VanEck Vectors Junior Gold Miners ETF

Latest VanEck Vectors Junior Gold Miners ETF News and Updates

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

Can Management Changes Break Gold’s Price Ceiling?

The gold mining industry is on a track to reverse its traditional method of mining to generate better shareholder returns.

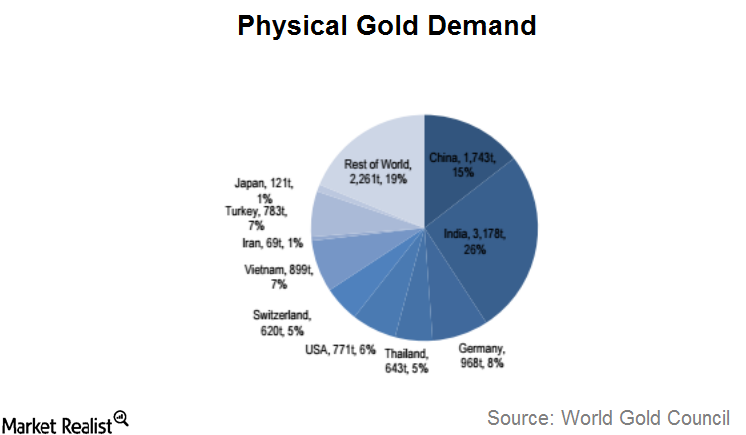

The Biggest Gold Buyer: India Is Back!

Indian jewelers have called off their 43-day strike, which began as a reaction to a 1% excise duty on gold jewelry.

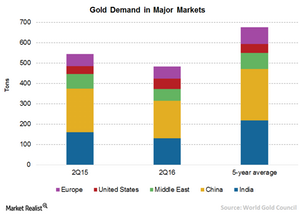

The Re-Emergence of Seasonal Gold Demand Trends

With selling pressure removed, normal gold demand trends may re-emerge Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline. Seasonal strength often occurs from August to January, beginning with […]

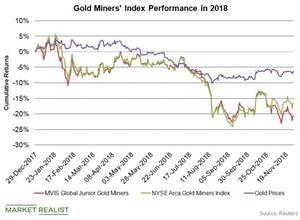

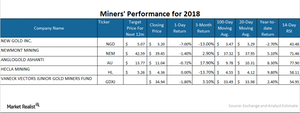

How Gold Stocks Have Performed This Year

Gold and gold miners didn’t start off the year on a good note.

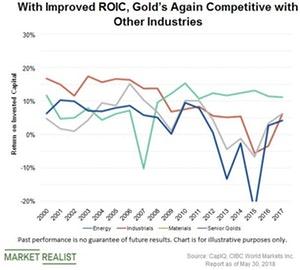

How Gold Mining Industry Has Revived Itself

The last ten years have been a roller coaster ride for the gold (GLD) (GDXJ) (GDX) mining industry.Materials Key things to look out for when you invest in junior gold stocks

The junior mining space is very risky, given very limited options in terms of mines and their involvement in early stages. So it’s very important to identify the right junior stock.

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

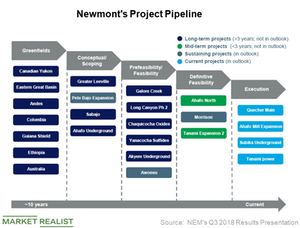

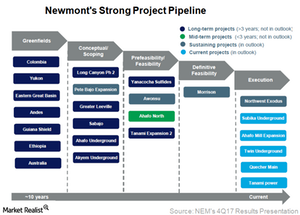

Newmont Mining’s Project Pipeline Is as Strong as It Gets

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU).

What Miners’ Moving Averages Indicate

NGD and HL are both trading below their longer-term 100-day moving averages.

Reading the Performance of Mining Shares amid Surging Metals

On January 12, 2018, precious metals were once again on a rising streak, which also led to increasing prices for mining shares.

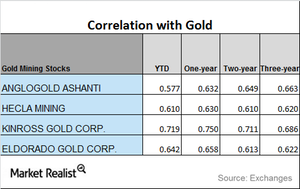

A Look at Miners’ Correlation Trends

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

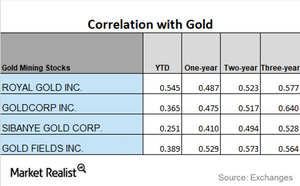

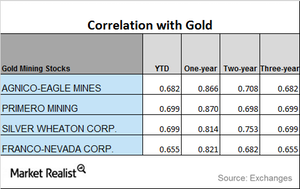

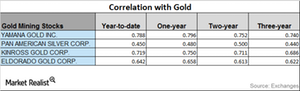

What’s the 3-Year Correlation between Miners and Gold?

Gold is the most influential precious metal, and most miners follow its price trends.

Will Gold Maintain Its Close Correlation to Inflation?

The rise in inflation could be a positive sign for the current scenario.

Your Brief Correlation Study of Major Mining Stocks Last Week

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

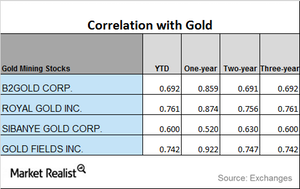

Reading the Correlation Movements of Precious Metal Miners with Gold

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) fell 2.6% and 1.5%, respectively, on October 26.

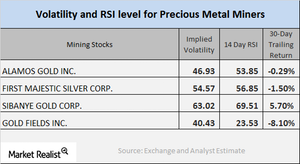

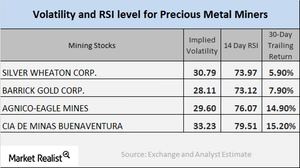

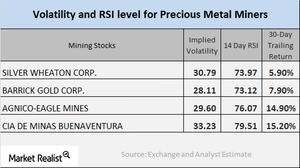

How Mining Stocks Have Moved in October

On October 23, Alamos, First Majestic Silver, Sibanye Gold, and Gold Fields had call implied volatilities of 46.9%, 54.6%, 63%, and 40.4%, respectively.

Behind the Recent Correlation Movements of Precious Metals

Among these four miners, AngloGold has the lowest correlation with gold so far this year, while Coeur Mining has the highest correlation YTD.

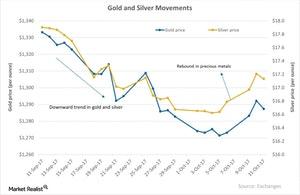

The Reaction of Precious Metals on October 11

The last few days have seen a rise in precious metal prices. However, on Wednesday, October 11, 2017, the prices of these loved metals fell.

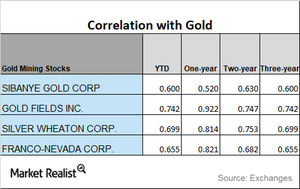

The Latest in Correlation Trends between Mining Stocks and Gold

Among the four miners that we’re analyzing here, Sibanye Gold has the lowest correlation with gold on a one-year basis, while Gold Fields has the highest.

Miners Followed Precious Metals Downhill on September 18

On September 18, Coeur Mining, Barrick Gold, Kinross Gold, and Eldorado Gold had volatilities of 42.3%, 26.4%, 40.8%, and 50.1%, respectively.

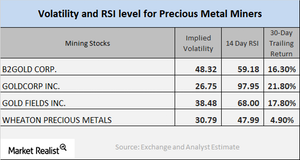

Analyzing the RSI Movements of Precious Metals

The price movement in precious metals is often closely traced by mining stocks. Before investors opt for mining stocks, they should analyze a few of the crucial technical details.

Reading Miners’ Correlation Trends

Mining stocks Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the […]

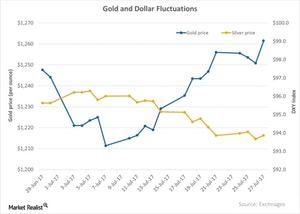

How the US Dollar Affected Gold

The US dollar has been on a downward swing over the past week.

Barrick Gold’s and Other Miners’ Correlation with Gold

Metal stocks As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur […]

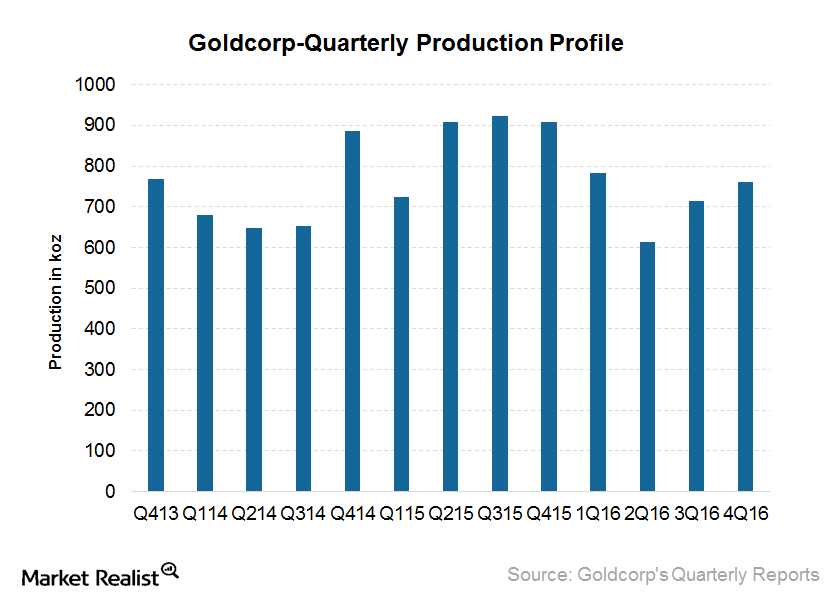

What Are the Drivers of Goldcorp’s Production Growth?

Goldcorp’s gold production fell 16% year-over-year in 4Q16 to 761,000 ounces. The company’s management had guided for 2.8 million–3.1 million ounces of gold production in 2016.

How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.

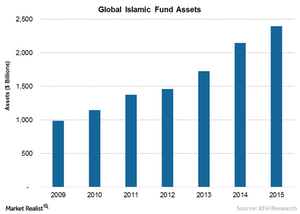

Will the Shari’ah Standard on Gold Be a Game-Changer?

In December, the AAOIFI and the WGC (World Gold Council) issued, for the first time, Shari’ah standard to deal with the use of gold (GDX) (GDXJ) as an investment in the Islamic finance industry.

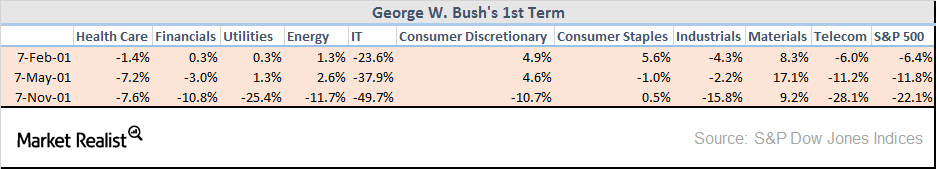

Which Sectors to Invest in If Donald Trump Wins

When Republican George H.W. Bush was elected president, the S&P 500 rose 8.5% three months after the election. It had a return of 11.2% six months after the election.

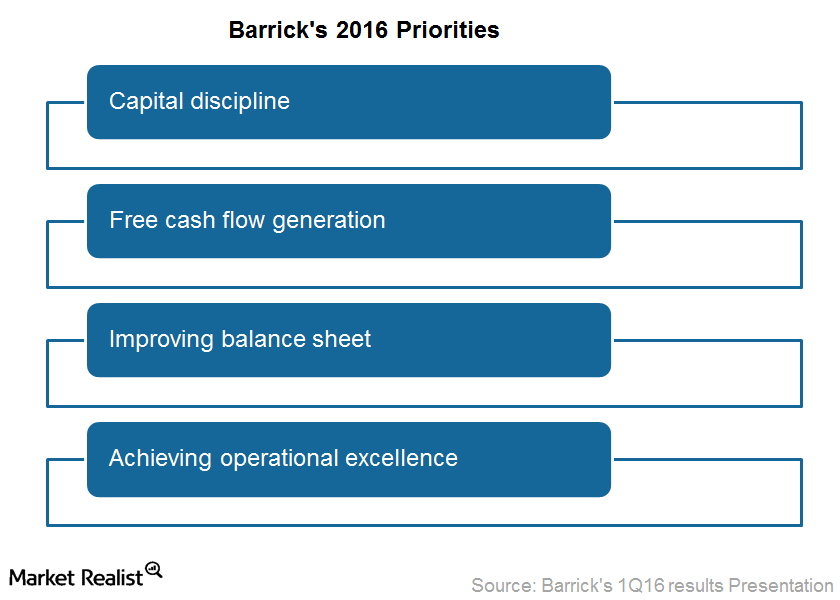

What Will Barrick Gold’s Focus on Its 4 Priorities Achieve?

Barrick Gold (ABX) wants to achieve positive free cash flow even at a gold price of $1,000 per ounce.