How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

July 7 2017, Updated 10:37 a.m. ET

Central bankers have affected bonds the most

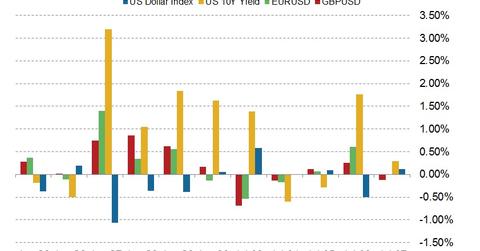

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher. The FOMC minutes inspired little action in the bond markets as expectations about inflation, further tightening, and balance sheet reduction remained unchanged after the minutes were released. The surprise was from the ECB and the Bank of England, which have signaled monetary policy tightening through their speeches.

The US ten-year yield (IEF) is up eight basis points this week, while the German ten-year Bunds (BWX) and the UK ten-year Gilts (IGOV) are up ten basis points and six basis points, respectively. The ECB has tried to calm the markets by suggesting that the comments from Draghi about policy changes have been misinterpreted, but there was no respite to the rising yields and falling bond prices.

Currency markets’ new short-term king

The FOMC meeting minutes failed to give a much-needed push to the US dollar as no new positive information has emerged from the minutes. The US dollar index (UUP) is continuing to struggle below the 96.00 level as markets weigh in on the Fed’s next move. The euro (FXE) and British pound (FXB) on the other hand restarted their appreciating trend after losing some of their gains before the FOMC meeting minutes were released. The reason for such a turn of events in the forex markets is that the US Fed might be slowing its pace of rate hikes to accommodate its balance sheet trimming, while the ECB and BOE could move towards further tightening.

Will this trend continue?

Currency markets are usually myopic in nature. With many short-term traders existing in these markets, quick reactions are imminent, but usually, such moves are reversed quickly. Longer-term traders would need strong evidence to alter their views on any particular currency. We cannot write off the US dollar yet, as the US Fed is the only central bank committed to tightening, while the others are just preparing the markets for future hikes. We can expect the US dollar to regain its crown once the economic data from the US gets back on track.