BTC iShares 7-10 Year Treasury Bond ETF

Latest BTC iShares 7-10 Year Treasury Bond ETF News and Updates

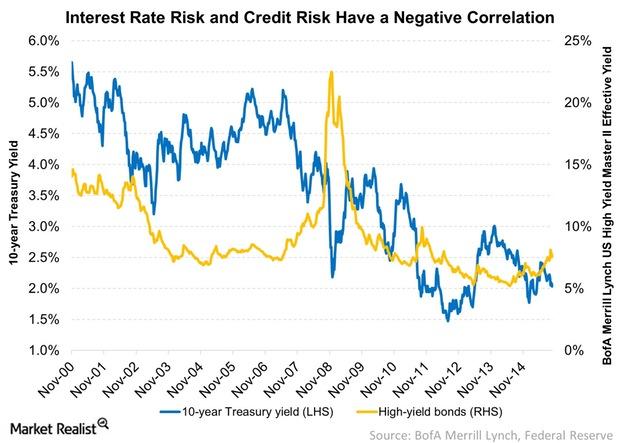

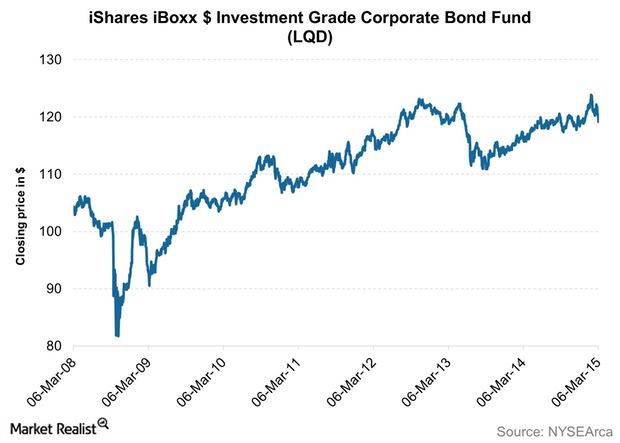

Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

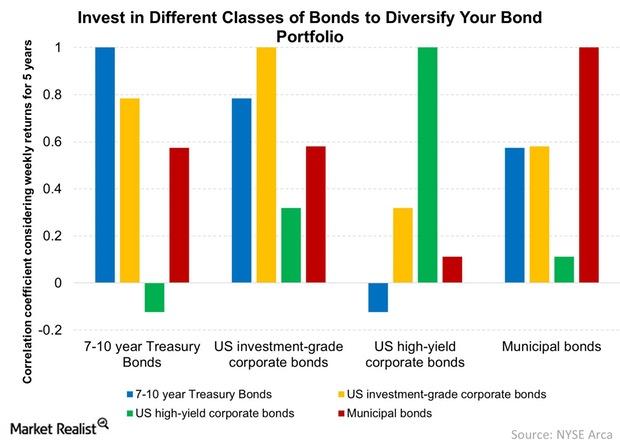

Own Bonds across Credit Quality to Diversify Your Portfolio

Adding bonds across credit classes helps diversify your bond portfolio. The weight of each category depends on your risk appetite and the business cycle.

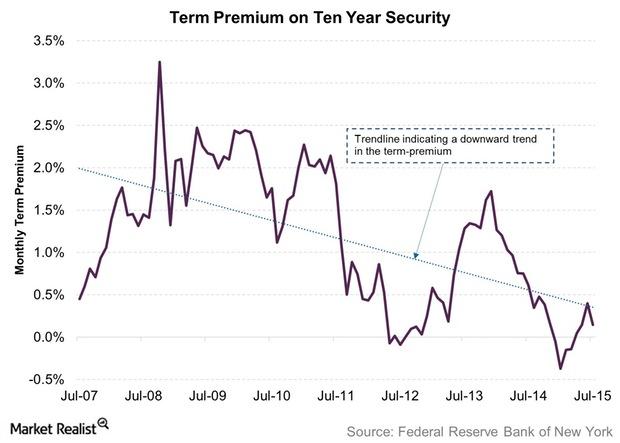

What Does US Term Premium Indicate?

Over an eight-year period, the term premium on a ten-year US security rose to 3.25% in October 2008. It saw a low of -0.37% in January 2015.

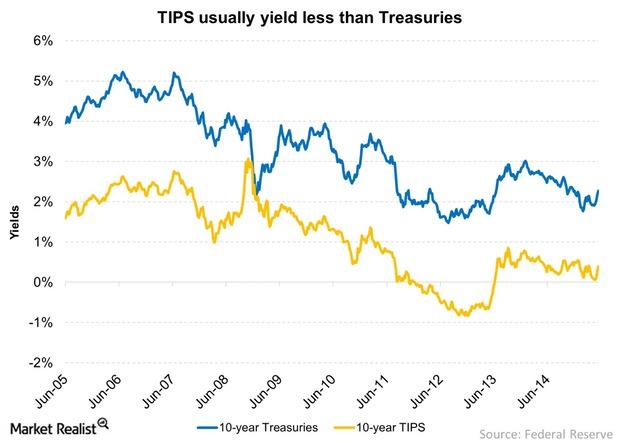

Comparing Treasury Inflation-Protected Securities and Treasuries

Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

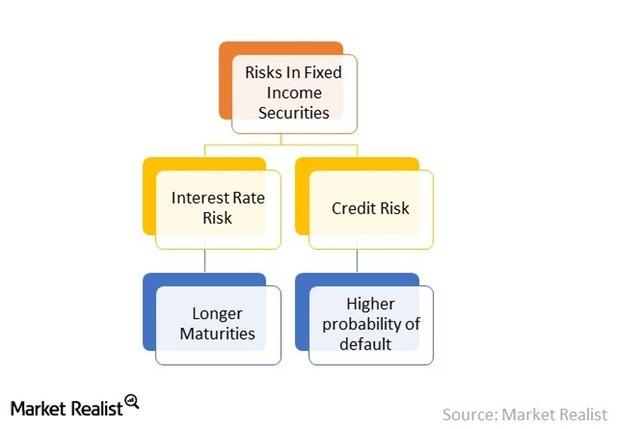

The Must-Know Risks of Fixed Income Investing

There are no free lunches. The risks involved in fixed income investing are two-fold.

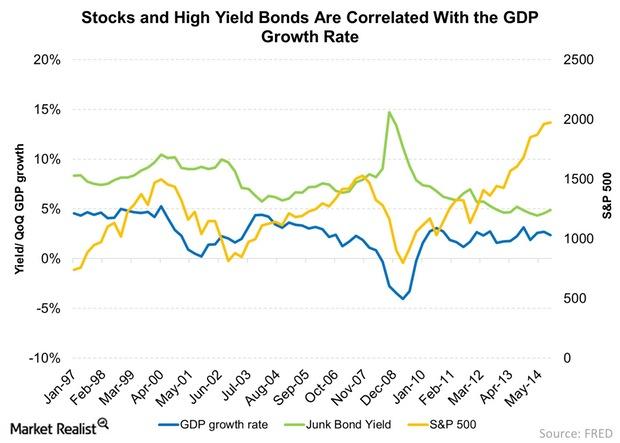

Why Corporate Bonds Correlate to Stocks

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits.

What are investment-grade bonds?

Investment-grade bonds are both U.S. Treasuries issued by the U.S. Treasury Department and corporate bonds issued by high-quality corporate borrowers.

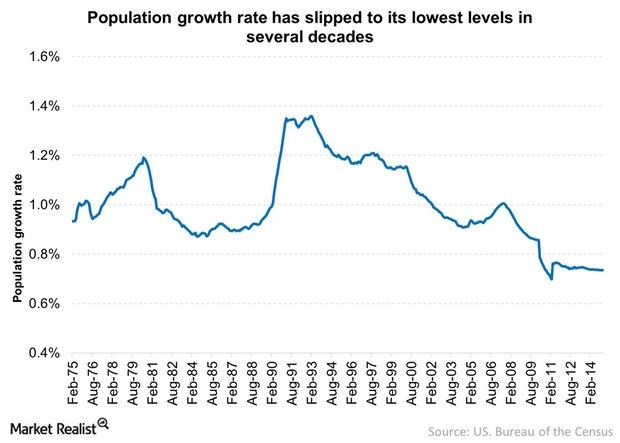

Job Creation Isn’t Matching Population Growth

Job creation isn’t matching population growth. The population growth has been dipping over the last two decades. Currently, it’s 0.7% per year.

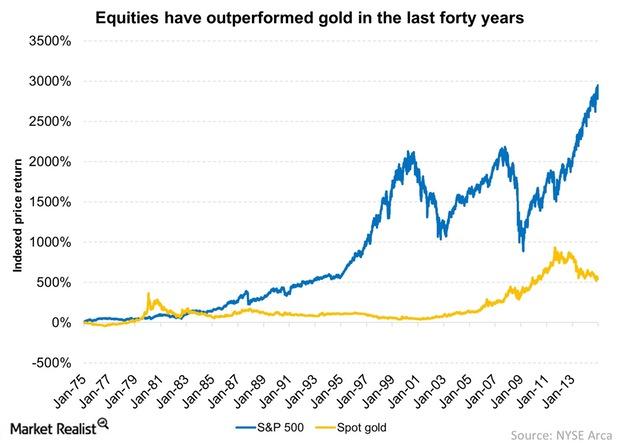

Equities are the best performing asset class in the long term

The CAGR for equity for the last 20 years is 7.8%. Equities outperformed investment-grade corporate bonds. Equities are the best performing asset class.Healthcare Why-high-yield issuers coast on “drive-by” and “add-on” deals

DaVita HealthCare Partners (DVA) and Tenet Healthcare (THC) were among the more prominent HY debt issuers in the week ending June 13.