Why Chicago’s Evans Sees Moderate Risks to Financial Stability

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.

June 29 2017, Updated 7:45 a.m. ET

Moderate risks, but nothing to worry about

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment. He’s also discussed inflation, interest rates, and the Fed’s balance sheet with The Wall Street Journal.

According to the transcript of his speech, Evans currently sees moderate risks to financial stability, but his concerns don’t spring from the idea of keeping interest rates low for an extended period. Evans noted that US economic growth (AGG) was backed by strong fundamentals, and he predicted a 3% rise in GDP in the short term. Evans persisted with his dovish sentiment despite his view that the United States is close to its natural level of employment.

Evans feels that inflation should rise

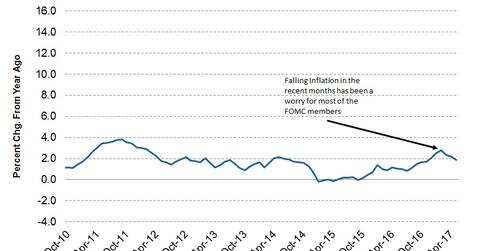

One concern Evans has about the US economy is the recent fall in its inflation. According to Evans, inflation (TIP) needs to rise, and the Fed shouldn’t place a cap of 2% on the inflation rate (VTIP).

Evans isn’t certain about the timing of the next rate hike this year, as he feels that the global inflation (SCHP) outlook remains weak and could lead to a slower path of rate hikes (BND). Such a thought process makes sense, as a lower level of inflation doesn’t warrant an aggressive tightening policy from the Fed.

Regulatory bodies should step up enforcement

Evans pointed out that if regulatory bodies remained vigilant and delivered on their responsibilities, the Fed wouldn’t have to step in and repair damage to the economy. Regulatory oversight could lead to financial uncertainty, and this was one of Evan’s concerns.

In the next part of this series, we’ll see why Philadelphia’s Fed president sees two more rate hikes on the horizon.