SSgA SPDR Gold Shares

Latest SSgA SPDR Gold Shares News and Updates

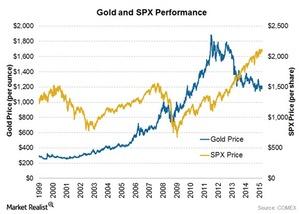

Gold’s Correlation to the Equity Markets

A look at gold and equity market performance demonstrates that a falling stock market isn’t necessarily a catalyst for a major rally in gold.

What Can You Learn from the Recent Gold Price Swings?

After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April.

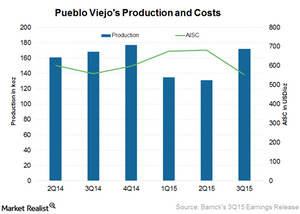

Barrick: What Will Drive Increased Recoveries for Pueblo Viejo?

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

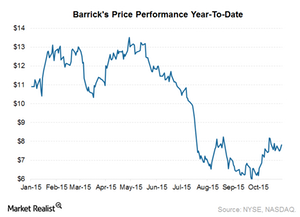

Must-Read Notes on Barrick Gold’s 3Q15 Earnings and Conference

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations.

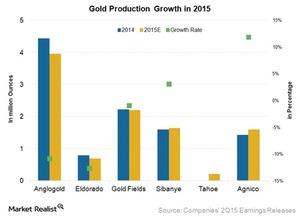

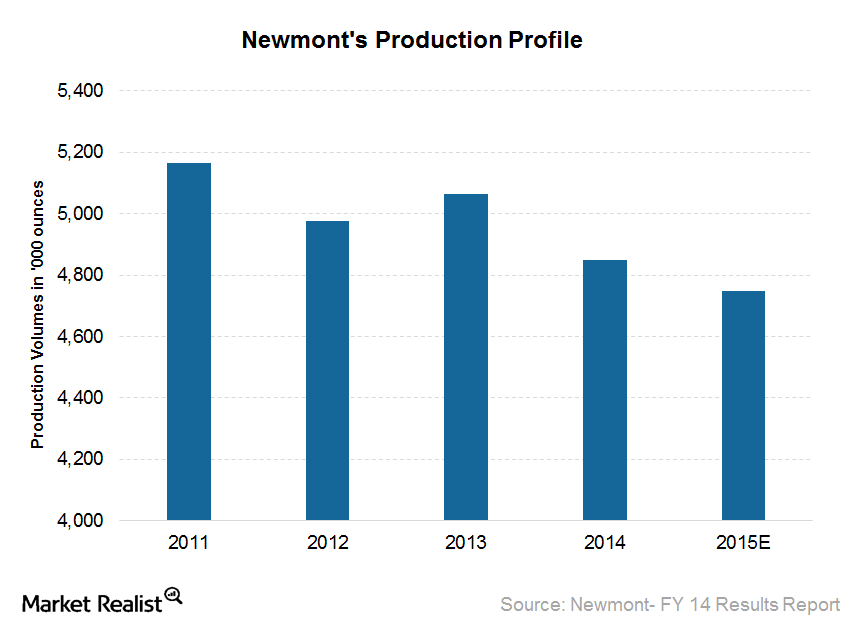

Why Growth in Gold Production Is Important for Gold Miners

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue.

Did Strong Data Push Gold Prices South?

Gold prices don’t seem to have caught up with interest rate expectations, which have gone from 1.5% at the start of the year to about 0.5% today. The loosening monetary policy has probably worked in favor of gold.

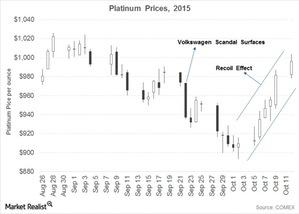

Analyzing the Coiled Spring Effect in Platinum Prices

After the VW scandal, platinum prices jumped to an almost two-week high, again entering the $1,000 territory after hitting a low of $893.4 on October 2.

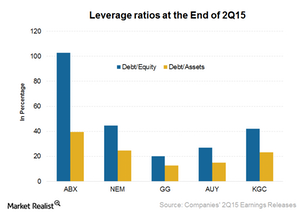

Comp: Analyzing the Financial Leverage for Gold Miners

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40%.

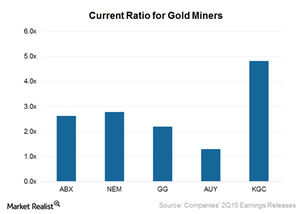

Comp: Importance of Looking at Gold Miners’ Liquidity Profile

In a weaker commodity price environment, a company’s short-term liquidity might come under more pressure. It could be forced to take drastic measures.

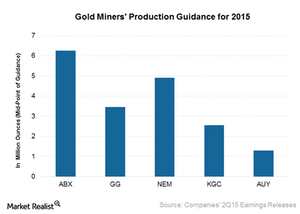

Comp: Which Gold Miners Expect Production Growth Going Forward?

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher.

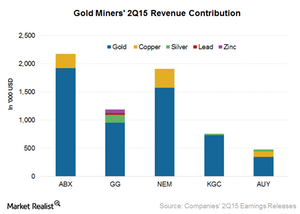

Comp: Do Gold Miners with an Exposure to Copper Face Downside?

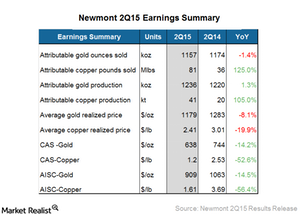

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales.

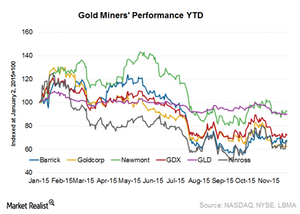

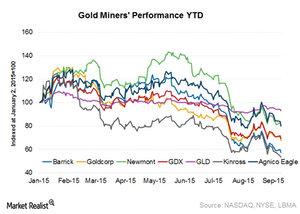

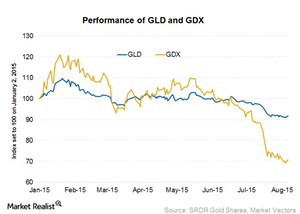

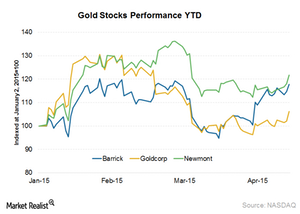

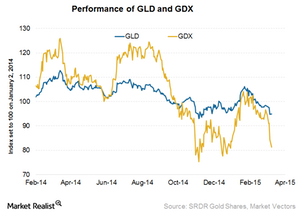

Comparative Analysis: How Have Gold Miners Performed This Year?

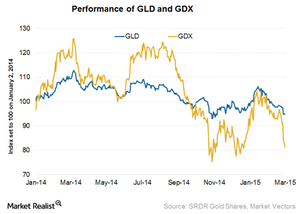

Gold prices, as tracked by the SPDR Gold Trust (GLD), have significantly outperformed the VanEck Vectors Gold Miners Index (GDX) since 2008.

Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.

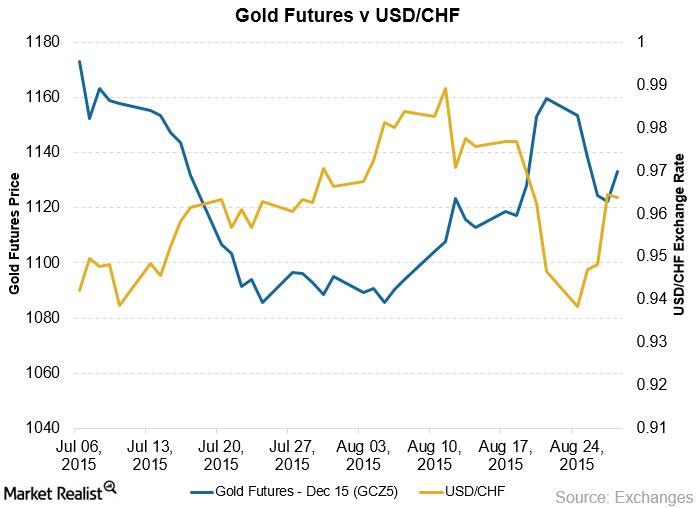

Why the Swiss Franc Is the Golden Currency

Recently, the safe haven currencies like the Swiss franc and the Japanese yen are the ones that are showing a greater correlation to gold.

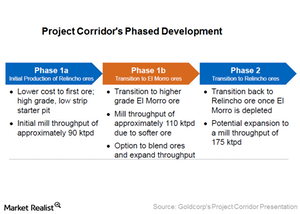

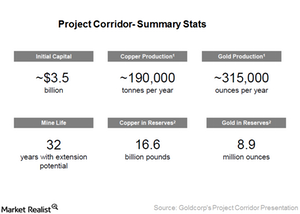

Goldcorp Forms Project Corridor Joint Venture with Teck Resources

The combined project will be a 50:50 joint venture between Goldcorp and Teck with the interim name of Project Corridor.

Goldcorp Acquires New Gold’s 30% Interest in the El Morro Project

On August 27, Goldcorp (GG) announced that it has entered into an agreement with New Gold (NGD) to acquire its 30% interest in the El Morro gold-copper project in Chile.

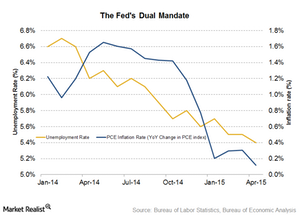

Inflation Rates: How They’re Related to Precious Metals

With the looming fears of inflation reaching its target 2% level, the Fed is likely waiting for assertions from the economy.

Broad Commodities Market Sell-Off: Impact on Gold

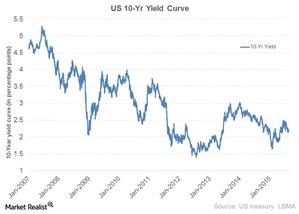

The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold.

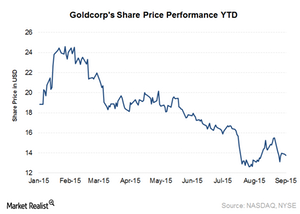

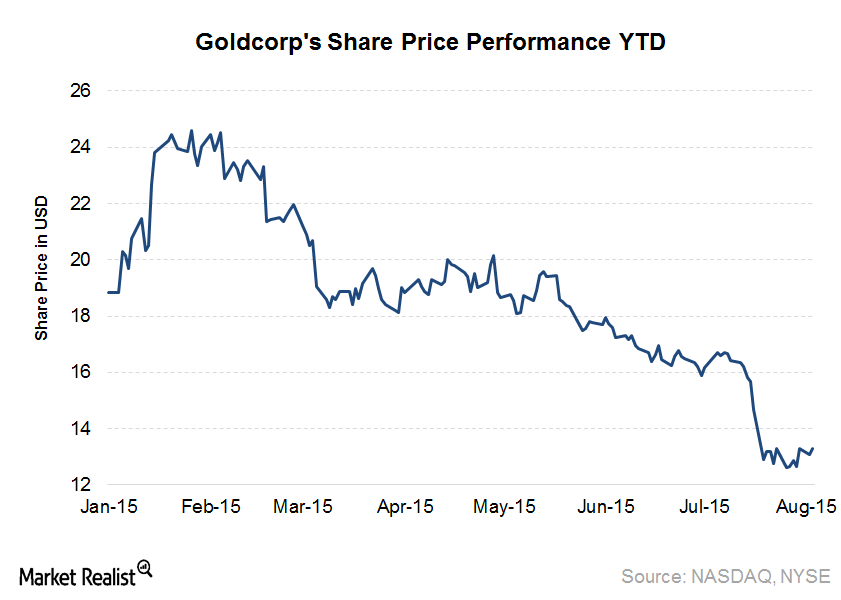

Is the Market Excited about Goldcorp’s Recent Moves?

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD).

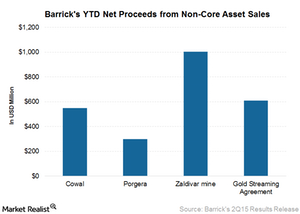

Barrick Gold in 2Q15: The Benefits of Asset Monetization

So far, Barrick has achieved 90% of its 2015 debt reduction target of $3 billion, mainly thanks to asset monetization.

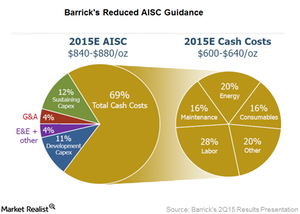

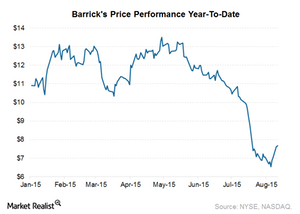

Current Gold Prices Push Barrick Gold to Go for a Leaner Look

Barrick Gold (ABX) is focused on reducing operating expenses. The company’s all-in sustaining costs to produce gold in 2Q15 totaled $895 per ounce. In 1Q15, costs came in at $927 per ounce.

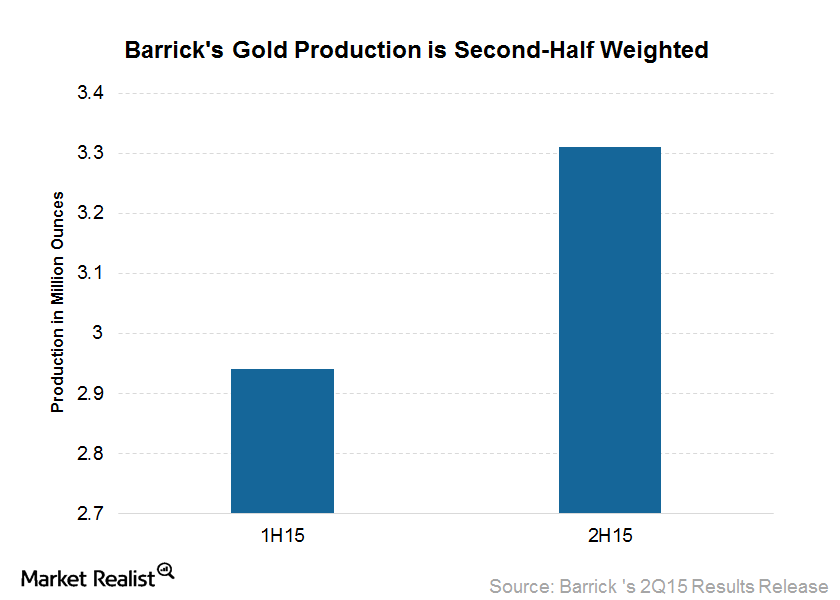

Barrick Gold Weights 2015 Production toward the 2nd Half

Barrick has reduced its 2015 gold production guidance to 6.1 million to 6.4 million ounces from 6.2 million to 6.6 million ounces.

Investors Are Excited about Barrick Gold’s 2Q15 Results, but Why?

In this series, we’ll analyze Barrick Gold’s 2Q15 results. Barrick stock reacted positively to its earnings report, its improved cost guidance, and its progress toward reducing its debt.

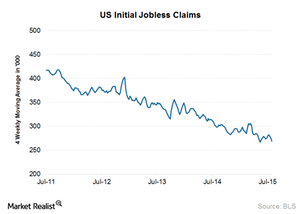

US Employment Report: Will It Keep the Hopes of a Rate Hike Going?

Since the current set of data were better than the market expectations, the market’s hopes for a September rate hike are still on.

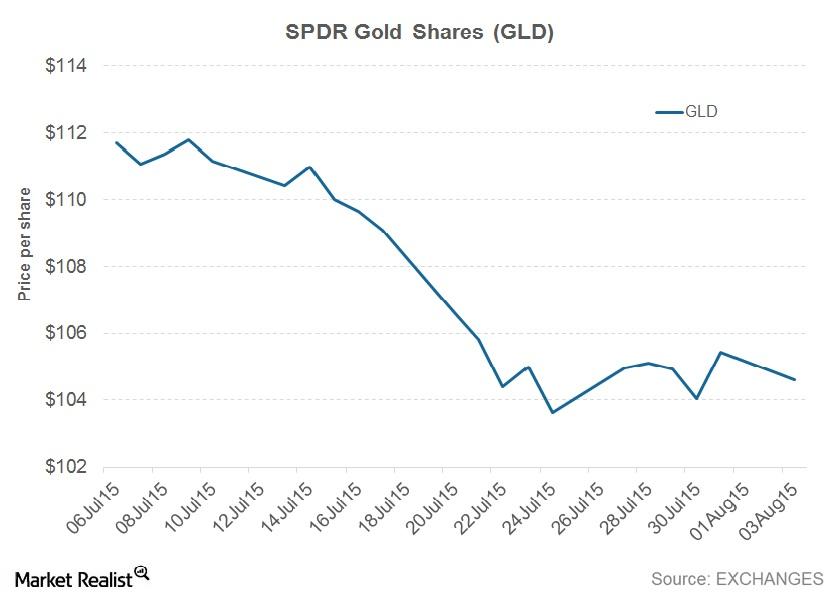

Key Indicators Are Pointing to Gold Prices

Gold prices have been steadily falling since the last week of June. As of August 11, gold prices (GLD) have fallen by 4.40% in a month.

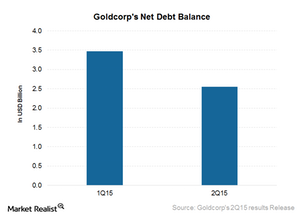

Goldcorp’s FCF Growth Could Strengthen Its Balance Sheet

Goldcorp has the strongest balance sheet in its peer group. Goldcorp’s liquidity is also comfortable at $3.2 billion, including $940 million in cash and cash equivalents.

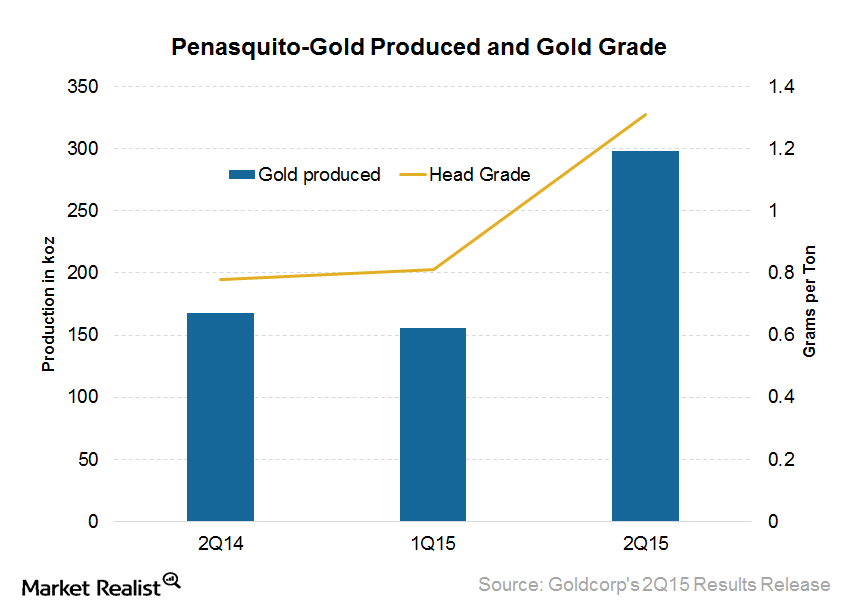

Peñasquito Helps Achieve Record Quarterly Production for Goldcorp

The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

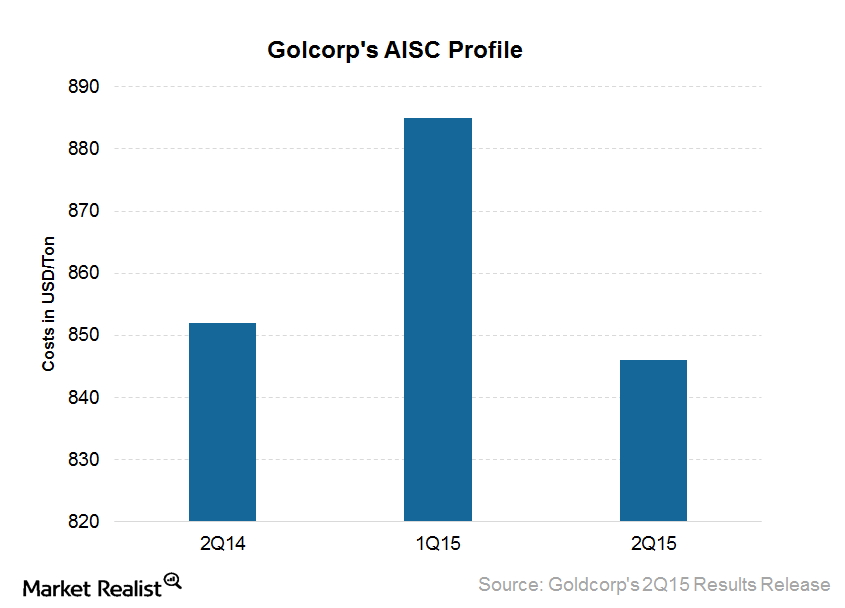

Improved Cost Outlook Bodes Well for Goldcorp’s Future

Goldcorp reported a strong reduction in all-in sustaining costs (or AISC) for 2Q15. AISC came in at $846 per ounce, compared with $885 per ounce in 1Q15 and $852 in 2Q14.

Why Is the SPDR Gold Shares ETF (GLD) Losing Its Sheen?

The SPDR Gold Shares ETF (GLD) is the world’s largest ETF. It’s also the highest-traded. Friday’s price for GLD was $104.39.

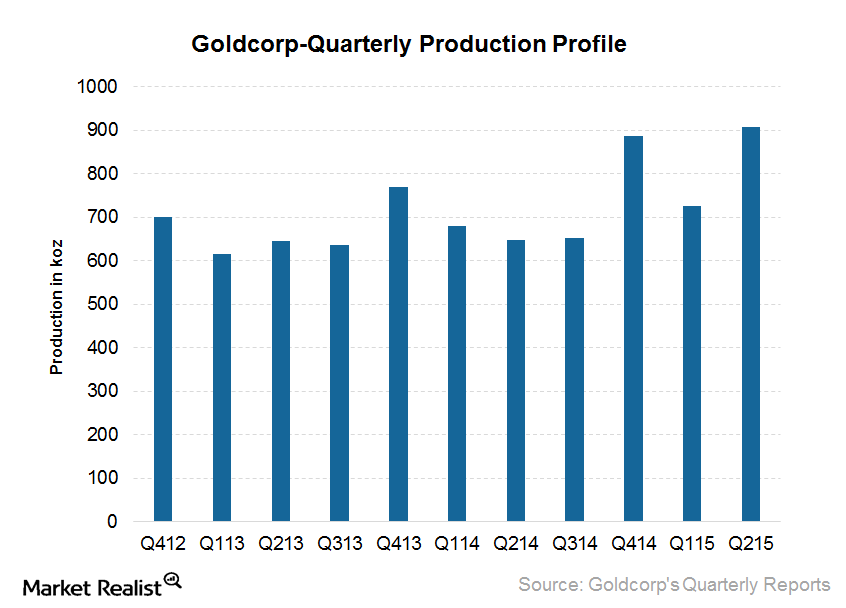

Goldcorp’s Production Growth Starts to Deliver in 2Q15

In 2Q15, Goldcorp achieved record gold production of 908,000 ounces. The Peñasquito mine in Mexico posted a record 298,000 ounces—33% of total gold production.

How Goldcorp Beat Estimates in Its 2Q15 Earnings

Goldcorp announced its 2Q15 results on July 30. The company’s gold production showed very strong growth at 25.3% quarter-over-quarter.

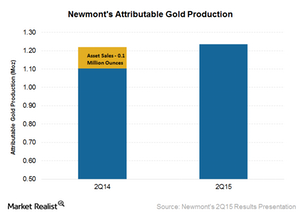

Newmont Reports Strong Gold Production in 2Q15

Newmont Mining’s (NEM) attributable gold production for 2Q15 was 1.24 million ounces. This is higher by 0.2 million ounces compared to the same quarter last year.

Newmont Mining Reports Solid 2Q15 Results

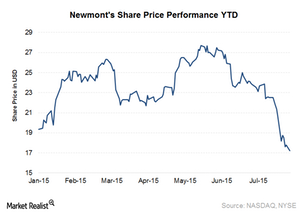

Newmont Mining (NEM) announced its 2Q15 results on July 22. It reported adjusted EPS of $0.26 and adjusted EBITDA of $692 million.

Key Highlights of Newmont’s 2Q15 Earnings

In its 2Q15 earnings release, Newmont Mining (NEM) reported net income attributable to shareholders of $131 million, or $0.26 per share. This compares to $101 million, or $0.20 per share, in 2Q14.

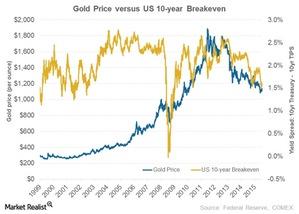

Rate Hike Expectations: How They Shape the Price of Gold

An interest rate hike by the Fed will lead to pressure on the price of gold. When alternative investments are attractive due to an increase in the interest rate, money flows from gold.

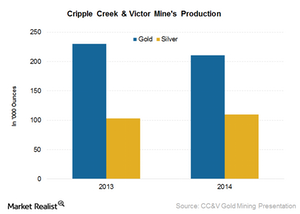

Newmont Mining Acquires Cripple Creek from AngloGold

The Cripple Creek & Victor mine is located near Colorado Springs, Colorado. It’s and open-pit mine that has been operational since 1995.

Newmont Mining Asset Optimization Efforts Encourage Analysts

Newmont Mining is the world’s second-largest gold producer. In this series, we’ll analyze various steps taken by Newmont toward asset optimization.

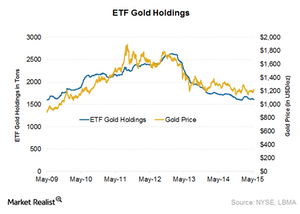

Gold ETF Holdings Fall to 4-Month Low Led by the SPDR Gold Trust

Gold ETF holdings reached a peak of 1,679.8 tons on February 24. In January and early February, gold holdings surged because of the Swiss National Bank’s decision to remove the euro cap.

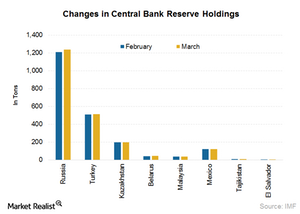

Russia on Gold Buying Spree, El Salvador Surprises with Sell-Off

After a break of two months, Russia resumed its gold buying spree in March, buying close to 30 tons of gold. Since 2005, Russia’s gold reserves have nearly tripled.

What Were Newmont’s Key Events Since Its Last Earnings Release?

Investors should be aware of two key events for Newmont Mining (NEM): the go ahead for Long Canyon Phase 1 and the renewal of the contract at Batu Hijau.

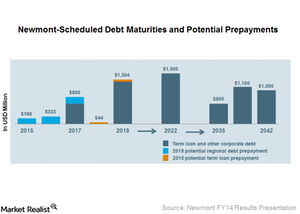

Key Updates Investors Should Look for in Newmont’s 1Q15 Results

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance.

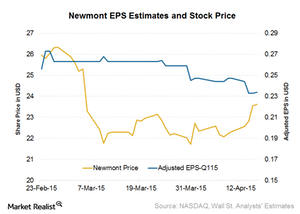

What Are Market Expectations for Newmont in 1Q15?

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14.

Newmont Will Release 1Q15 Results on April 24

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500.

Key Indicators Impacting Gold Price Performance

Gold prices are holding steady in April. The SPDR Gold Trust ETF traded at $115.43 on April 15, almost flat when compared with April 1’s value of $115.60.

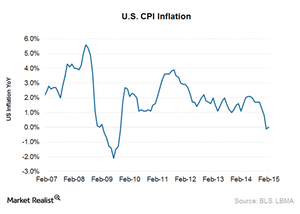

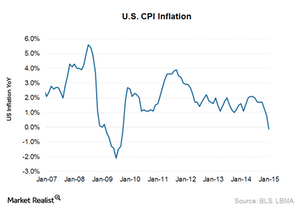

US CPI Inflation Sees Marginal Uptick in February

Gold usually has a direct relationship to inflation. Gold demand increases during periods of high inflation and falls when inflation is low.

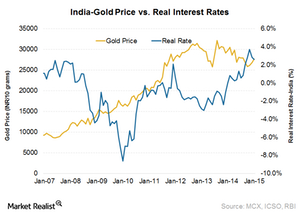

India’s rising real interest rate is negative for gold

India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

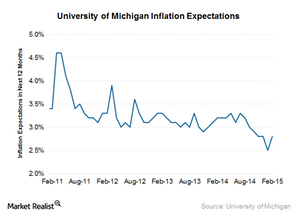

What do US inflation expectations mean?

In 2014, inflation expectations were 2.8% to 3.3%. In January 2015, expectations dropped to 2.5%, the lowest since September 2010.

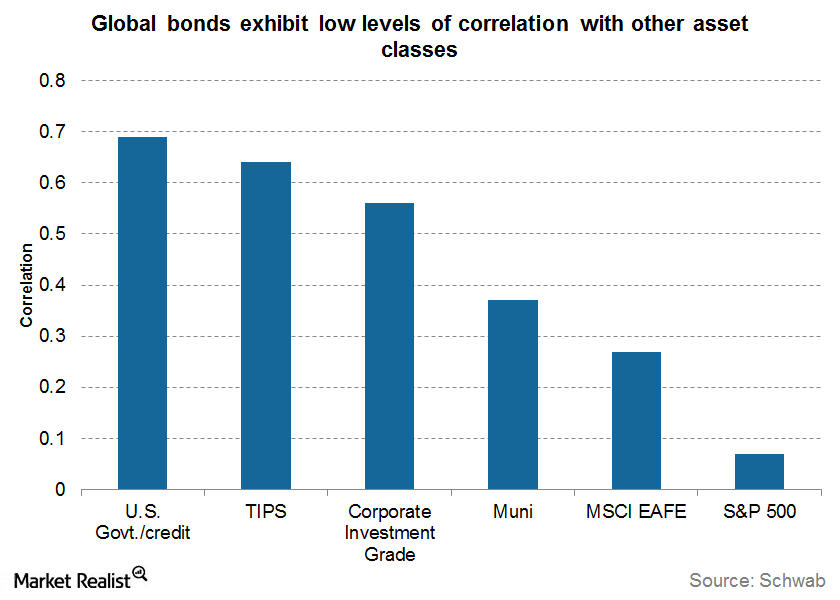

Cushion Volatility With Bonds

High yield bonds are becoming increasingly correlated with the S&P 500 and might increase your risk exposure instead of giving diversification benefits.

US inflation rate hits negative for the first time since 2009

The US Consumer Price Index reading for the month of January was -0.1%. This is the first negative US inflation reading since October 2009.

Why tracking gold indicators is important for investors

In this series, we’ll look at some gold indicators investors can track to get a sense of what direction the price of gold will take.