Goldman Sachs Picks 5 New Stocks with 100% Upside: Should You Buy?

Goldman Sachs has picked five new stocks that it believes can rally over 100 percent. What are these stocks and should you buy them?

Dec. 6 2021, Published 9:32 a.m. ET

Goldman Sachs is among the most popular names in the investment world. The brokerage recently said that it expects the S&P 500 to hit 5,100 in 2022. Now, Goldman Sachs has picked five new stocks that it thinks can rally 100 percent over the next year. What are these stocks and should you buy them now?

Some of Goldman Sachs’ recent predictions have been right on, especially in the commodity space. Copper prices hit $10,000 per metric ton, which the bank forecast. The brokerage expects copper to hit $15,000 per metric ton by 2025

Goldman Sachs was correct on crude oil prices.

Goldman Sachs also correctly predicted a rally in crude oil prices. Crude oil prices hit a multi-year high in November but have since come down after the emergence of the omicron variant of the COVID-19 virus, which was first identified in South Africa. The variant has since spread to various countries, including the U.S.

Goldman Sachs picks five new stocks.

In November, Goldman Sachs started to cover five new stocks. Going by the target prices, these stocks have over 100 percent upside potential over the next 12 months. These stocks are:

- HireRight

- Sema4

- K Car

- IHS Holding

- Sonendo

It isn't guaranteed that the target prices Goldman Sachs has assigned will play out. Multiple stocks trade way above or below their consensus target prices. It's important to do your research before grabbing any of these five names. Here’s a brief overview of these companies.

HireRight is a play on the recovering employment market.

The U.S. employment market has been strong even though the headline November jobs data missed the estimates. HireRight provides background screening services. Goldman Sachs sees strong secular growth for the company in the U.S. It's also forecasting margin expansion amid automation.

HireRight was listed in October and trades below the IPO price of $19. Goldman Sachs has assigned a target price of $35 on the stock, which would mean an upside in excess of 100 percent from these levels.

Sema4 is a health intelligence company.

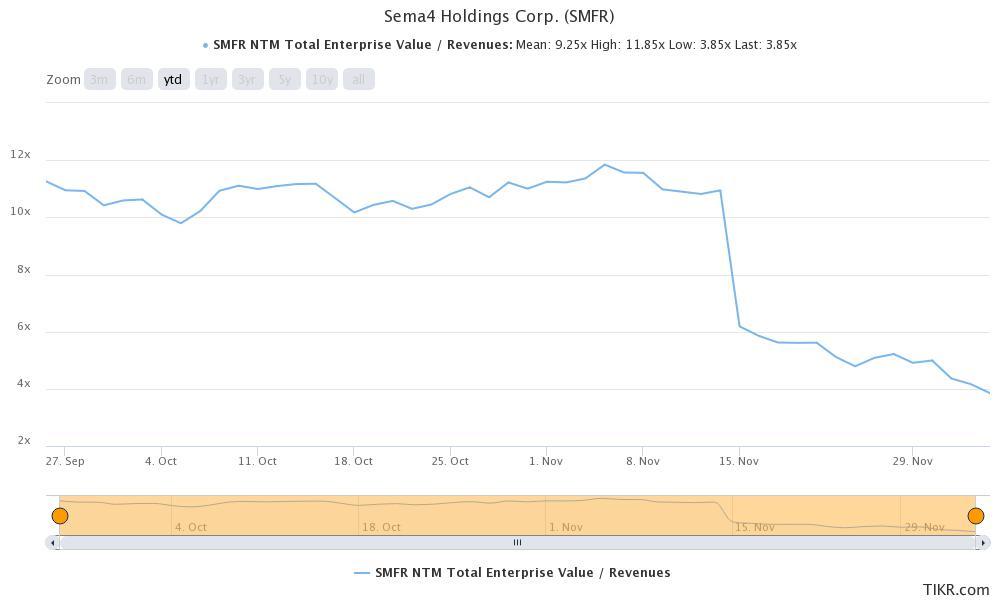

Sema4 is a health intelligence company that went public through a SPAC reverse merger. The stock has been falling in 2021 and is down almost 50 percent for the year. It continued to fall in November even though Goldman Sachs assigned a $12 target price for the company.

Sema4 is a loss-making company. However, its topline is expanding fast and it has a high share of revenues from recurring business. The stock currently trades at an NTM EV-to-sales multiple of 3.8x, which is the lowest since it went public.

Goldman Sachs expects K Car stock to double.

Goldman Sachs expects South Korean used car company K Car to also double amid the structural changes in the used car market in South Korea. However, the stock doesn't trade on U.S. markets.

IHS Holdings is trading below the IPO price.

IHS Holdings was listed in October and priced the IPO at $21 per share, which was at the bottom end of the projected range. The stock trades well below the IPO price but Goldman Sachs sees better days for the telecom infrastructure company.

Goldman Sachs has assigned a target price of $29 on the stock, which is a sharp premium over its current prices. IHS Holdings has its towers across the Middle East, Latin America, and parts of Africa. Goldman Sachs thinks that the company is “well positioned to benefit from secular tailwinds in emerging markets.”

Sonendo is a play on a less-evasive root canal treatment.

Sonendo is a medical device company that produces a less evasive root canal treatment called the GentleWave. The company went public in October and priced the shares at $12, which was below the original range of $15–$17. The stock now trades below $8.5.

Meanwhile, Goldman Sachs has assigned a target price of $30 on Sonendo, which would mean the stock more than tripling from these levels. In terms of potential upside, Sonendo promises the highest returns based on Goldman Sachs' target price.