Could an FOMC Rate Hike Drive Bond Yields Higher?

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

June 12 2017, Published 4:59 p.m. ET

Yields fell lower after jobs report

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds (BND), which are considered safe havens in times of uncertainty, receded after the risk events in the previous week failed to deter market sentiment. US political uncertainty before former FBI Director James Comey’s testimony drove the demand for U.S. Treasury bonds (GOVT) and forced the yields lower before the testimony. But when there were no major surprises in the testimony, yields began to rise again, with the US ten-year yield posting a 2.0% rise for the week.

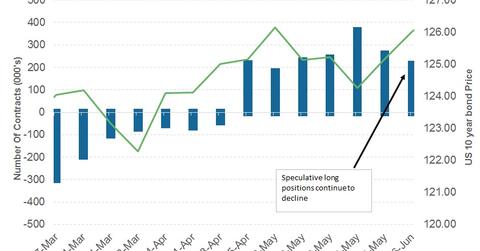

The US ten-year bond price (IEF) closed the week at $126.38 compared to $126.62 the previous week. The ten-year yield rose 5 basis points to 2.20% from 2.15%. The two-year bond yields (SHY) at the shorter end of the curve rose 4 basis points to 1.33%, reflecting traders’ sentiments of rising yields going into the FOMC (Federal Open Market Committee) decision on June 14.

Bond traders reduced their long positions again

According to the latest Commodities Futures Trading Commission (or CFTC) report, large speculators in the bond markets have lowered their bullish positions for a second straight week after five weeks of increased long positions. A total net position of 212,066 contracts have been reported, which is a fall of 46,099 contracts compared to the previous week.

The CTFC data are published on Fridays, but they’re for the traders’ positions on Tuesday of each week. Traders would have increased their positions on US bonds (SCHO) before the risk events on Super Thursday, but the trend might have turned after the risks fizzled out.

Key movers for bond yields this week

Attention will be on the FOMC this week. Analysts’ surveys point to a 0.25% rate hike, and the focus will be on the tone of the statement, which could give clues about future rate hikes. A dovish tone from the Fed is likely to have a negative impact on bond yields as expectations for future hikes are likely to recede.