Analyzing the Coiled Spring Effect in Platinum Prices

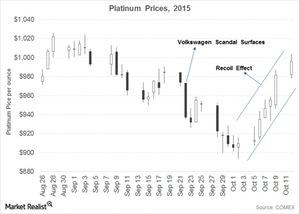

After the VW scandal, platinum prices jumped to an almost two-week high, again entering the $1,000 territory after hitting a low of $893.4 on October 2.

Oct. 13 2015, Published 1:38 p.m. ET

Coiled spring effect

In the wake of a Volkswagen scandal that decided the direction of platinum prices, platinum is now experiencing a coiled spring effect. Platinum prices jumped to an almost two-week high, once again entering the $1,000 territory after hitting a low of $893.4 on October 2, 2015.

On Monday, October 12, platinum traded at $995.90 per ounce. But while prices have been volatile during the preceding month, showing movements of nearly 11%, Monday marked the seventh straight day of gains for platinum. The V formation on the graph below illustrates this coiled spring effect.

Supply crunch

Investigations into alleged cheating on emission tests—a scandal involving 11 million Volkswagen diesel cars—have hurt demands for diesel cars with catalytic converters containing platinum, pushing the platinum price lower. Other cars produced by Honda, Mazda, Mitsubishi, and Mercedes-Benz have also been found to have emissions that fall short of set standards.

These findings could lead to a further decline in diesel engine car production and a rise in the sale of gasoline cars. On the other hand, falling prices spur demand—especially for jewelry, which could buoy platinum prices. And on the supply side, platinum production is expected to fall by 15–20% in South Africa in coming years, providing additional support for the metal.

Other precious metals have also seen a bounce back in their prices from the steep decline during July 2015. Major mining companies like Goldcorp (GG), Barrick Gold Corporation (ABX), Gold Fields (GFI), and Hecla Mining Company (HL) have seen gains in prices on a trailing 30-day basis. These four companies make up 19.40% of the VanEck Vectors Gold Miners ETF (GDX).

GDX itself has gained by 19.50% in the past month. The SPDR Gold Shares (GLD) is another ETF backed by gold prices that has seen a surge. Read the next part of this series for a deeper dig into gold.