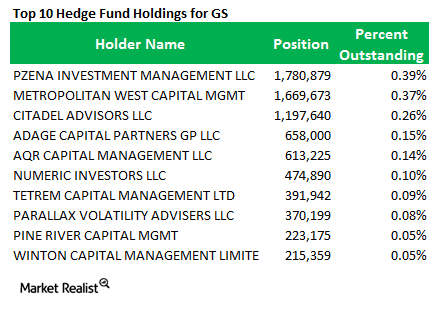

Berkshire Hathaway reveals a new position in Goldman Sachs

Berkshire Hathaway opened a brand new position in Goldman Sachs that accounts for 2.14% of the investment company’s $104 billion portfolio.