Tax Cuts and Rate Hikes Could Impact the Fed

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s stance.

Dec. 6 2017, Updated 1:50 p.m. ET

Impact on bond markets

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s current stance. The Fed stated its intent to continue its monetary tightening path with a proposed rate hike this month and another three hikes in 2018. As a result, bond (BND) yields are poised to increase in the short term. With the prospect of tax cuts leading to an increased deficit, bond investors will likely demand higher yields for US debt in the future. If the tax cuts are implemented, they’re expected to increase savings and wages. The tax cuts could result in a higher rate of inflation (TIP) growth.

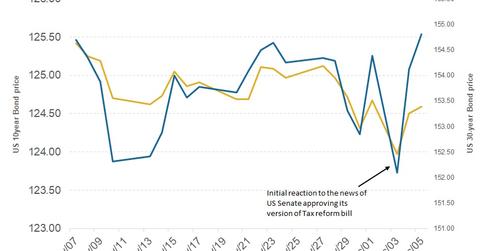

How did bond markets react?

Bond yields, especially in the short term, have increased in response to the heightened possibility of US tax reform. The immediate impact of the Senate passing the proposed tax bill was a bump in US Treasury bond yields, which have cooled off in the last two days. Tax cuts alone wouldn’t impact bond (AGG) yields. In the current economic climate, expected rate hikes and inflation (VTIP) growth would remain the key drivers for the bond (HYG) markets. In the long term, lower tax rates and the higher deficit could help make the yield (SHYG) curve steeper. The yield has been flattening since 2014. A flattening yield curve is considered to signal a future recession.

Tax cuts and the Fed

Tax cuts alone likely won’t sway the Fed from its current plans to tighten the policy. If the Trump Administration doesn’t unveil any additional stimulus plans, we can expect the US Fed to continue with its plans to increase interest rates. The only conditions that the Fed would be considering would be economic growth, employment, and inflation. Right now, we can expect one rate hike this month and three more next year.

In the next part of this series, we’ll analyze how tax cuts would impact equity markets.