Goldman Sachs Is Bullish on Metaverse, But Is Hedging Its Bet

Investment bank Goldman Sachs is bullish on the metaverse. However, the company just led a $227 million investment round in IRL events startup Fever.

Jan. 26 2022, Published 11:59 a.m. ET

Web 3.0 has its fair share of critics, but Goldman Sachs (GS) isn't one of them. The big cap investment bank says that the metaverse could be worth up to $8 trillion over time.

In an episode of the Exchanges at Goldman Sachs podcast, investment analyst Eric Sheridan talked about how bullish Goldman Sachs is on the metaverse—and why he thinks others should be too. Despite this, Goldman Sachs just led a $227 million investment round in real-world events company Fever.

Goldman Sachs says that the metaverse holds big potential.

Goldman Sachs CEO David Solomon

In a branded podcast episode, Sheridan talked about what the metaverse really is. Sheridan said, “We're going to take what our physical world experience is, and broadly move them into elements of mixed reality, virtual reality, and eventually augmented reality.”

Sheridan said that he has a 14-and-a-half-year-old kid who's a big fan of video games. He has experienced the end-user adoption of gaming first hand, but recognizes that the metaverse is much more than that.

Speaking on behalf of Goldman Sachs, Sheridan said, “We think this could be as much as an $8 trillion opportunity on the revenue or the monetization side.”

Sheridan referenced the digital economy, which he said makes up about a quarter of the global economy. As the digital economy grows, so too will the metaverse, according to Sheridan.

In reality, Goldman Sachs’ estimate is much broader. Sheridan said that the team has calculated that the metaverse could be worth between $2 trillion and $12 trillion, with $8 trillion being a midpoint estimate.

Goldman Sachs isn’t the only name estimating the metaverse to be worth so much. In November, Morgan Stanley said that the market could hit $8 trillion. Ark Investment Management CEO Cathie Wood said that the industry’s valuation will be in the multi-trillion-dollar region. Grayscale Investments said it could hit $1 trillion.

Goldman Sachs leads the $227 million investment round in Fever.

Goldman Sachs Asset Management’s growth equity arm just led a $227 million investment round in tech startup Fever.

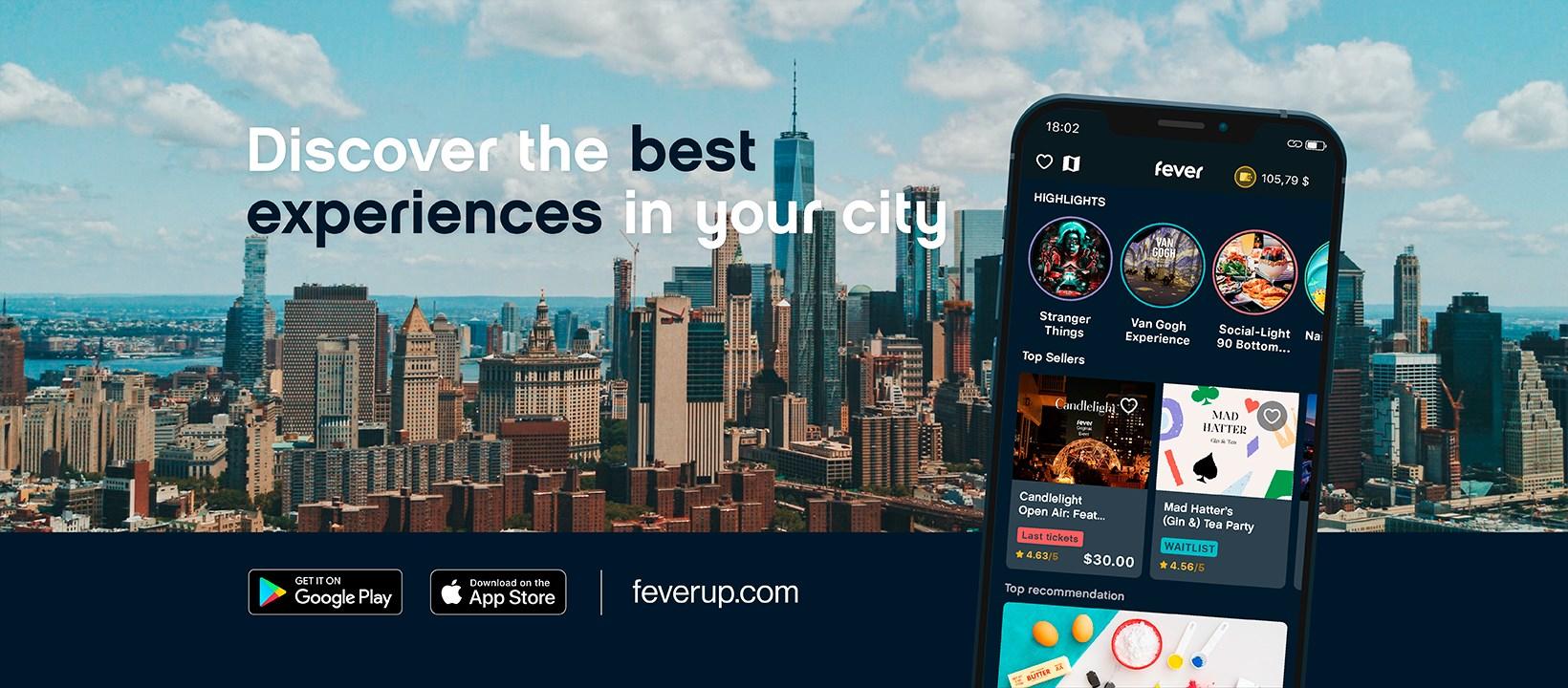

Fever is a live-entertainment discovery platform co-led by Ignacio Bachiller Ströhlein, Alexandre Perez Casares, and Francisco Hein. The company isn’t a metaverse concert brand. Instead, it caters to people’s needs for in-person, or IRL, events that satisfy needs for live experiences and socialization.

The latest investment round makes Fever a unicorn with a $1 billion valuation. Despite Goldman Sachs’ bullishness on the metaverse, the investment bank seems to be hedging its bet in the real world.

The investment phase of the metaverse is now.

Exchanges at Goldman Sachs podcast host Allison Nathan said that the world is in the investment phase of the metaverse. This means that money is going out, but not returning just yet. Meta Platforms (formerly Facebook) admitted it lost about $10 billion to metaverse investments in 2021.

In the private sector, venture capital for gaming, augmented reality, and similar digital experiences exceeded $10 billion in 2021, according to Sheridan.

Sheridan thinks that there’s more to come of the metaverse. “I think what you're going to see over time is the potential for it to evolve beyond just gaming and for more experiences to come into these types of experiences and expand the potential footprint beyond gaming,” Sheridan told the host.

Goldman Sachs has a market capitalization of nearly $117 billion as of Jan. 26. The shares are down YTD with the rest of the stock market, but the investment bank hopes its combination of digital and real-world investments could help propel it in the long run.