Why Bond Prices Rose after the FOMC’s Statement

US government bonds gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

July 31 2017, Updated 7:37 a.m. ET

Bond markets rebound as Fed turns dovish

US government bonds (GOVT) gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

The Fed also confirmed that balance sheet normalization would begin soon, prompting market participants to speculate that an announcement could be made as early as September 2017, when the FOMC members meet again.

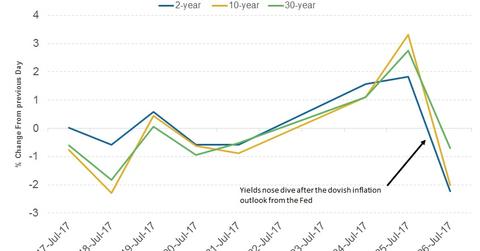

The Fed’s dovish tone with respect to inflation (TIP) led bond market (BND) traders to believe that there could be a delay in the next rate hike. This sparked a rally in the bond markets, with yields dropping along the curve.

Bond market reaction to FOMC

Yields all along the curve trended lower after the dovish outlook on inflation from the US Federal Reserve. Two-year yields closed at 1.4, a fall of 27 basis points from the previous day’s close, and ten- (VGIT) and 30-year yields (TLT) closed at 2.3 and 2.9, falls of 40 basis points and 17 basis points, respectively.

What’s next for the bond markets?

This month’s FOMC statement is a temporary relief for the bond markets. Going forward, the Fed is likely to continue on its path toward normalization, provided there are no major negative shocks in the US economy.

Rate hikes could be delayed once balance sheet normalization begins (balance sheet trimming is also a form of tightening), but as the economy continues to improve, bond markets will have to bear the brunt of rate hikes.

In the next part of this series, we’ll analyze the currency market’s reaction to the FOMC’s July statement.