JPMorgan Chase & Co

Latest JPMorgan Chase & Co News and Updates

Dish Stock Jumps after Chairman Mentions SoftBank in Merger Trial

Dish stock jumped after Dish Network Chairman Charlie Ergen mentioned financial support from SoftBank in the T-Mobile–Sprint merger trial. We’ll look at what this support means to Dish.

Ray Dalio, the Role of Credit, and the Economic Machine

Credit is the most important part of the economy, leading to increased spending, increased income levels, higher GDP, and faster productivity growth.

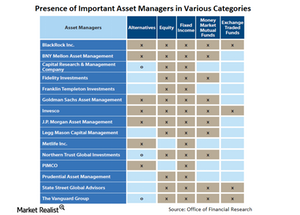

The main players in asset management

The efficient market hypothesis maintains that the market prices everything correctly and so it isn’t possible to outperform the market in the long run.

Citigroup globally established in emerging markets

Citigroup’s exposure in emerging markets is mainly to investment-grade global multinationals through its institutional businesses.

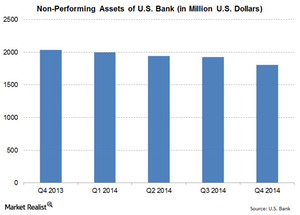

U.S. Bank’s non-performing assets declined in 4Q14

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13.

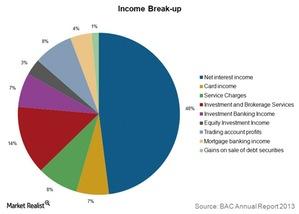

How does Bank of America make money?

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

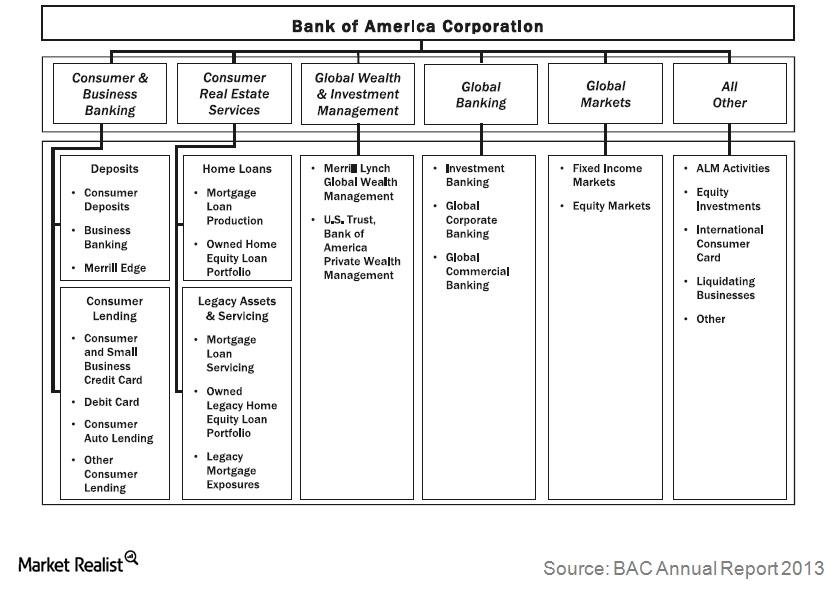

Bank of America’s six operating segments

Bank of America operates through five major segments. Its Consumer and Business Banking segment contributes a third of the bank’s total revenues.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

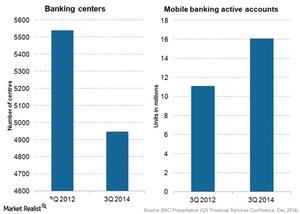

Why consumer banking is important for Bank of America

Consumer and Business Banking is Bank of America Corporation’s (BAC) largest segment. It contributes about a third of the bank’s total revenues.

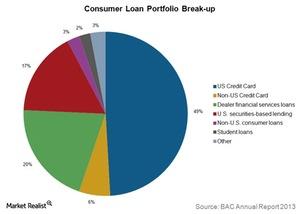

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

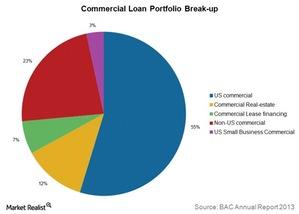

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

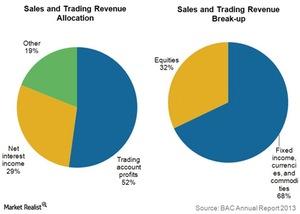

Bank of America’s Global Markets operations

Bank of America’s (BAC) Global Markets segment offers sales and trading services across asset classes to institutional clients.

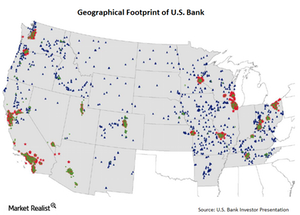

A brief overview of U.S. Bank

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

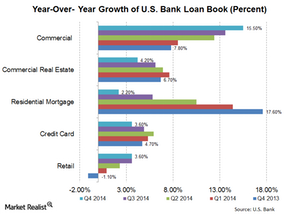

Why U.S. Bank’s loan growth showed interesting trends

You need to understand loan categories better in order to see some very interesting trends in U.S. Bank’s loan growth. Its loans are divided into five main categories.Financials Richard Fisher explains why excess reserves can create velocity

Richard Fisher also discussed the impact of quantitative easing (or QE) on excess reserve balances held by depository institutions at his speech at the London School of Economics on Monday, March 24.Financials Why do investors continue to prefer floating-rate notes?

Last week’s Treasury auctions included $13 billion two-year Treasury FRNs auctioned on May 28. The FRNs were indexed to the May 19 13-week Treasury bill auction high rate,.Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

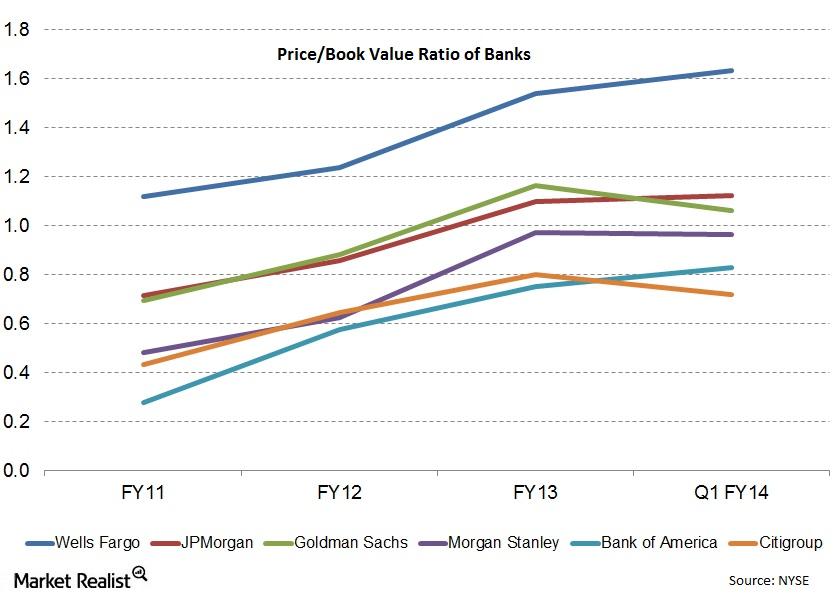

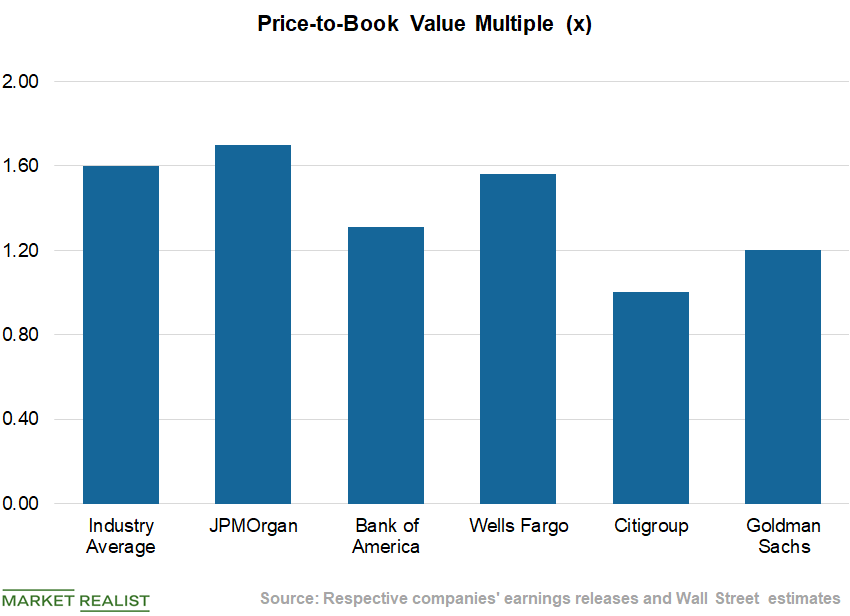

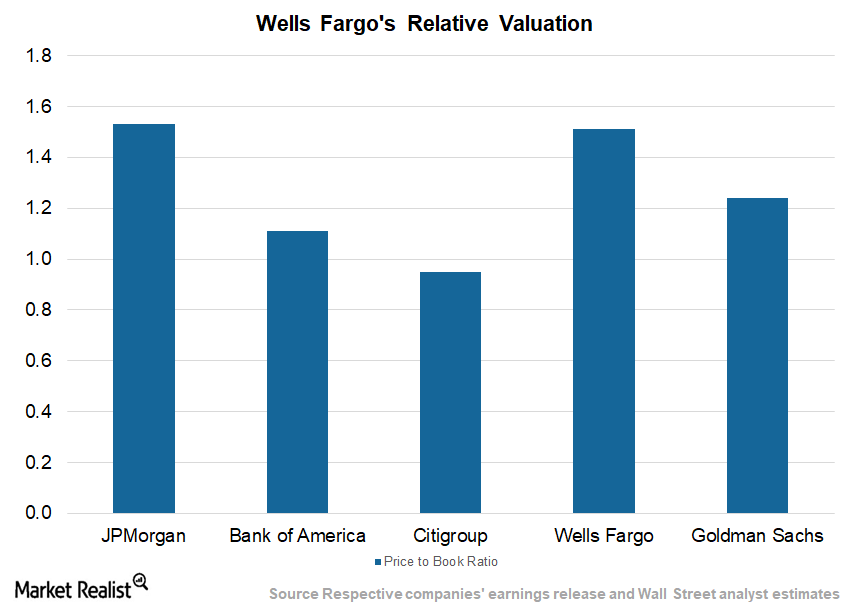

Why the price-to-book value ratio’s the most used valuation

The price-book value ratio is the ratio of the market value of equity to the book value of equity. Price stands for the current market price of a stock. Book value is the total assets minus liabilities, or net worth, which is the accounting measure of shareholders’ equity in the balance sheet.

Must-Know: Credit and Liquidity Risks in Banking

The top risks that every bank faces are credit risk and liquidity risk. We’ll look at the banks that managed this risk safely, and those that didn’t.

Amazon: Analysts Revise Target Price, Earnings Are a Concern

Amazon (AMZN) shares are trading close to 4% in early-market today. The company announced its third-quarter results on Thursday.

Bank of America Stock: Analysts Are Upbeat

Most of the analysts covering Bank of America stock recommend a “buy.” On Tuesday, Atlantic Equities upgraded the stock to “overweight” from “neutral.”

Get Real: Misunderstood and Undervalued?

In today’s Get Real, we focused on Bill Ackman’s Berkshire Hathaway comments, Mexico’s major cannabis milestone, earnings season, and much more.

Apple’s iPhone 11 Could Drive Fiscal 2020 Sales

Apple’s (AAPL) iPhone 11 preorders have been encouraging. Furthermore, demand for the iPhone 11, Pro, and Pro Max are exceeding supply chain expectations.

Verizon and Wells Fargo Are Getting on the Blockchain

Verizon (VZ) and Wells Fargo (WFC) are taking steps to integrate blockchain technology into their business models. Here’s why.

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Investors’ Obsession with Yield Curve Inversion

You’ve likely heard about it in the financial press recently: this ominous, notorious thing called the “yield curve inversion.”

Kudlow Doesn’t See a Recession, Trump Might Fear One

White House economic advisor Larry Kudlow doesn’t see a looming recession. However, recession fears grew as the yield curve inverted last week.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Bank of America Posts Mixed Q2 Results Amid Rate Cut Concerns

On Wednesday, Bank of America (BAC) reported mixed second-quarter results. The bank’s profitability beat analysts’ expectation.

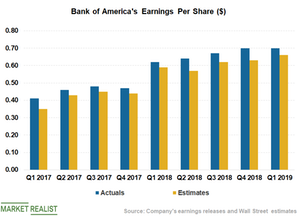

Bank of America’s Asset Quality, Efficiency, and Earnings

Bank of America’s (BAC) credit quality across its consumer and commercial portfolios remained stable at the end of the first quarter.

Analysts Lower Target Price on FedEx after Its 2019 Outlook Cut

Most analysts reduced their target prices on FedEx after the delivery giant trimmed its fiscal 2019 earnings outlook.

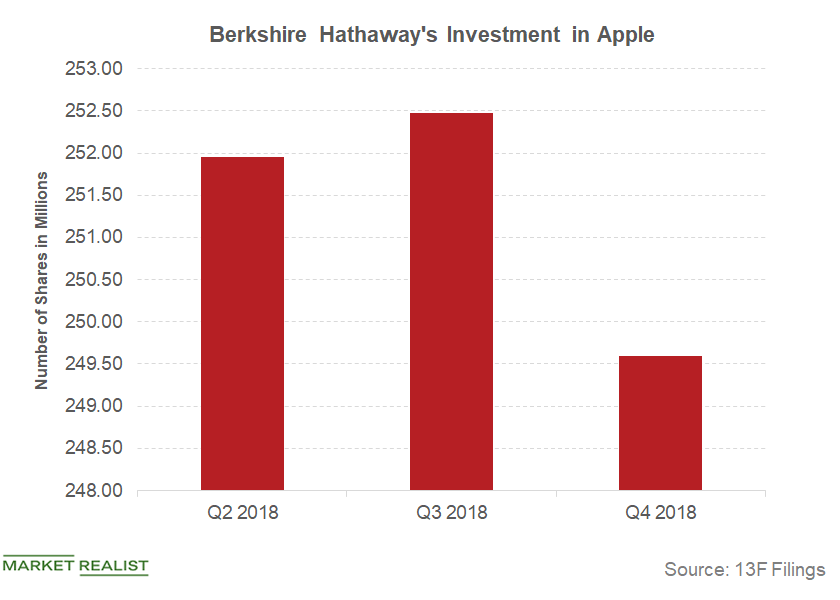

Could NIO Be on Warren Buffett’s Radar after Recent Stock Fall?

Chinese electric carmaker NIO (NIO) continued to burn cash in the fourth quarter.

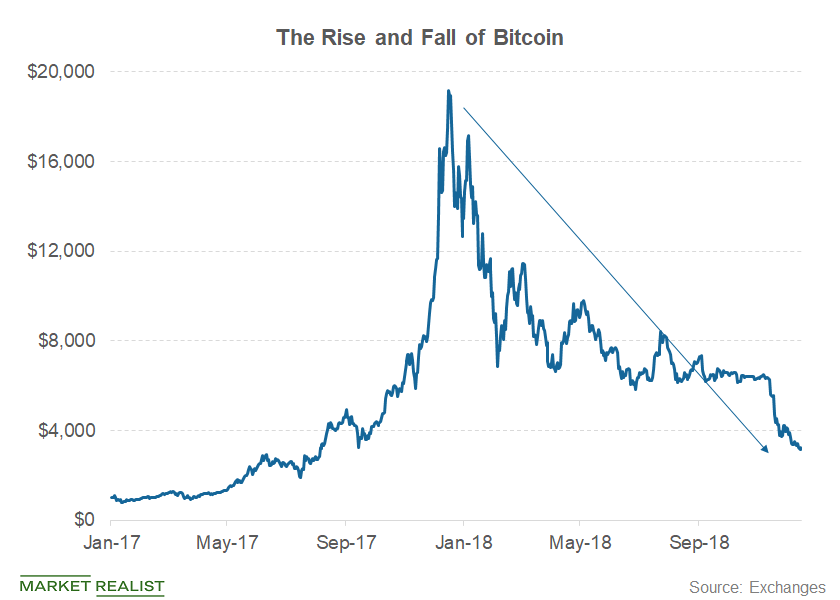

Could Warren Buffett’s Views on Bitcoin Change?

Berkshire Hathaway (BRK-B) chair Warren Buffett has never been a fan of cryptocurrencies like bitcoin.

Bank of America Stock: Analyzing the Uptrend

Bank of America (BAC) has impressed investors with its financial performance. We expect Bank of America to sustain the momentum in 2019.

Wells Fargo to Cut Over 600 Jobs amid Mortgage Business Slowdown

On August 23, Wells Fargo (WFC) announced that it planned to terminate the jobs of 638 employees in its home mortgage division.

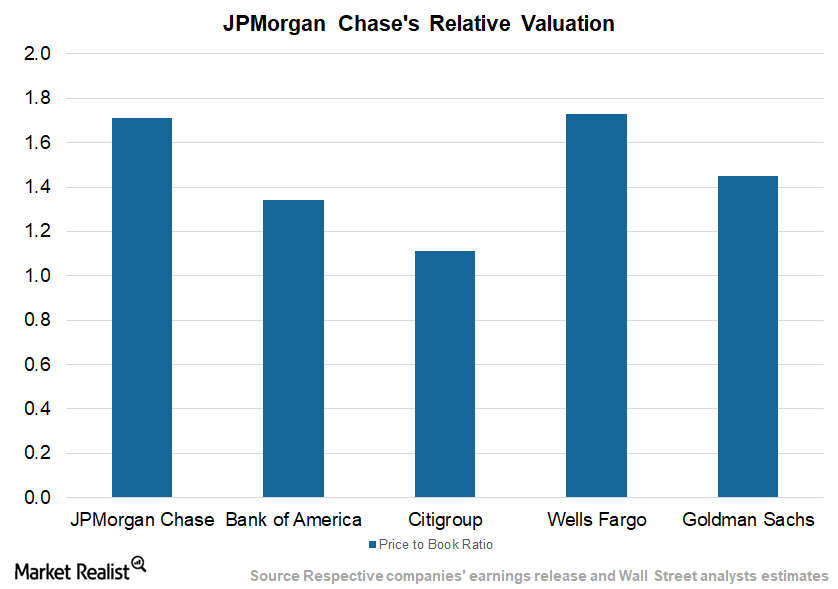

A Look at the Top Five US Banks’ Valuations

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

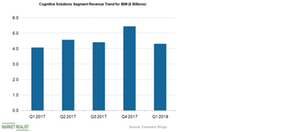

IBM Takes Slow and Steady Approach for Watson AI

The growing adoption of IBM’s (IBM) Watson AI platform is contributing significantly to the company’s overall business.

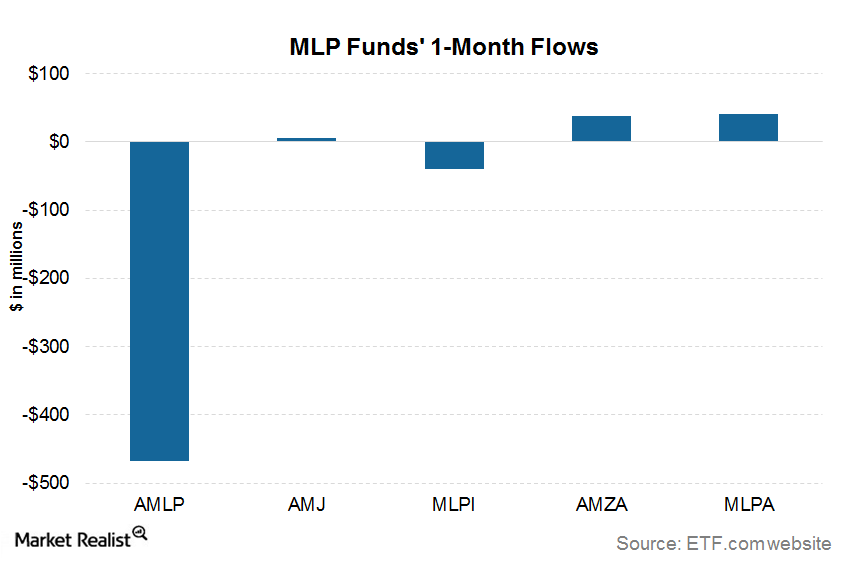

What Do the MLP Funds Flows Indicate?

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018.

What’s JPMorgan Chase’s Valuation?

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year.

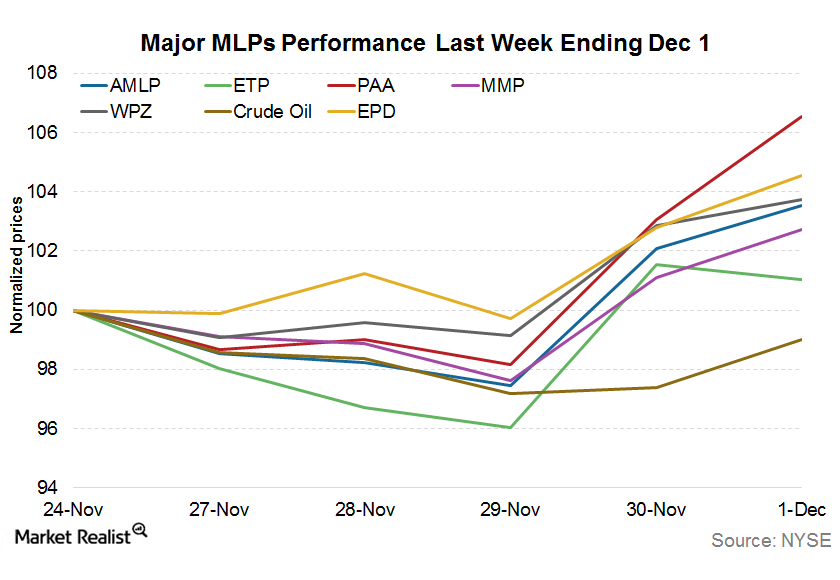

Why MLPs Underperformed the Energy Sector Last Week

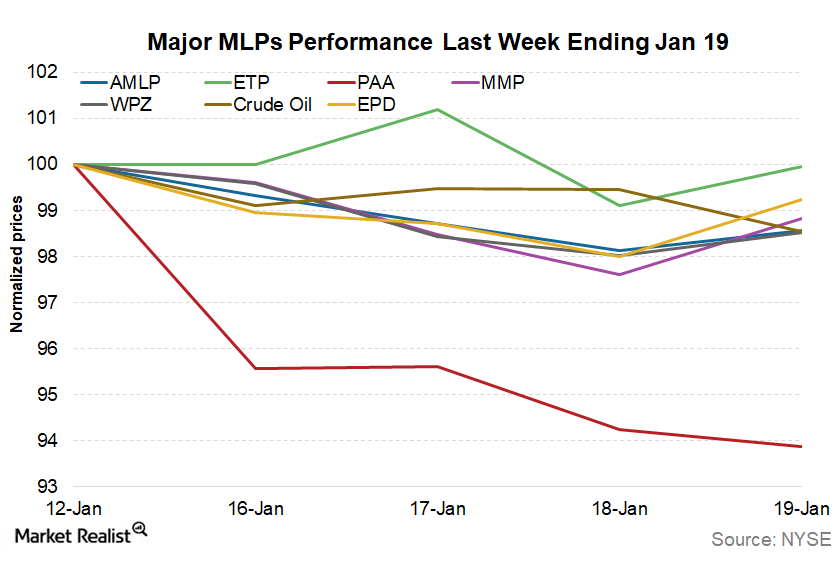

MLPs underperformed the energy sector and the broader US markets last week. Let’s take a look.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

MLPs Continue to Outperform Broader US Markets in 2018

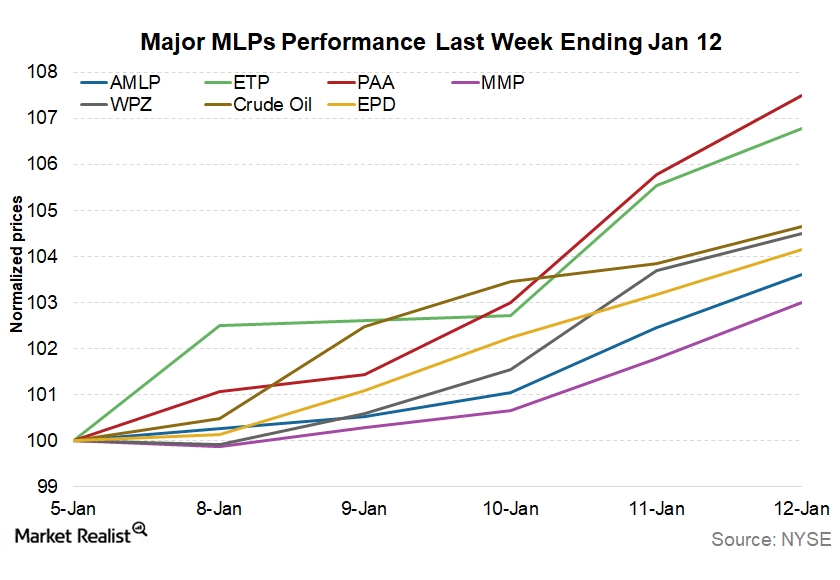

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

What’s Wells Fargo’s Valuation?

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year.

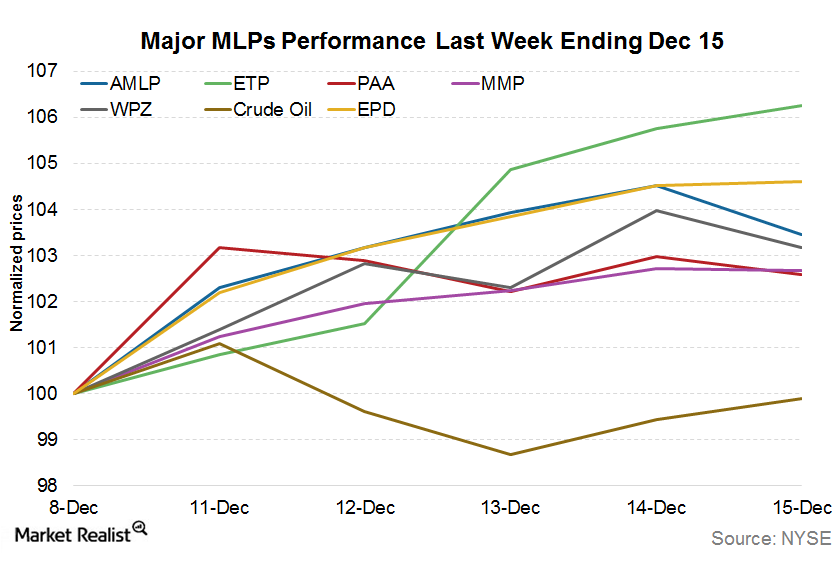

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

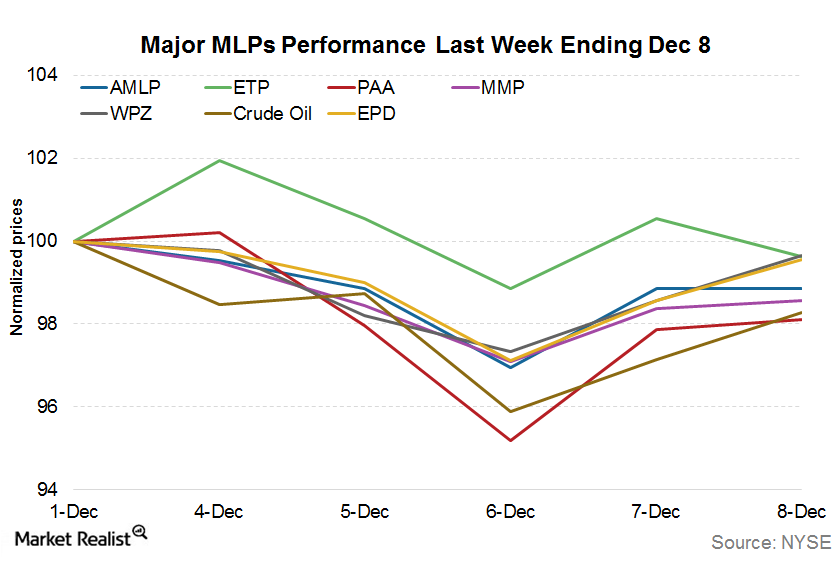

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

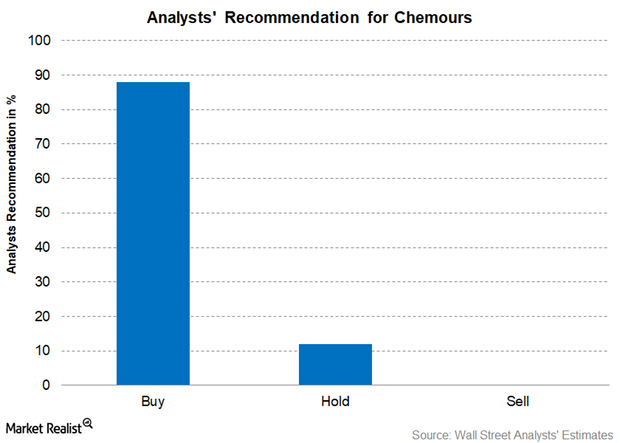

Chemours: Analysts’ Recommendations and More

For Chemours, 88% of the analysts recommended a “buy,” 12% of the analysts recommended a “hold,” and none of the analysts recommended a “sell.”

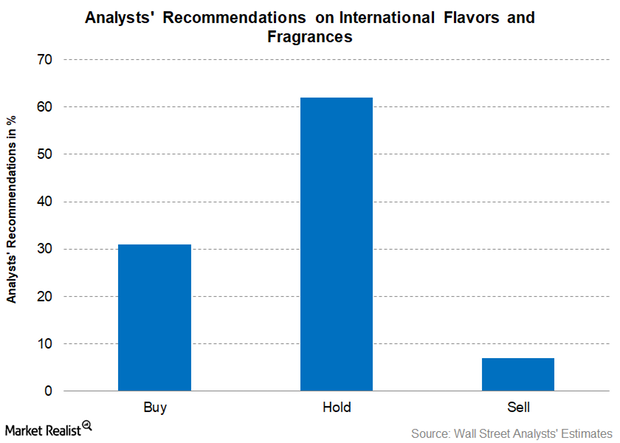

Why Most Wall Street Analysts Recommend a ‘Hold’ for IFF

International Flavors and Fragrances continues to work towards its 2020 vision of increasing its revenue by $500 million by way of acquisitions.

What’s Square’s Mission?

With Apple (AAPL) announcing its entry in the peer-to-peer payment market and PayPal (PYPL) stepping up its pursuit of merchant customers, it seems that the competition could suffocate Square (SQ).