SPDR Bloomberg Barclays International Treasury Bond ETF

Latest SPDR Bloomberg Barclays International Treasury Bond ETF News and Updates

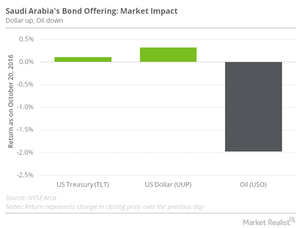

Saudi Arabia Enters International Bond Market, Raises $17.5 Billion

On October 20, the government of Saudi Arabia raised about $17.5 billion in an international bond issuance, marking the emerging market’s first foray into the international bond market.Financials Must-know variants in developed market international bond funds

International bond funds like the Vanguard Total International Bond Index ETF (BNDX) can have various investment styles determined by their stated choice of bond investments.

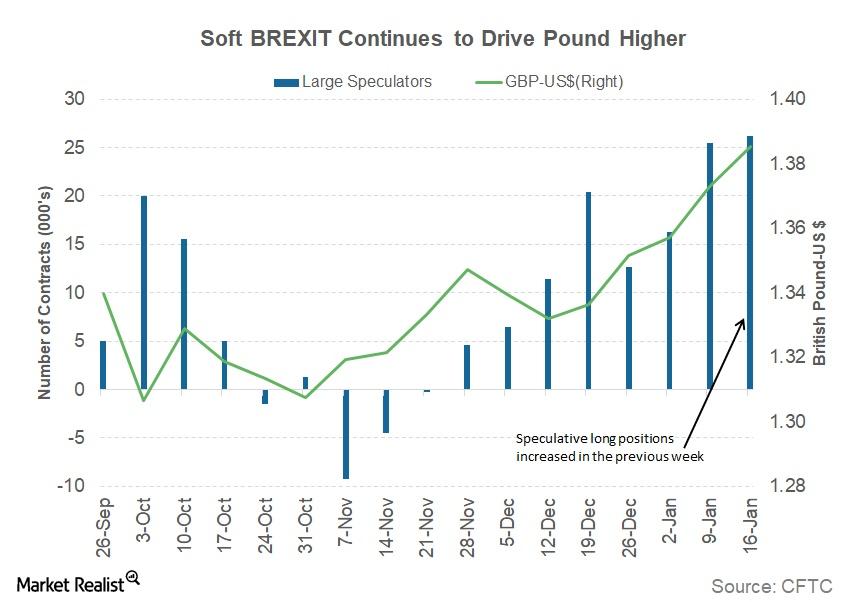

Factors that Drove the British Pound over 1.38 against the Dollar

During the week ended January 29, 2018, British equity markets (BWX) were supported by the prospect of a soft Brexit.

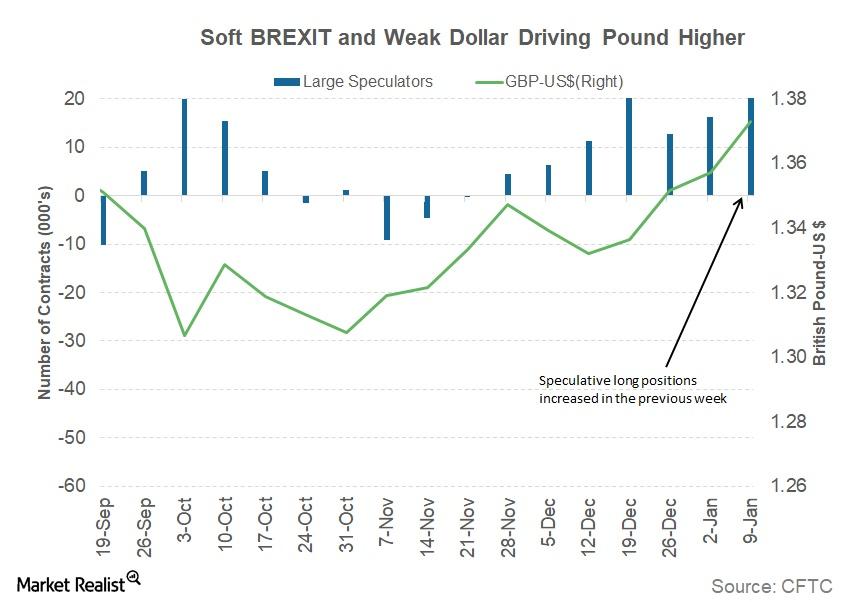

Why a Soft Brexit Possibility Is Driving the British Pound Higher

The gains in the British pound were driven by the higher chances of a soft Brexit deal, which could see economic relations between the UK and the EU remain mostly unchanged.

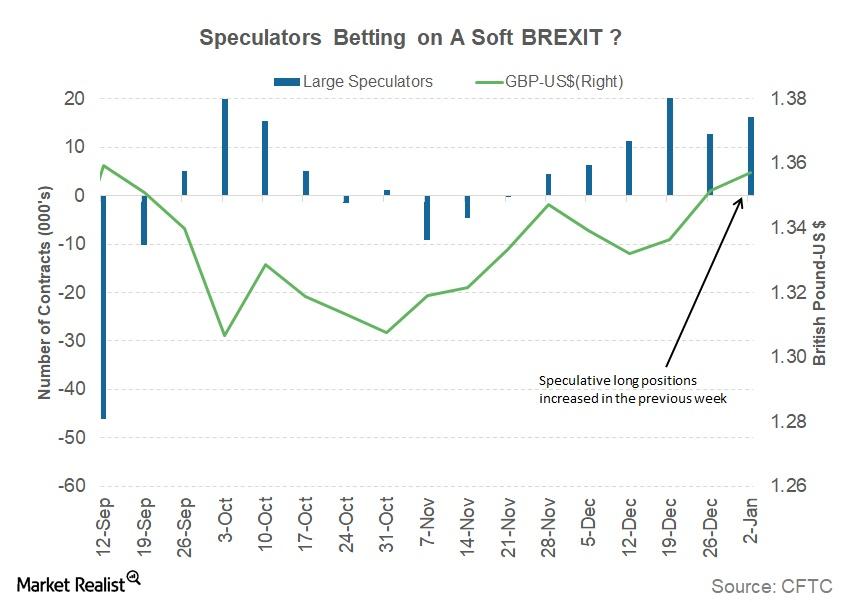

Will the Pound Gain with Signs of a Soft Brexit?

The British pound (FXB) (GBB) continued to appreciate against the US dollar in the first week of 2018, rising 0.41% against the dollar (UUP).

Why the British Pound Appreciated by 1.5% Last Week

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP).

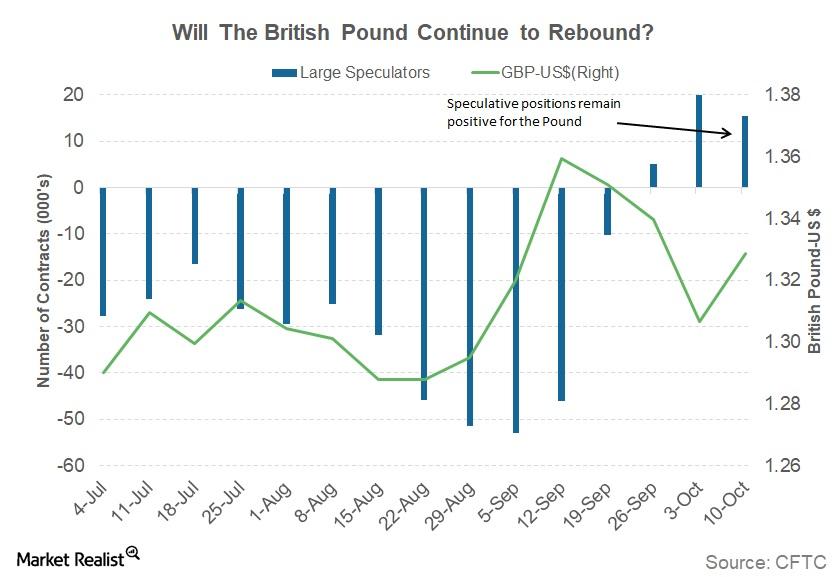

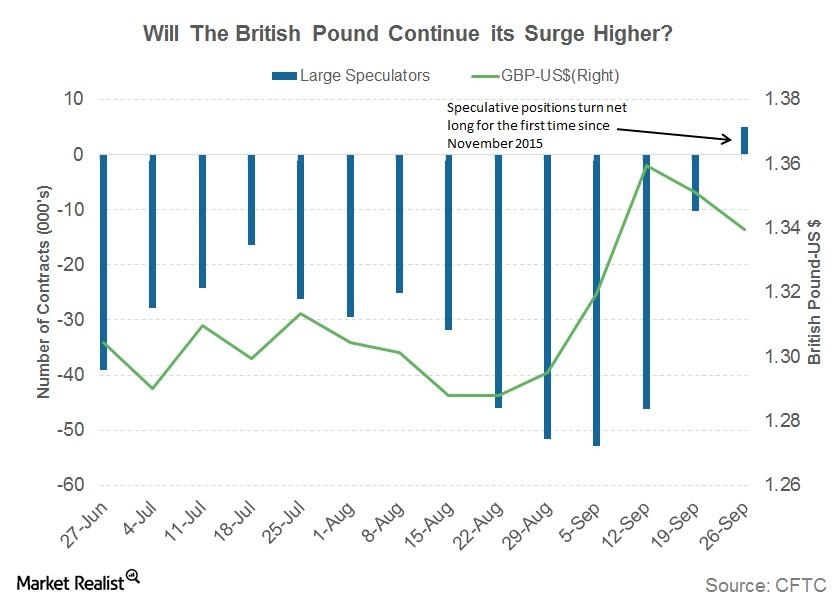

Why British Pound Speculators Turned Bullish after 22 Months

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP).

Why the British Pound Rallied to 15-Month High

The British pound (FXB) appreciated against the US dollar for the week ending September 15.

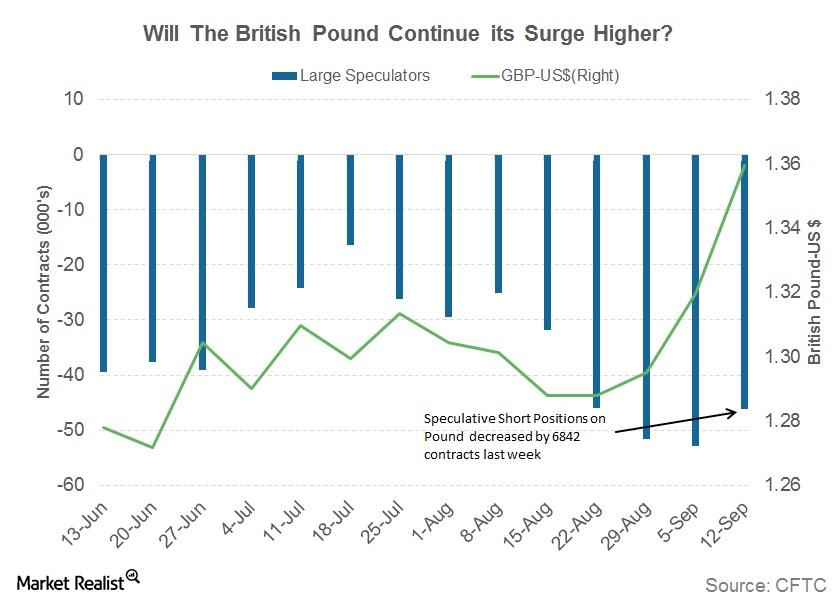

The Reason behind the Sharp Gains in the British Pound

The British pound (FXB) appreciated against the US dollar for the week ended September 8, 2017. The pound closed at 1.32, appreciating 1.9% against the US dollar.

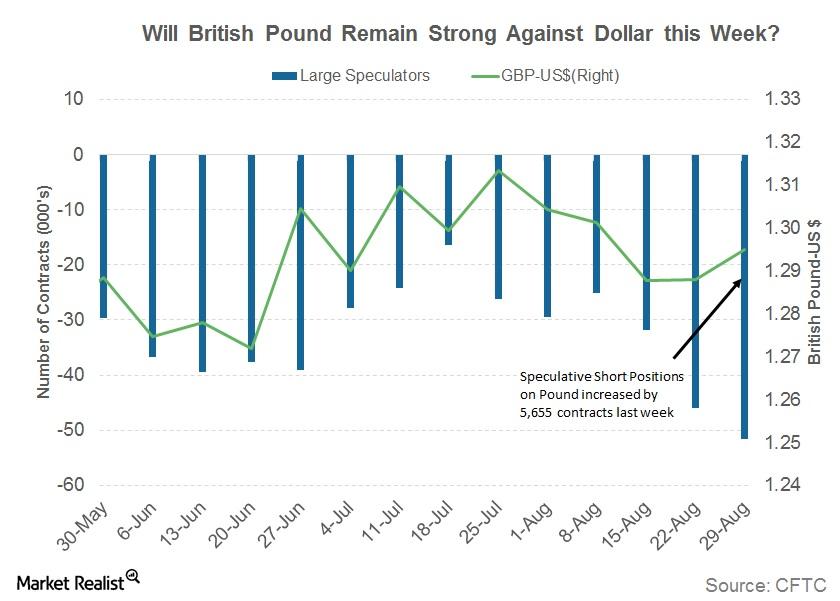

Can the British Pound Continue to Remain Strong This Week?

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017.

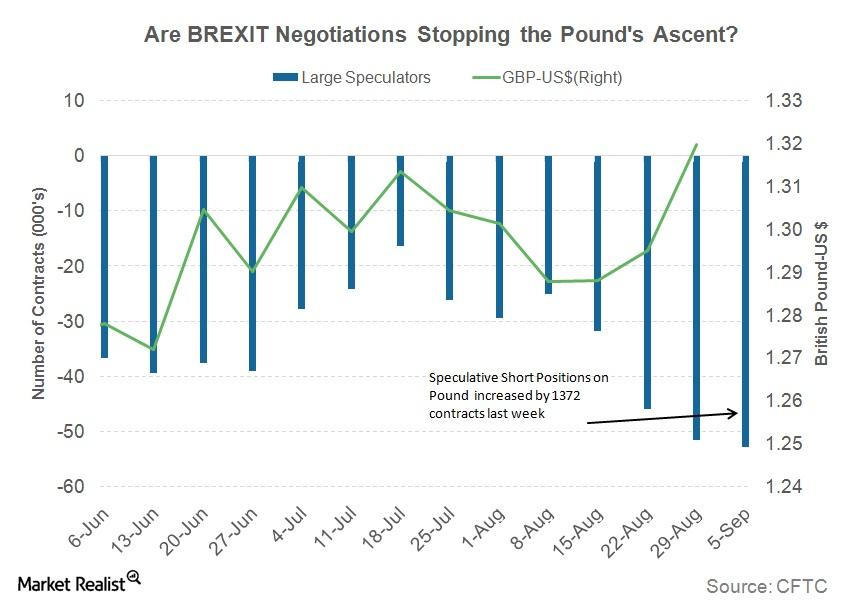

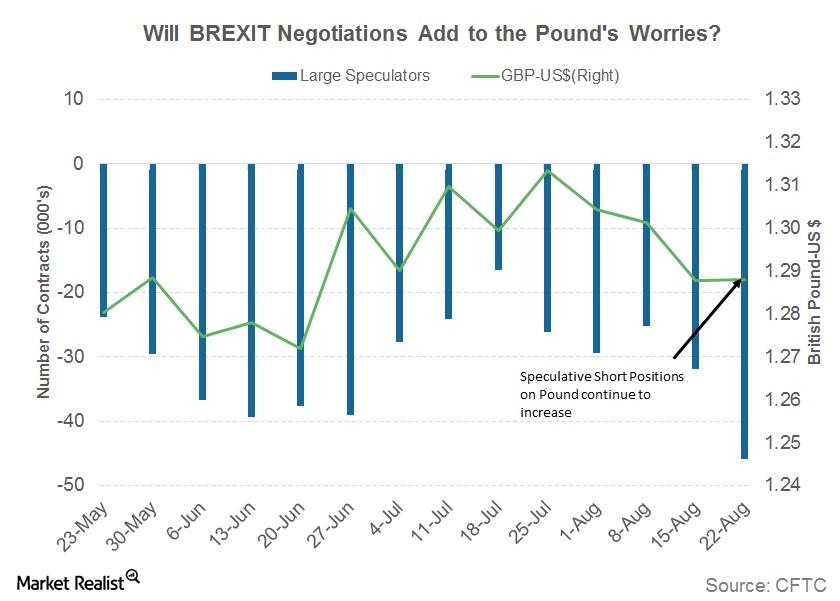

Round 3: Will Brexit Negotiations Help the British Pound?

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887.

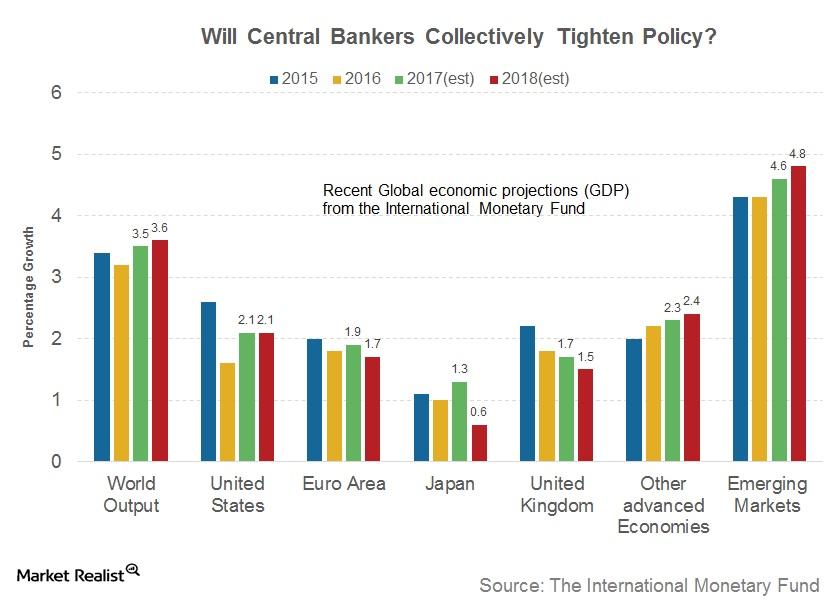

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”

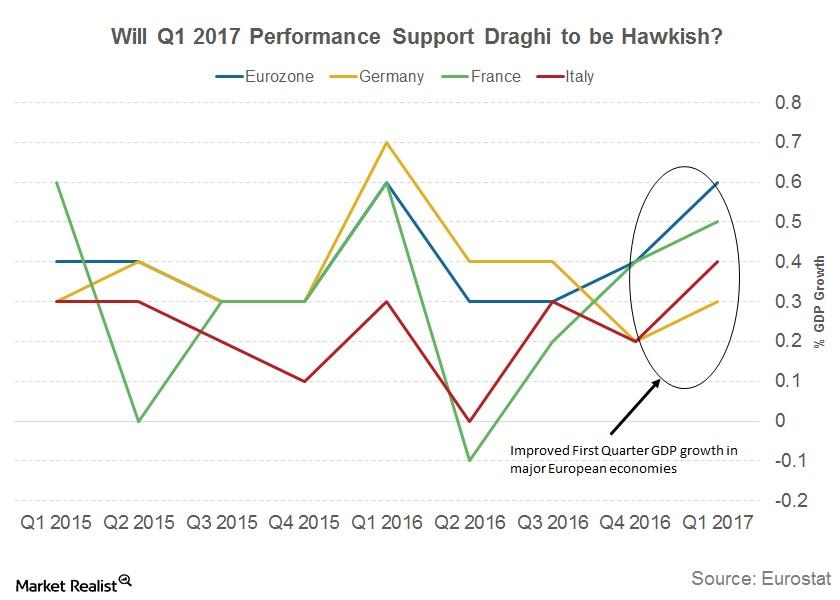

Why Draghi Is a Person of Interest at Jackson Hole

ECB President Mario Draghi is scheduled to speak at this year’s Jackson Hole Symposium on August 25—after a hiatus of three years.

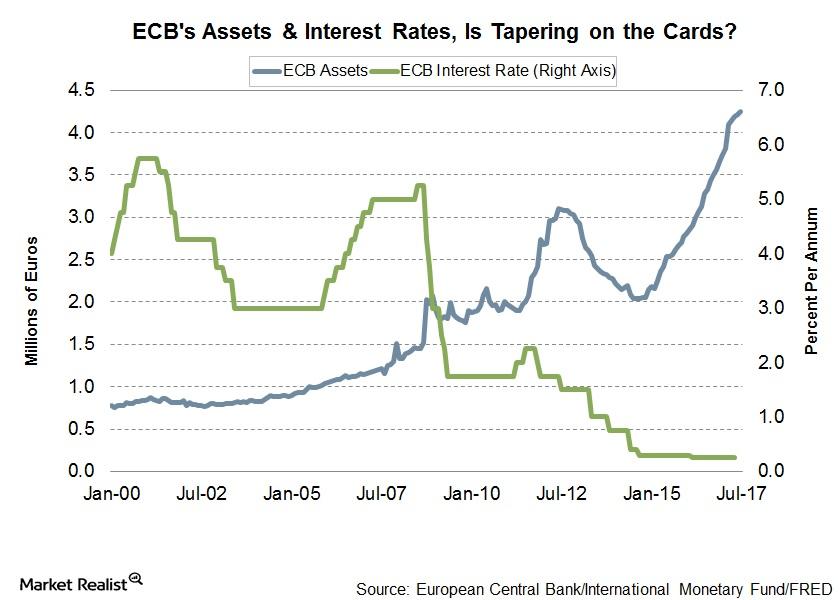

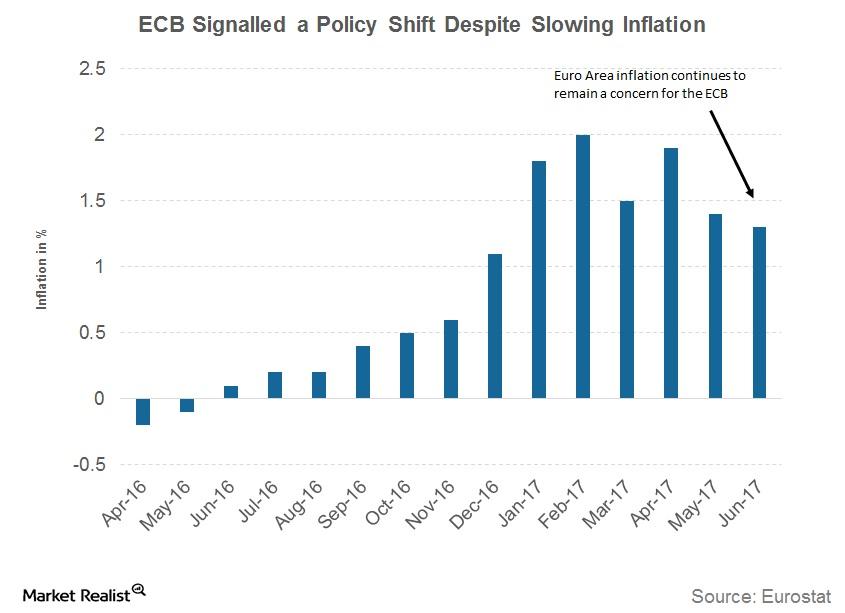

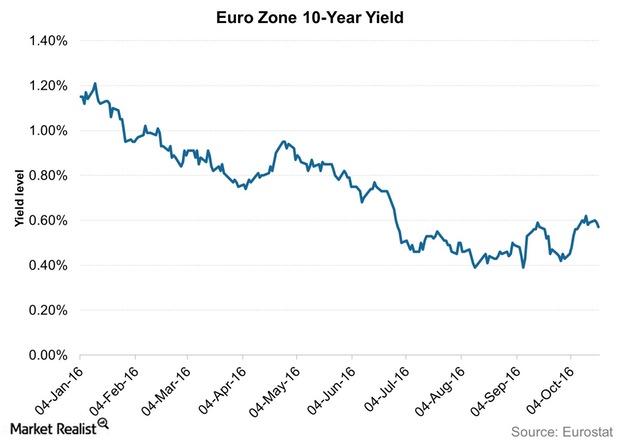

Will ECB’s Tightening Lead to Bond Market Sell-Off?

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

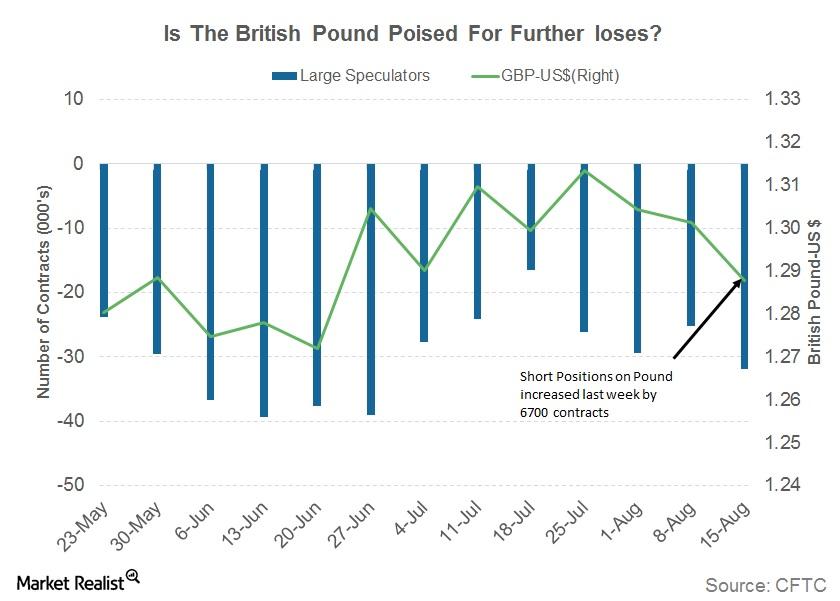

Here’s Why the British Pound Could Be Headed for Further Losses

The British pound (FXB) was one of the worst performers in the week ending August 18.

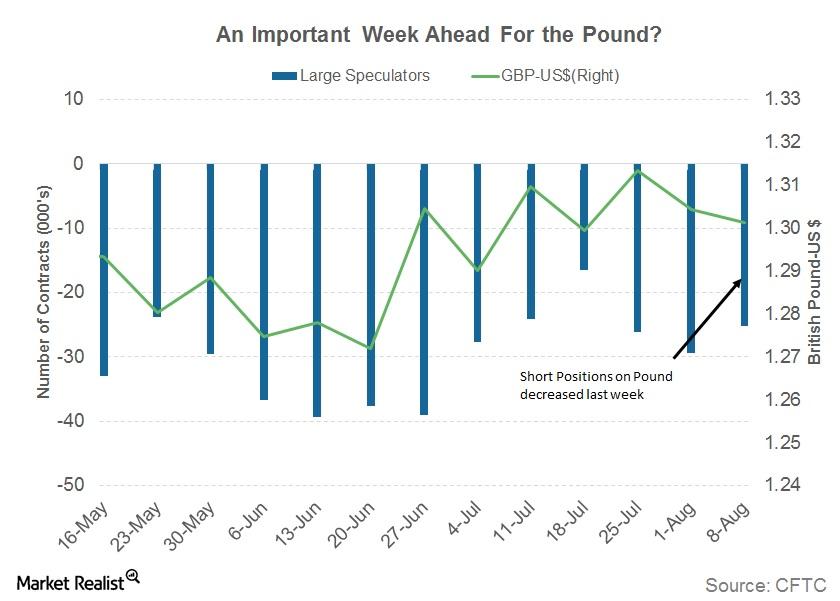

Why the British Pound Has an Important Week Ahead

The British pound (FXB) had another negative week as a dovish statement from the Bank of England continued to drag the currency lower.

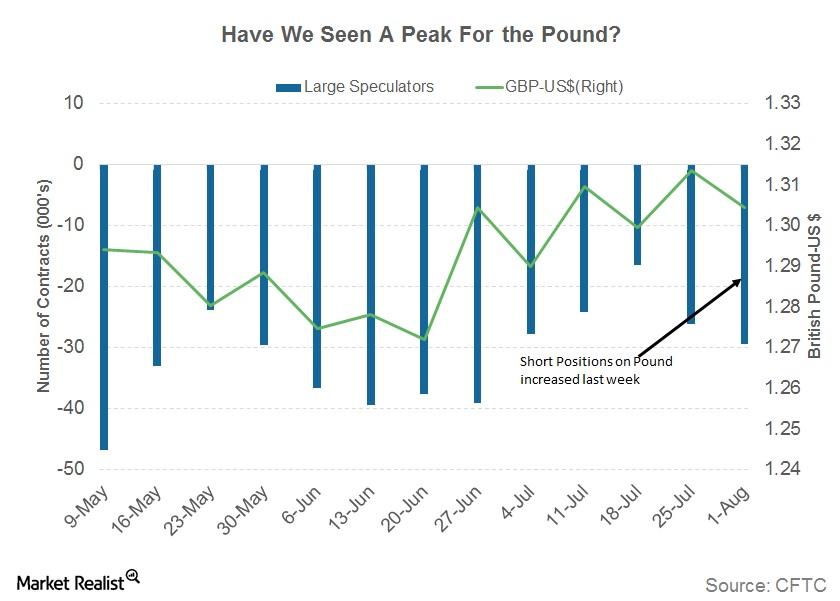

Chart in Focus: A Look at the British Pound

The British pound recorded another multi-month high of 1.3266 against the US dollar before the Bank of England announced its inflation report and interest rate decision on August 3.

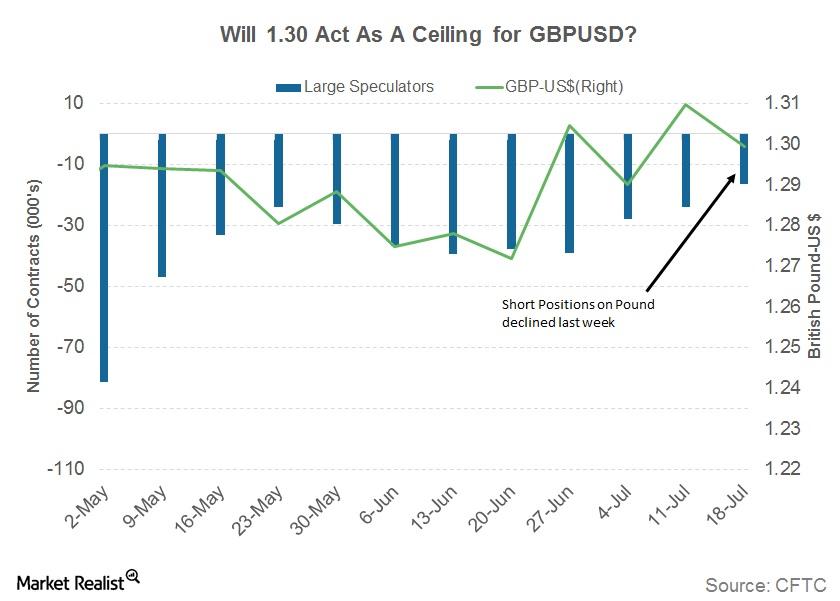

Why the British Pound Failed to Stay above 1.30

Investors not confident the Bank of England will raise rates The British pound (FXB) has had a roller coaster ride over the last few weeks, as mixed signals were given by the Bank of England. After a hawkish tone at its June meeting, the Bank of England has turned dovish in recent weeks. The British pound […]Macroeconomic Analysis Is the British Pound Facing the Risk of Stagnation?

Economic data from the United Kingdom showed unexpected signs of a slowdown last week, with weaker-than-expected data reported in trade, production, and house prices.

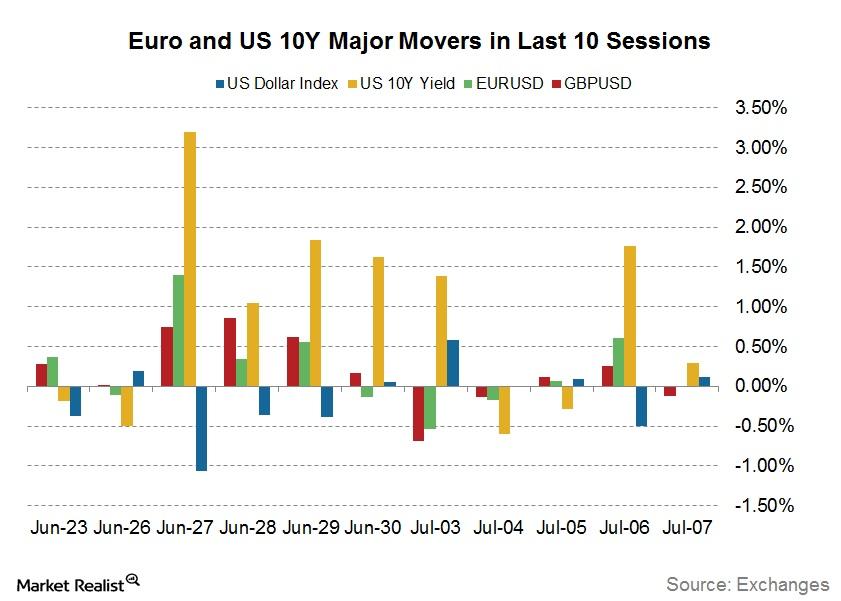

How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

Confused Markets: Inside the ECB’s Struggle amid Miscommunication

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

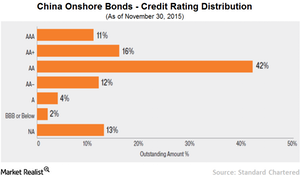

What’s Holding Back Foreign Investors from China?

Many leading bond index providers are still not including China’s onshore bonds in their benchmark indexes due to various regulatory and operational concerns.

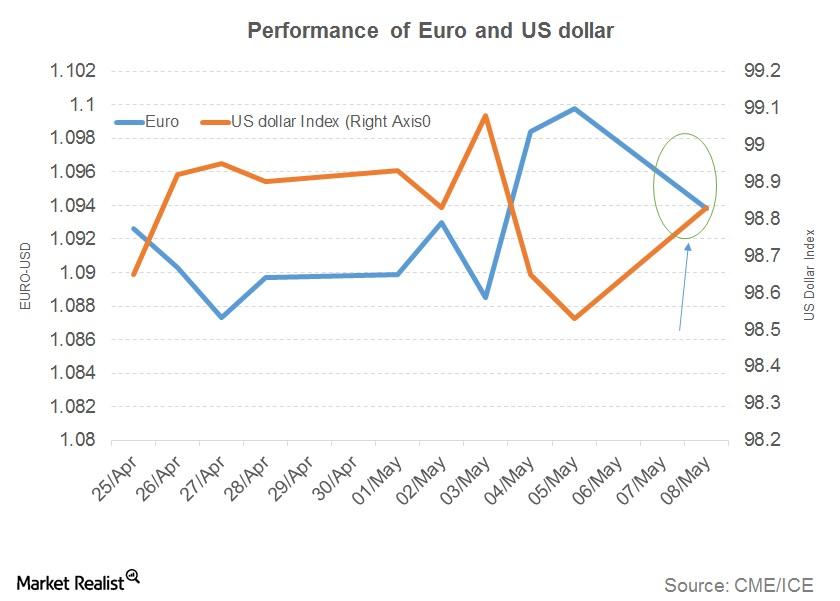

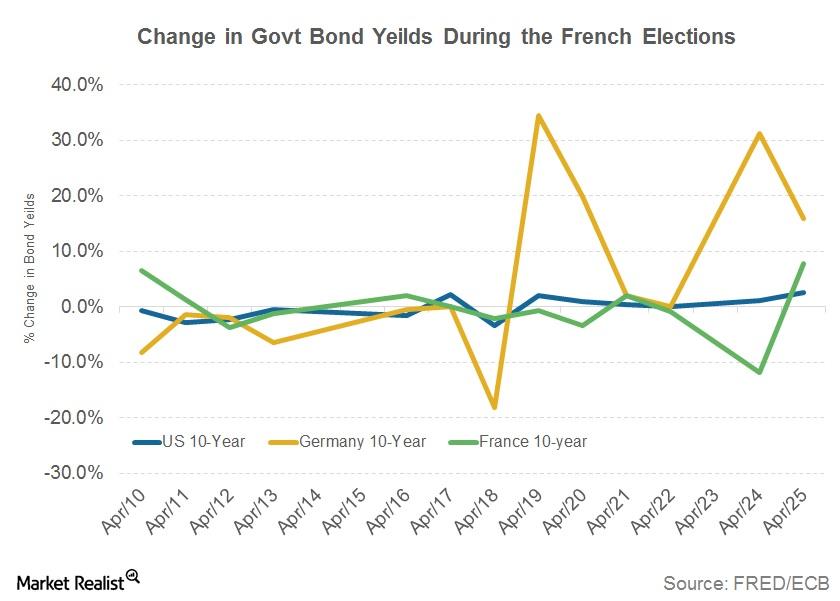

How Fixed Income, Currency Markets Reacted to the French Election

European bonds (BWX) started showing signs of celebration late May 5 as opinion polls pointed toward an Emmanuel Macron win in the French presidential election.

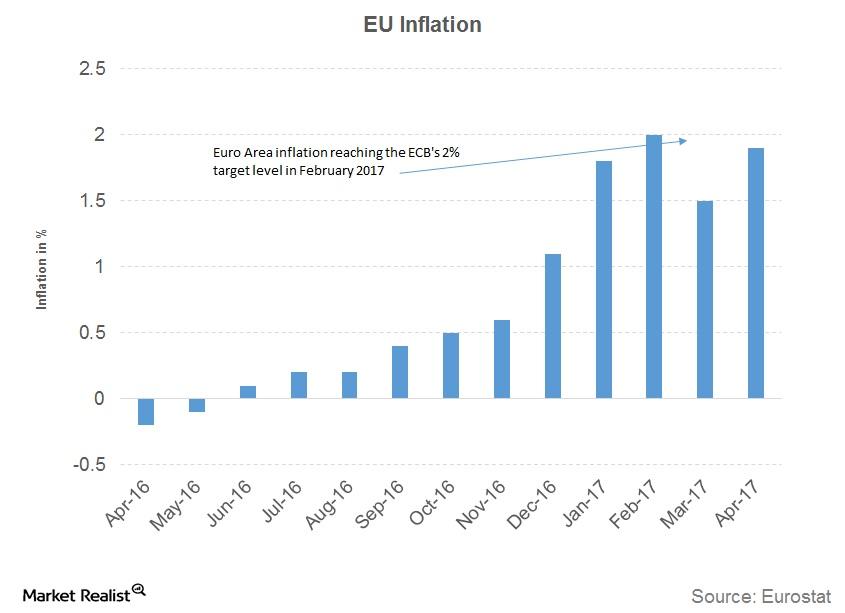

Why the ECB Is Struggling to Hide Its Excitement

The European Central Bank’s (or ECB) policy statement that was released on April 28 reported that the ECB left monetary policy unchanged, which was in line with expectations.

How Did Fixed Income Markets React to the First Round?

Demand for fixed income securities will likely be subdued because of excess supply this week, which would mean additional support for bond yields.

No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

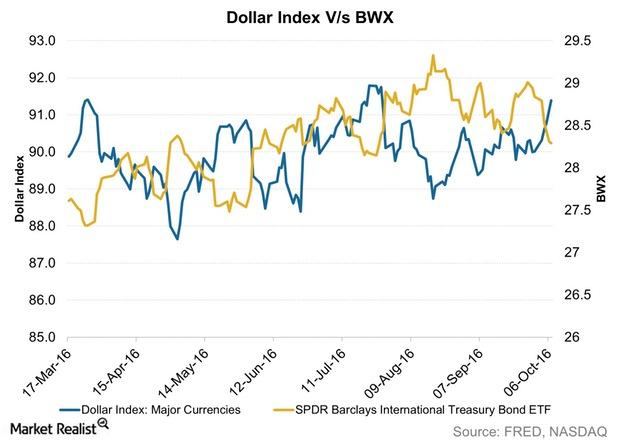

How Does a Strong Dollar Impact International Bonds?

When we talk about the relationship between the US dollar and bonds and how currency movements impact bonds, we’re essentially talking about international bonds.

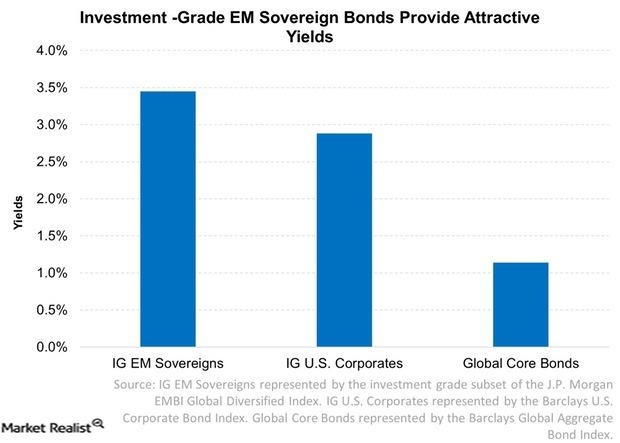

Investment-Grade Emerging Market Bonds Appear Attractive

Investment-grade emerging market sovereigns have been given BBB or higher credit ratings by one of the credit rating companies. They’re relatively safe.