Citigroup Inc

Latest Citigroup Inc News and Updates

Wells Fargo to Cut Over 600 Jobs amid Mortgage Business Slowdown

On August 23, Wells Fargo (WFC) announced that it planned to terminate the jobs of 638 employees in its home mortgage division.

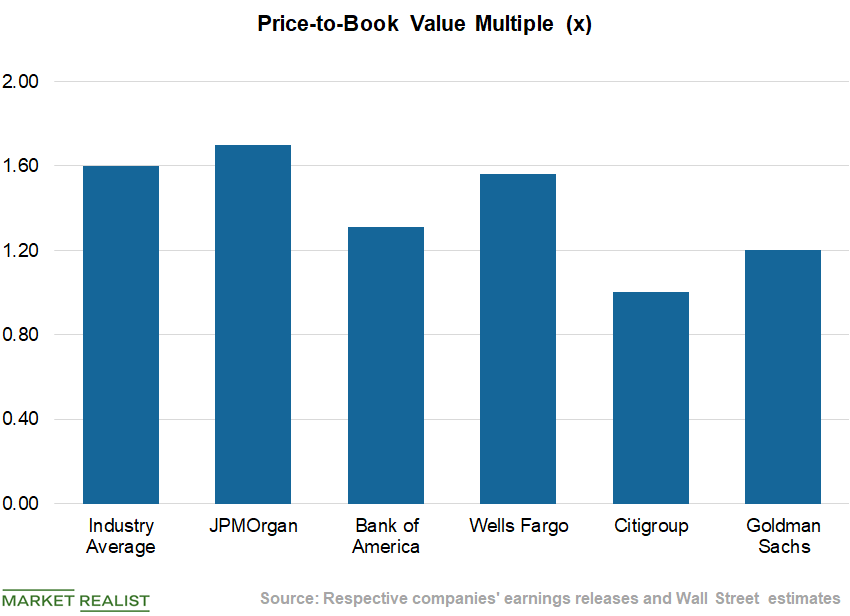

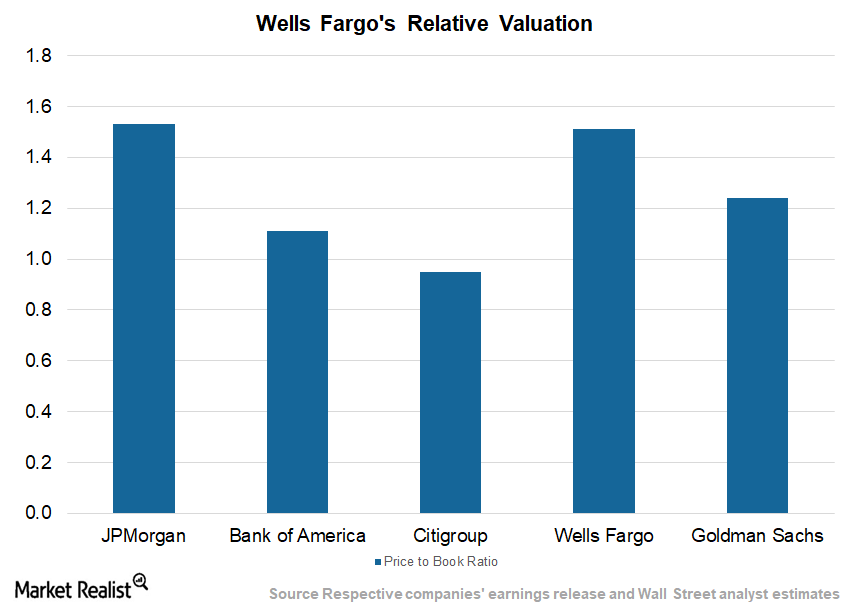

A Look at the Top Five US Banks’ Valuations

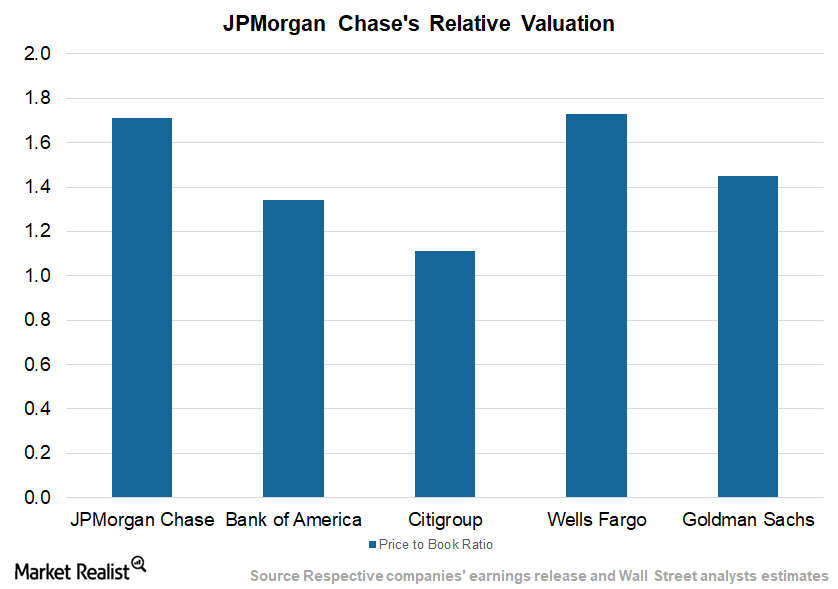

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

What’s JPMorgan Chase’s Valuation?

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year.

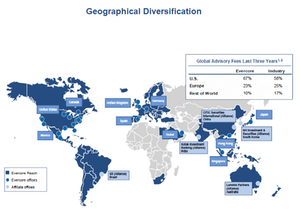

A Look at Evercore’s Business Model

Evercore generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17.

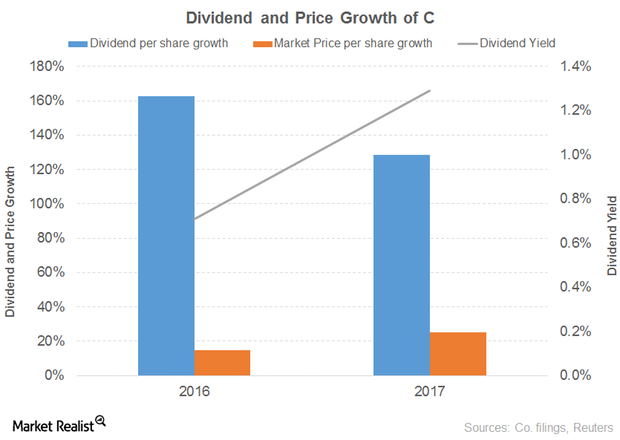

Why Citigroup’s Outlook Seems Promising

Citigroup is projected to grow its revenue 2% and 4% in 2017 and 2018, respectively. The 2017 and 2018 diluted EPS are projected to grow 12% and 14%, respectively.

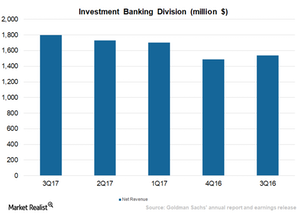

Goldman Sachs and Its Commanding Investment Banking Division

Goldman Sachs’s (GS) Investment Banking segment generated revenues of $1.8 billion in 3Q17, which was a 4% rise compared to 2Q17.

What’s Wells Fargo’s Valuation?

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year.

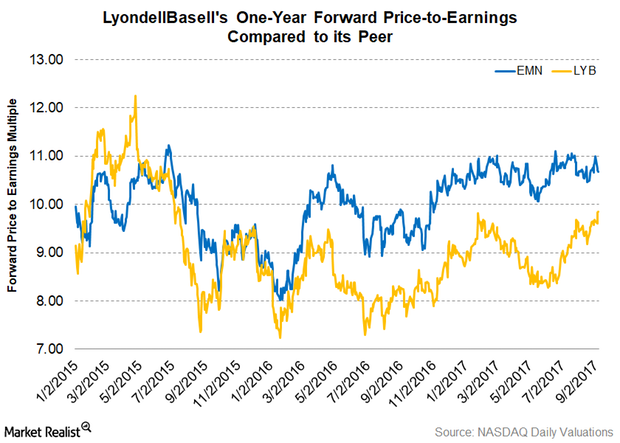

Is LyondellBasell Stock Undervalued Compared to Its Peer?

As of September 7, 2017, LyondellBasell’s one-year forward PE multiple stands at 9.80x, while Eastman Chemical has one-year forward PE multiple of 10.70x.

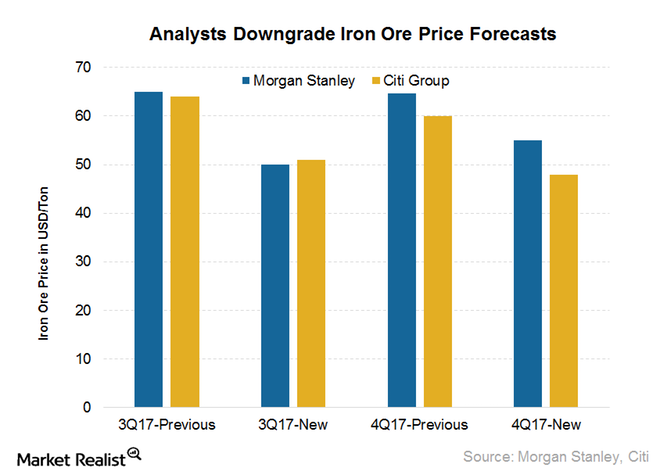

Why Analysts Are Rethinking Their Near-Term Iron Ore Price Forecasts

Goldman Sachs is bullish Although Goldman Sachs (GS) is bullish on the near-term price forecasts for iron ore, it believes that the pressure could return in the long run. In the near term, it believes that prices could be supported by the better-than-expected demand in China. Goldman Sachs believes that the supply pressure could build […]

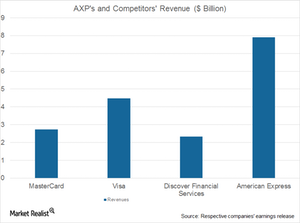

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

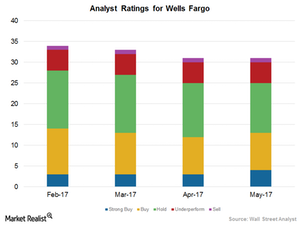

What Do Analysts’ Ratings Suggest for Wells Fargo in 2017?

In May, 13 of the 31 analysts covering Wells Fargo rated the stock as a “buy,” 12 analysts rated it as a “hold,” and six analysts rated it as a “sell.”

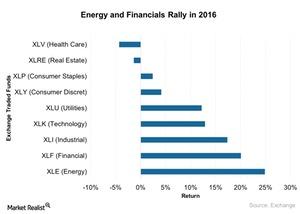

2016 US Sector Performance: Top Performers in Energy and Financials

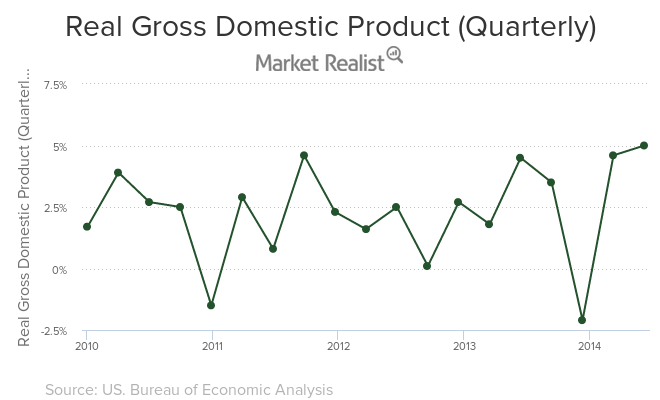

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.

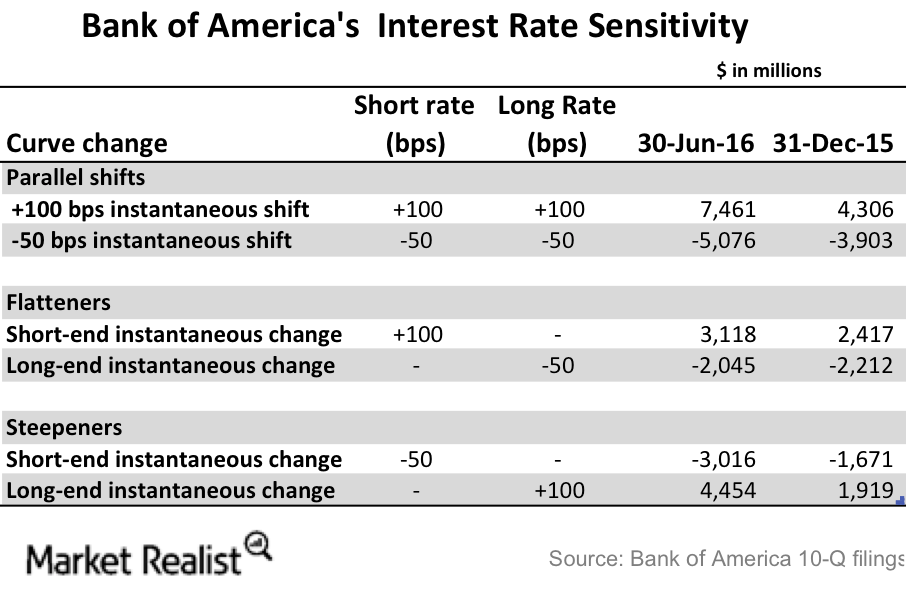

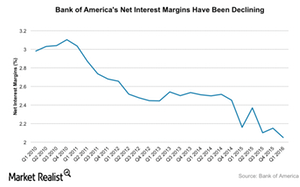

What’s Bank of America’s Interest Rate Risk?

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q15.

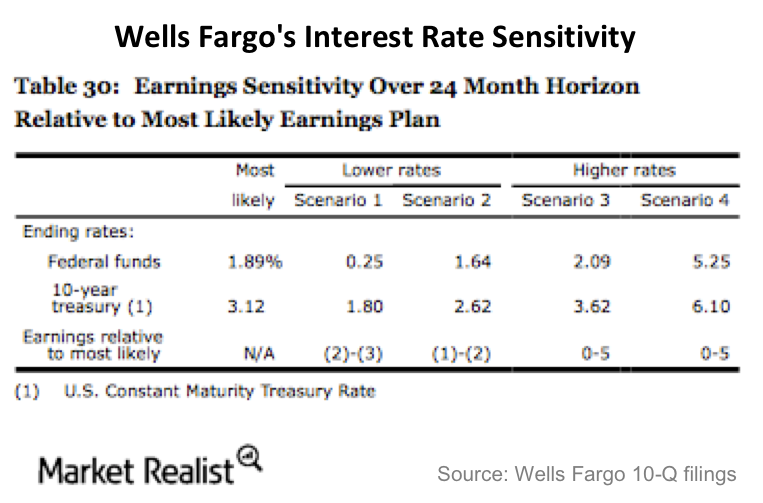

How Sensitive Are Wells Fargo’s Earnings to Interest Rates?

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion.

Why Wells Fargo Has a Less Risky Business Model than JPMorgan Chase

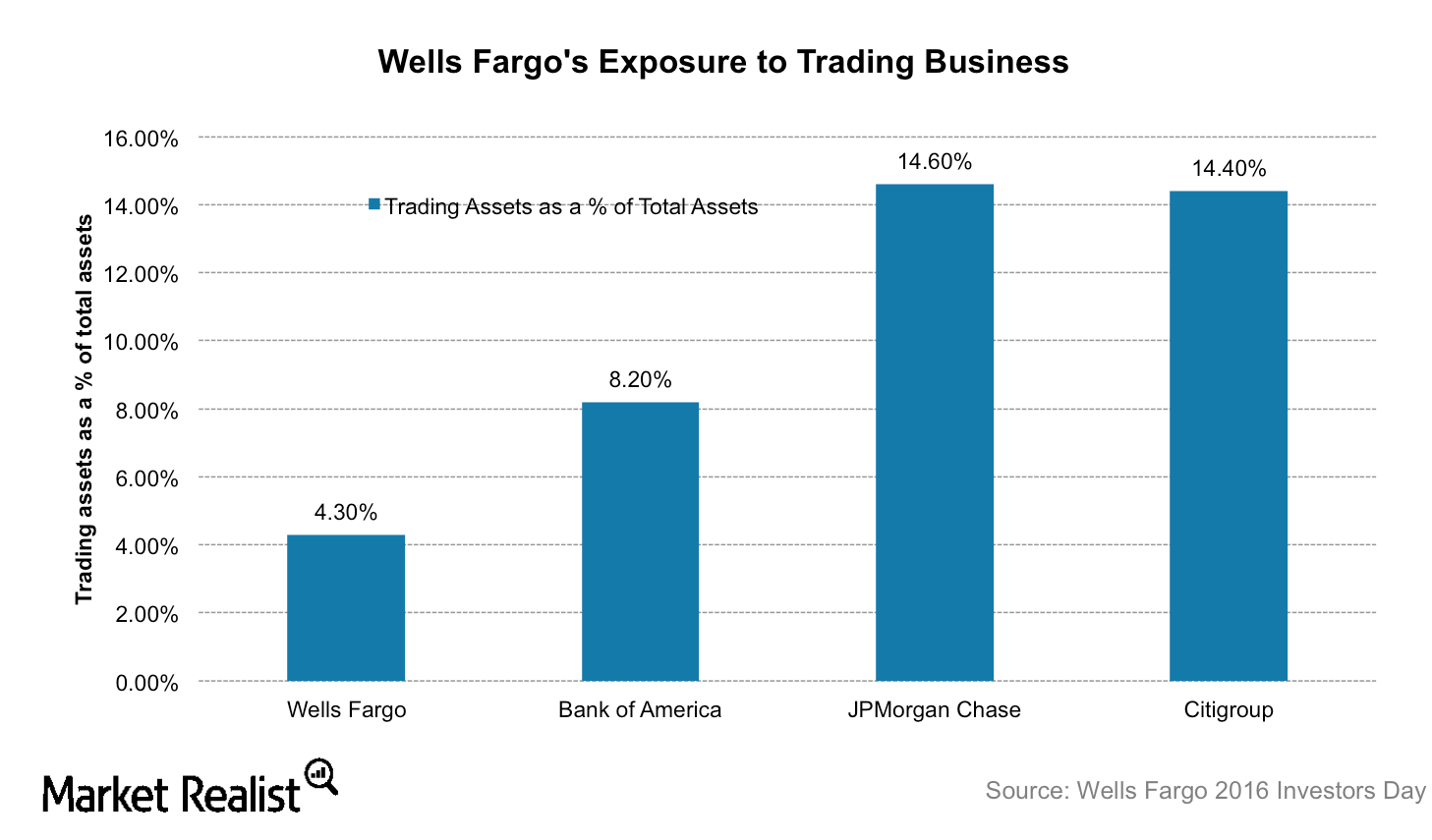

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC).

Interest Rate Sensitivity: JPMorgan Chase versus Wells Fargo

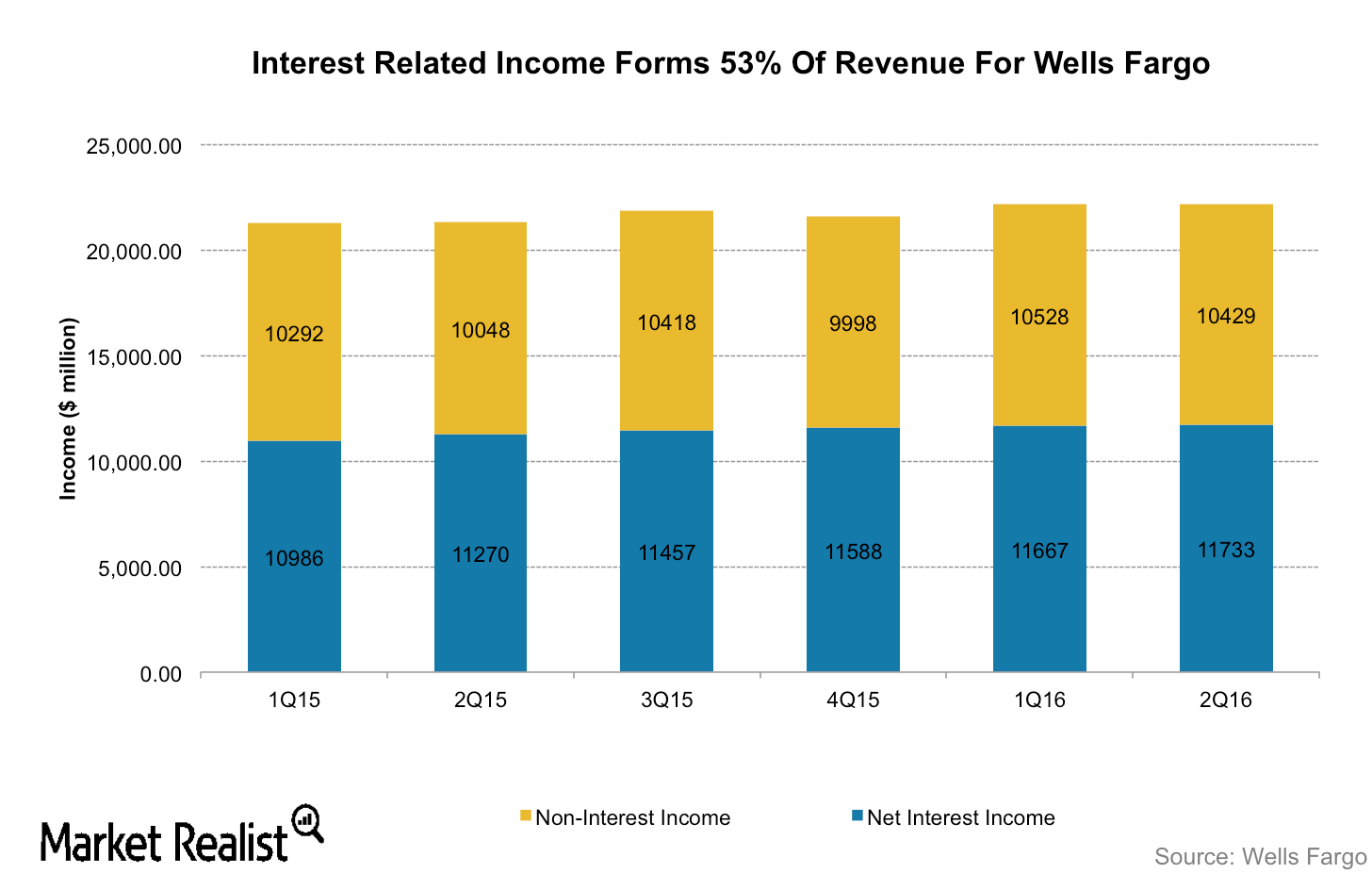

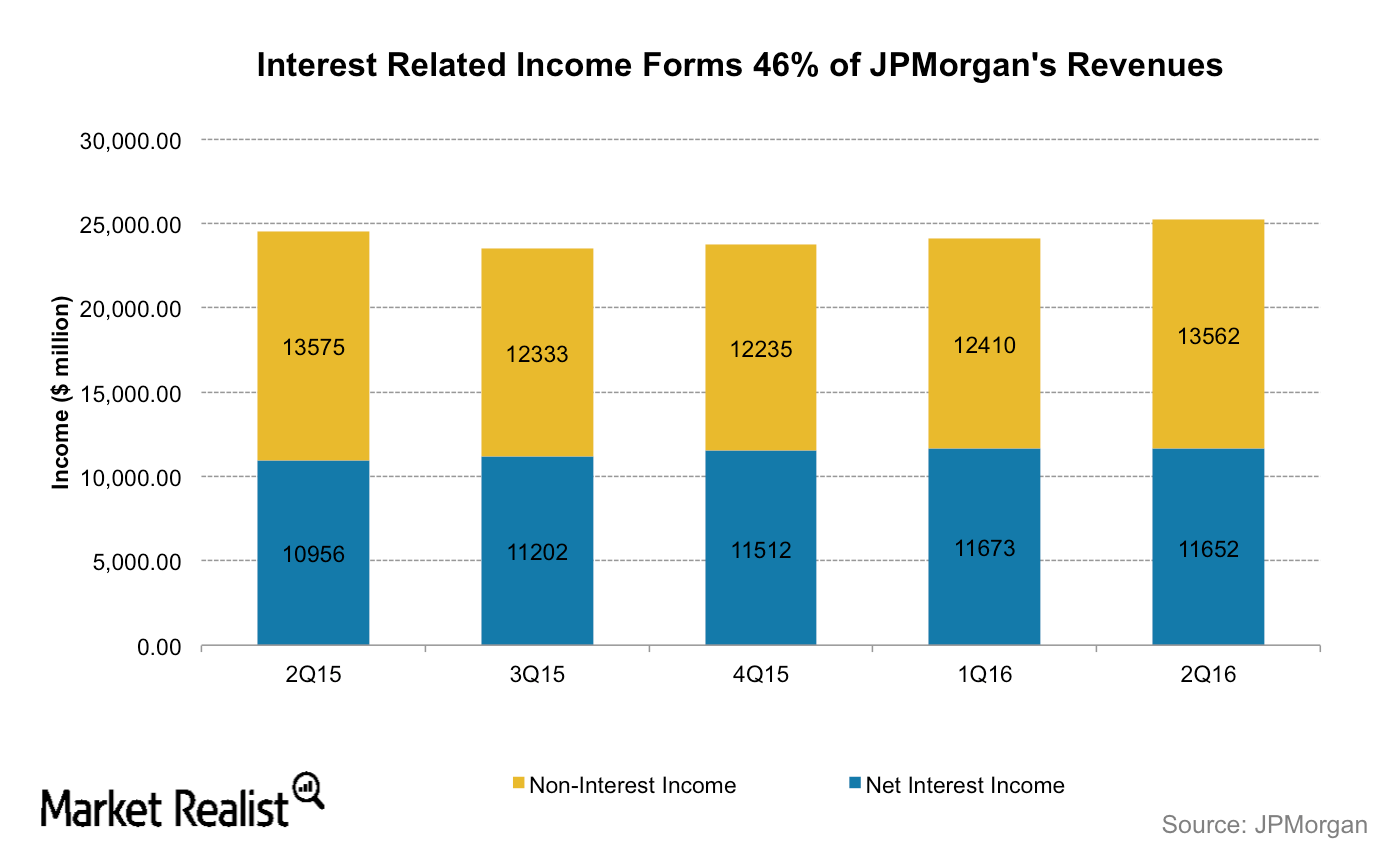

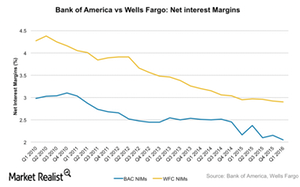

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

Why BAC Is Better Positioned to Gain from a Rate Hike Than JPM

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). It’s more sensitive to interest rate changes.

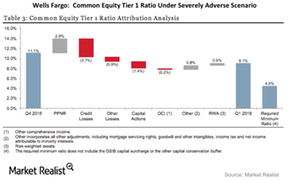

Did Wells Fargo Pass the Fed’s Stress Test?

The Federal Reserve’s stress test results indicate that Wells Fargo (WFC) has sufficient capital to absorb the estimated $25 billion in losses it is projected to incur under the test’s worst-case scenario.

Wells Fargo: What Sets It Apart from Its Peers?

Wells Fargo (WFC) is the largest mortgage lender in the US, operating primarily as a retail and commercial bank. It is been the most profitable bank in its peer group, posting a return of 10% on shareholder’s equity and ~1.3% on assets in 2015.

Wells Fargo Benefits from a Solid Business Model

Wells Fargo (WFC) has been considered the strongest and most steady among the “too big to fail” banks in the United States for years.

Comparing Wells Fargo and Bank of America’s Profitability

In 1Q16, Wells Fargo’s revenue grew 4% to $22.2 billion. Bank of America’s (BAC) revenue fell 7% YoY (year-over-year) to $19.5 billion.

How Sensitive to Interest Rates Has Bank of America Really Become?

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line.

Indirect Bidders Participated in the 13-Week T-Bills Auction

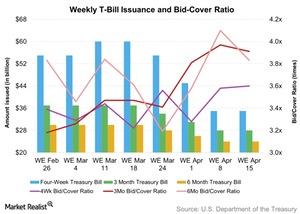

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

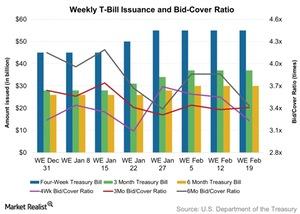

How Was Market Demand for the 13-Week Treasury Bill Auction?

The U.S. Department of the Treasury conducted the weekly auction of 13-week Treasury bills on February 16, 2016. The total issuance was worth $37 billion.

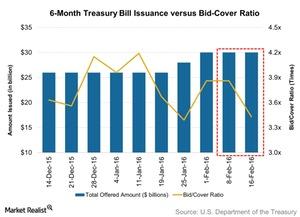

Bid-to-Cover Ratio Fell for 26-Week Treasury Bill Auction

The U.S. Department of the Treasury held the weekly 26-week Treasury bill auction on February 16, 2016. T-bills totaling $30 billion were on offer.

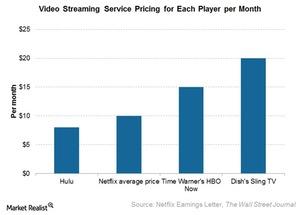

Hulu: Its Strategic Significance for Disney

Disney expects the equity loss from its investment in Hulu to accelerate since Hulu is increasing its investment in acquiring original content from media companies and producing original programming.

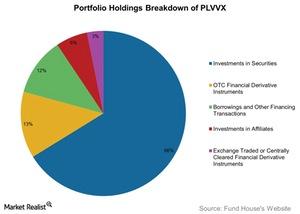

A Detailed Holdings Analysis of PLVVX

PLVVX holds fixed income securities in both long and short positions. The fund also holds derivative forward, future, and swap agreements on government securities, indexes, and currencies.

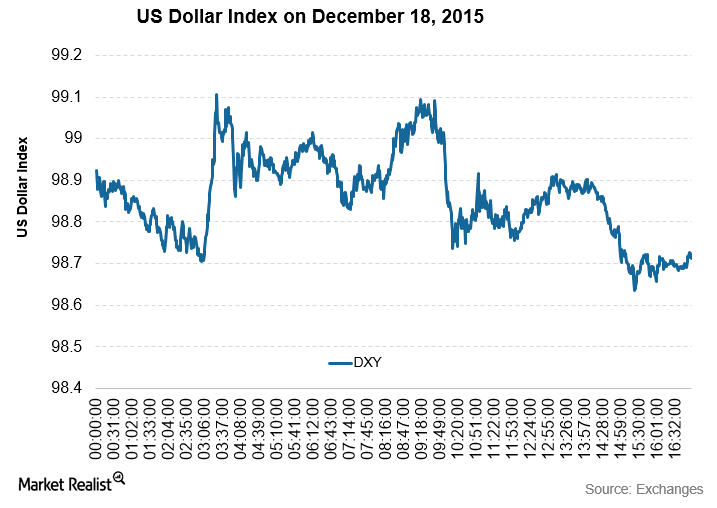

Dollar Index and Services PMI Both Fell

The US Dollar Index measures the strength of the US dollar against other major currencies. It fell by 0.58% on December 18, 2015. It was on a correction mode.

What Is the Dodd-Frank Act?

Analysts who favor the Dodd-Frank Act believe it will protect the investing community and consumers. Critics believe it will hamper economic growth and hurt competitiveness.

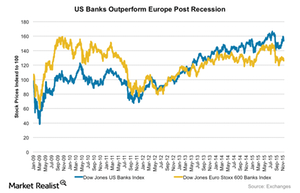

US Banks Played a Pivotal Role in the 2008 Financial Crisis

During the period between September 2008 and March 2009, US stock markets plunged, and the financial sector fell 60% in value.

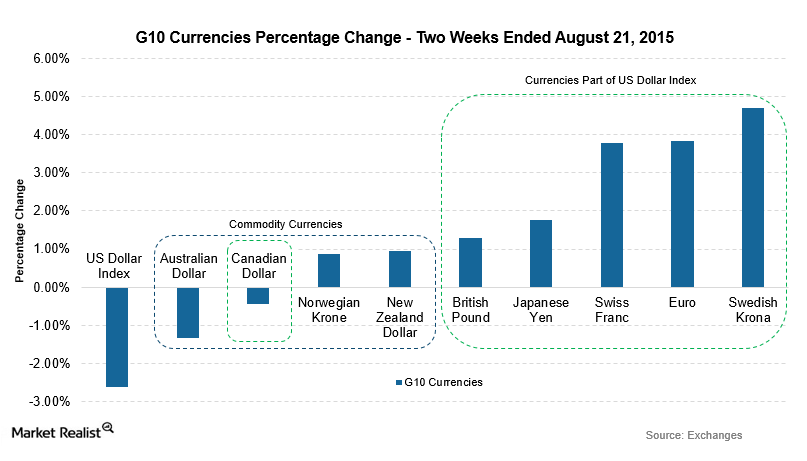

G10 Currencies Gain as US Dollar Index Sinks

The G10 currencies were impacted positively as the US dollar index dropped in value in the two weeks ending August 21, 2015.

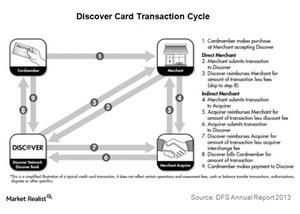

Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

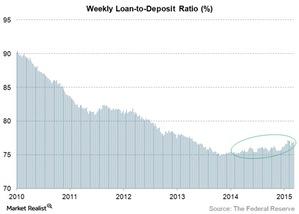

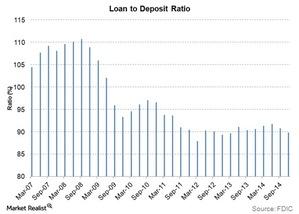

Loan-to-Deposit Ratio Moves in the Right Direction for Banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios.

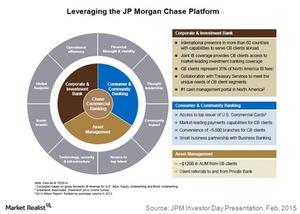

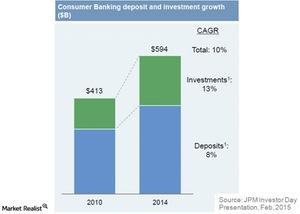

J.P. Morgan: Commercial Banking and Firm-Wide Synergies

J.P. Morgan Commercial Banking clients can access the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network.

J.P. Morgan Looks to Deepen Customer Relationships

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As a result, the bank is adapting its digital capabilities.

J.P. Morgan’s 4 Operating Segments

Consumer and Community Banking is the biggest of J.P. Morgan’s four segments. Corporate and Investment Banking follows, with 34% of revenues.

J.P. Morgan: The Banking Giant

In this series, you’ll learn what value J.P. Morgan holds for its shareholders, about its various businesses, and how it compares with other big banks.

Why Is the Loan-to-Deposit Ratio Declining for US Banks?

The industrywide loan-to-deposit ratio has declined over the last few years, largely due to the increase in non-interest-bearing bank deposits.

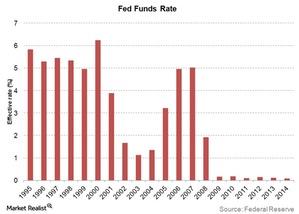

Why Are Interest Rates at an All-time Low?

The quantitative easing policy adopted by the Federal Reserve at the end of 2008 to boost economic growth included a drastic reduction in interest rates.

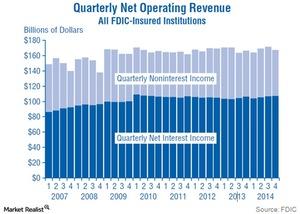

Why Is Interest Income Important to Banks?

Interest income typically contributes more than 60% to a bank’s total operating income.

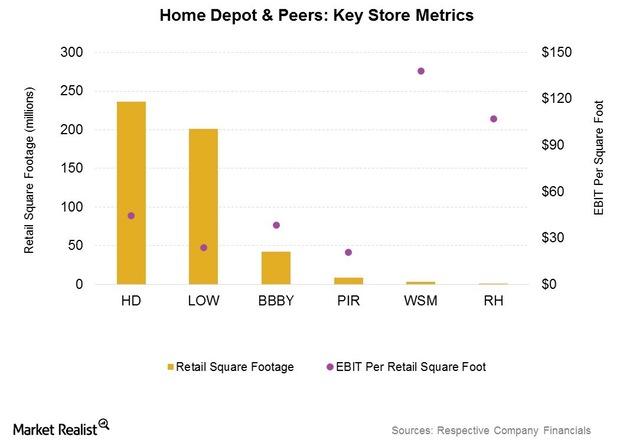

Marketing at Home Depot Designed for Customer Base

Marketing initiatives at Home Depot include Pro Xtra. This program exclusively targets professional customers.

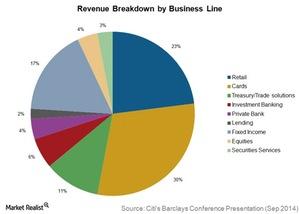

Citigroup: Number 3 US bank has $1.9 trillion in assets

Citigroup provides a broad range of financial products and services, including consumer banking, corporate and investment banking, among other things.

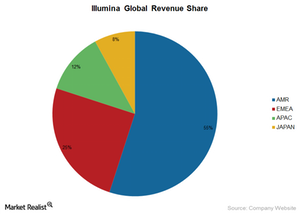

Why Illumina’s outlook is so bright

Illumina’s outlook is outstanding, as it has posted excellent 3Q14 results and its earnings continue to be bullish.

What 2 factors drive real GDP growth?

According to Jeffrey Lacker, two fundamental factors contribute to GDP growth in the long term—population growth and real GDP per worker.Financials Must-know: Wells Fargo is strongly capitalized for future growth

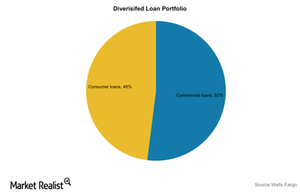

A bank’s growth can be limited if it doesn’t have enough regulatory capital. If the bank doesn’t have enough capital, it will be forced to dilute its equity to raise capital.Financials Why commercial lending is important to Wells Fargo strategy

The bank’s strategy is to not focus on any particular segment of industry. This helps it mitigate risk because the bank’s earnings and delinquencies are not dependent on any particular sector.Financials Must-know: Basel III’s shortcomings

Basel III addresses most of Basel II and II.5’s deficiencies. But it still has some shortcomings. Firstly, the increased regulatory capital required under Basel III will increase barriers to enter into the sector.Financials Why Basel II.5 corrected Basel II to improve banking regulations

Basel II.5 was essentially a revision of Basel II norms, as the existing norms often failed to correctly address the market risks that banks took on their trading books. Basel II.5’s main aim was to strengthen the capital base, and so the banks’ ability to withstand risk, by increasing banks’ capital requirements.Financials Why Basel II wasn’t good enough for reducing bank risks

Basel II was a comprehensive regulation that covered major sources of risks for banks. But it had a few major drawbacks. Firstly, it provided incentive to a bank’s management to underestimate credit risk.Financials Must-know: Why capital ratio is an important bank ratio

Capital ratio is also known as capital adequacy ratio or capital-to-risk-weighted assets ratio. Capital ratio is nothing but the ratio of capital a bank has divided by its risk-weighted assets. The capital includes both tier one and tier two capital.