Why Interest Rate Spreads Are Growing

Reduced odds for another rate hike in 2017 Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction […]

Aug. 25 2017, Published 5:03 p.m. ET

Reduced odds for another rate hike in 2017

Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction program, and markets (BND) expect an announcement to be made at the September meeting. This exercise has been clearly communicated by the Fed and it is unlikely to have any major effect on bond markets (AGG).

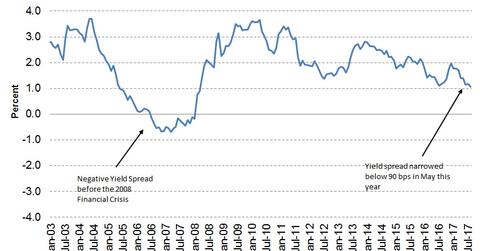

Yield spreads

The Conference Board Leading Economic Index (or LEI) uses the spread between the federal funds and ten-year Treasury bonds (IEF) rates as a constituent of its economic model. According to the August LEI report, the spread between the ten-year bond (TBF) and leading rate was 1.17, compared with 1.15 the month prior.

This increase in the spread was the first in seven months. The net contribution of this yield spread to the LEI remained at 13% in August.

How does this spread affect the LEI?

A yield spread closer to zero is a negative sign for the economy. Keeping the credit spread constant, a narrowing yield spread means negative interest rate expectations. Negative interest rates are only expected in times of economic recession.