ProShares Short 20+ Year Treasury

Latest ProShares Short 20+ Year Treasury News and Updates

Technology & Communications Exposure to junk bonds: How much should you hedge?

Junk bonds are high yield bonds issued by below–investment grade corporations. Due to the low ratings and high risk of default attached to these bonds, they’re popularly called “junk bonds.”Financials Why do floating rate notes, or FRNs, differ from regular bonds?

The U.S. Treasury Department’s latest issue on January 29, the floating rate note (or FRN) will fulfill two investor needs: participating in anticipated future interest rates increases and protecting principal against default.Financials Why investors should look at floating rate notes as an option

On January 29, 2014, the U.S. Treasury Department issued a new class of security: the floating rate note (or FRN). This is the first new security introduced by the Treasury since 1997.Financials Fixed income ETFs: The longer the duration, the higher the loss

The higher the expense ratio, the deeper the decline in an investment’s value. Also, the higher the period of investment, the greater the impact of expense ratios due to the compounding effect.Financials Why do floating rate notes, or FRNs, differ from leveraged loans?

FRNs are usually issued in capital markets, whereas leveraged loans are arranged by commercial and investment banks. While FRNs are typically unsecured and investment-grade, leveraged loans are secured.

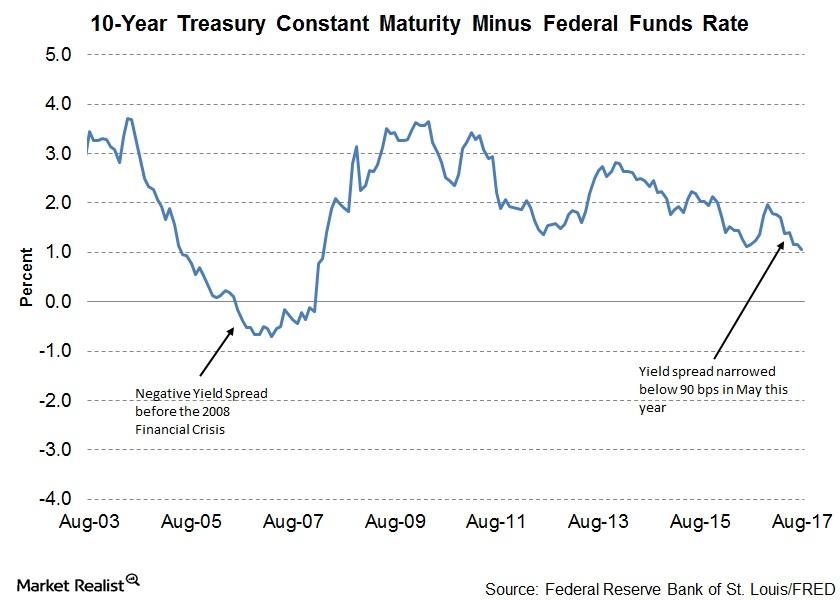

Analyzing the Yield Curve’s Ongoing Flatness

A December rate hike and a flattening yield curve The Fed rolled out another rate hike at its final meeting of 2017. The target range for the federal funds rate was increased by 0.25% to 1.25%–1.50%, and the Fed has signaled three more rate hikes in 2018. Two members dissented to the rate hike due to lower […]

Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

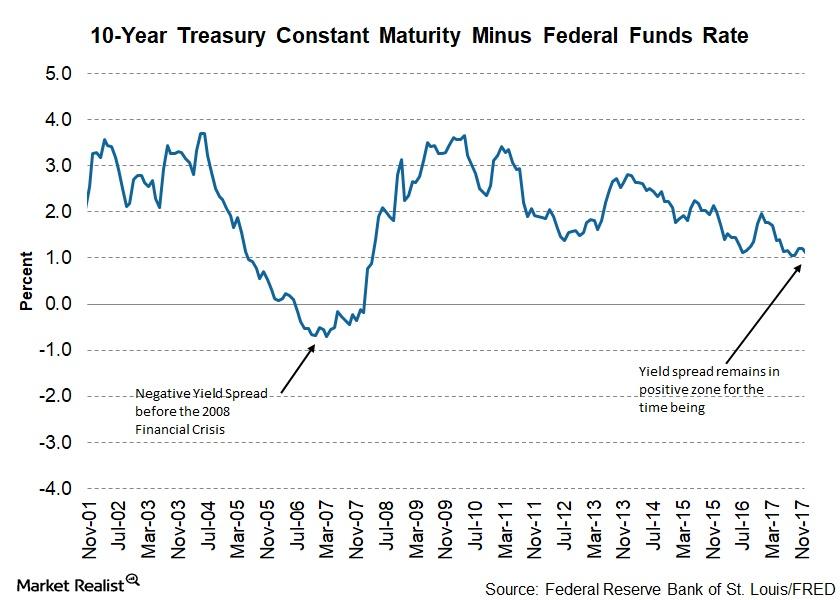

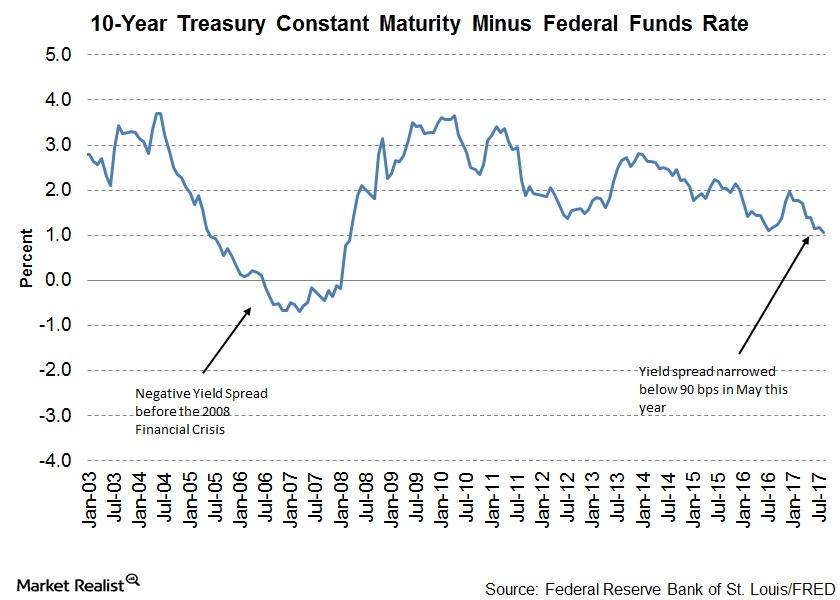

Are Declining Yield Spread Worries Done for Now?

At the last FOMC (Federal Open Market Committee) meeting on September 20, 2017, Fed members decided to initiate a balance sheet normalization process starting in October.

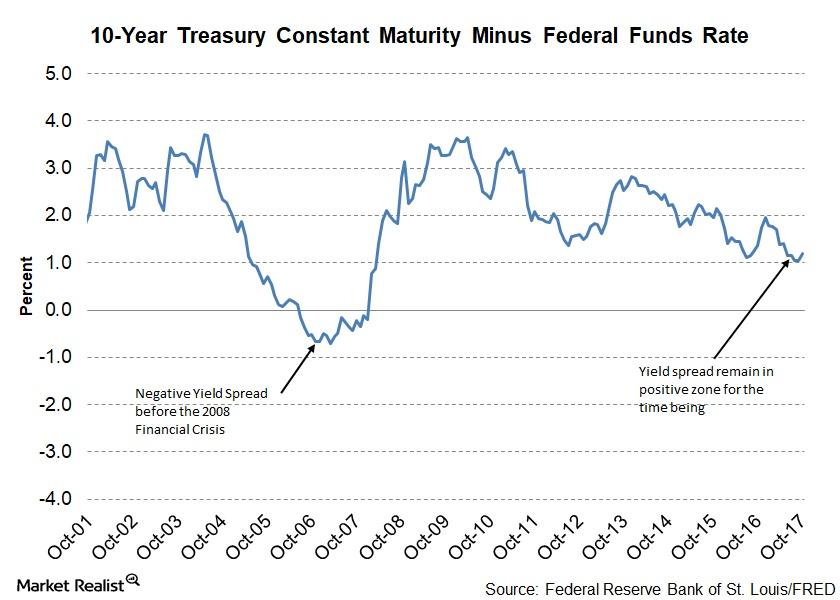

How Credit Spreads May React to the Fed’s September Statement

Another rate hike in 2017 The FOMC’s (Federal Open Market Committee) meeting on September 20 changed the outlook for bond markets (BND). It suggested that the Fed could be looking at another rate hike by the end of this year, along with a balance sheet unwinding program. Gains in August inflation (TIP) boosted Fed members’ […]

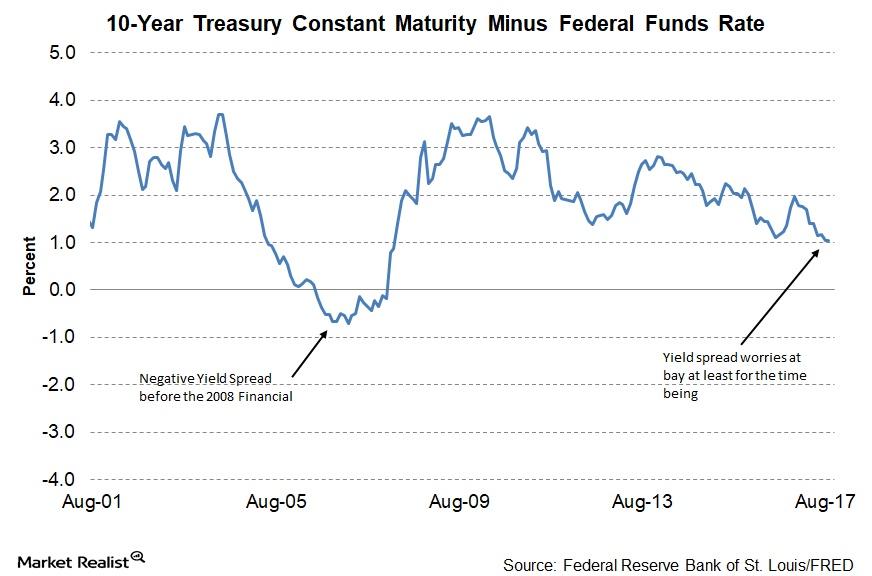

Why Interest Rate Spreads Are Growing

Reduced odds for another rate hike in 2017 Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction […]

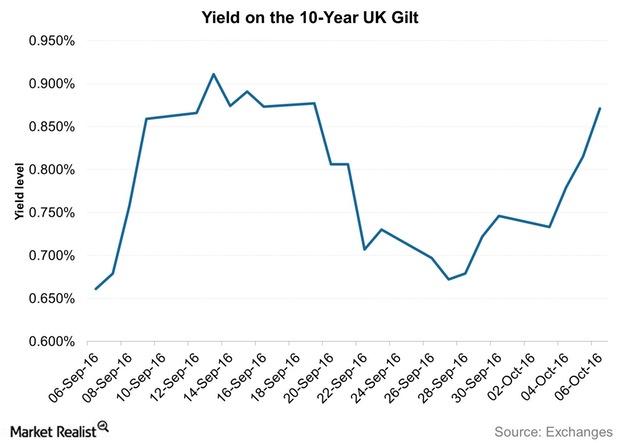

Should You Short European Bonds due to Taper Talks?

Like their equity peers, bonds can be short-sold as well. You can do it by either shorting an ETF or investing in an inverse ETF.