Reading Miners’ Gold Correlation Trends

Correlation trends On September 26, precious metals and mining stocks fell. Analyzing mining stocks’ correlation with gold is important since it can give some idea of future stock movement. In our analysis, we’ll focus on Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC). Mining funds track precious metals and their price movements. Whereas the Global […]

Sept. 29 2017, Updated 6:04 p.m. ET

Correlation trends

On September 26, precious metals and mining stocks fell. Analyzing mining stocks’ correlation with gold is important since it can give some idea of future stock movement. In our analysis, we’ll focus on Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Mining funds track precious metals and their price movements. Whereas the Global X Silver Miners ETF (SIL) and the Sprott Gold Miners ETF (SGDM) have seen strong gains this year, they fell 1.6% and 1.9%, respectively, on September 26, led by the fall in gold and silver.

Correlation trends

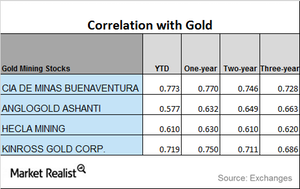

Among the four miners we’re analyzing, AngloGold has had the lowest correlation with gold this year, while Buenaventura has the highest correlation. Kinross’s and Buenaventura’s gold correlation has moved upward over the past three years, while AngloGold’s has fallen. Hecla’s correlation has been mixed.

AngloGold has a three-year correlation of 0.66 and a year-to-date correlation of 0.58. The correlation of 0.58 implies that ~58.0% of the time, AngloGold has moved in the same direction as gold.