iShares TIPS Bond

Latest iShares TIPS Bond News and Updates

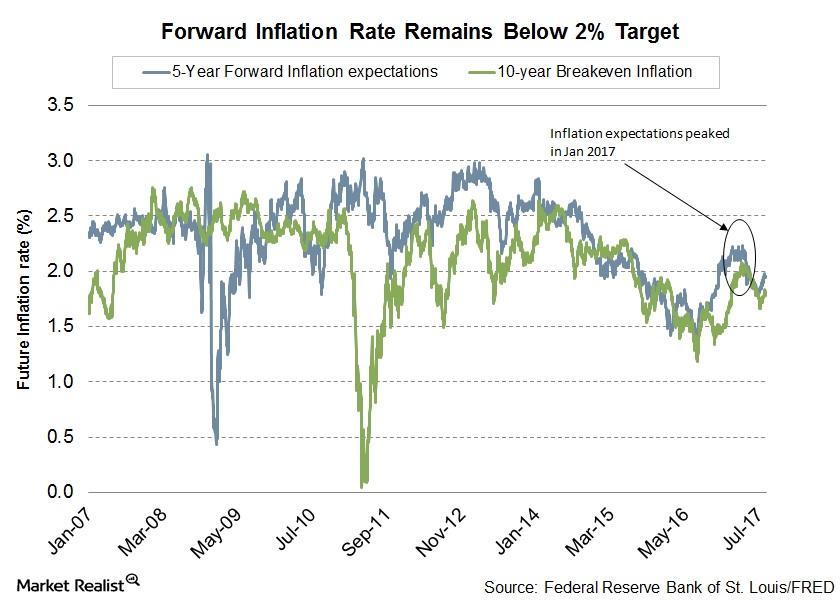

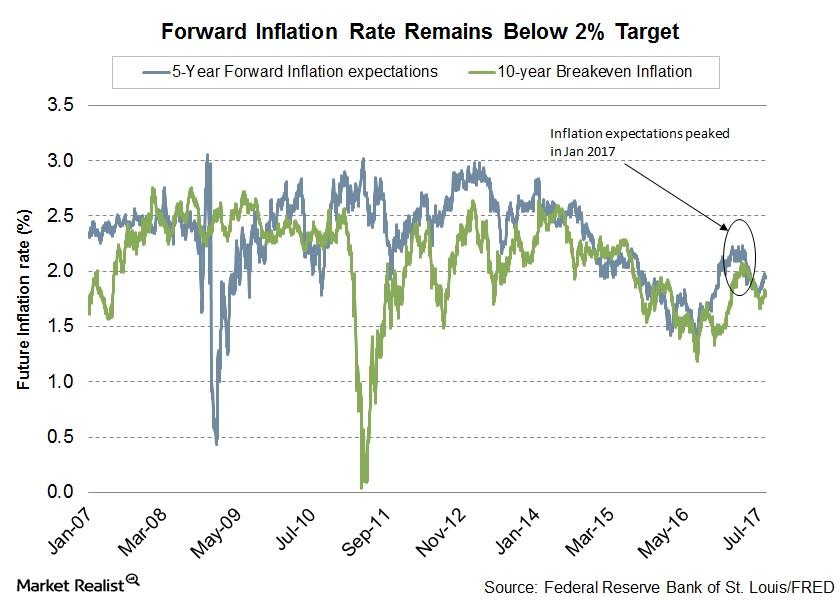

Do Markets Agree with Janet Yellen on Low Inflation?

In her post-meeting press conference, US Federal Reserve Chair Janet Yellen seemed less worried than expected about the current state of US inflation.

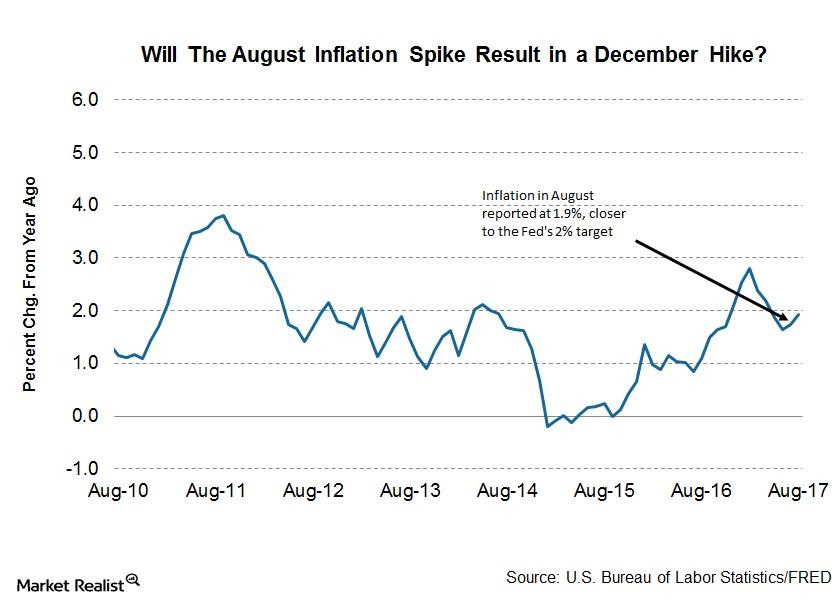

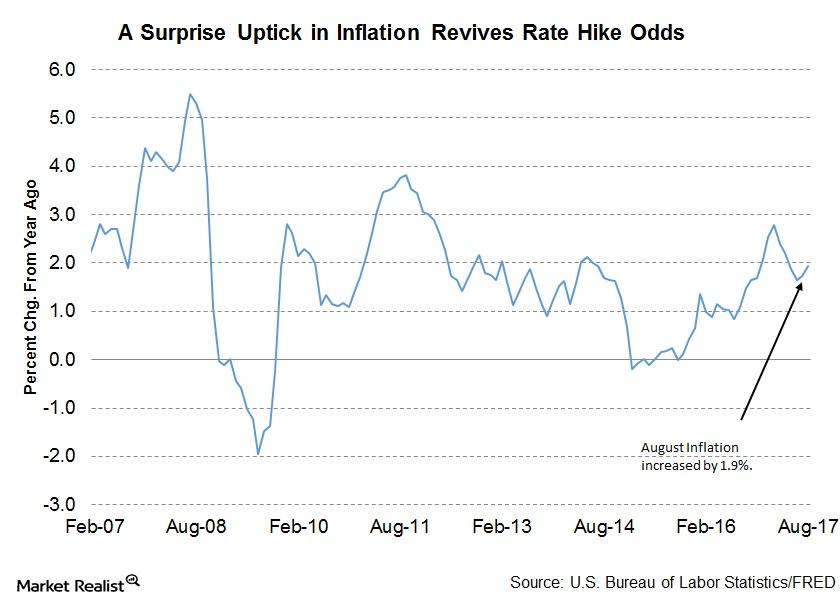

Is the Uptick in August Inflation Enough for a Fed Hike in December?

Slow US inflation growth has been a concern for the US Fed and was one of the key reasons that the Fed raised interest rates only twice in 2017.

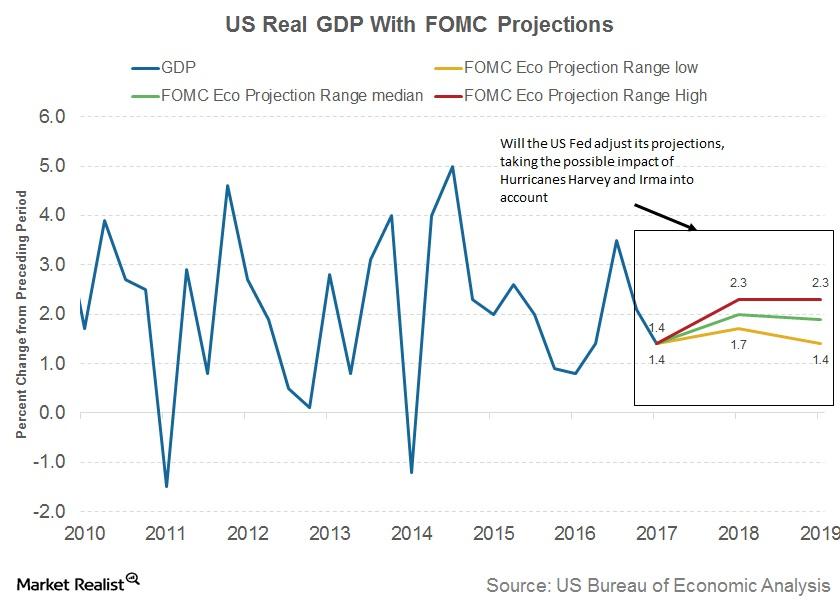

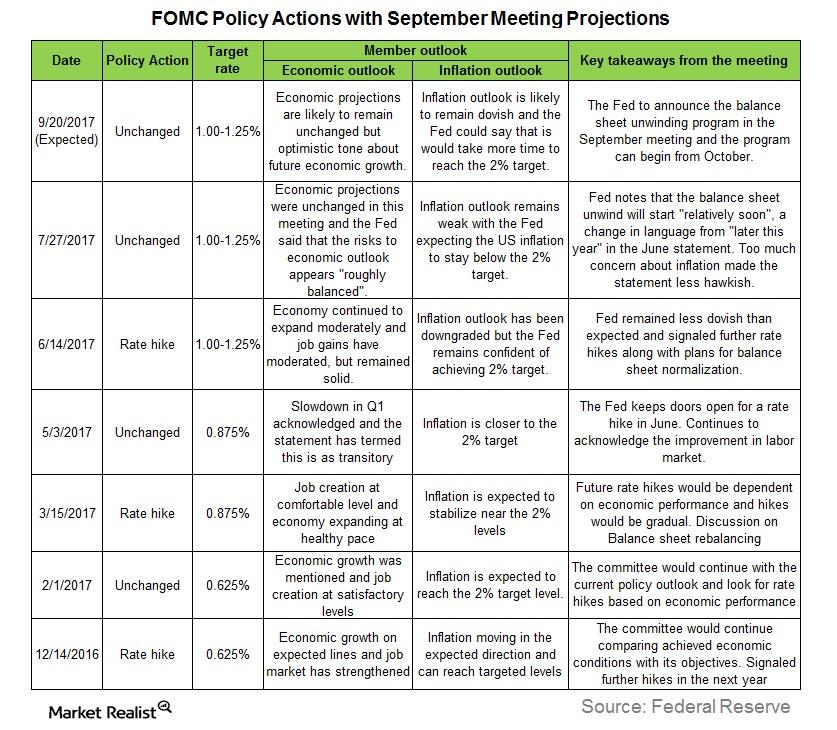

How Has the US Economy Fared since the Last FOMC Meeting?

Since the last FOMC meeting in July, economic conditions in the US have continued to improve.

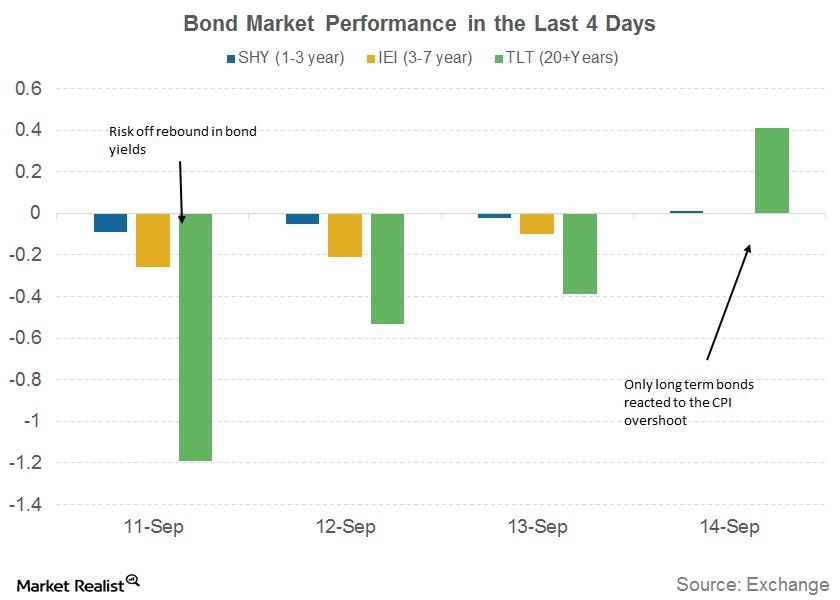

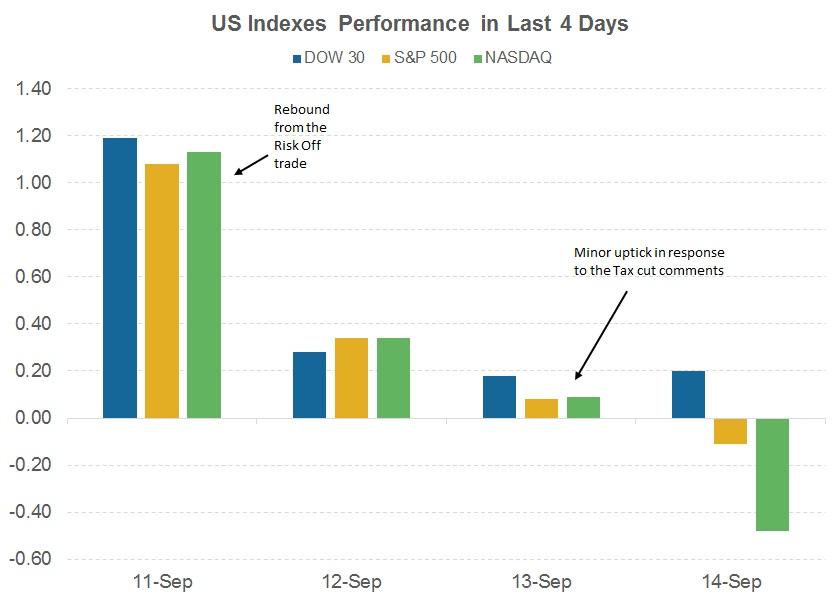

The Bond Market’s Reaction to New Rate Hike Hopes

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%.

Understanding the Ups and Downs of the US Dollar

The US dollar has been on a roller coaster ride over the last ten trading sessions. The US dollar (UUP) index hit a low of 90.99 on September 8.

Will the Sudden Rise in Inflation Change the US Fed’s Outlook?

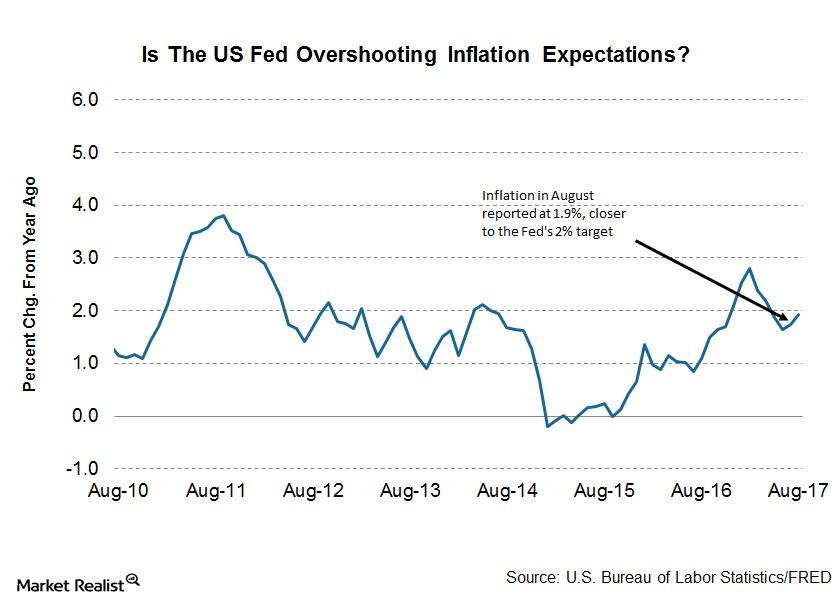

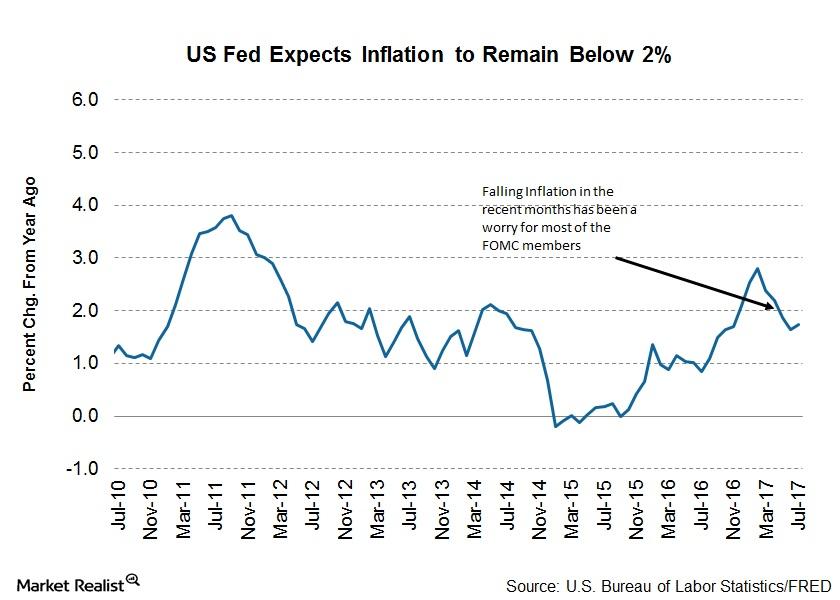

The consumer price inflation (CPI) data reported on Thursday indicated an increase of 0.4% in August. The year-over-year rate improved from 1.7% to 1.9% for August.

Could the Federal Reserve Surprise the Markets in September?

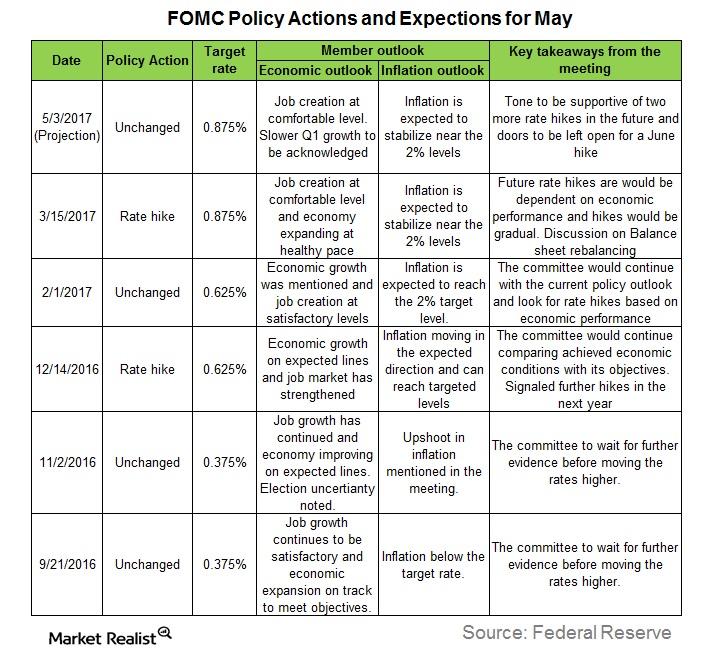

The US Federal Open Market Committee (or FOMC) is scheduled to meet on September 19 and 20 to discuss the current economic climate in the US and to decide whether any monetary policy adjustments are necessary.

Stanley Fisher’s Solution for Low Interest Rates

Stanley Fisher, vice chair of the U.S. Federal Reserve, has shared his views on low interest rates and some solutions to get rates back to normal levels.

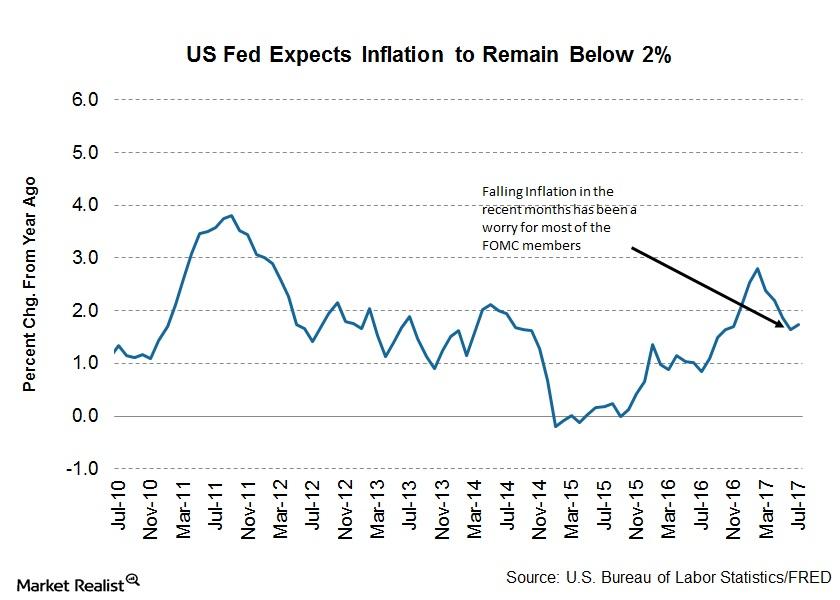

Here’s Why the US Inflation Rate Is Troubling the Fed

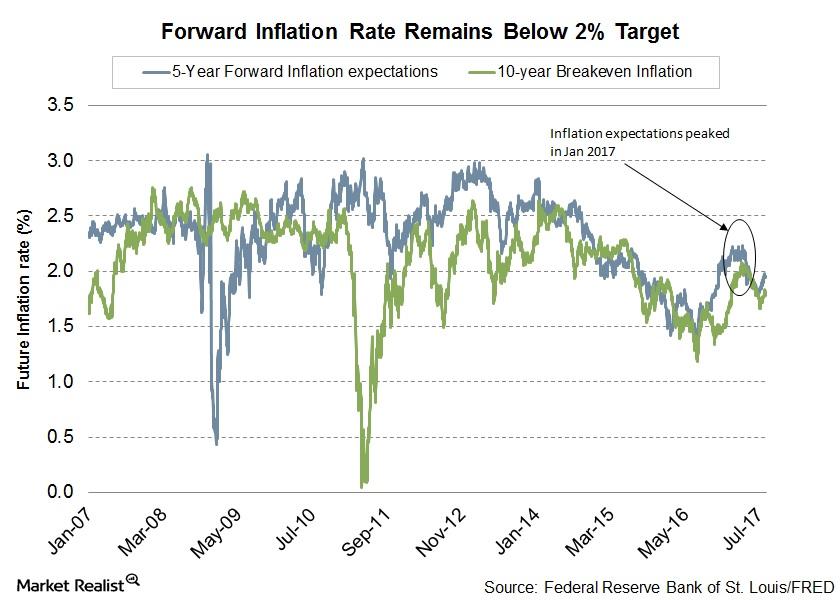

In its latest monetary policy statement, the Fed admitted it would take longer than expected for inflation to reach its 2.0% target.

What Financial Markets Predict for the US Economy

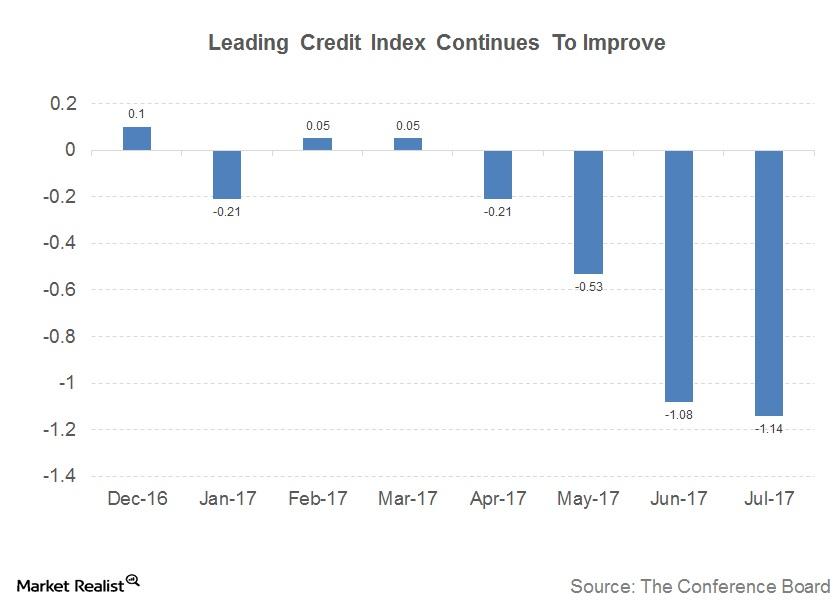

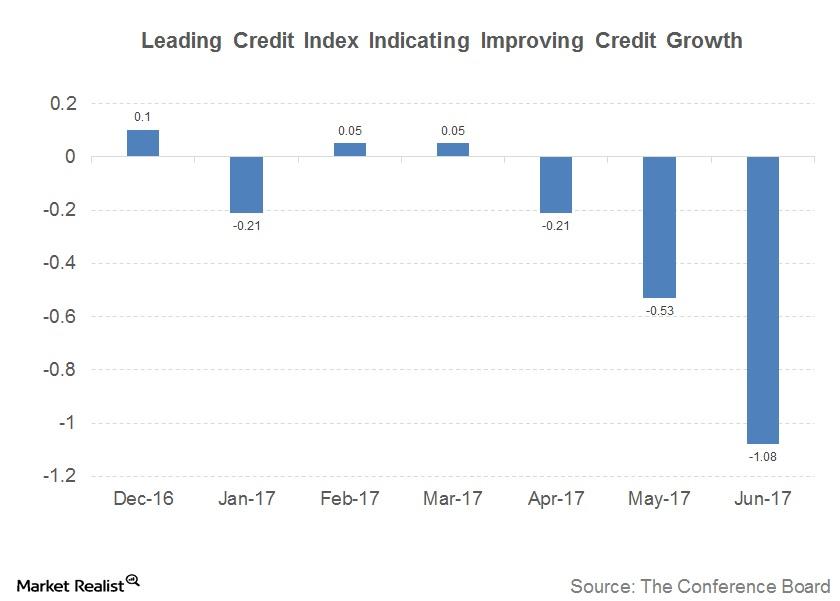

Understanding the Leading Credit Index The Conference Board Leading Credit Index (or LCI), which tracks lending conditions in the economy, is reported monthly. The index has six constituents: 2-Year Swap Spread (SHY) (real time) LIBOR[1.London Interbank Offered Rate] 3-month (SCHO) less 3-month Treasury-bill (VGSH) yield spread (real time) debit balances in margin accounts at broker dealers […]

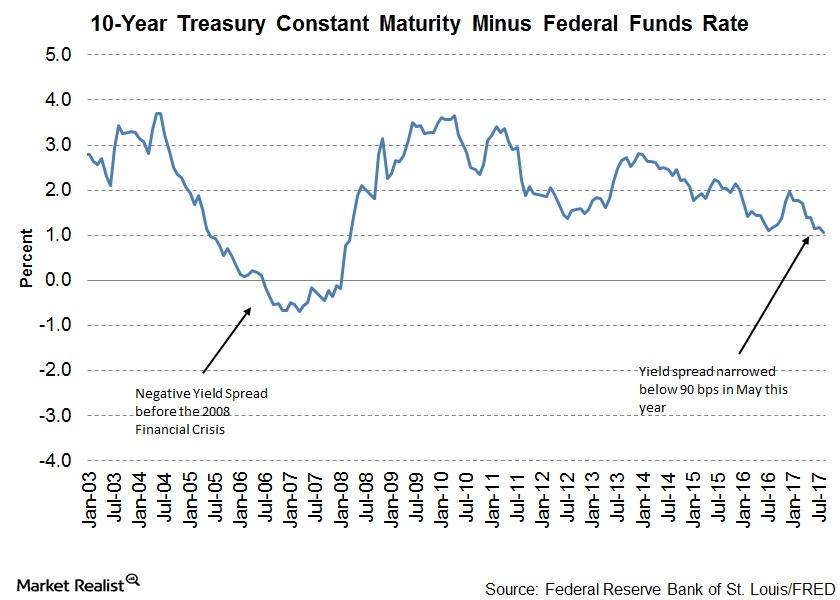

Why Interest Rate Spreads Are Growing

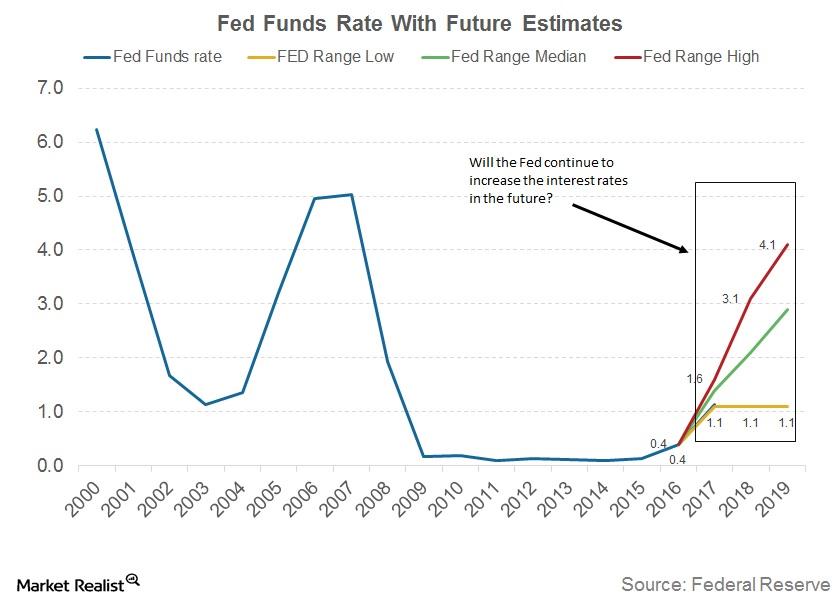

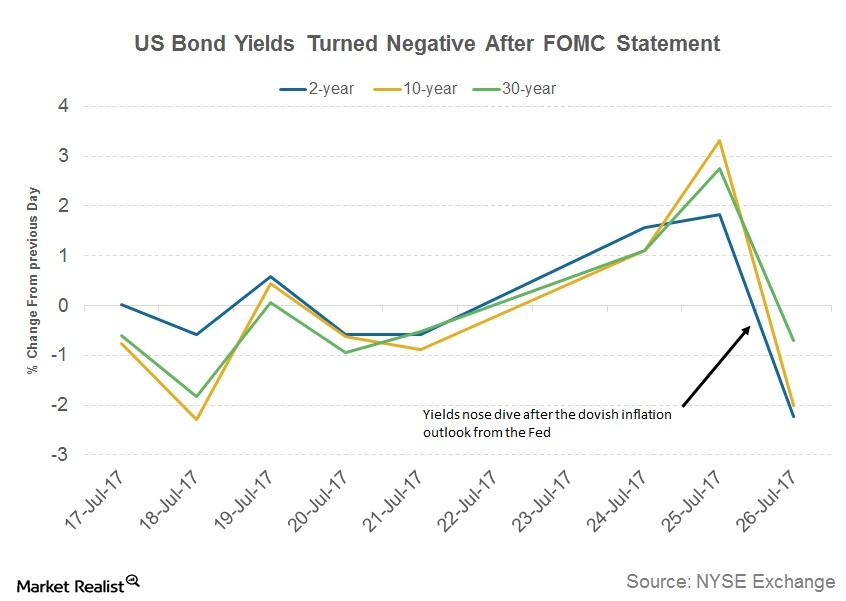

Reduced odds for another rate hike in 2017 Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction […]

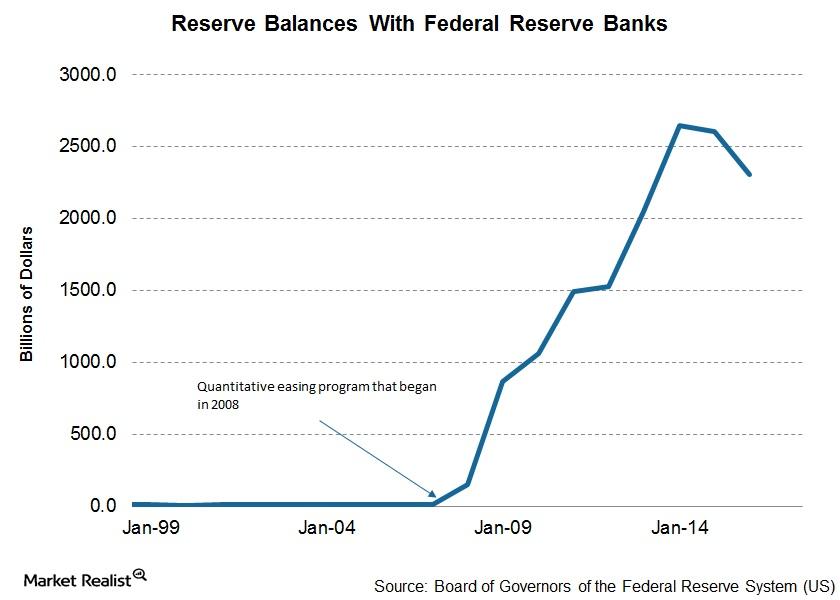

Will the Fed Repeat Its Taper Tantrum Mistakes?

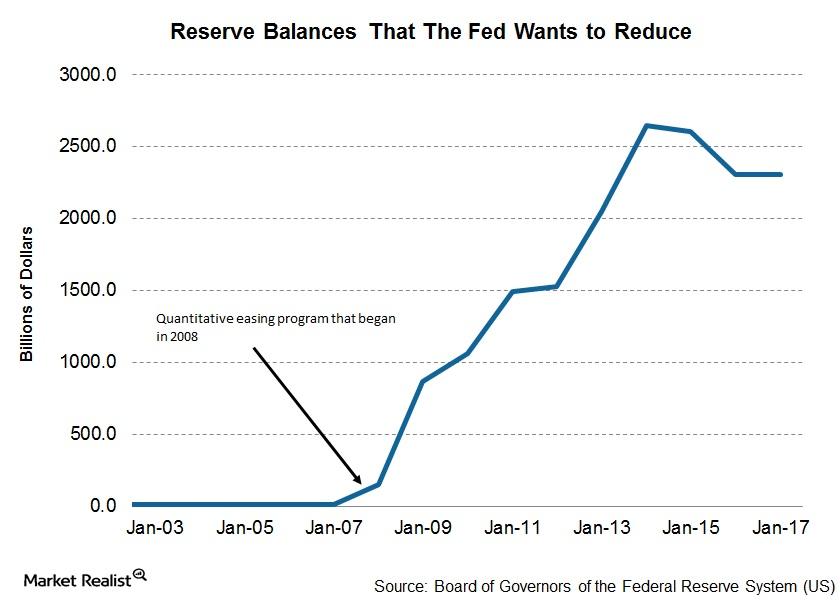

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening.

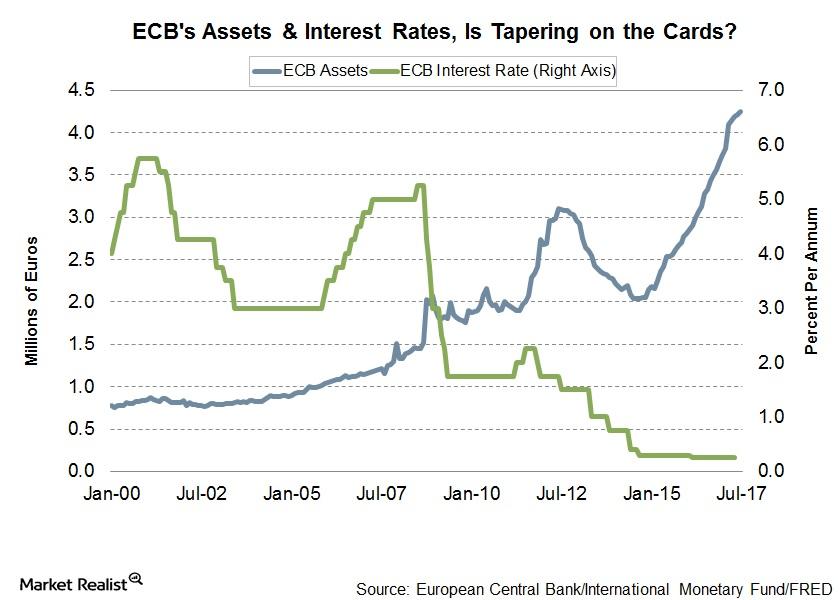

Will ECB’s Tightening Lead to Bond Market Sell-Off?

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

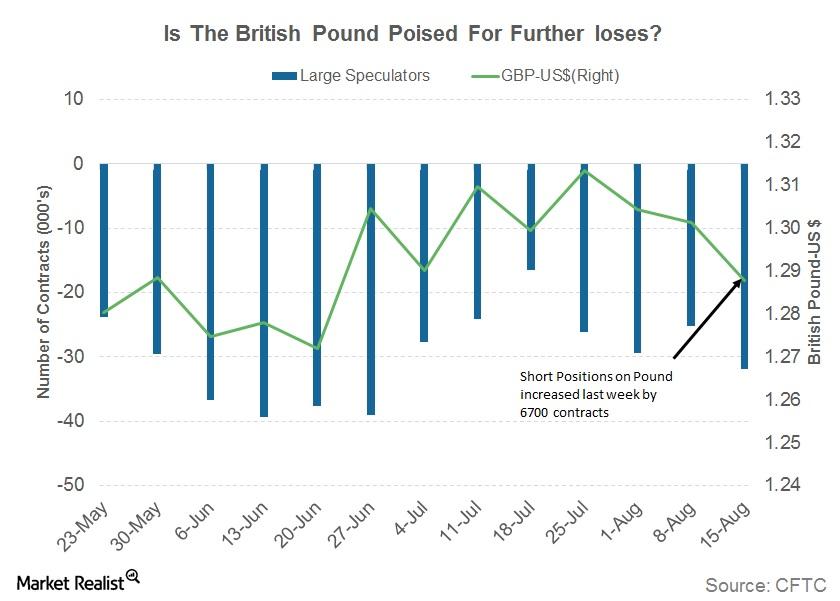

Here’s Why the British Pound Could Be Headed for Further Losses

The British pound (FXB) was one of the worst performers in the week ending August 18.

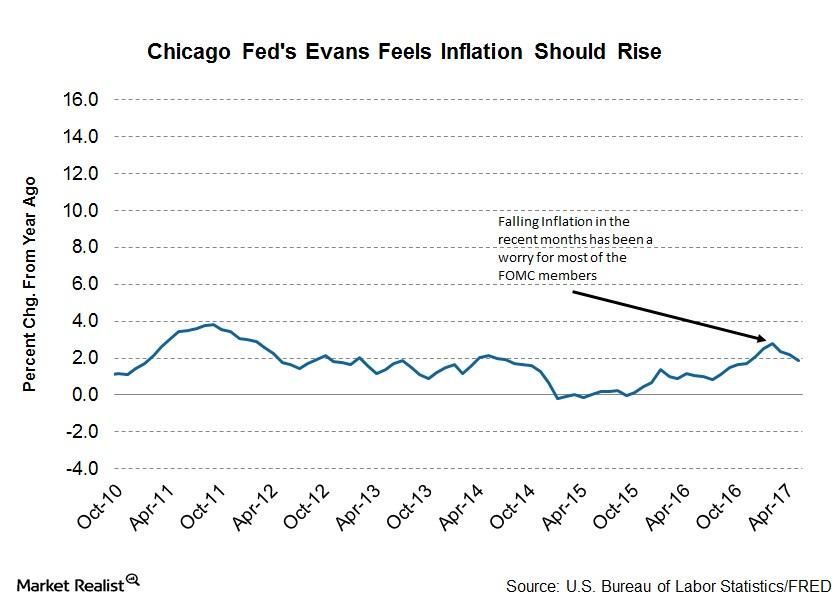

Why Inflation Remains a Huge Concern for FOMC Members

Members of the FOMC (Federal Open Market Committee) attributed the recent slowdown in inflation growth to idiosyncratic factors.

New York Fed President William Dudley Discussed Inflation

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

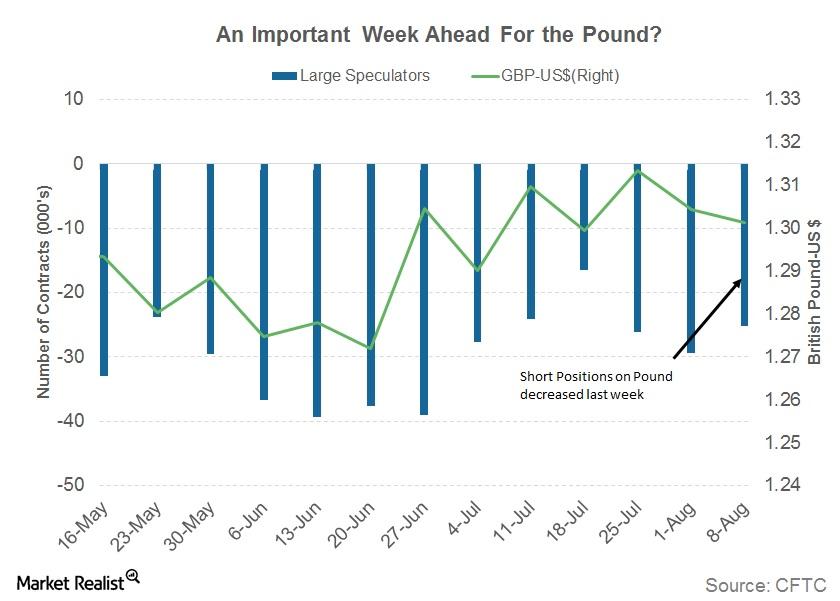

Why the British Pound Has an Important Week Ahead

The British pound (FXB) had another negative week as a dovish statement from the Bank of England continued to drag the currency lower.

Should We Be Worried about Greenspan’s Bond Market Warning?

Greenspan cites rapid inflation growth as the reason for a bond market collapse. But the markets and Fed officials think otherwise.

Why Bond Prices Rose after the FOMC’s Statement

US government bonds gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

What the Conference Board LEI Tells Us about the Market

The Leading Credit Index is one of the constituents of The Conference Board Leading Economic Index (or LEI), which is reported by The Conference Board on a monthly basis.

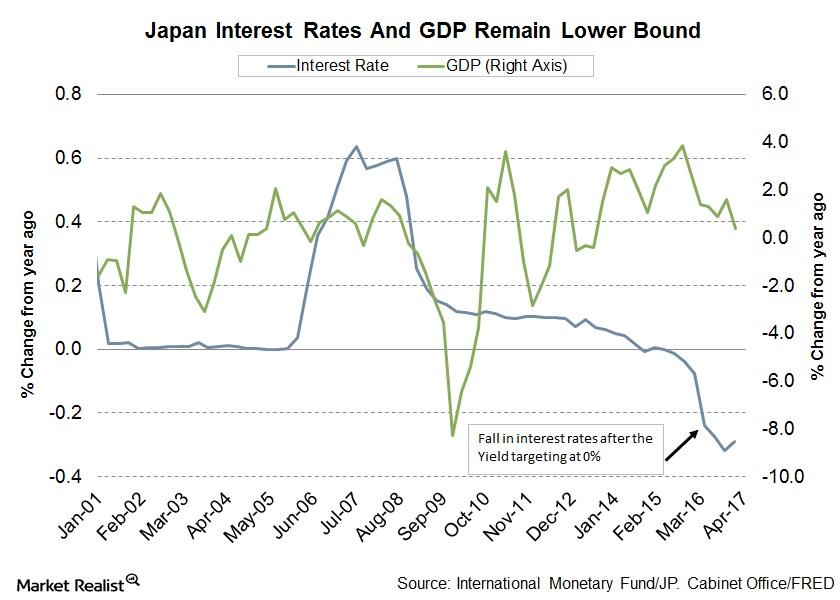

The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.

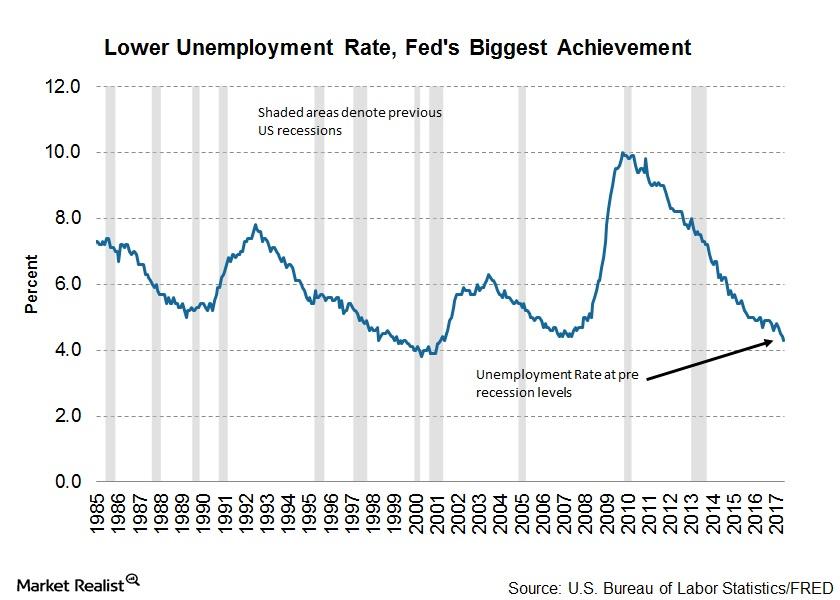

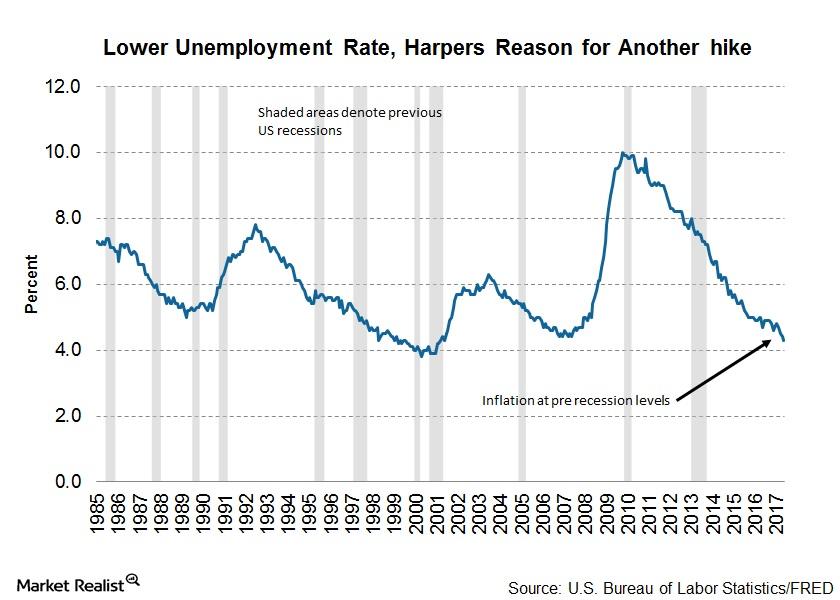

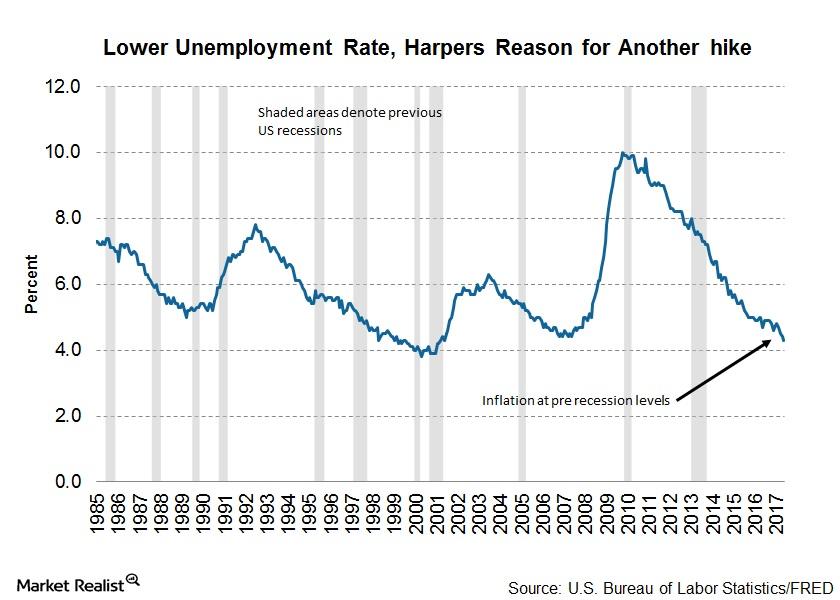

Why the Fed Isn’t Satisfied with Labor Market Conditions

Despite the strong growth in employment numbers, the Fed’s latest monetary policy report had some comments about slow wage growth.

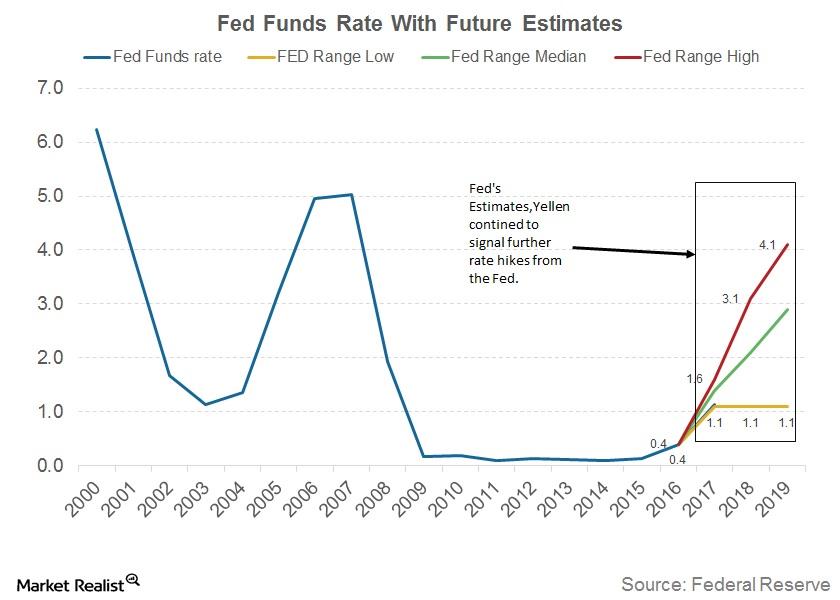

Why Fed’s Yellen Feels Gradual Rate Hikes Are Warranted

The tone of Yellen’s responses before the committee confirmed that the Fed is set to stay its course on monetary tightening, leading to policy normalization.

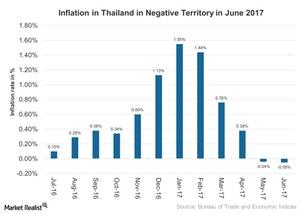

Is Negative Inflation Suggesting Contraction in Thailand in 2017?

Thailand’s (EEM) inflation in June 2017 exceeded the market estimate of a 0.1% drop.

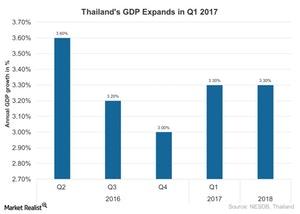

Will Thailand Continue Its Economic Expansion in 2Q17?

Thailand saw impressive growth in 1Q17 due in part to external demand and public investment. Its GDP rose 3.3% in 1Q17 as compared to a 3% rise in 4Q16.

Why Minneapolis’s Fed President Voted Against a Rate Hike

In an essay published by Minneapolis’s Federal Reserve president, Neel Kashkari, after he voted against a rate hike in the Federal Open Market Committee’s (or FOMC) June 2017 meeting, he explained why he dissented.

Why Philadelphia’s Fed President Supports Another Rate Hike

In a recent interview with The Financial Times, the hawkish president of the Philadelphia Federal Reserve said that the Fed’s balance sheet’s unwinding could begin in September 2017.

Why Chicago’s Evans Sees Moderate Risks to Financial Stability

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.

St. Louis’s Bullard Thinks Rebalancing Will Take 5 Years

At the Illinois Bankers Association’s annual conference in Nashville, organized on June 23, 2017, St. Louis’s Federal Reserve president, James Bullard, sounded dovish about the US economy.

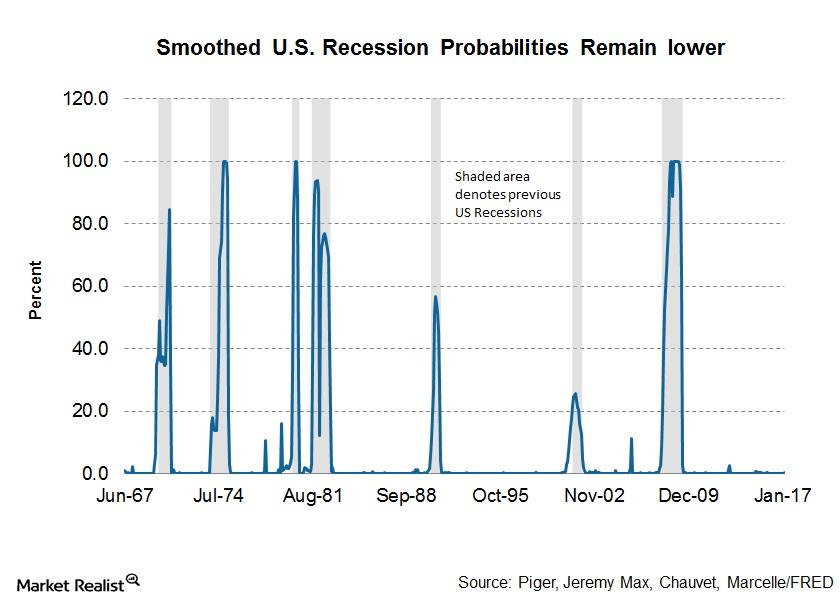

Why Cleveland’s Fed President Worries about Another Recession

Loretta J. Mester, the president and CEO of the Cleveland Federal Reserve, spoke at the 2017 Policy Summit on Housing, Human Capital, and Inequality held on June 23, 2017.

Unpacking the Fed’s Outlook on the US Market

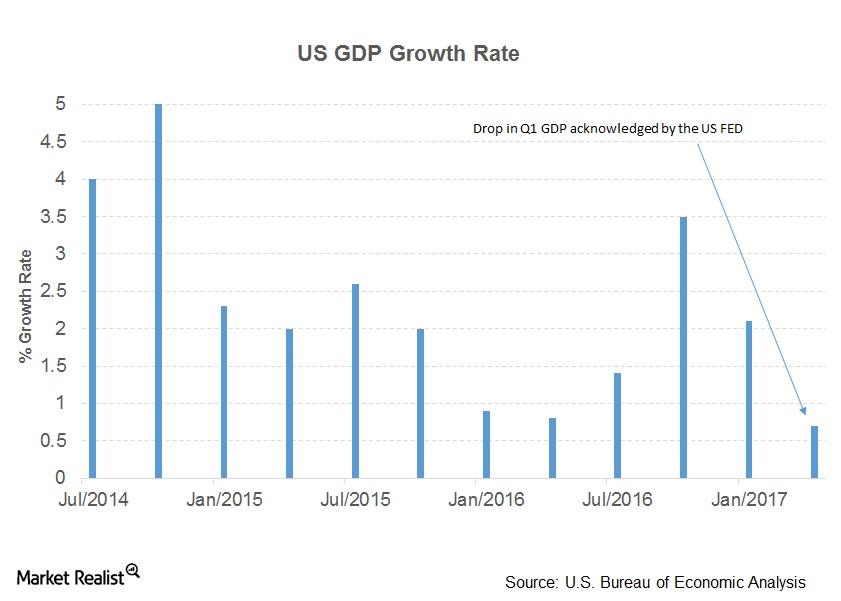

In its May statement, the Fed seems to have gone the extra mile to explain the slowdown in the first quarter.

Will the FOMC Remain Hawkish?

In its last meeting in March, the Fed increased interest rates (SCHZ) by 0.25% and sounded hawkish about the US economy.

Your Update on the FOMC March Meeting Minutes

The minutes from the FOMC meeting on March 14 and 15 were reported on April 5 and revealed the tone of the conversation among members to be hawkish.

Will Treasury Inflation-Protected Securities Be a Game-Changer?

According to Bloomberg, Treasury Inflation-Protected Securities (or TIPS) have generated a year-to-date return of 6.3% compared to 4.7% by the broad Treasury market.

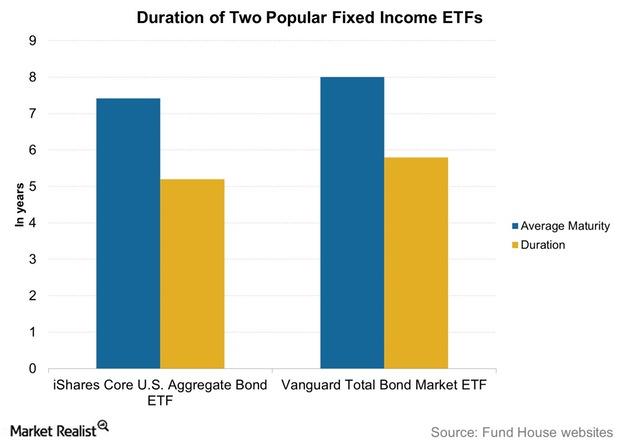

How Holding Duration Is Risky during Rising Inflation

Moving on to the fixed income space, the Janus team sees holding duration in portfolios as a risk.

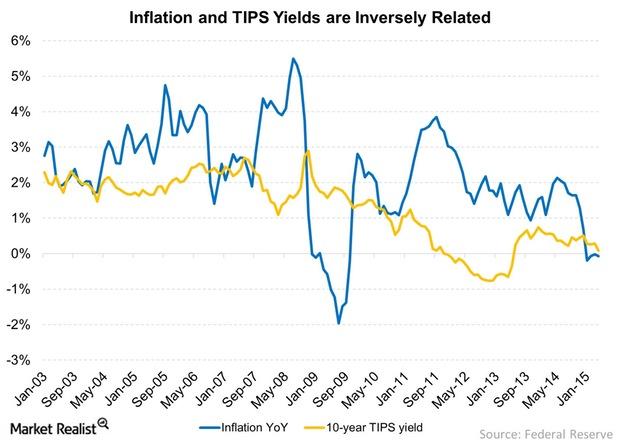

The Relationship between TIPS and the Break-Even Rate

Between Jan 2014 and September 2015, the break-even rate was higher than the CPI inflation rate, as markets were surprised by the sudden dip in oil (USO) prices.

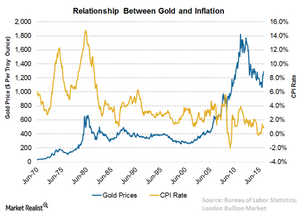

How Inflation Expectations Affect Gold Prices

In the 1990s and 2000s, when gold prices tracked inflation, although the correlation seems to be a bit weak compared to the 1970s and 1980s.

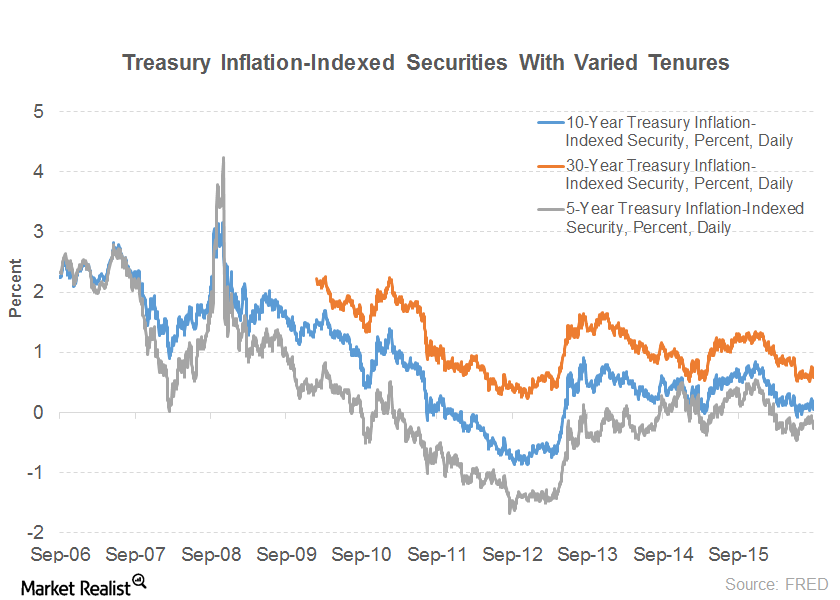

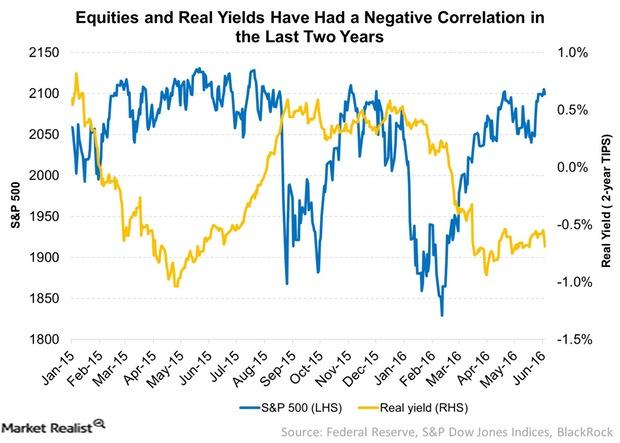

How Rising Real Yields Could Affect Equities

Since the start of 2015, the S&P 500 and real yields have had a high negative correlation. Falling real yields have encouraged investors to take more risk in search of higher returns.

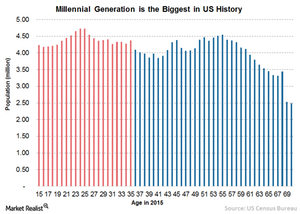

Why Millennials Are Often Called ‘the Unluckiest Generation’

A population of 80 million strong in the U.S., millennials – those born between 1980 and 1999 – are breaking with tradition.

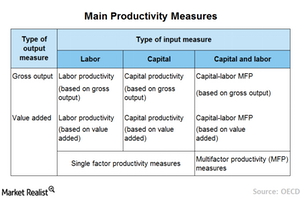

What Are the Traditional Measures of Labor Productivity?

Labor productivity is an important tool to measure the strength of a country’s economy. Policymakers often use this indicator to compare output efficiency during a particular period.

The Impact of Rising Interest Rates on TIPS

With interest rates likely to go up by the end of the year, TIPS with shorter maturities look more attractive.