iShares TIPS Bond

Latest iShares TIPS Bond News and Updates

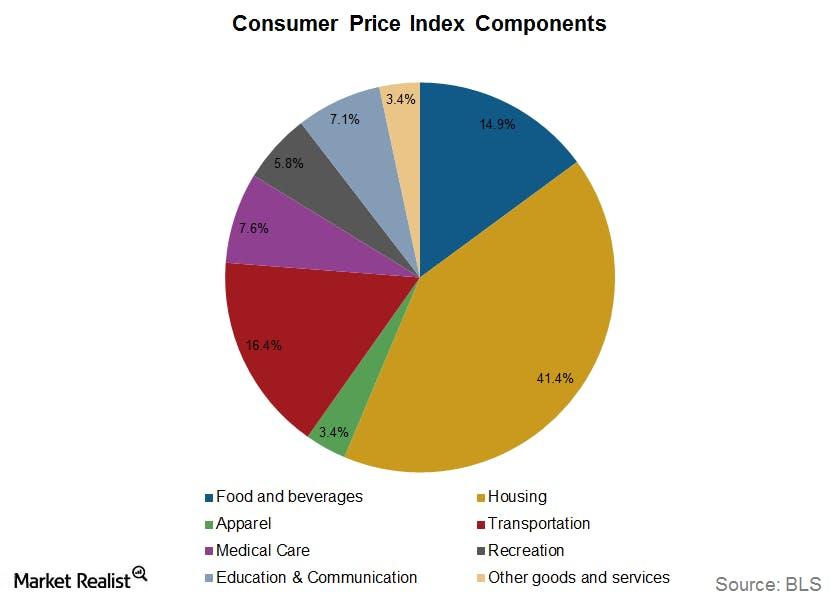

Must-know fundamentals about the US Consumer Price Index

The Bureau of Labor Statistics (or BLS) developed the U.S. CPI in 1913 to measure the change in prices.

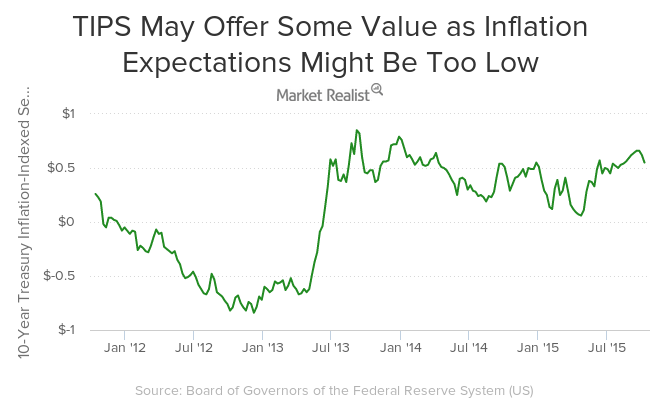

Why Treasury Inflation-Protected Securities May Offer Some Value

TIPS may offer some value as inflation breakeven seems modest. TIPS provide investors a hedge against inflation just like gold (GLD) and other commodities (DBC).

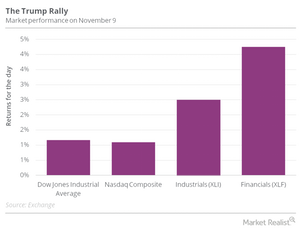

Gundlach: Invest in Industrials, Materials, Financial Sectors

“Industrials, materials, and financials are the sectors. . .you want to be invested in,” said Jeffrey Gundlach recently in a CNBC interview.

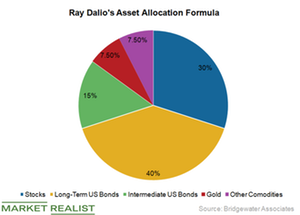

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

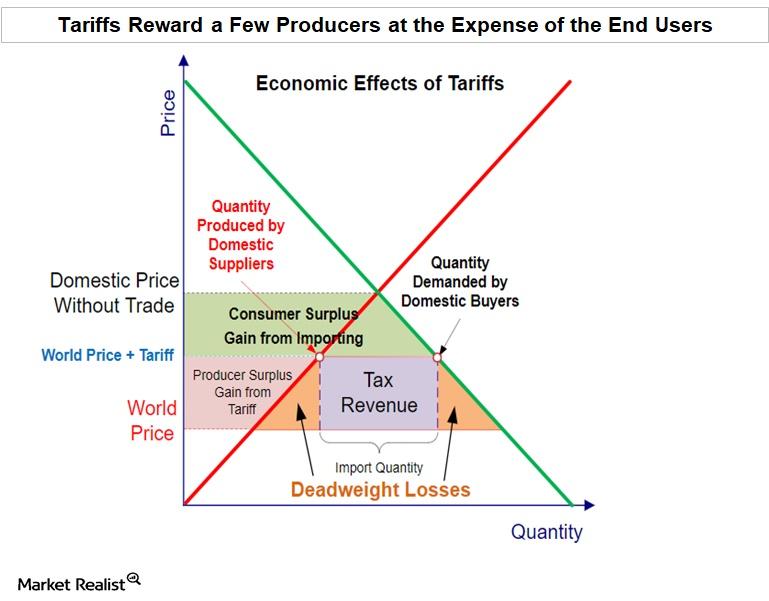

Why Economist Argue That Tariffs Are Bad for the Economy

The recently proposed import tariffs on steel and aluminum imports by US President Donald Trump are an effort to protect the interests of US manufacturers.

FOMC’s Review of Economic Situation Signals Strong US Economy

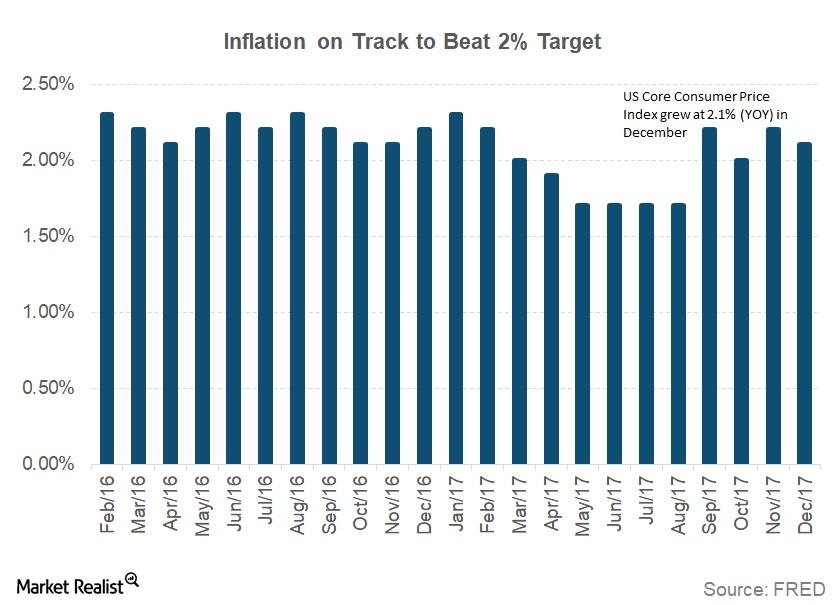

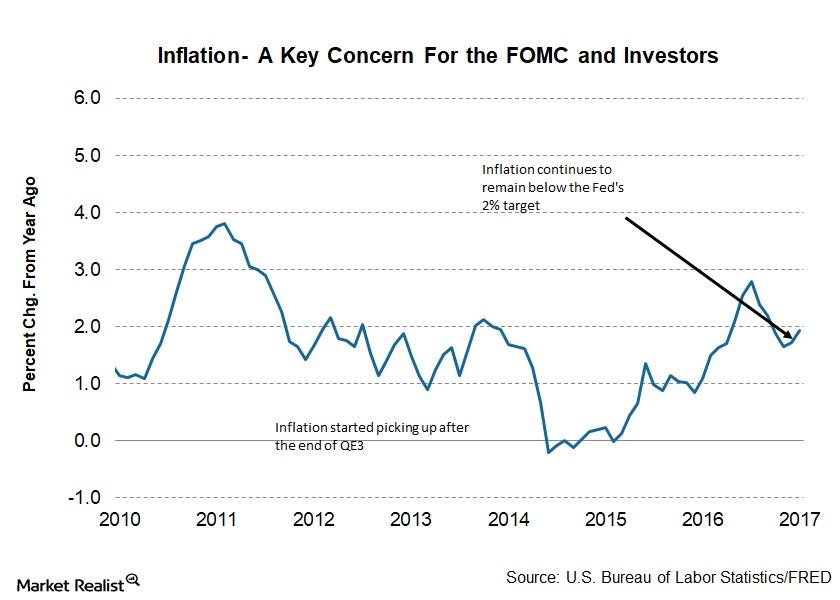

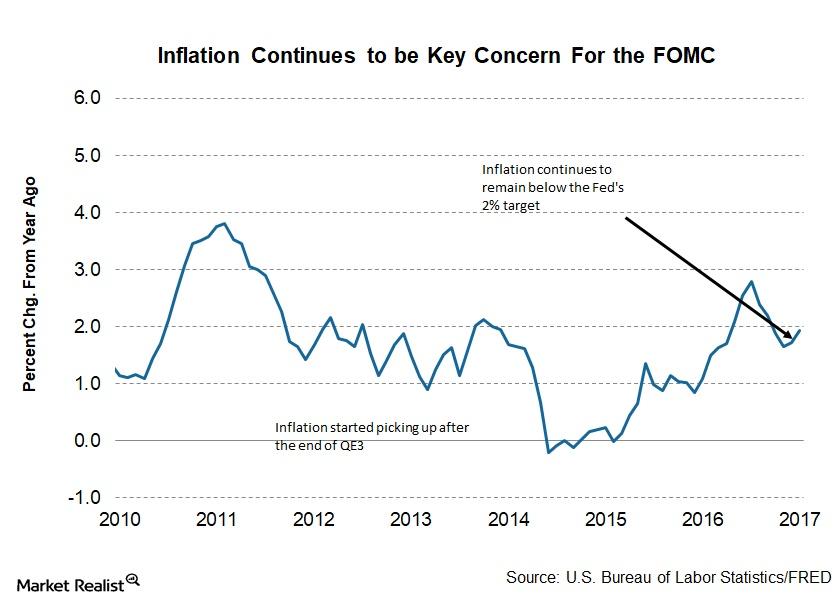

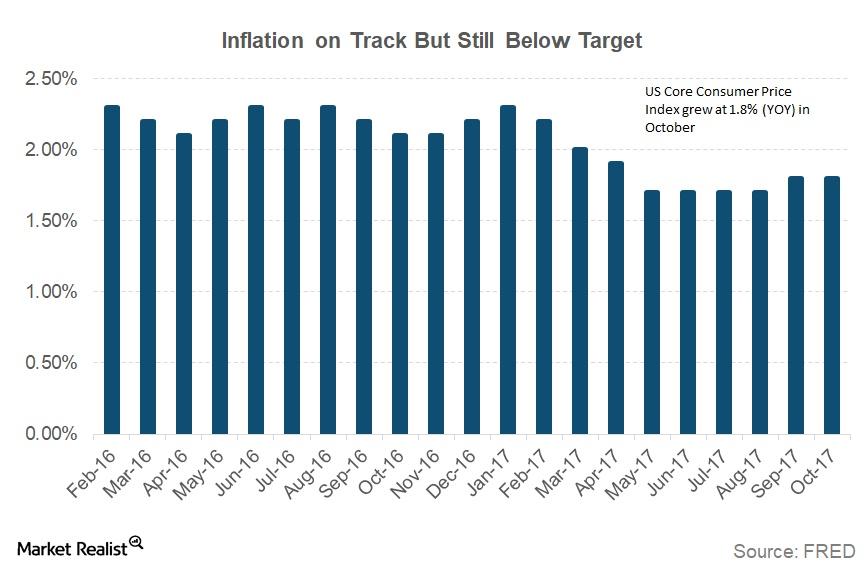

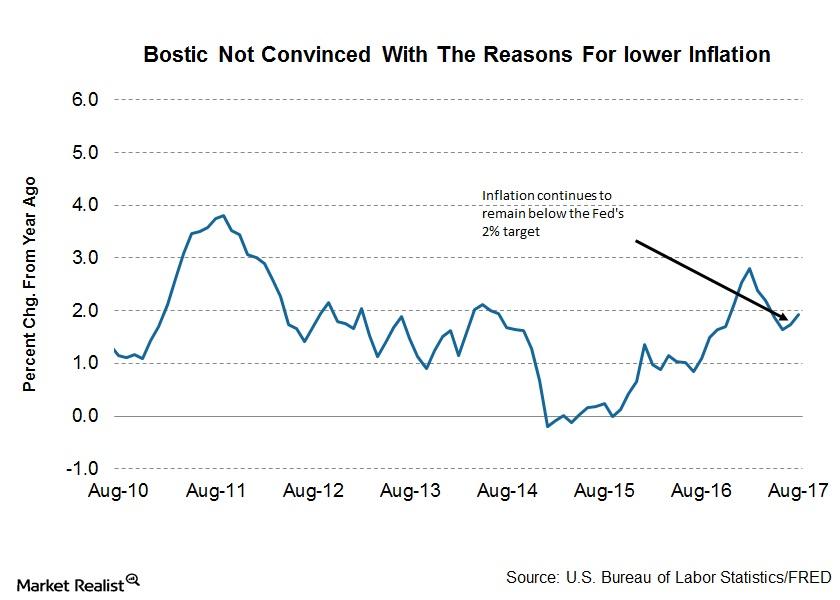

As per the FOMC staff report, inflation (TIP) in the US remained below the 2% target.

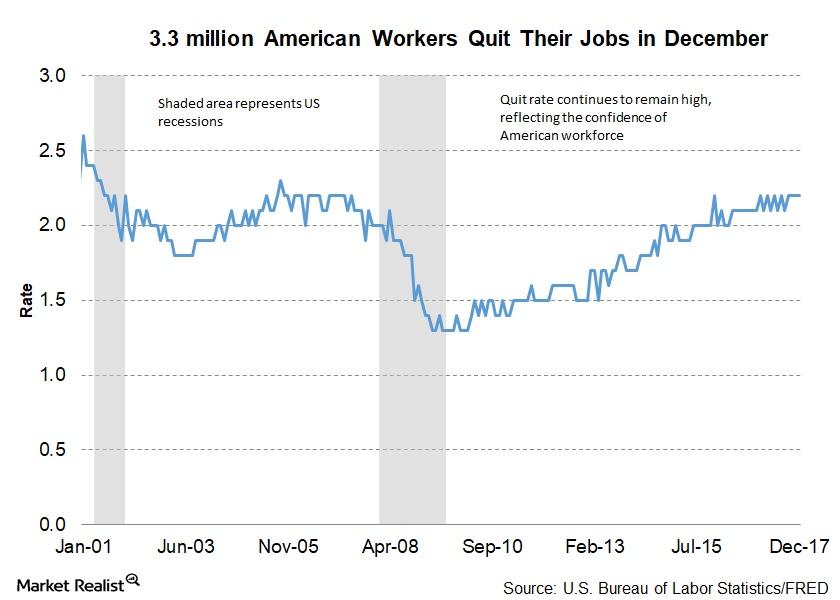

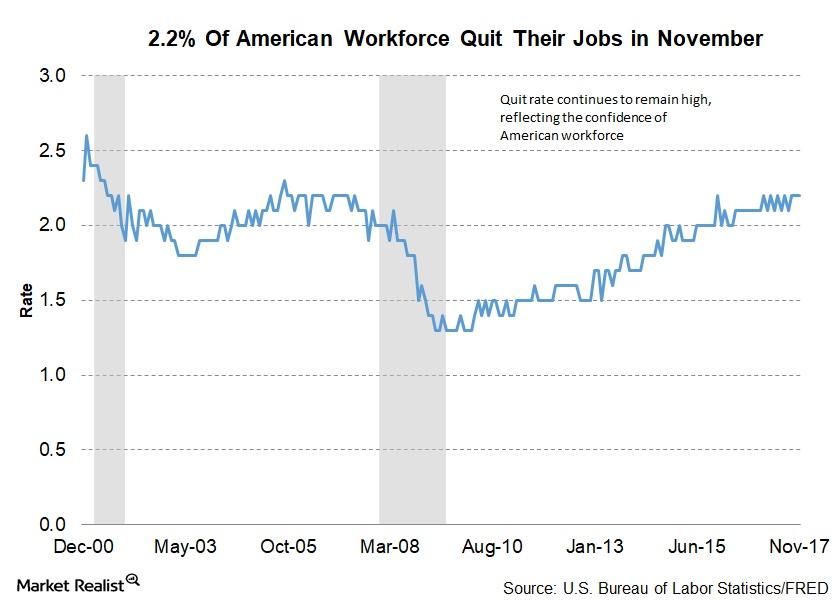

Why Quit Rate Indicates a Strong US Employment Market

As per the latest JOLTS report, total separations for December were 5.2 million, which is 3.6% of the total workforce.

Why Did the Consumer Price Index Rise in December?

According to the December CPI report released by the U.S. Bureau of Labor Statistics on January 12, consumer prices in December increased 0.1%.

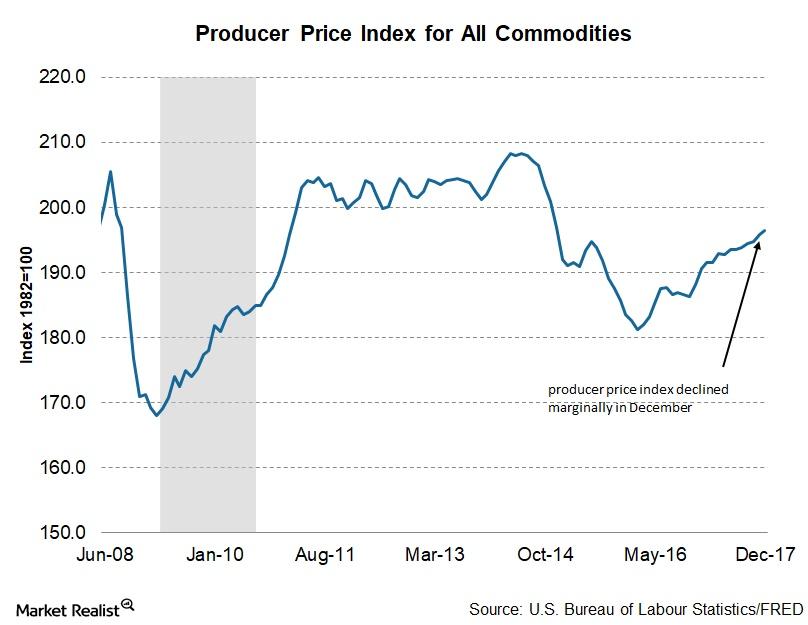

Analyzing the Producer Price Index in December

The December PPI fell 0.1% month-over-month—compared to a 0.4% increase in November and October. The final demand index rose 2.6% in 2017.

How Many Americans Quit Their Jobs in November?

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in November.

What November Job Openings Say about US Economy

As per the January JOLTS report, there were 5.9 million job openings at the end of November.

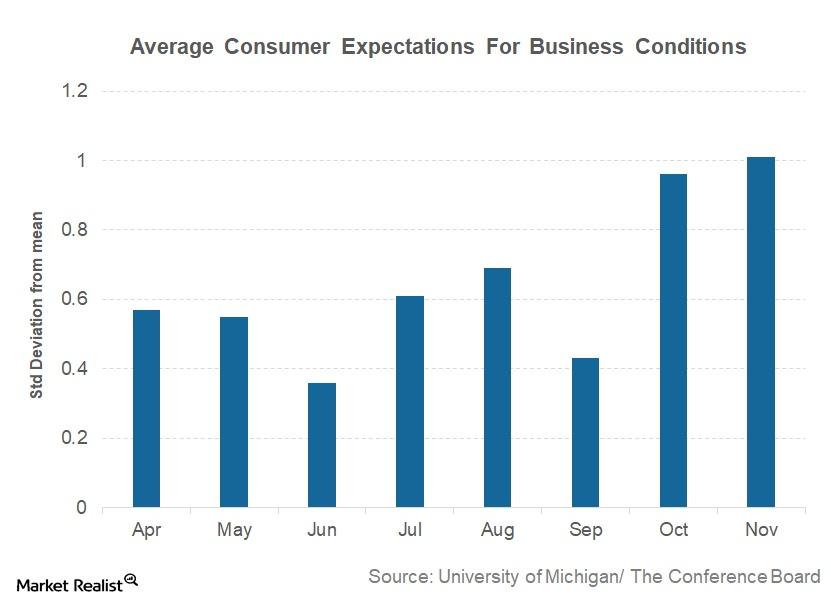

Why Consumer Expectations Continued to Increase in November

Consumer expectations for business conditions Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by […]

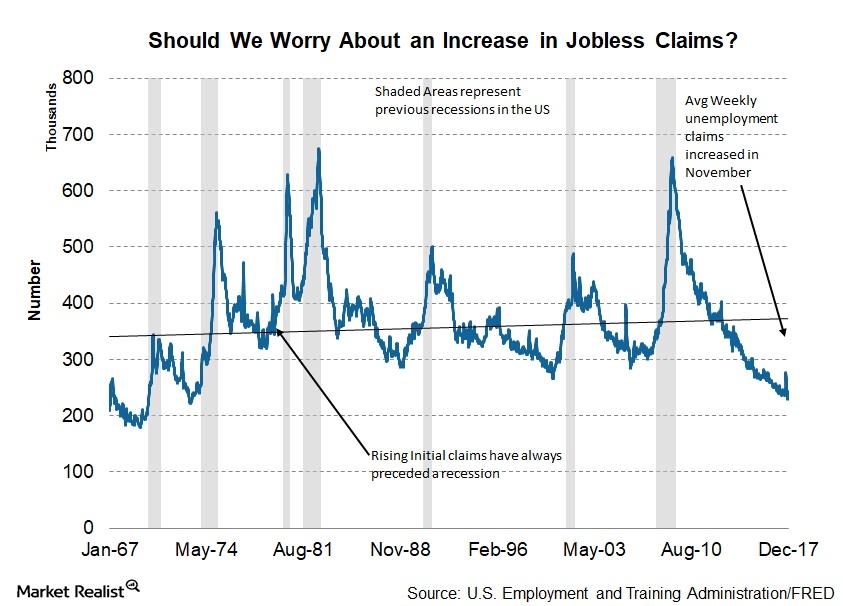

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

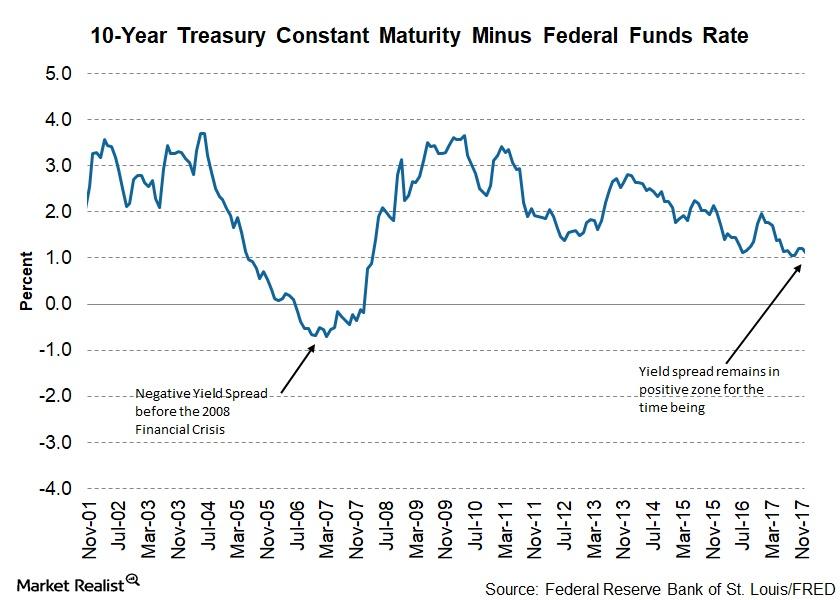

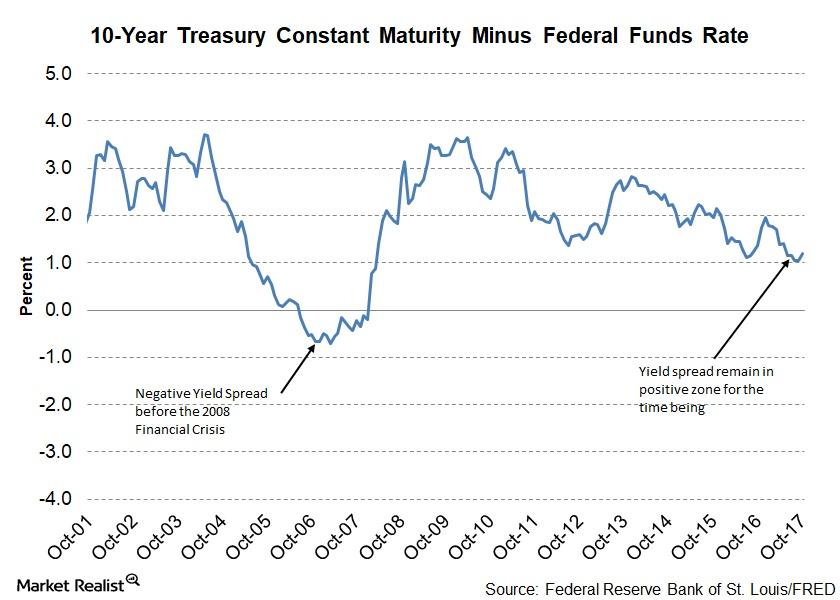

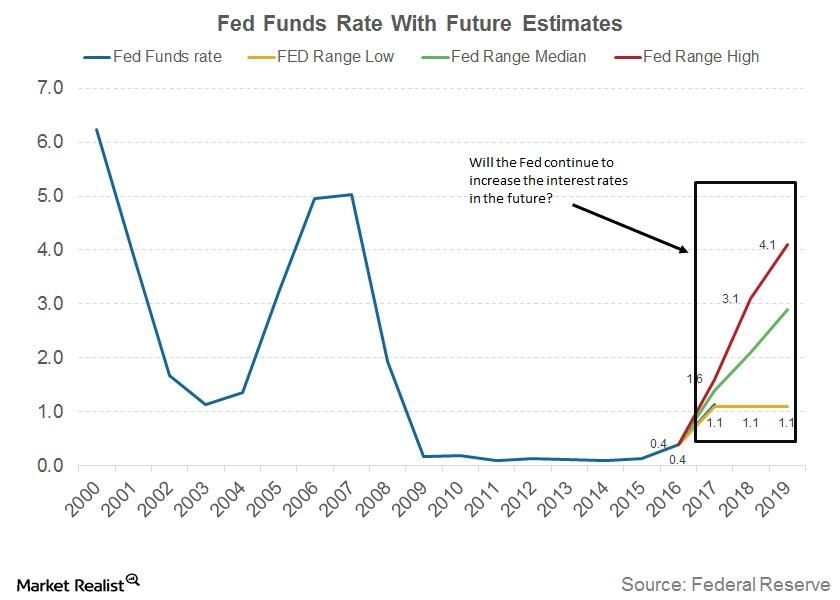

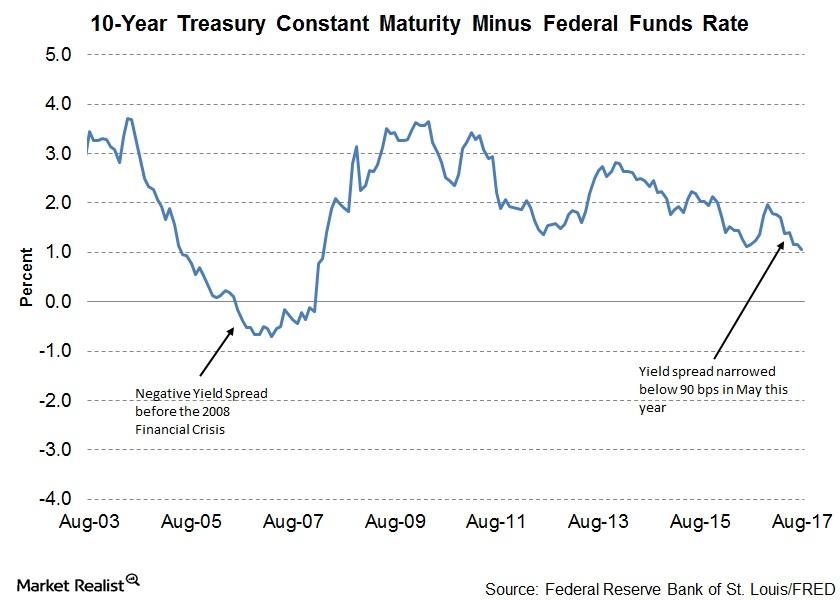

Analyzing the Yield Curve’s Ongoing Flatness

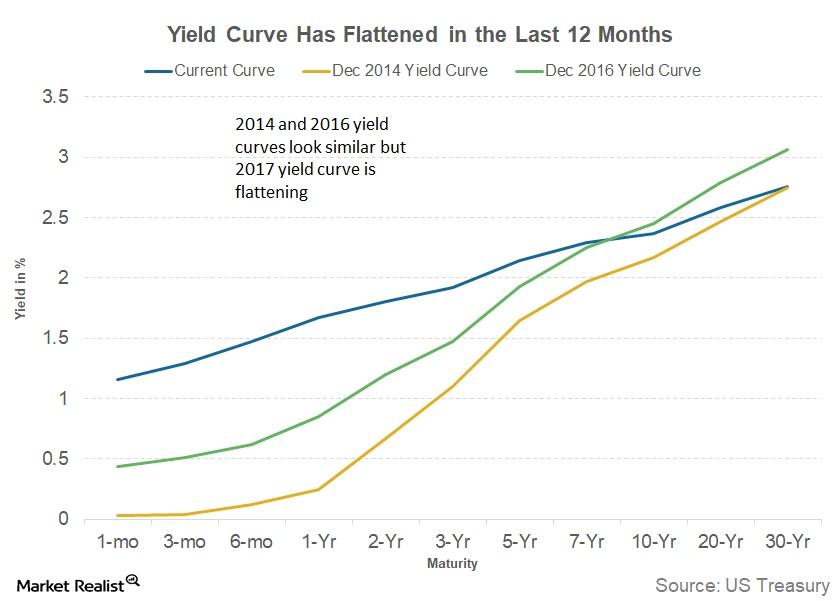

A December rate hike and a flattening yield curve The Fed rolled out another rate hike at its final meeting of 2017. The target range for the federal funds rate was increased by 0.25% to 1.25%–1.50%, and the Fed has signaled three more rate hikes in 2018. Two members dissented to the rate hike due to lower […]

Will Gold Maintain Its Close Correlation to Inflation?

The rise in inflation could be a positive sign for the current scenario.

The Curious Case of Low Inflation in 2017

The last statement from the US Fed, which was released with its recent rate hike decision, cited lower levels of inflation but hopes that the inflation target could be achieved in 2018.

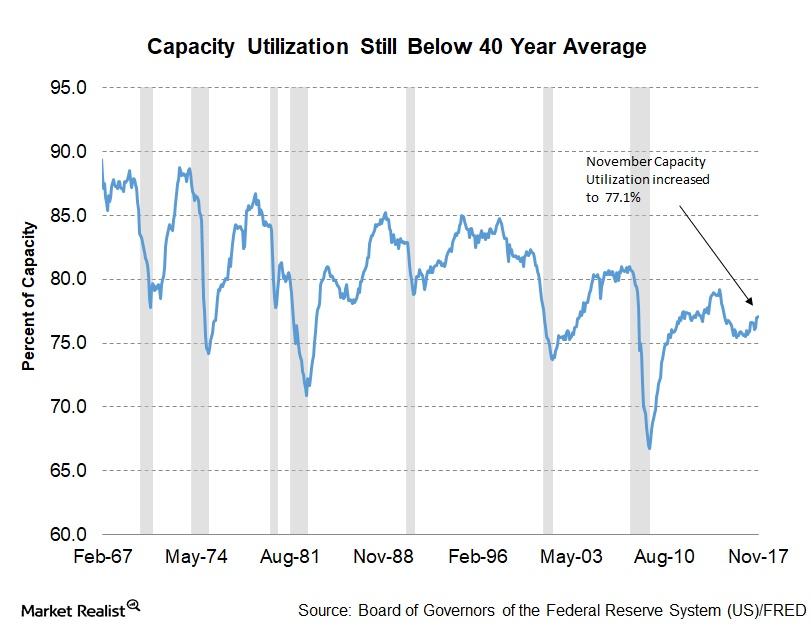

A Look at Capacity Utilization across US Industries in November

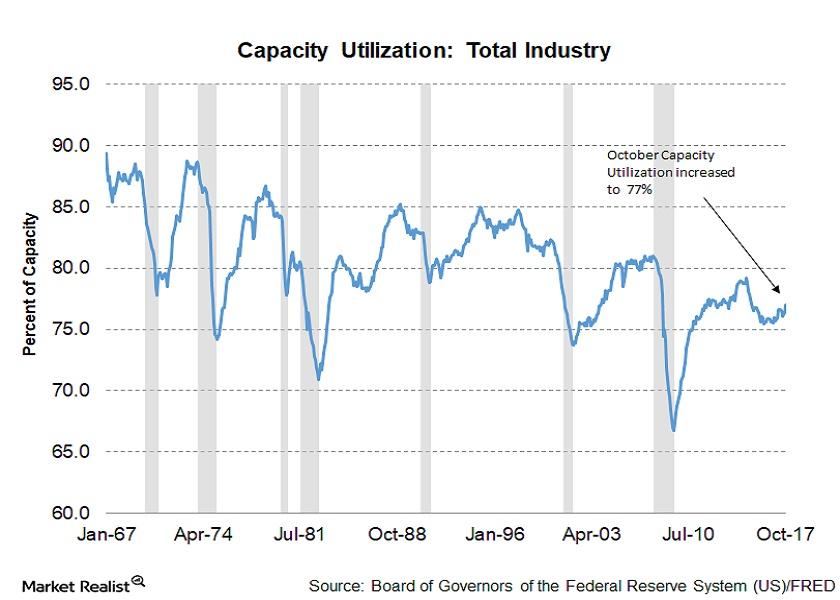

In the November capacity utilization report, the manufacturing sector remained strong with 76.4% capacity utilization, the highest level since May 2008.

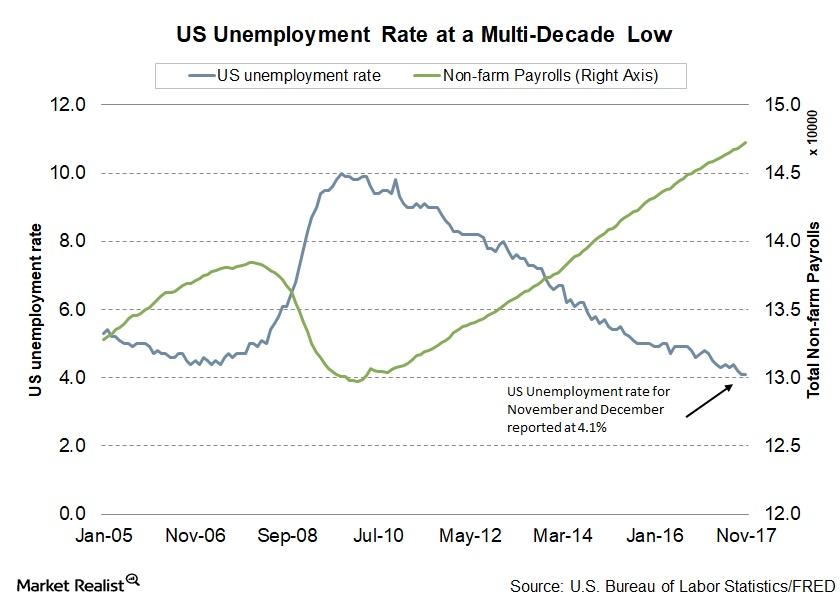

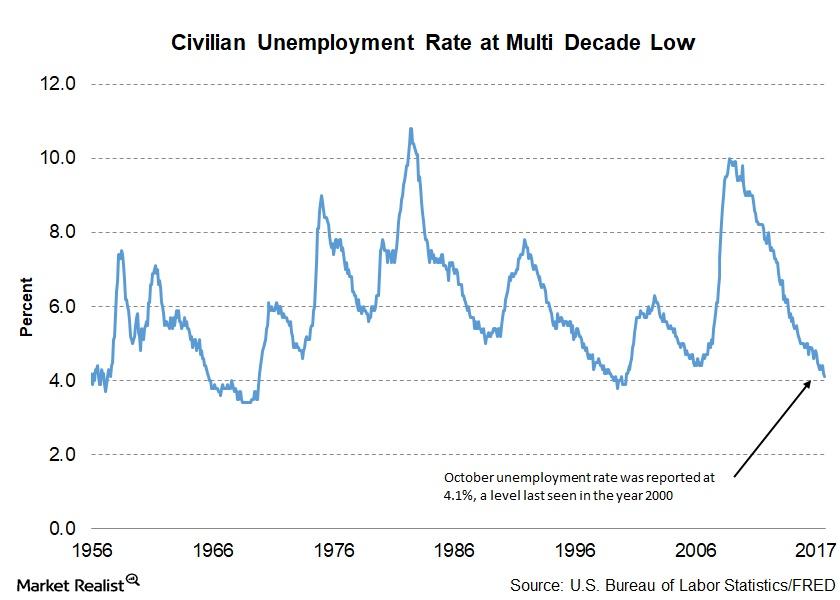

Will US Unemployment Rate Fall below 4% in 2017?

A lower unemployment rate is one of the key objectives of the Fed. In 2017, the unemployment rate fell, reaching 4.1% in its latest November reading.

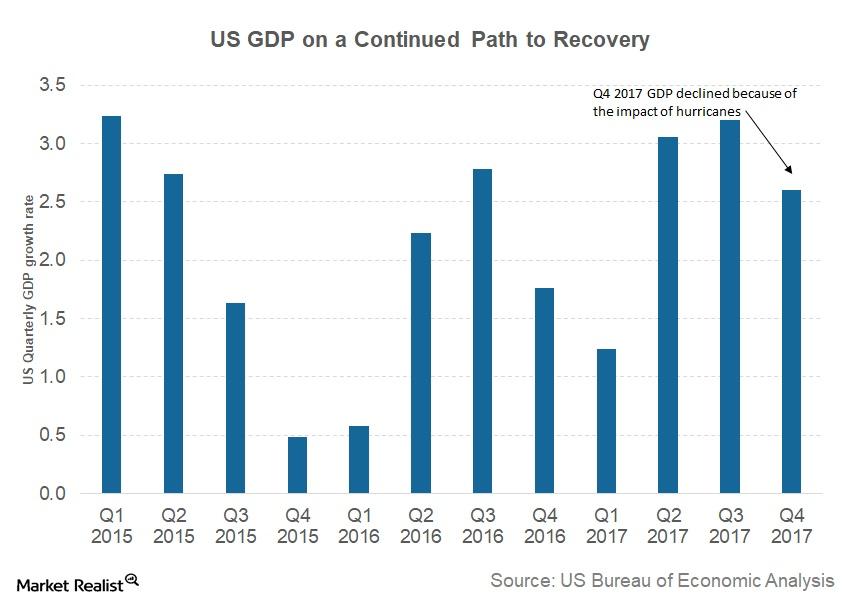

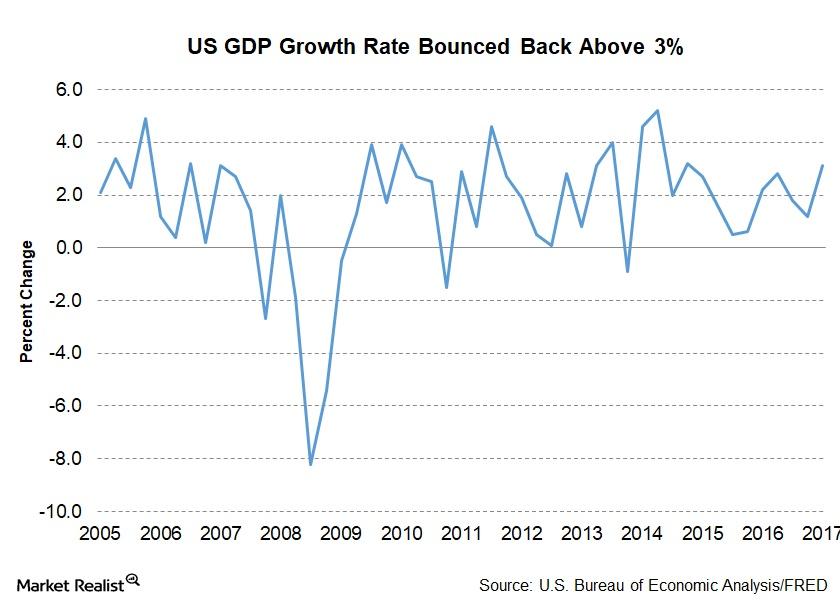

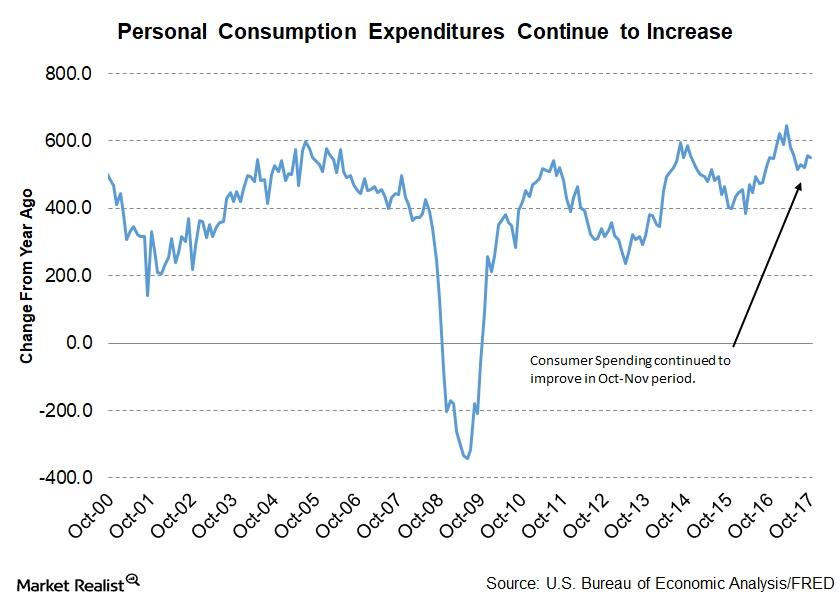

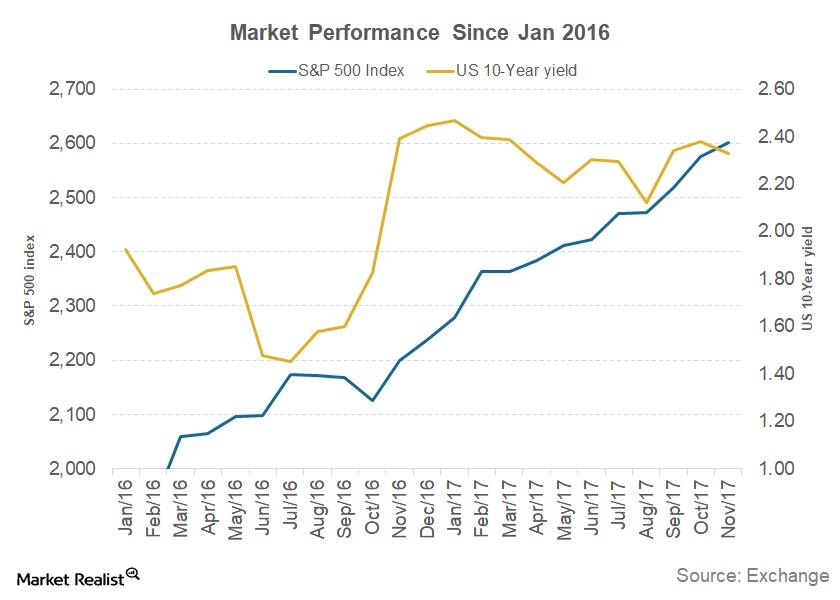

How the US Economy Performed in 2017

This year has been a year to watch the US economy. Hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher.

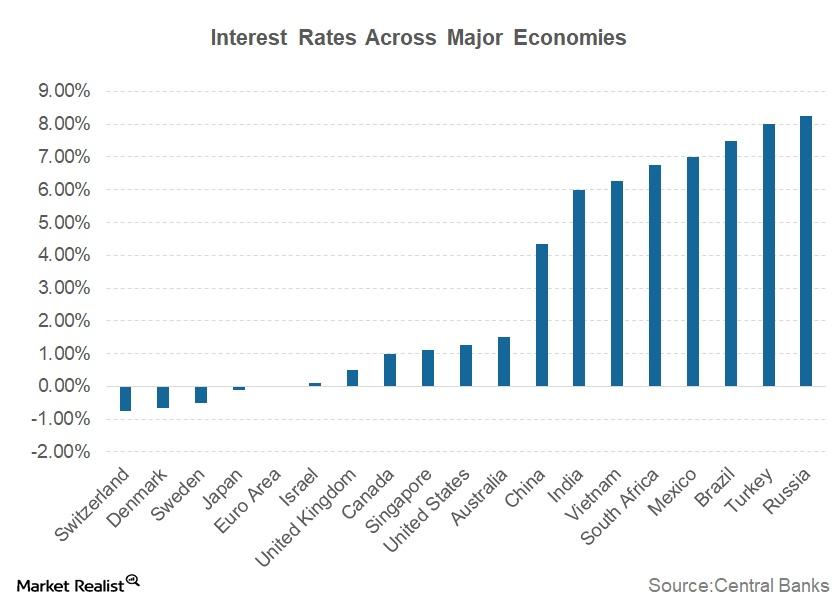

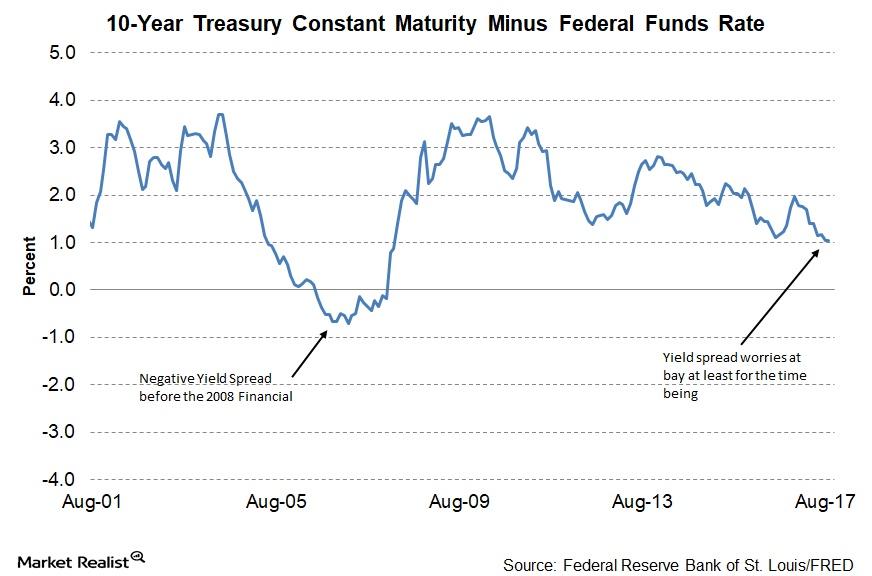

The Primary Cause of Yield Curve Flattening

Interest rates and inflation The pace of interest rate hikes and inflation rate growth have a profound influence on the US yield curve. The US Fed has been communicating its intent to increase interest rates from the current ultra-low level to a target rate of 2.5% over the next few years. The conditions required for […]

What Leads to Yield Curves Flattening

Factors leading to yield curves flattening There are multiple factors that can affect the shape of yield curves. Bonds (BND) with different maturities react differently to changes in economic conditions and expectations. For example, when the US Fed announces an interest rate hike, short-term bonds (SHY), which are to the left side of a yield curve, react […]

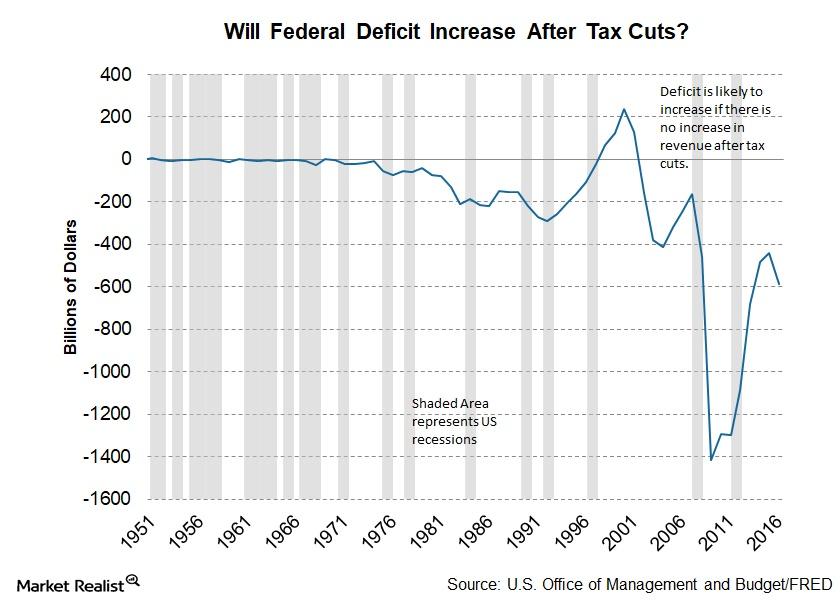

How Will Tax Cuts Impact the Federal Deficit?

The report from the Joint Committee on Taxation included an estimate of budgetary deficits for 2018–2027. Tax reforms could have a limited impact in 2018.

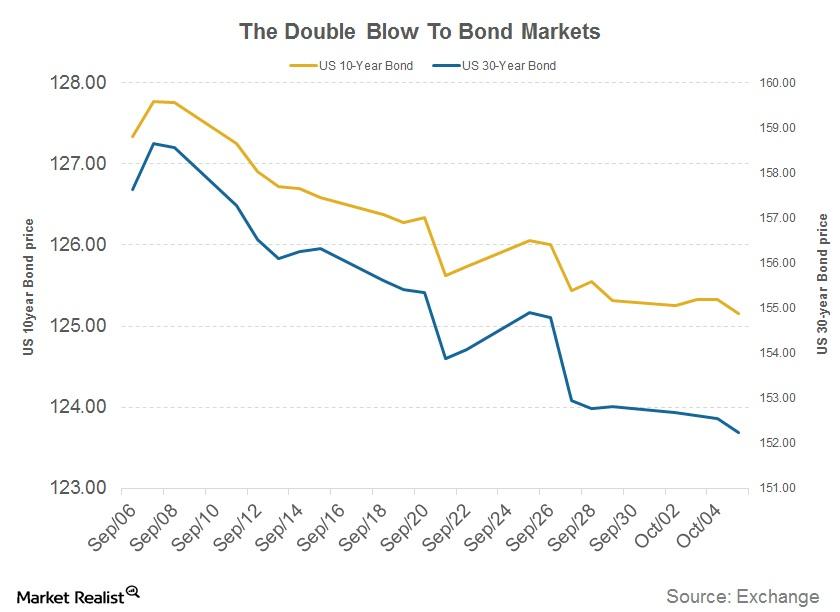

Tax Cuts and Rate Hikes Could Impact the Fed

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s stance.

Fed’s November Beige Book and Restrained Hiring Plans

The inability of employers to find suitable workers is leading to wage increases, especially in the professional, technical (XLK), and production (XLI) sectors.

The Economic Indicators Covered by the Fed’s Beige Book

Comparing the economic performance with economic expectations and the previous cycles gives investors an idea of whether the economy is expanding or contracting.

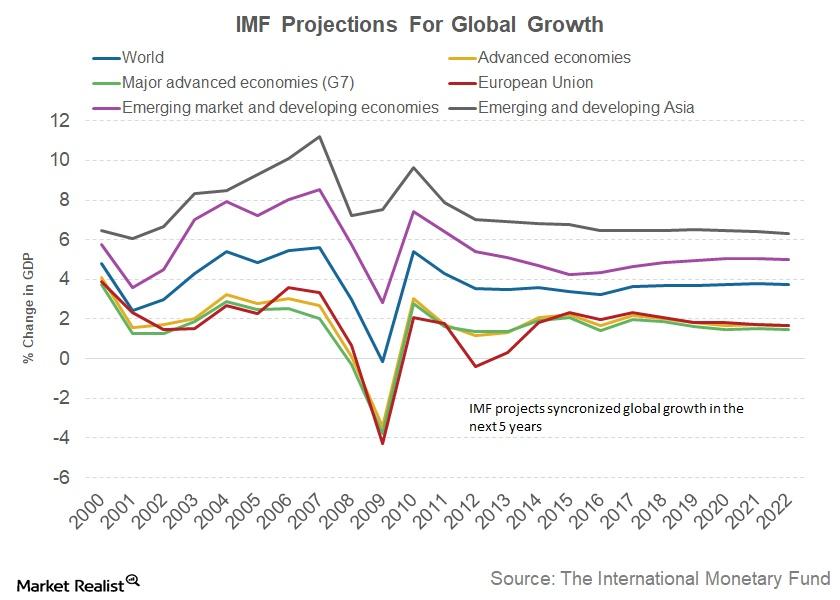

When the United States Sneezes, Will the World Catch a Cold?

Williams suggested that the monetary policy framework should be designed considering the global scenario rather than central banks looking at their economies in isolation.

The Problem with the Current Interest Rates

With global economies progressing toward normalcy or the “new normal,” as Williams called it, central banks are moving toward normalizing policy by signaling interest rate hikes.

San Francisco Fed John Williams and Monetary Policy Challenges

John Williams, president and CEO of the Federal Reserve Bank of San Francisco, spoke on November 16, 2017, at the 2017 Asia Economic Policy Conference in San Francisco.

Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

The FOMC’s View of the Equity and Bond Markets

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

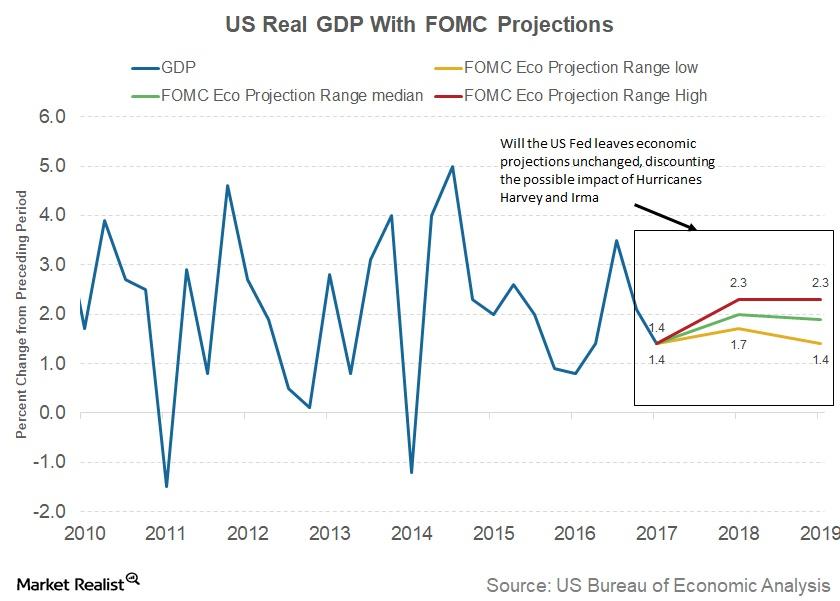

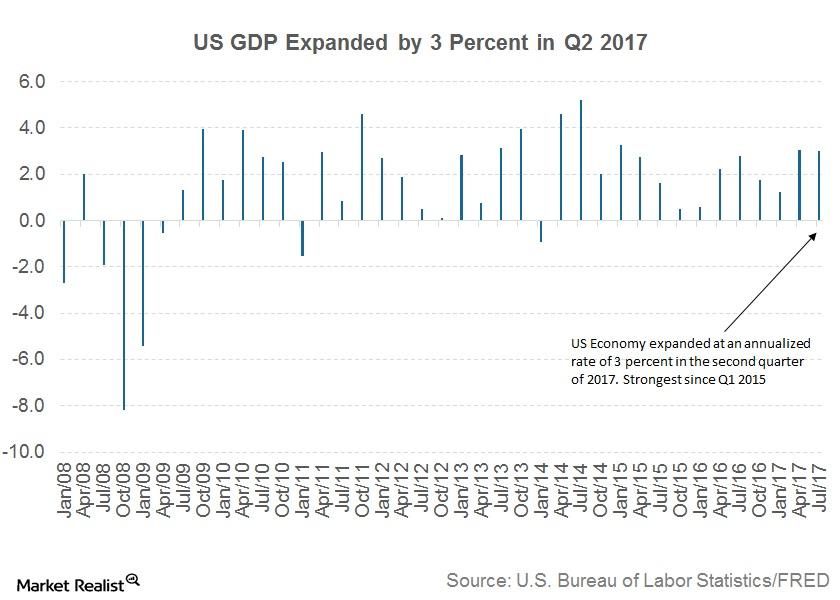

The FOMC’s Outlook for the US Economy

As per economic projections prepared by the FOMC, US real GDP is expected to improve in the final quarter of this year.

The FOMC’s View on the US Economy

At the November meeting, the FOMC staff review indicated that US labor market conditions continued to strengthen and that the US economy continued to expand at a solid pace.

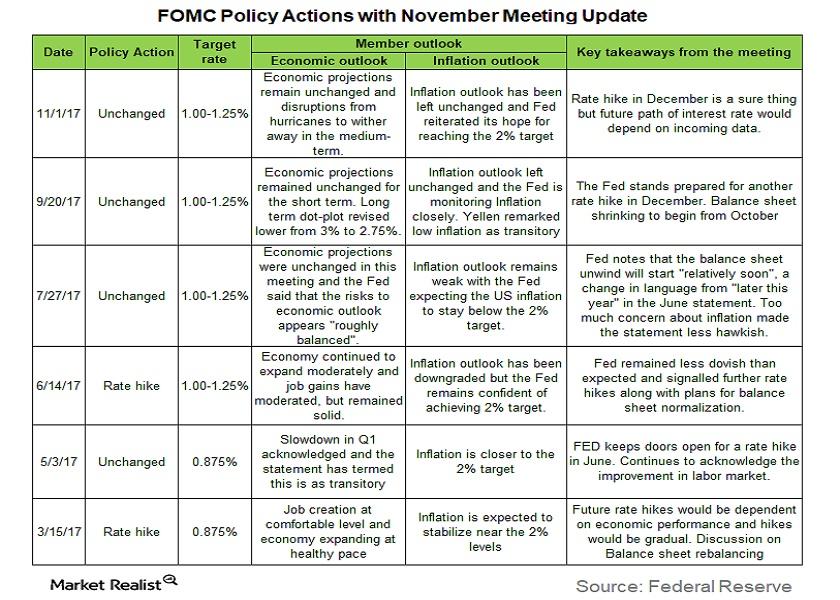

The November FOMC Meeting Minutes: Must-Knows

The last Federal Open Market Committee (or FOMC) meeting took place on October 31–November 1. The target range for the federal funds rate stayed unchanged at 1%–1.25%.

Reading the Trends in Capacity Utilization across US Industries in October

Among the key macroeconomic indicators published by the Fed, capacity utilization in US industries helps investors forecast business cycle changes.

Chart in Focus: The Consumer Price Index Rose in October

The Fed is expected to increase the target funds rate by 0.25% at its December meeting.

How an Increase in the Producer Price Index Affects the Economy

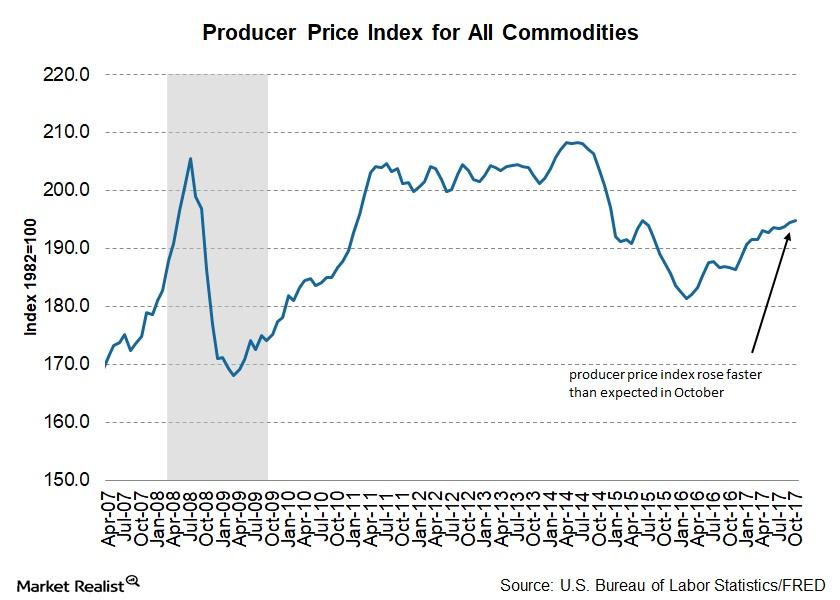

The October Producer Price Index rose 0.4% month-over-month, and it was unchanged compared to the September reading. On a year-over-year basis, the index has risen 2.8%.

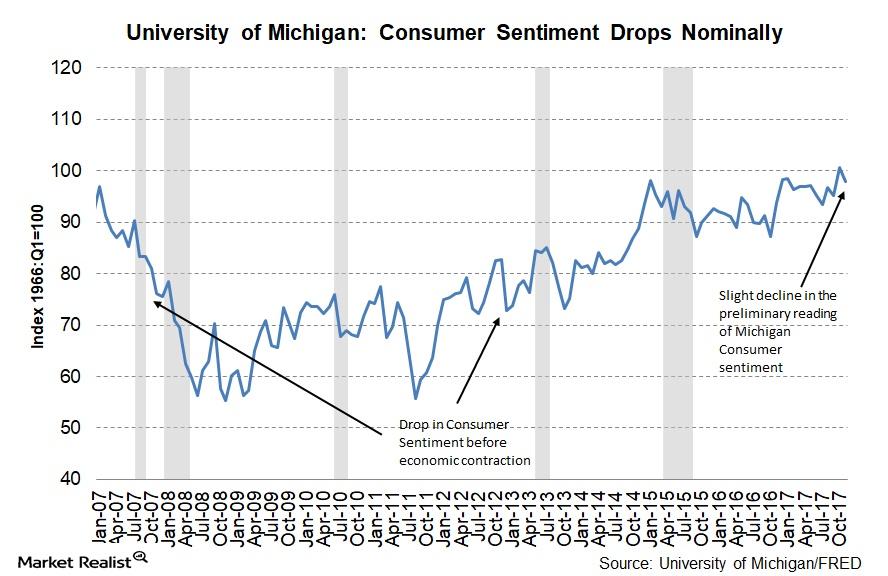

Here’s What Drove Consumer Expectations Lower in November

The University of Michigan Preliminary Consumer Sentiment for November was reported at 97.8, which was 2.9 lower than the final October reading of 100.7.

Did Job Openings Rise in September?

The Job Openings and Labor Turnover Survey (or JOLTS) report for September came out on November 7. Job openings remained unchanged at 6.1 million as of the last business day in September.

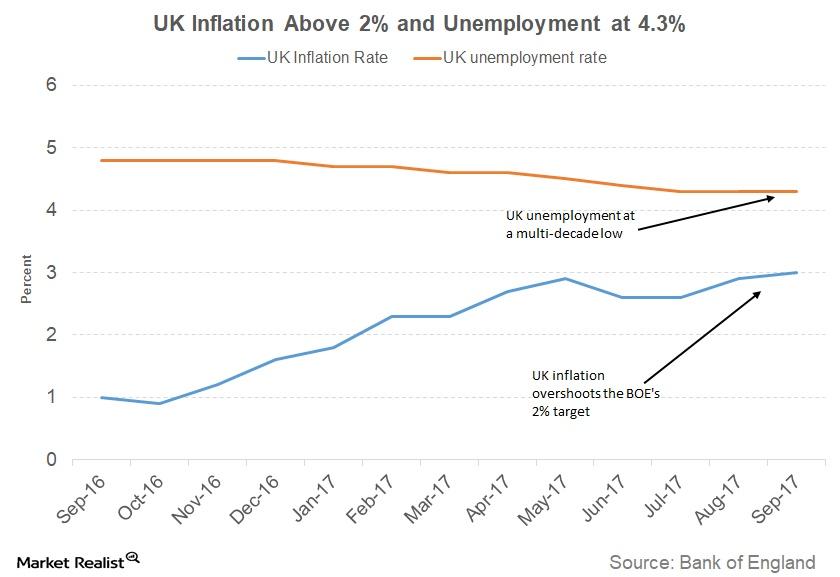

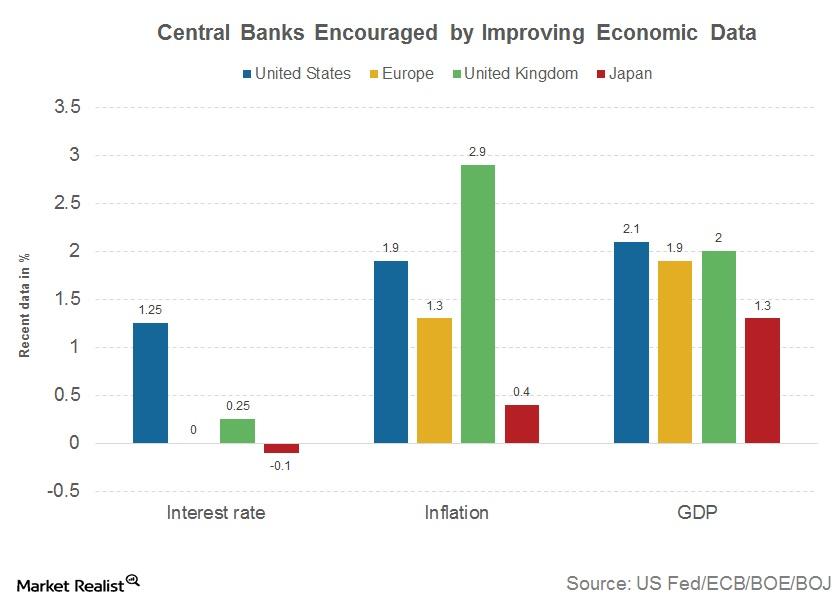

Why the Bank of England Wants Inflation to Fall

The central bank said that the key reason for such sharp increase in prices was due to the depreciation of the British pound after the Brexit referendum.

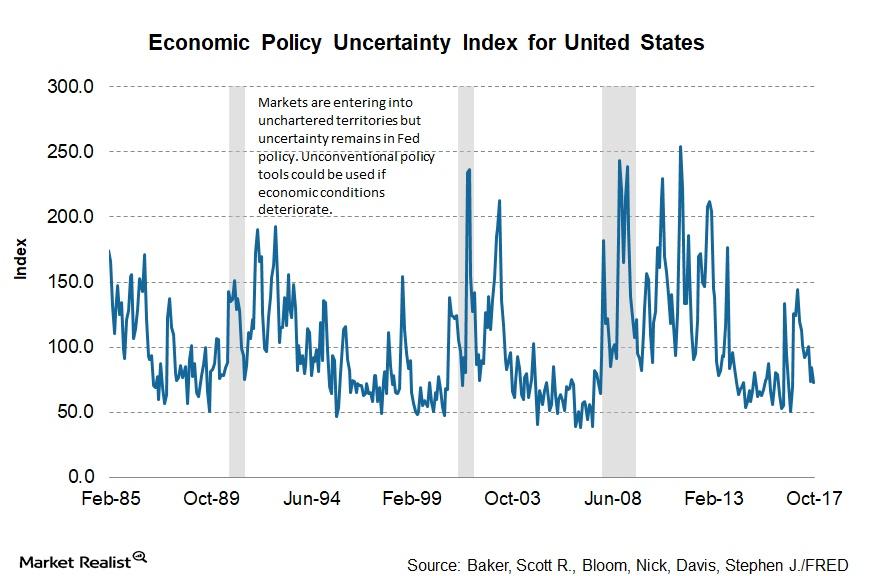

Janet Yellen: A Key Question for the Future

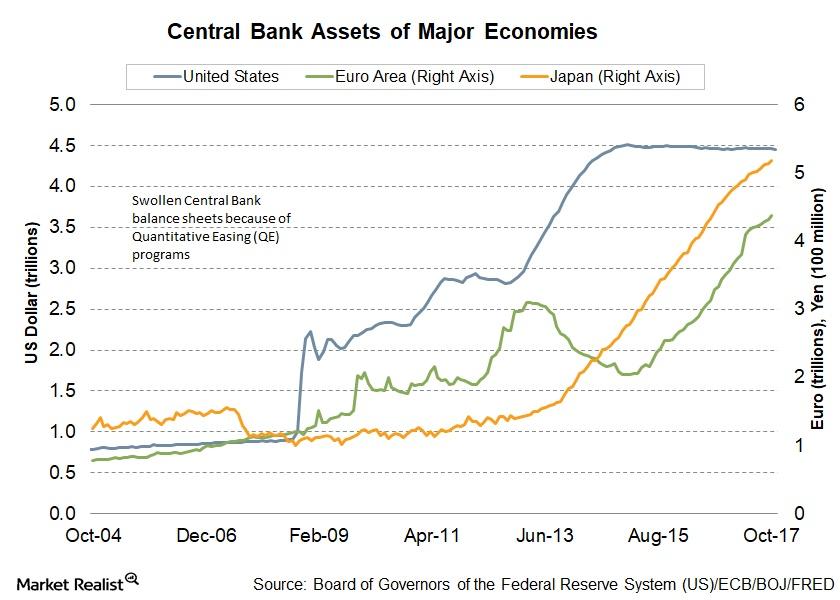

In a speech at the 2017 Herbert Stein Memorial Lecture, Fed Chair Janet Yellen shared her thoughts on monetary policy for the future and discussed whether there will be any role for unconventional policy again.

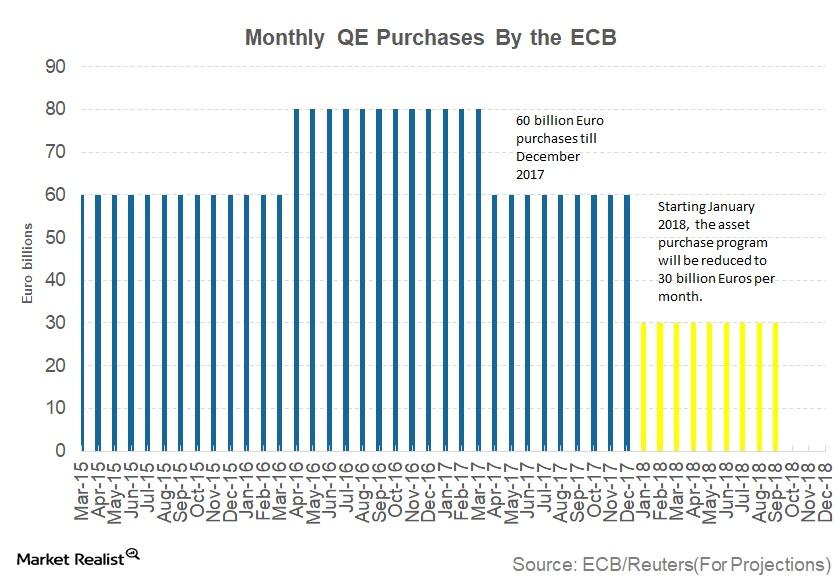

Update from the European Central Bank’s October Policy Statement

In the ECB’s (European Central Bank) October policy meeting, its laid out its plans for the QE (quantitative easing) program.

Are Declining Yield Spread Worries Done for Now?

At the last FOMC (Federal Open Market Committee) meeting on September 20, 2017, Fed members decided to initiate a balance sheet normalization process starting in October.

Why a December Rate Hike Shouldn’t Be Taken for Granted

Not all members of the FOMC, according to the minutes of the meeting, were on the same page with respect to a December interest rate hike.

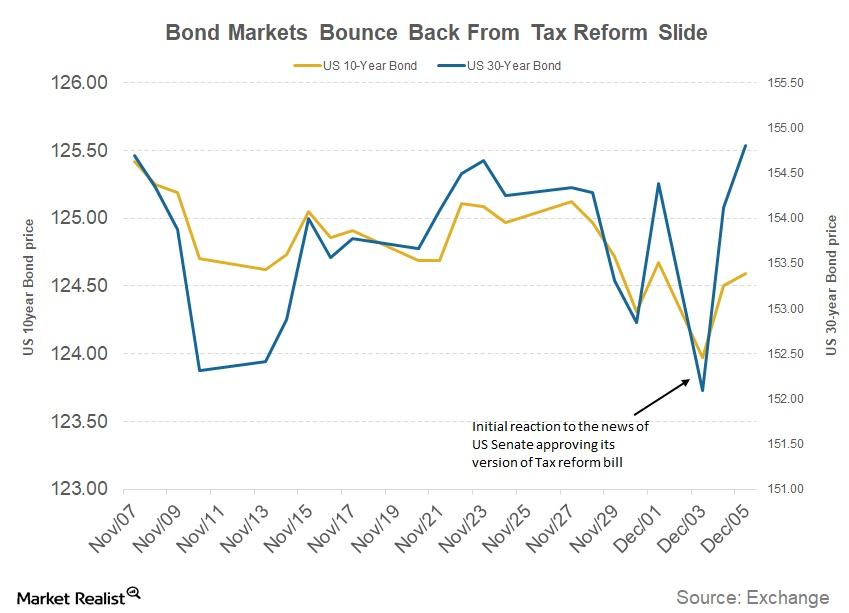

A Double Blow for Bond Markets?

The announcement of the GOP tax reform plan added to the pressure on bond markets.

Why FOMC’s Raphael Bostic Is Not Happy with Low Inflation Explanations

Bostic dealt with various reasons that have been cited as reasons for the lower level of inflation—even questioning the common ones.

FOMC’s James Bullard Has Three Questions for US Monetary Policy

Bullard said that the current growth rate in the US economy is likely to remain consistent with recent quarterly growth—near the 2% mark.

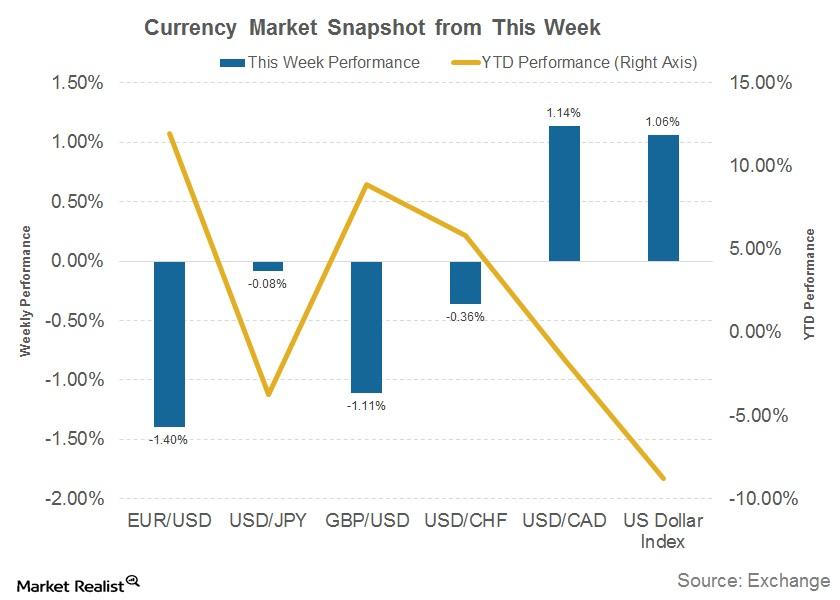

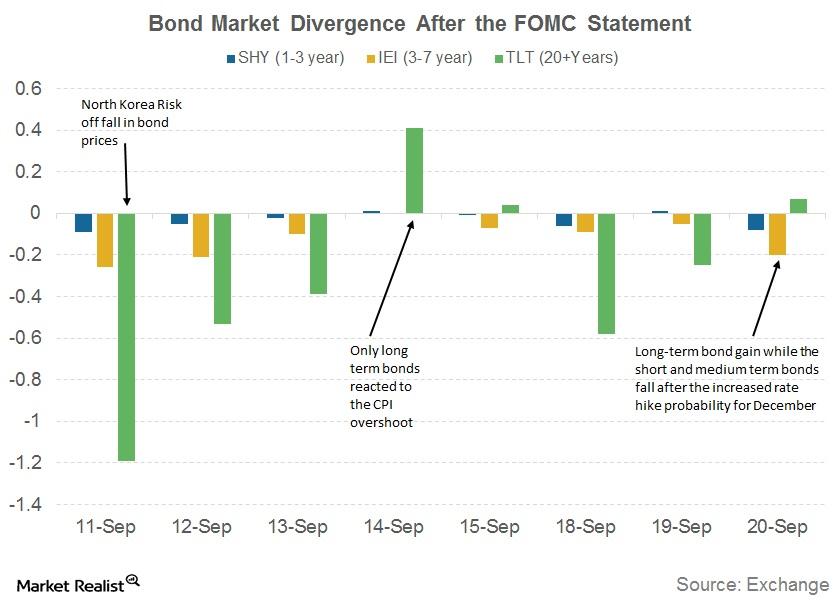

Could Rising Interest Rates Help the US Dollar?

Double dose of optimism for the US dollar The US dollar (UUP) was being written off before the beginning of September, as the Fed was expected to stay on hold and other major central banks were expected to start policy normalization. However, the Fed had a surprise in store for the market. The FOMC’s (Federal Open […]

Would Markets Be Prepared for a Central Bank Surprise?

Three central banks on a path to tightening After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted […]

How Credit Spreads May React to the Fed’s September Statement

Another rate hike in 2017 The FOMC’s (Federal Open Market Committee) meeting on September 20 changed the outlook for bond markets (BND). It suggested that the Fed could be looking at another rate hike by the end of this year, along with a balance sheet unwinding program. Gains in August inflation (TIP) boosted Fed members’ […]

Why Maturity Bonds Reacted Differently to the Fed’s September Statement

The Fed’s balance sheet has $4.4 trillion in bond market securities, and it intends not to reinvest a small portion of the maturing securities every month.