Kinross Gold Corp

Latest Kinross Gold Corp News and Updates

What Led to the Recent Rebound in Precious Metals?

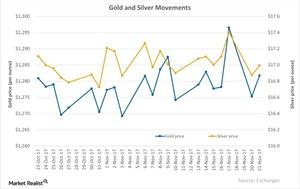

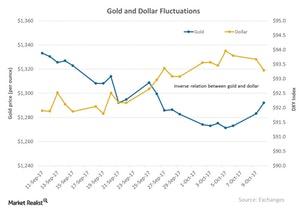

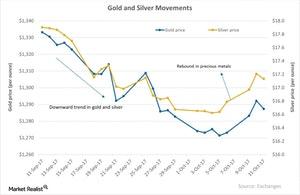

After a substantial slump on Monday, gold futures for December delivery rose 0.5% on Tuesday and closed at $1,281.7 per ounce.

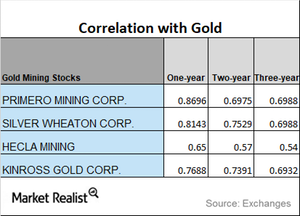

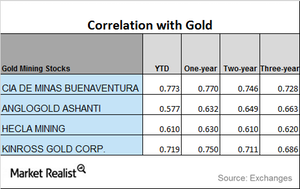

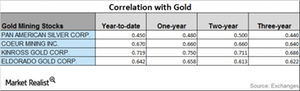

Mining Stocks: Understanding Correlation

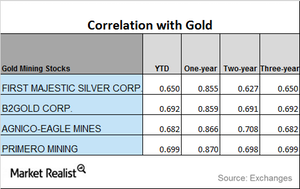

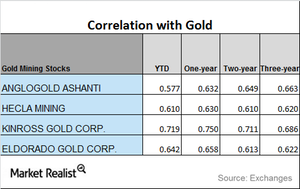

When you look at mining stocks’ performance, it’s important to analyze their correlation with gold. These stocks typically take their directional cues from gold, which is the most dominant among precious metals.

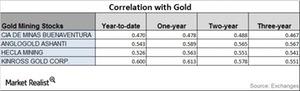

Analyzing the Correlation of Mining Stocks to Gold

Kinross Gold’s correlation has risen from a three-year correlation of 0.69 to a one-year correlation of 0.77, which suggests that Kinross has moved in the same direction as gold 77% of the time.

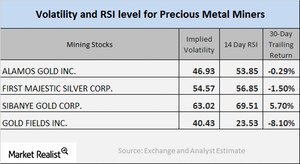

The Importance of Knowing the Technicals of Mining Stocks

On October 30, 2017, ABX, AU, KGC, and IAG had call implied volatilities of 29.1%, 40.9%, 41.6%, and 44.3%, respectively.

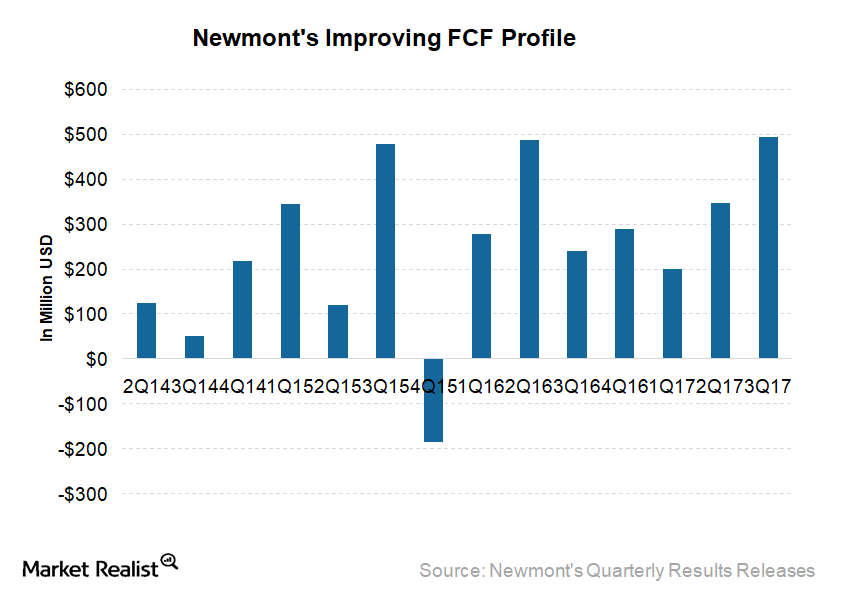

These Factors Could Drive Newmont’s Free Cash Flow

Generating FCF (free cash flow) is very important for miners (GDX)(RING) as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns.

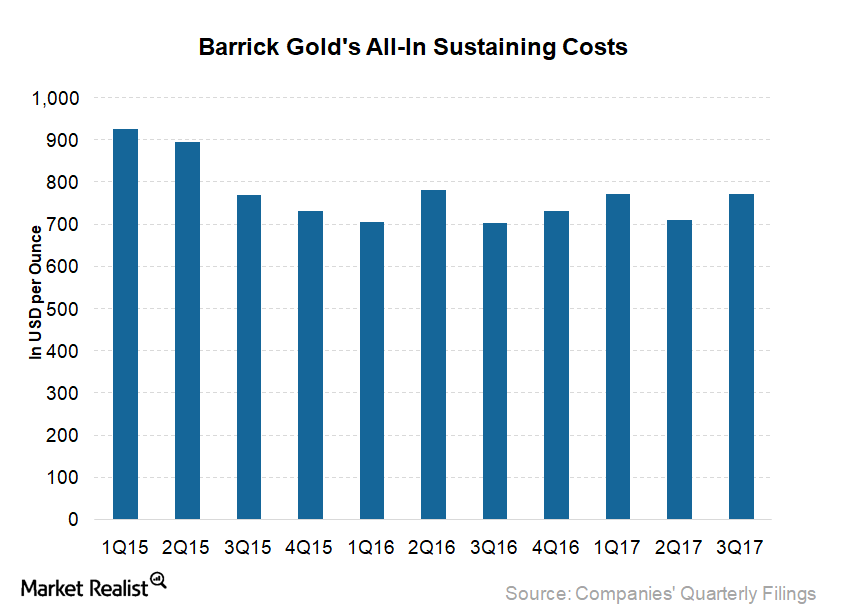

Is Barrick Gold behind in Achieving Its Unit Cost Target?

Barrick Gold (ABX) reported AISC (all-in sustaining costs) of $772 per ounce in 3Q17, which is 10% higher year-over-year and 9% higher sequentially.

Reading the Drop in Precious Metals on Monday, October 16

After the rise we saw on Friday, October 13, precious metals had a down day on Monday, October 16.

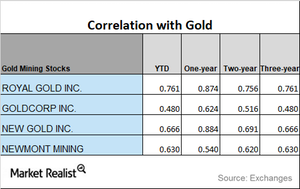

How Key Mining Stocks Are Correlated with Gold in October 2017

The PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ) have risen 12.1% and 12.95, respectively, year-to-date, taking strong cues from gold.

Relative Strength Index Indicators of Mining Shares in October

On October 11, 2017, Randgold Resources, Pan American Silver, Barrick Gold, and Kinross Gold had implied volatility readings of 25.0%, 34.0%, 29.1%, and 41.6%, respectively.

The Reaction of Precious Metals on October 11

The last few days have seen a rise in precious metal prices. However, on Wednesday, October 11, 2017, the prices of these loved metals fell.

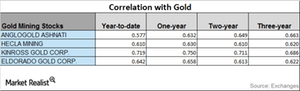

Reading Miners’ Gold Correlation Trends

Correlation trends On September 26, precious metals and mining stocks fell. Analyzing mining stocks’ correlation with gold is important since it can give some idea of future stock movement. In our analysis, we’ll focus on Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC). Mining funds track precious metals and their price movements. Whereas the Global […]

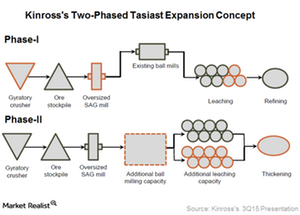

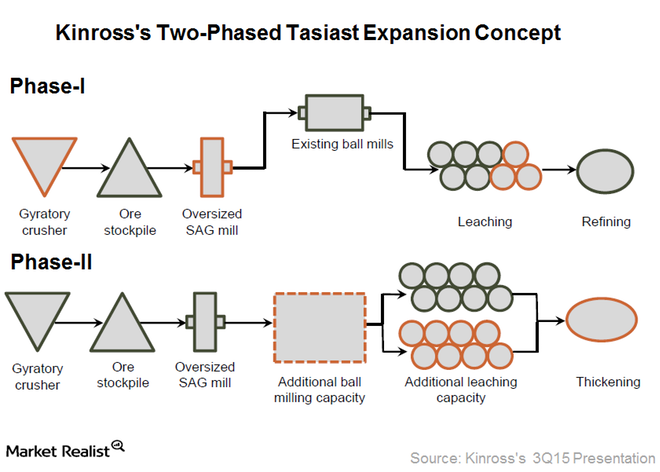

Why the Tasiast Expansion Is Key to Kinross Gold’s Potential

The Tasiast Phase One expansion is expected to increase mill throughput capacity from 8,000 tons per day to 12,000 tons per day.

Miners Followed Precious Metals Downhill on September 18

On September 18, Coeur Mining, Barrick Gold, Kinross Gold, and Eldorado Gold had volatilities of 42.3%, 26.4%, 40.8%, and 50.1%, respectively.

How Gold, Silver, and Mining Companies Performed on September 18

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

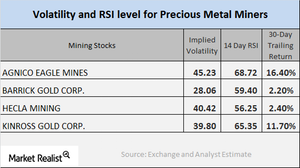

Analyzing the Miners’ Crucial Indicators in September

On September 11, 2017, Agnico-Eagle, Barrick Gold, Hecla Mining, and Kinross had volatilities of 45.2%, 28.1%, 40.4%, and 39.8%, respectively.

Reading Miners’ Correlation Trends

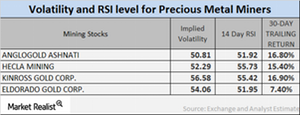

Mining stocks Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the […]

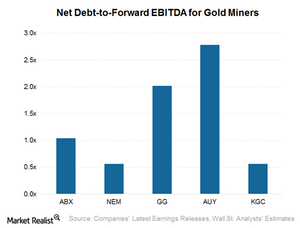

Assessing Gold Miners’ Capacity to Repay Debt through Earnings

Yamana Gold’s (AUY) net-debt-to-forward EBITDA ratio is 2.8x, which is higher than its peers’ ratios.

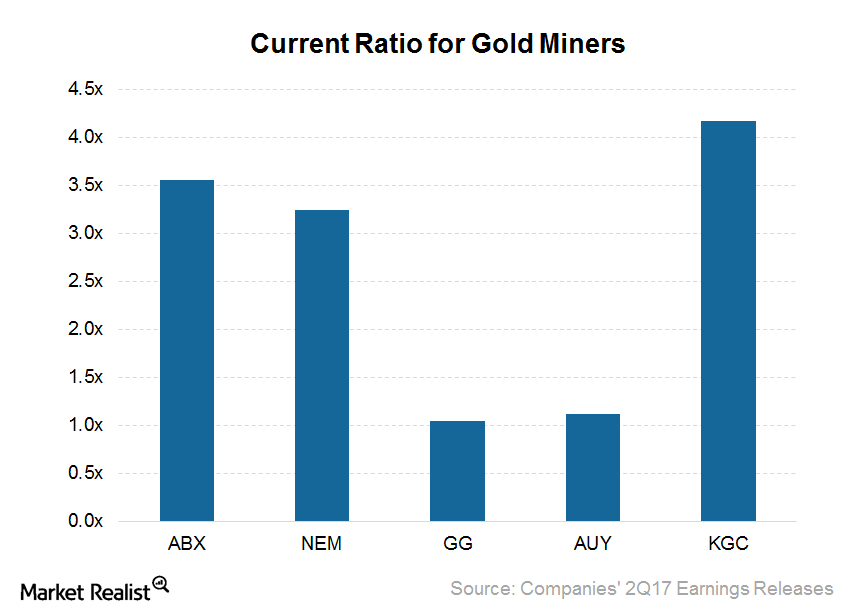

Is Liquidity a Concern for Gold Miners after 2Q17 Earnings?

Newmont Mining had $5.5 billion in liquidity, including $3.1 billion in cash at the end of 2Q17. It has one of the best credit ratings in the sector.

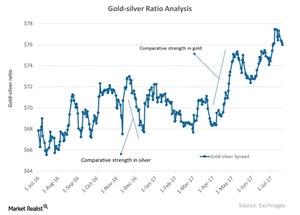

How the Gold-Silver Spread Is Trending

The gold-silver spread measures the price of one ounce of gold in relation to silver.

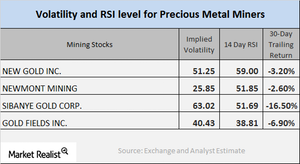

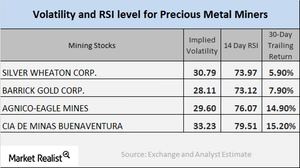

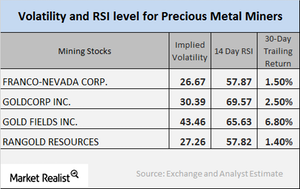

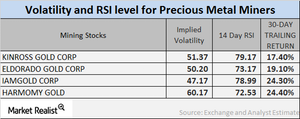

A Look at Volatilities for Precious Metal Miners

In this part of the series, we’ll look at some important technical indicators, including volatility figures and RSI levels for major miners.

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

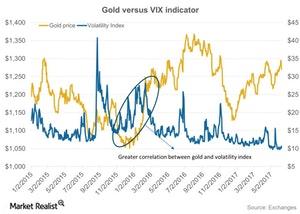

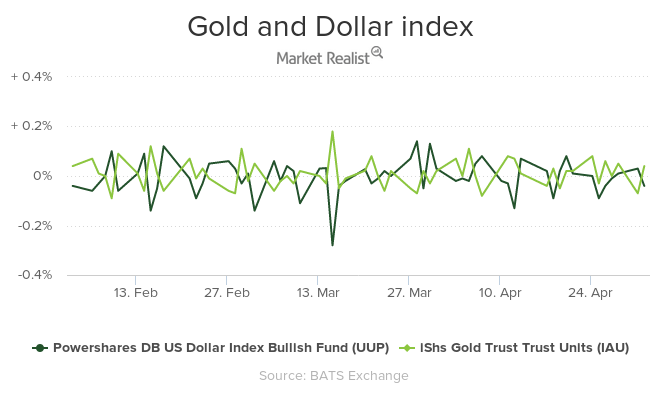

Global Tremors, the Dollar, and Gold in Early May

Geopolitical risks had been playing on haven bids for precious metals, but now, we may be seeing to be a temporary respite—however brief—from global worries.

How Miners’ Correlations to Gold Are Trending

As global tumult grips markets and investors turn to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals.

Behind Mining RSI Levels and Volatility Now

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

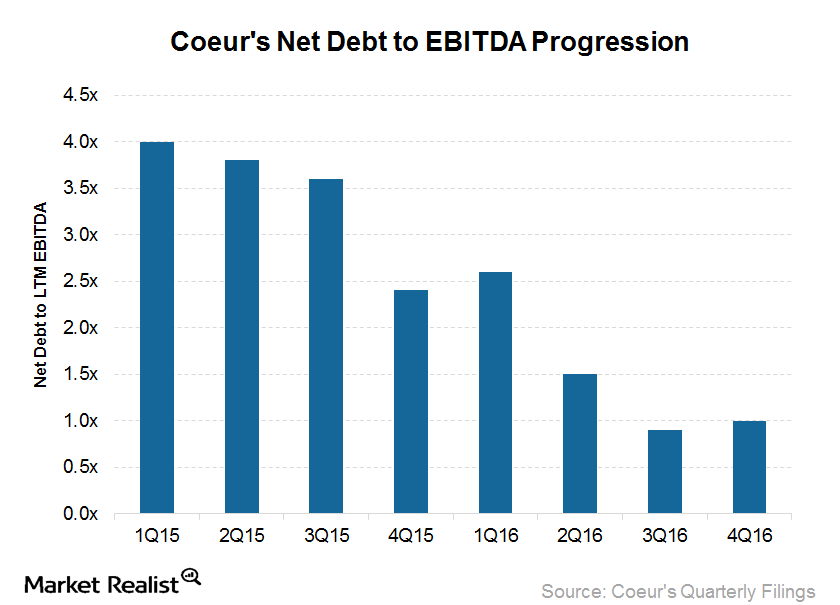

Coeur’s Financial Leverage Improves: A Word of Caution

Coeur Mining (CDE) ended 2016 with an outstanding debt of $210.9 million. That’s 57.0% less than at the end of 2015.

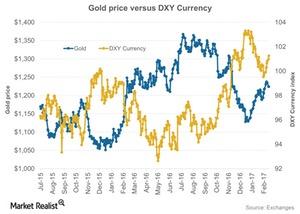

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

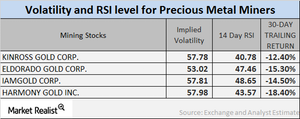

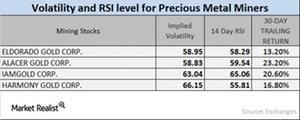

Reading Mining Companies’ Volatilities and RSI Levels

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

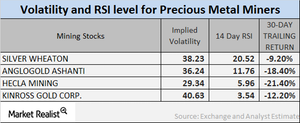

Analyzing Mining Stocks’ Volatility

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

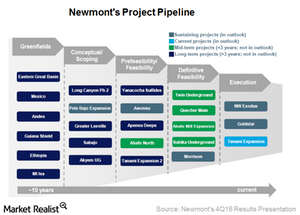

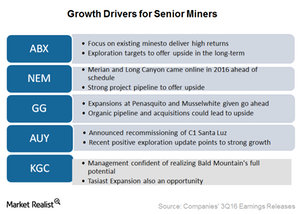

Newmont Mining: How’s the Project Pipeline Looking?

Newmont Mining (NEM) approved funding for its Northwest Exodus project in June 2016, and the project is now under construction.

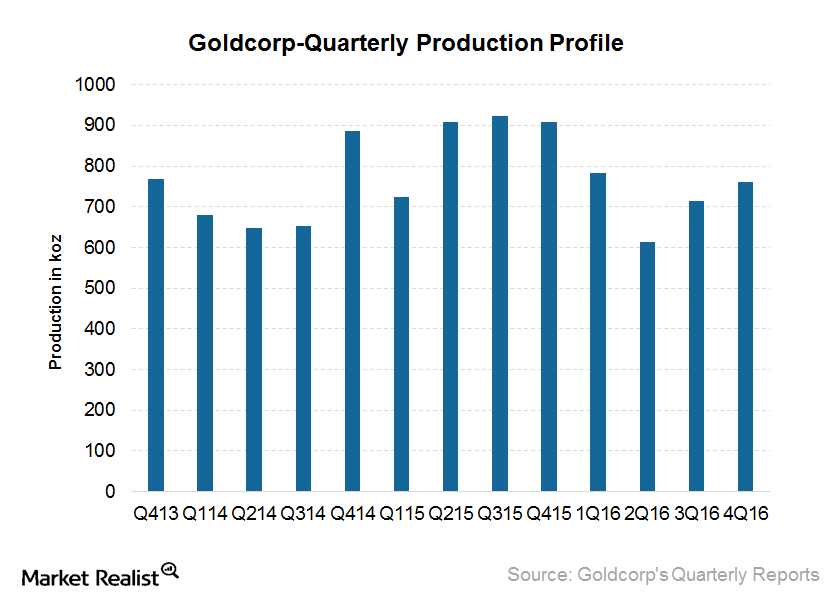

What Are the Drivers of Goldcorp’s Production Growth?

Goldcorp’s gold production fell 16% year-over-year in 4Q16 to 761,000 ounces. The company’s management had guided for 2.8 million–3.1 million ounces of gold production in 2016.

What the Latest Volatility and RSI Numbers Indicate

It’s important to monitor the implied volatilities of large mining stocks as well as their RSI levels, particularly after changes in precious metal prices.

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

Analyzing Silver’s January Technicals

Among the other precious metals trading on the COMEX, silver shares for March expiration maintained an almost flat end to the day on January 11, 2017.

Analyzing Mining Stocks’ Correlation in 2016

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

Which Mining Stocks Have Highest Correlation to Gold?

Mining companies that have high correlations with gold include Cia de Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Which Gold Miners Offer Long-Term Production Growth?

Barrick Gold (ABX) slightly increased its 2016 production guidance to ~5.3 million to ~5.6 million ounces.

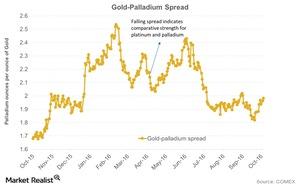

Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

What Tasiast Mine Being Back in Full Swing Means for Kinross Gold

Kinross Gold (KGC) announced in June 2016 that it was temporarily halting its mining and processing activities at the Tasiast mine in Mauritania.

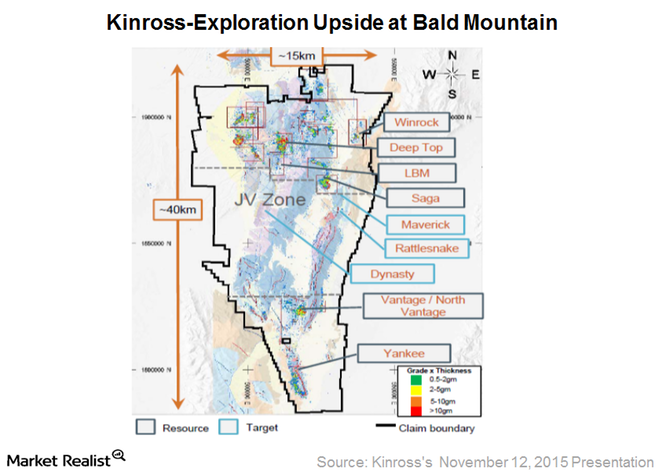

How Bald Mountain Is a Positive for Kinross Gold

Kinross Gold (KGC) acquired 100% of the Bald Mountain gold mine and the remaining 50% of the Round Mountain gold mine in Nevada from Barrick Gold (ABX) in November 2015.

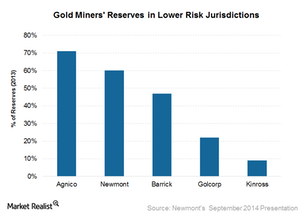

Gold Miners Are Cutting Down on Risky Geographical Exposure

While gold miners (GDX) are trying hard to limit their exposure to safe jurisdictions, it’s important to look at their geographic exposure and the implications it could have on their future prospects.

Did Strong Data Push Gold Prices South?

Gold prices don’t seem to have caught up with interest rate expectations, which have gone from 1.5% at the start of the year to about 0.5% today. The loosening monetary policy has probably worked in favor of gold.

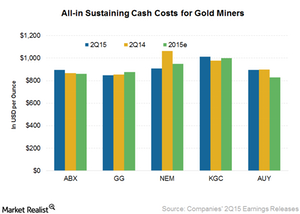

Comp: How Are Gold Miners Progressing on the Cost-Cutting Front?

For 2Q15, Newmont has been the most successful YoY in cost cutting. It had a reduction of 14.50%—mainly due to a rise in productivity and efficiency improvements.

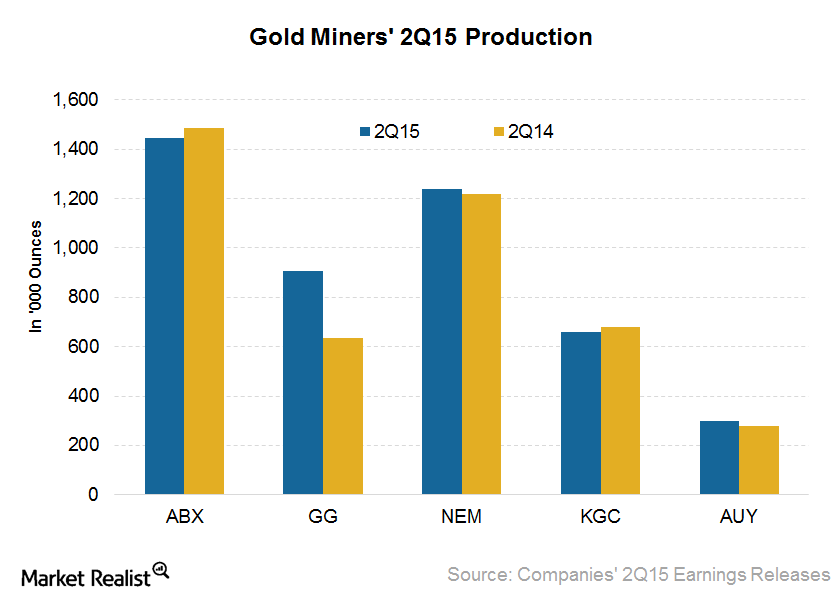

Comp: A Look at Gold Miners’ 2Q15 Production Profile

Gold miners’ (GDX) production profile is very important for investors. According to the WGC, gold mine production rose by 3% YoY to 786.6 tons in 2Q15.

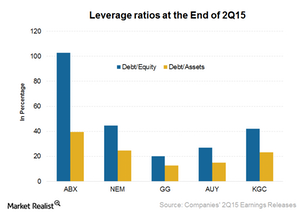

Comp: Analyzing the Financial Leverage for Gold Miners

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40%.

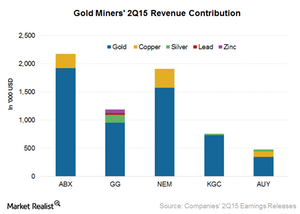

Comp: Do Gold Miners with an Exposure to Copper Face Downside?

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales.

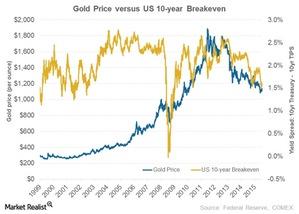

Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.

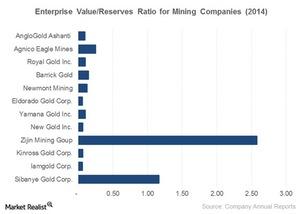

Analyzing the EV-to-Reserves Ratio for Tracking Miners

The EV-to-reserves ratio is good for the mining industry. “Enterprise value” reflects the company’s total value. “Reserves” refers to geologic reserves that the business owns.

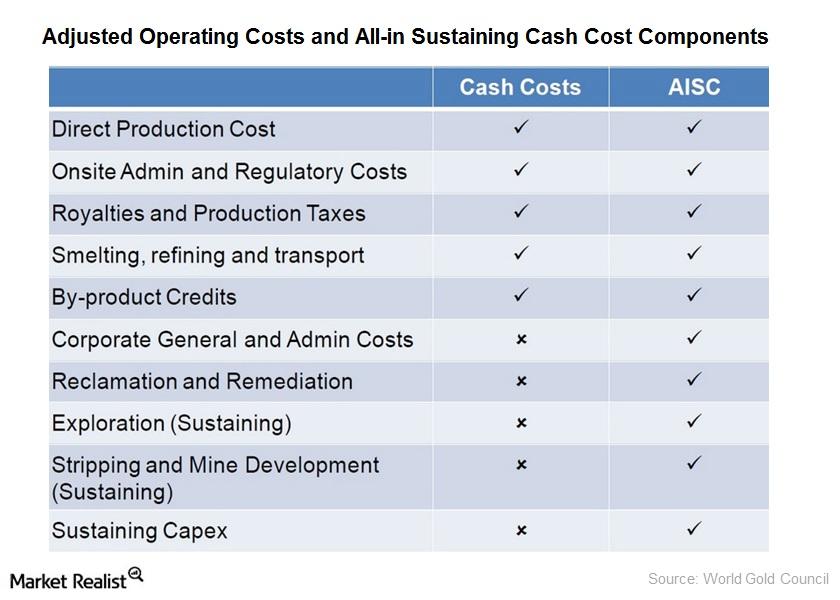

Key for Investors: Understanding Mining Cost Structures

The cash cost has been the dominant measure of the gold mining cost structure. It represents what the mine costs are for each ounce of gold.