Fed’s November Beige Book and Restrained Hiring Plans

The inability of employers to find suitable workers is leading to wage increases, especially in the professional, technical (XLK), and production (XLI) sectors.

Dec. 5 2017, Updated 7:33 a.m. ET

Fed’s observation on employment

The Federal Reserve’s Beige Book before the December 12–13, 2017, meeting was released on November 29, 2017. The report is released two weeks before the FOMC (Federal Open Market Committee) meeting and contains anecdotal information about economic conditions in the 12 Federal Reserve districts. The Beige Book reported that employment growth in the United States has improved since the last report, with the 12 districts reporting moderate employment growth. Some companies reported difficulty finding qualified workers across all skill levels, which was the key reason they were holding back on their hiring plans.

Skill shortage could lead to higher wages

The inability of employers to find suitable workers is leading to wage increases, especially in the professional, technical (XLK), and production (XLI) sectors. Although wage growth in the report was modest, a continued shortage of workers could lead to higher wages and increased non-compensation-based benefits in the future. The latest reading for average hourly earnings remained unchanged in October, but the Fed expects this economic indicator to improve as employers are likely to increase wages to attract workers.

Implications for the December FOMC meeting

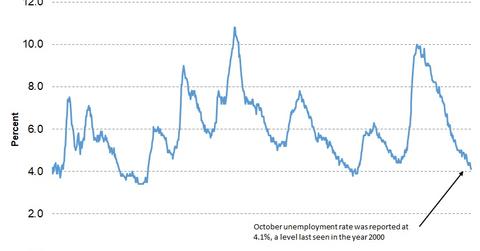

Employment numbers haven’t been a concern for the Fed in recent months. The unemployment rate has been steadily falling with the November rate at 4.1%. Non-farm payrolls have also bounced back and are above the long-term average of 250,000 jobs per month. To summarize, the employment market is not likely to keep the Fed from raising the interest (AGG) rate in December.

In the next part of this series, we’ll analyze the Fed’s outlook on prices and inflation (TIP) and see if low inflation (VTIP) growth could stop the Fed from increasing rates in its next meeting.