Invesco CurrencyShares British Pound Sterling Trust

Latest Invesco CurrencyShares British Pound Sterling Trust News and Updates

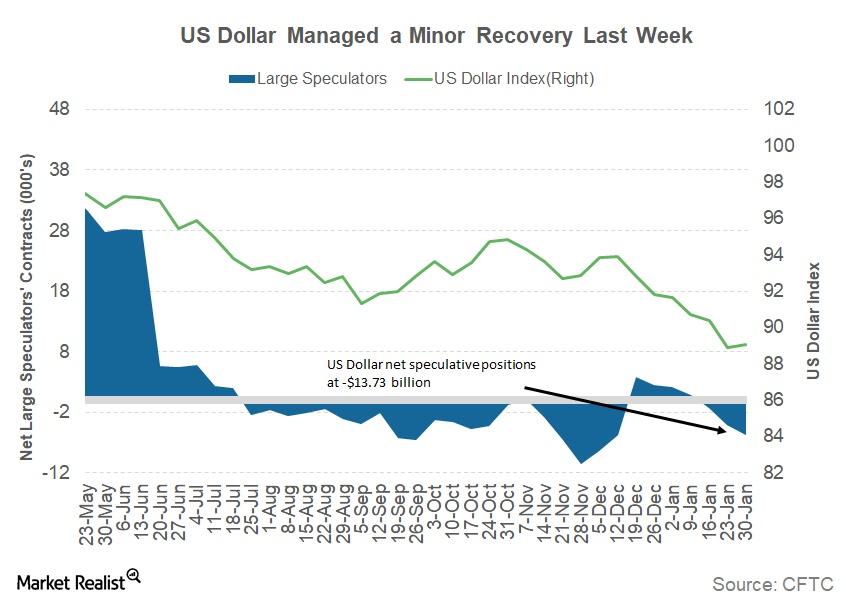

Have We Seen a Short-Term Bottom for the Dollar?

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

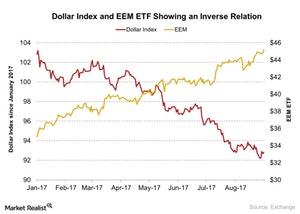

Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

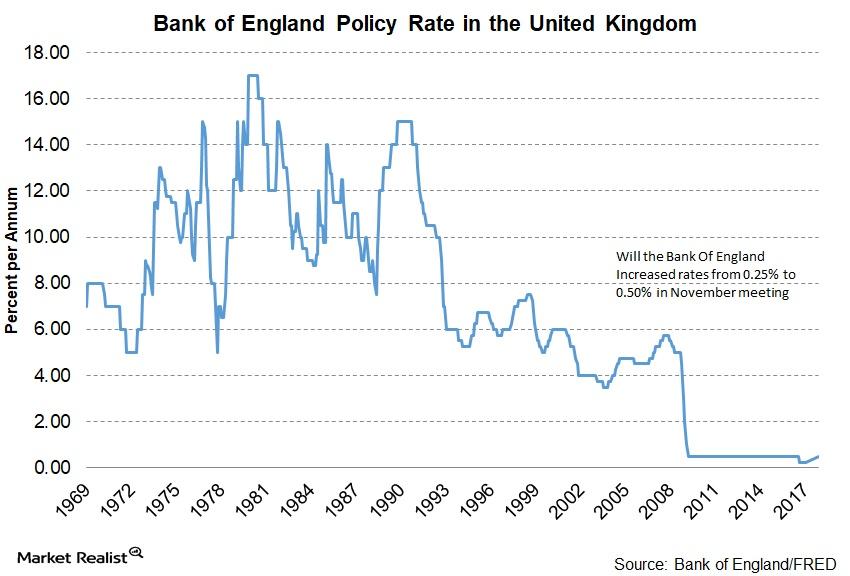

Bank of England Raises Interest Rate to 0.50%

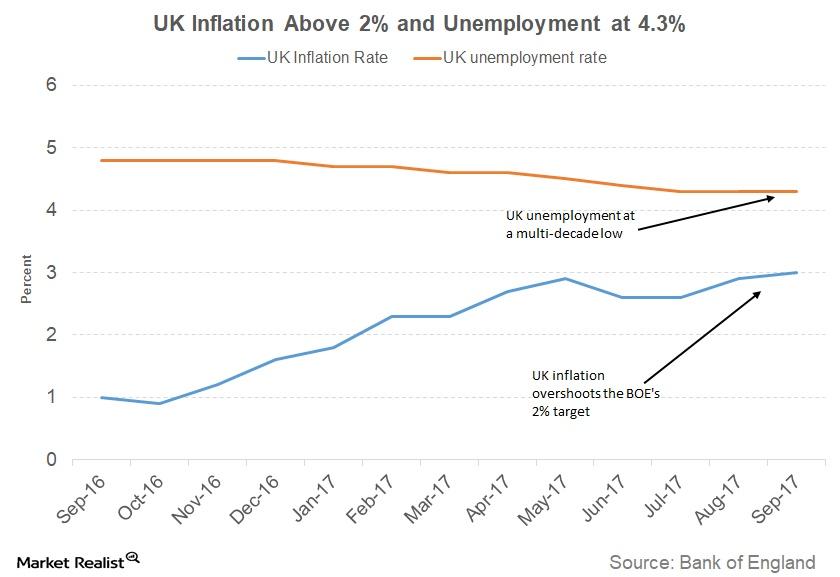

The BOE (Bank of England) in its November meeting increased its benchmark interest rates from 0.25% to 0.50%.

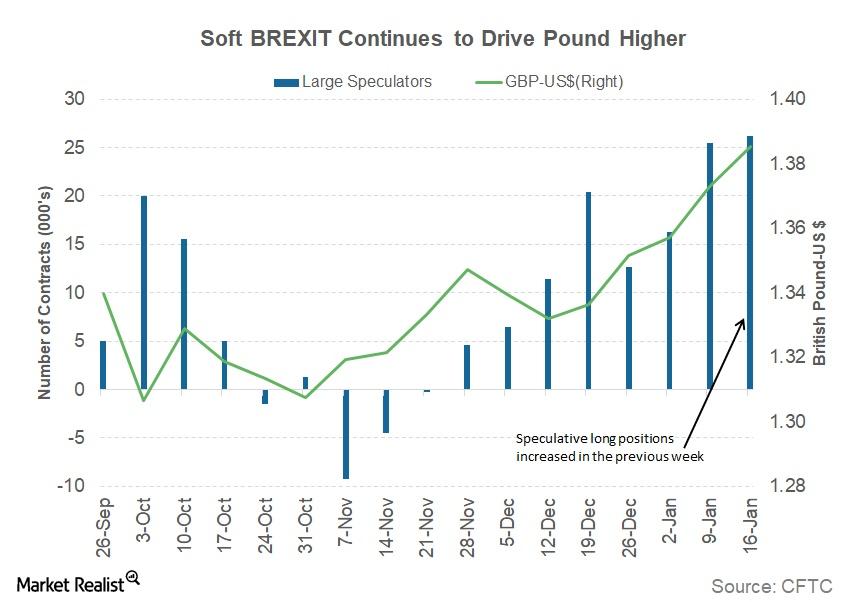

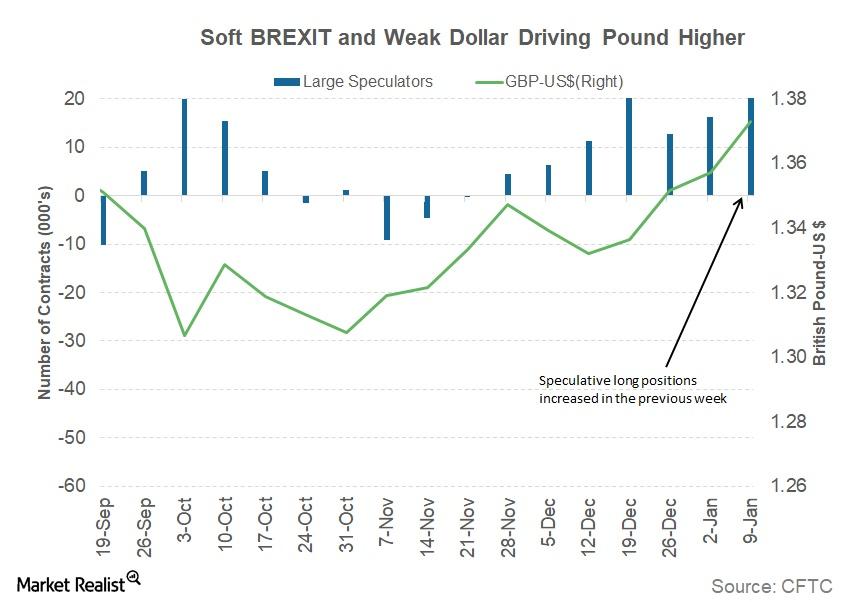

Factors that Drove the British Pound over 1.38 against the Dollar

During the week ended January 29, 2018, British equity markets (BWX) were supported by the prospect of a soft Brexit.

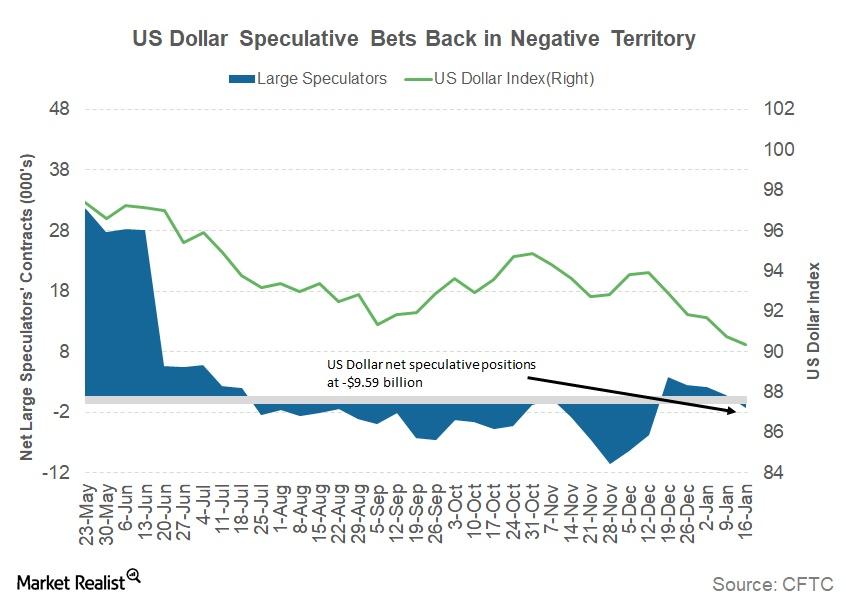

How the US Dollar Could React to a US Government Shutdown

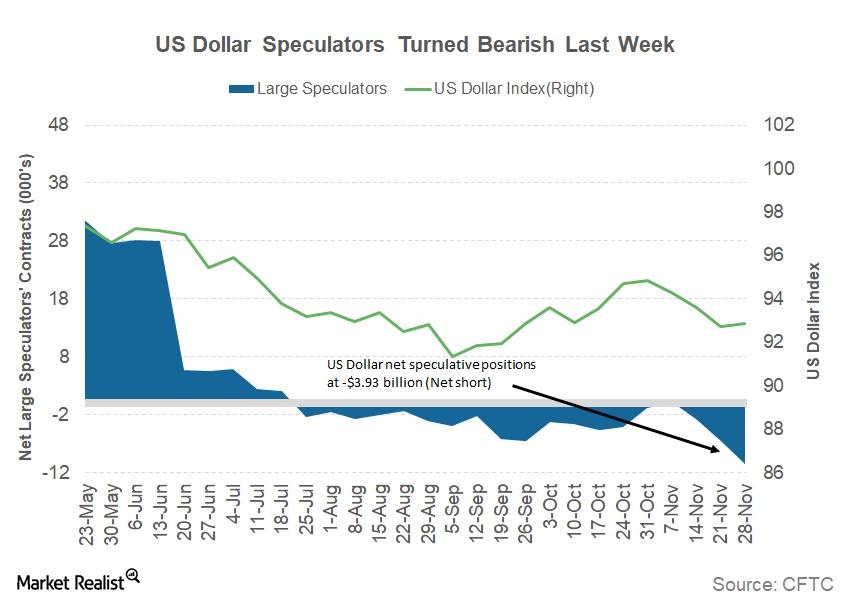

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

Why a Soft Brexit Possibility Is Driving the British Pound Higher

The gains in the British pound were driven by the higher chances of a soft Brexit deal, which could see economic relations between the UK and the EU remain mostly unchanged.

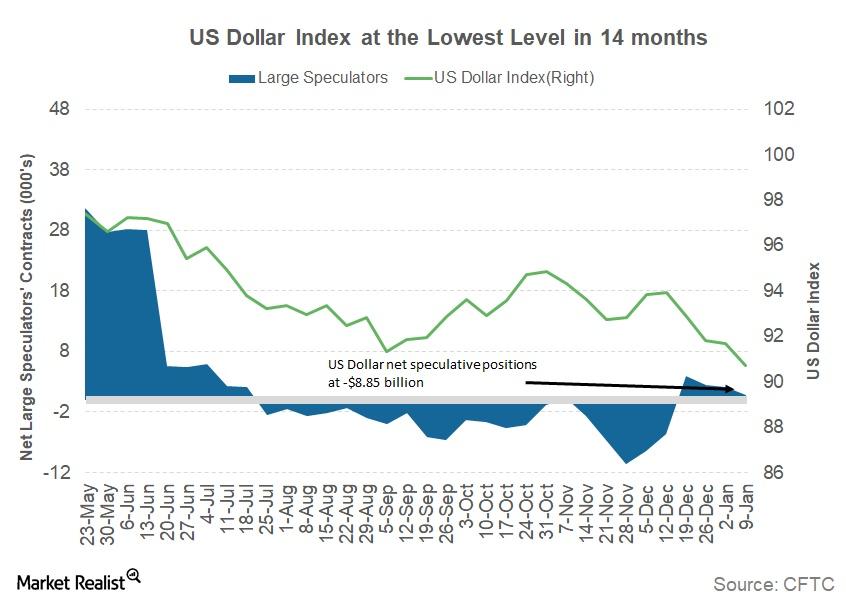

Why the US Dollar Is Losing Its Appeal

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

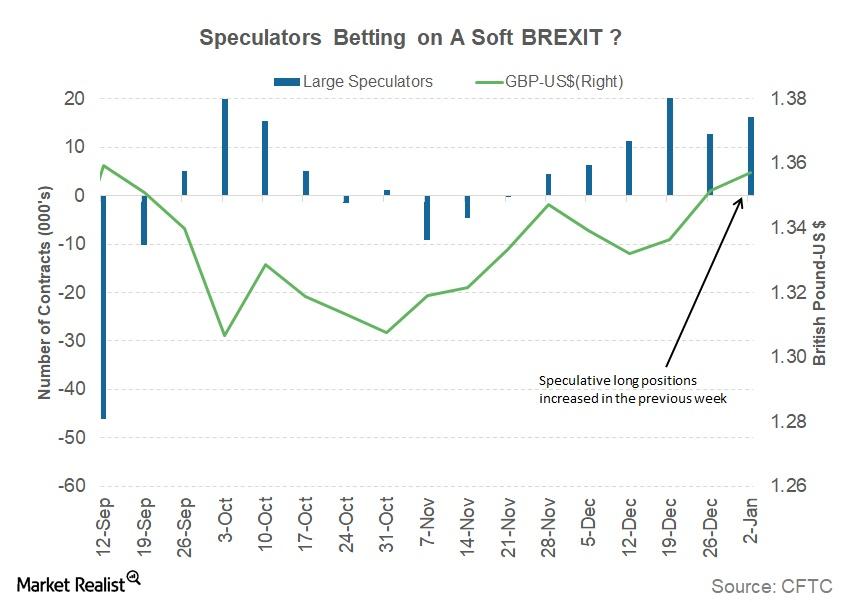

Will the Pound Gain with Signs of a Soft Brexit?

The British pound (FXB) (GBB) continued to appreciate against the US dollar in the first week of 2018, rising 0.41% against the dollar (UUP).

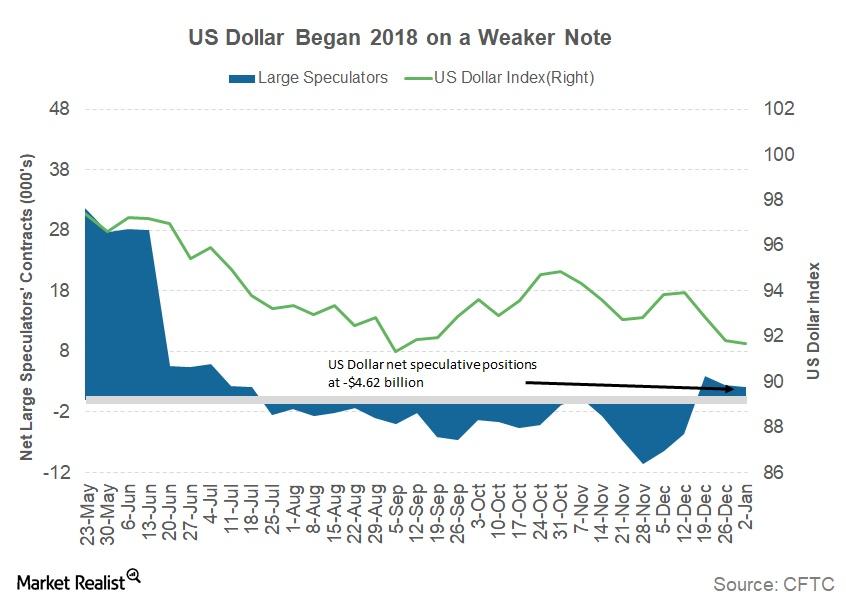

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

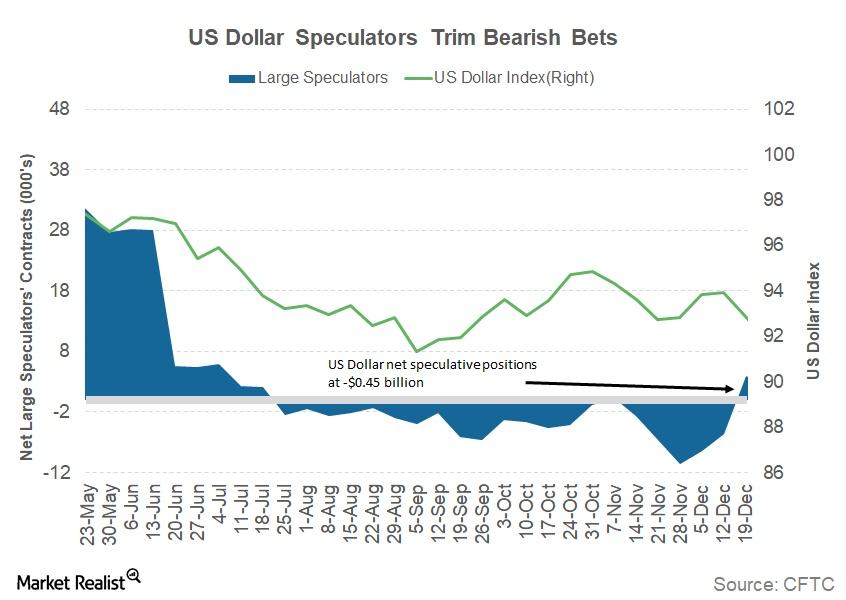

Can the US Dollar Gain Back Lost Ground This Week?

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

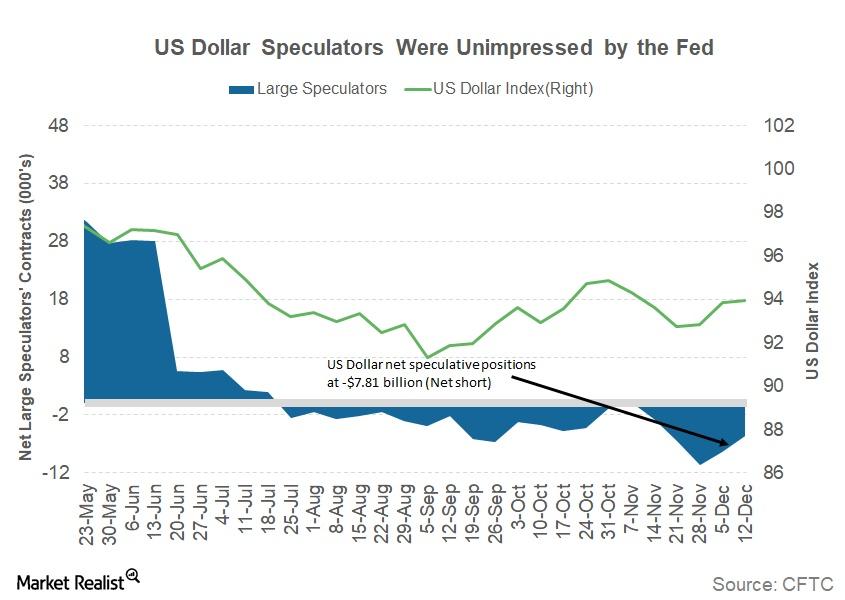

Why the US Dollar Resisted the Fed’s Latest Rate Hike

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

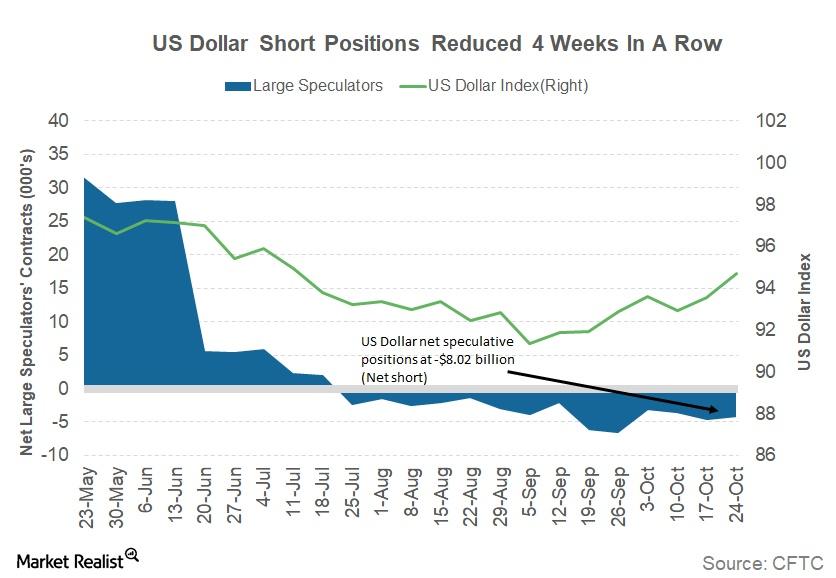

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

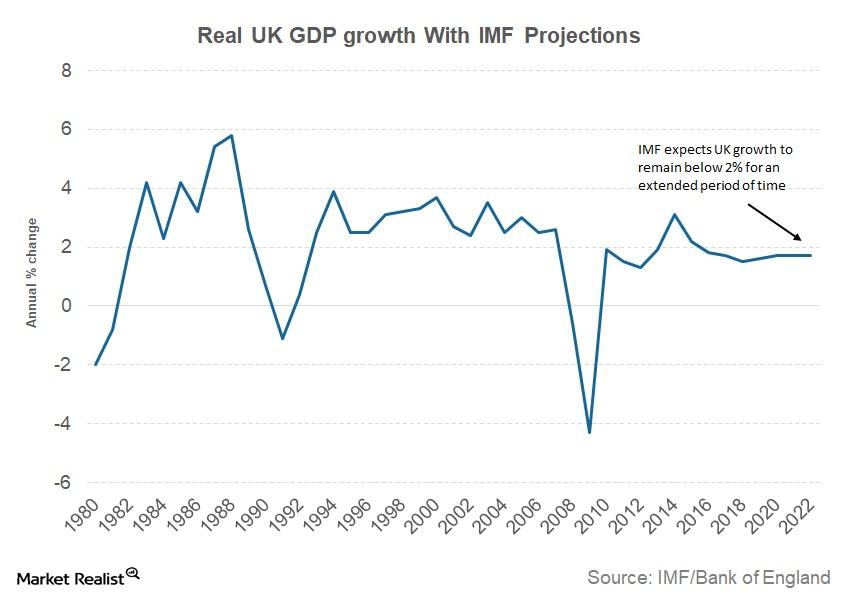

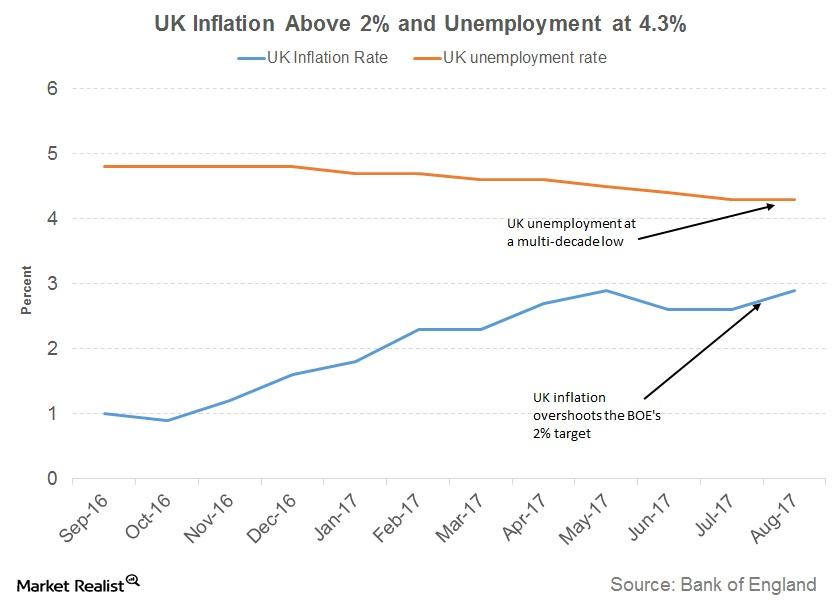

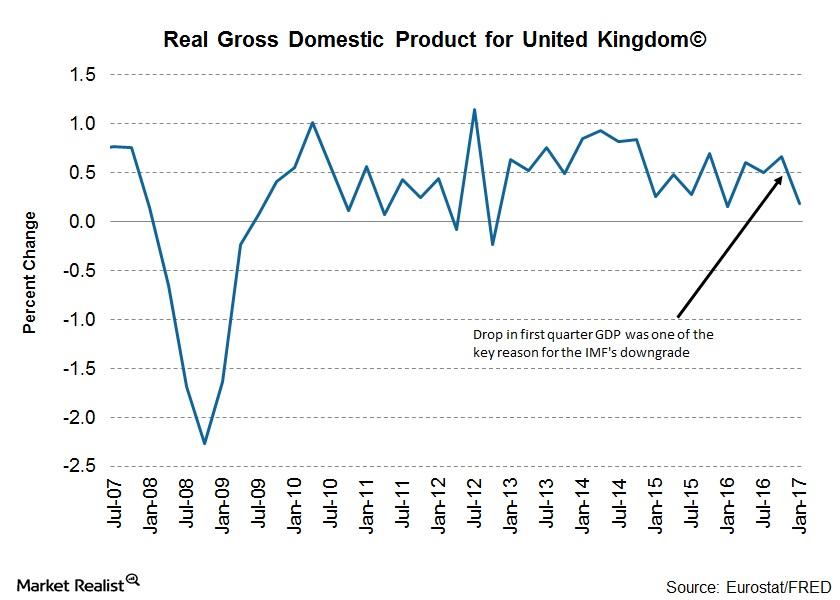

Why the IMF Sees Continued Uncertainty in the UK

The International Monetary Fund (or IMF), in its October world economic outlook, downgraded its growth outlook for the United Kingdom.

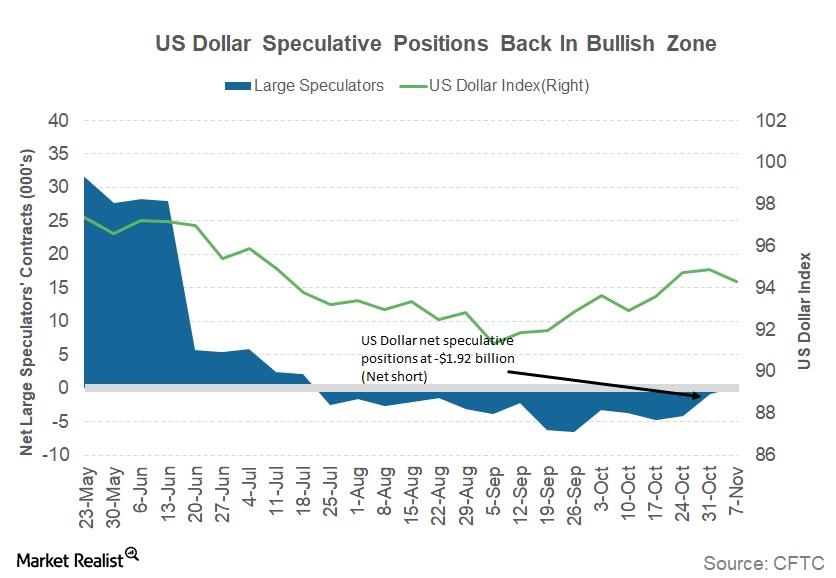

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

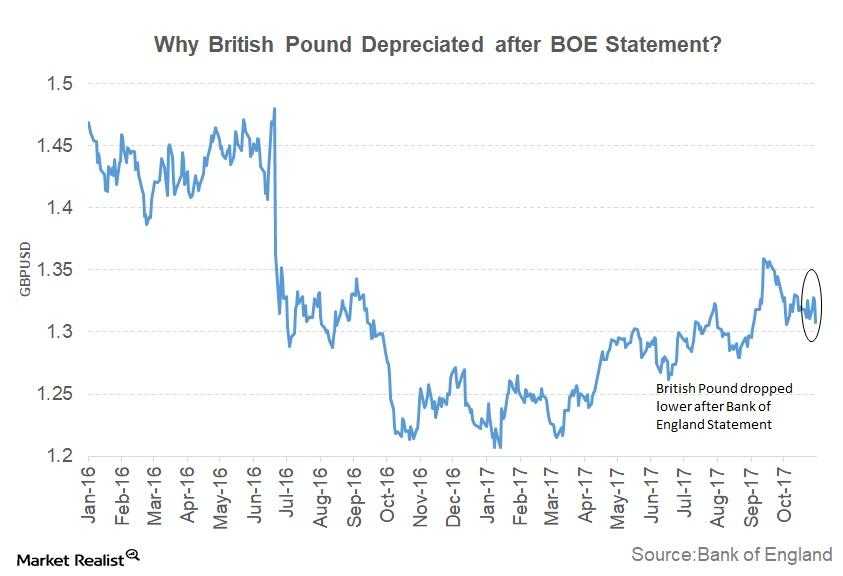

Why the British Pound Fell—Despite the Bank of England’s Rate Hike

The British pound depreciated 1.41% against the US dollar after the policy statement from the BOE (Bank of England) on November 2.

Why the Bank of England Wants Inflation to Fall

The central bank said that the key reason for such sharp increase in prices was due to the depreciation of the British pound after the Brexit referendum.

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

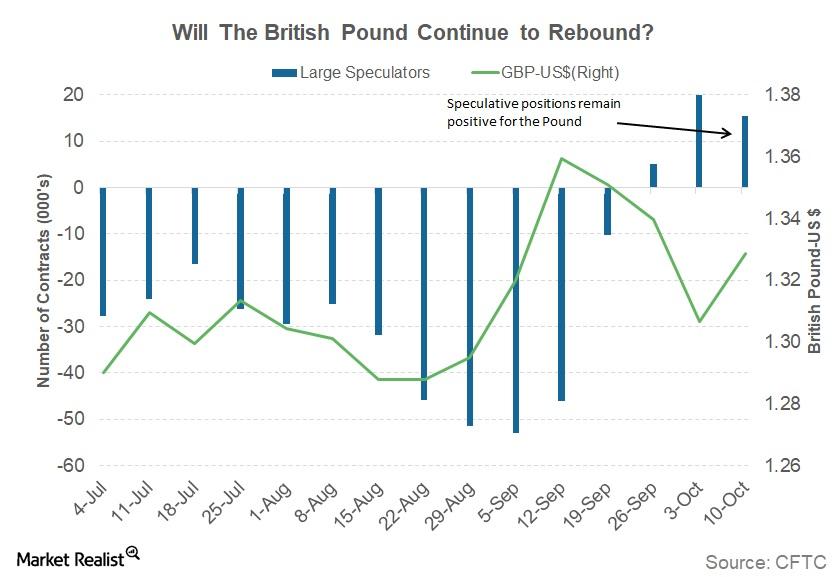

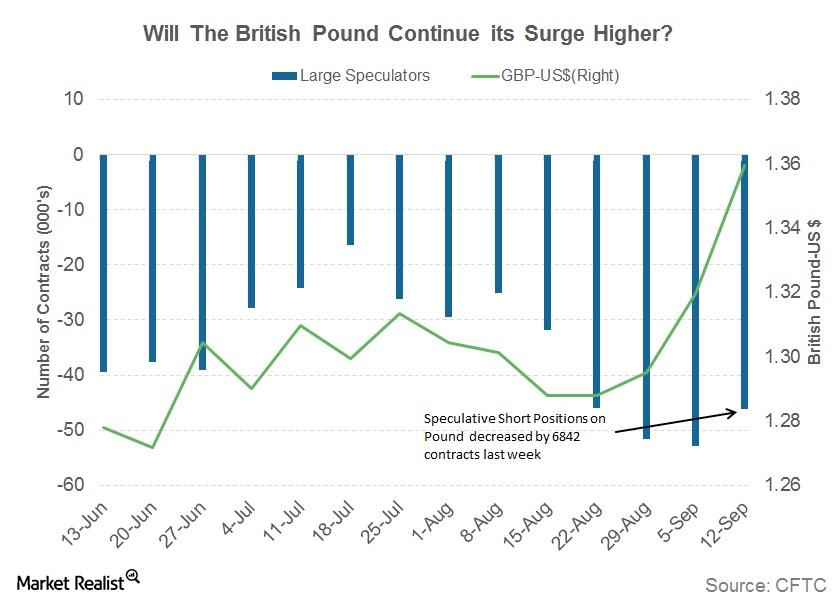

Why the British Pound Appreciated by 1.5% Last Week

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP).

Has the US Dollar Rally Ended for Now?

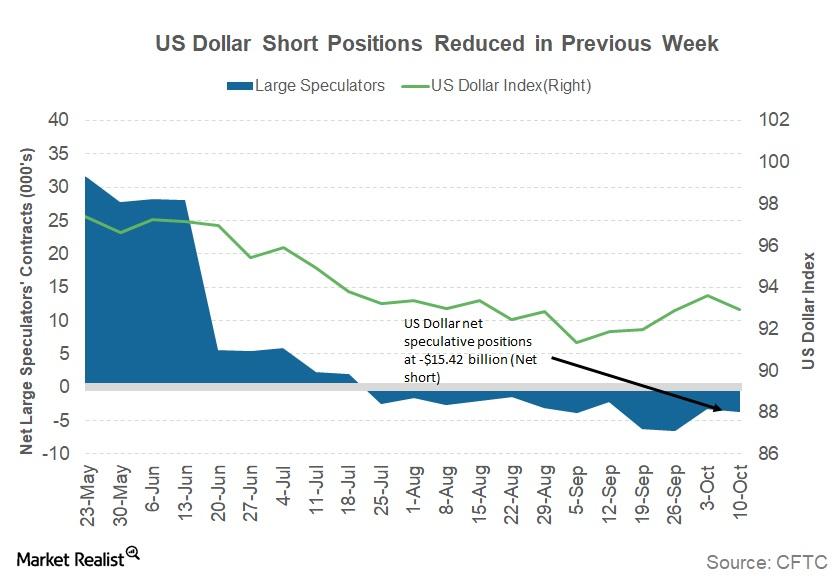

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

Are Investors Positioning for a US Dollar Rally?

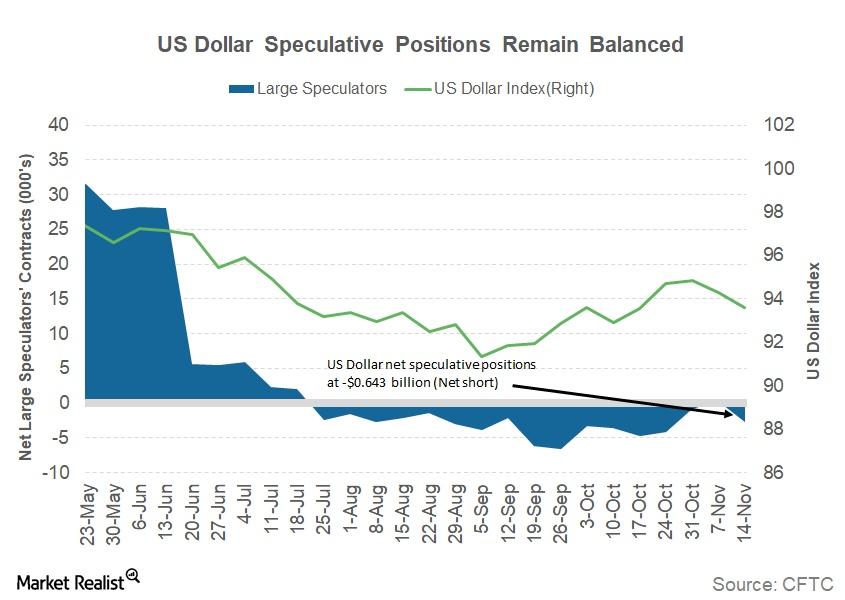

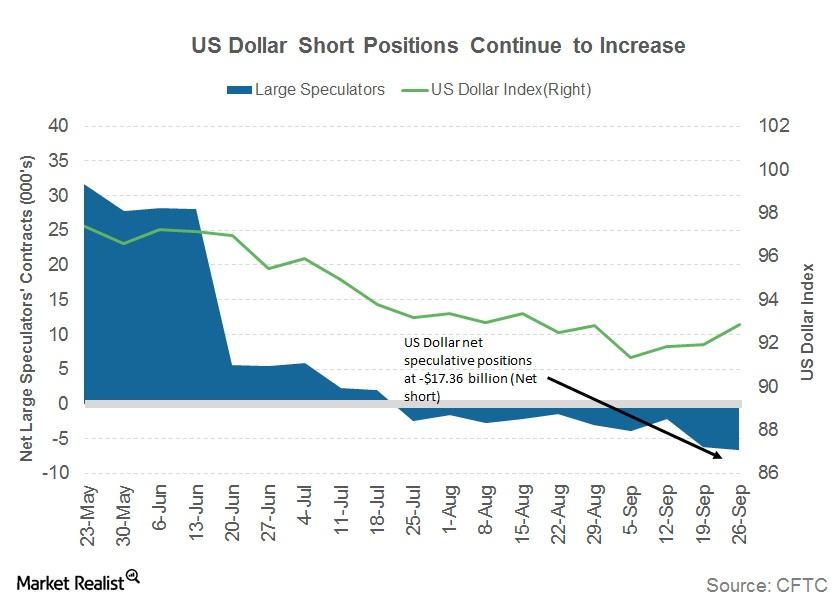

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

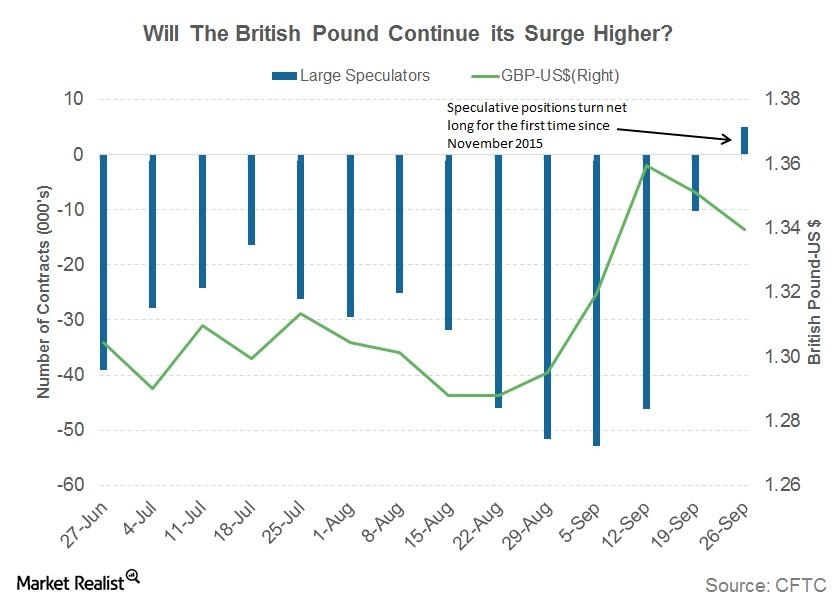

Why British Pound Speculators Turned Bullish after 22 Months

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP).

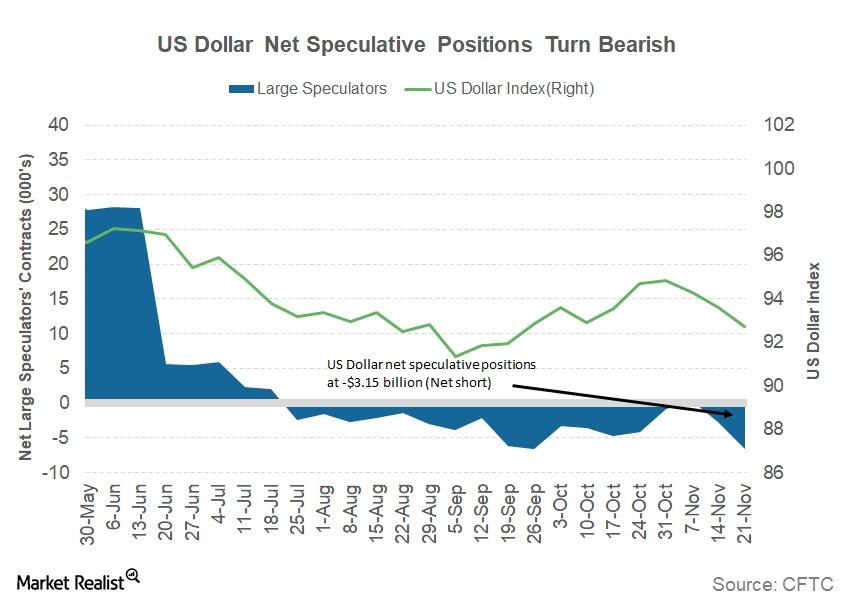

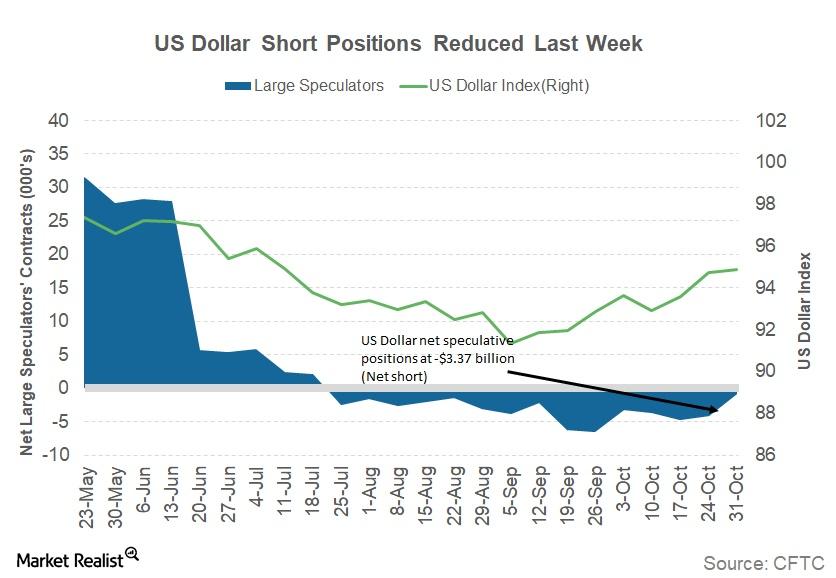

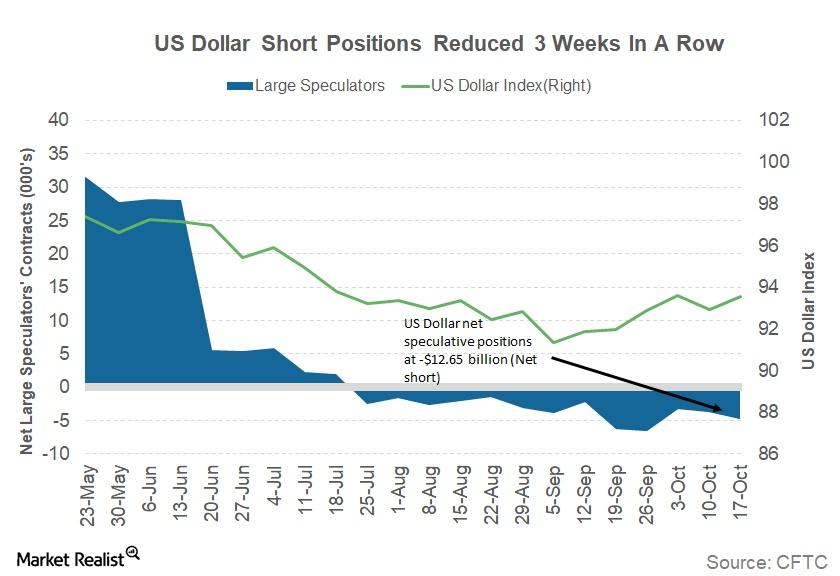

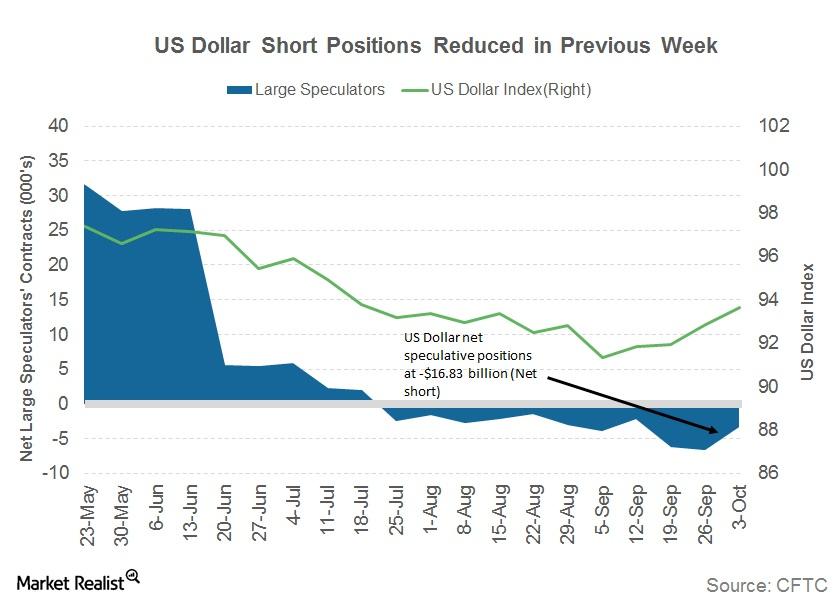

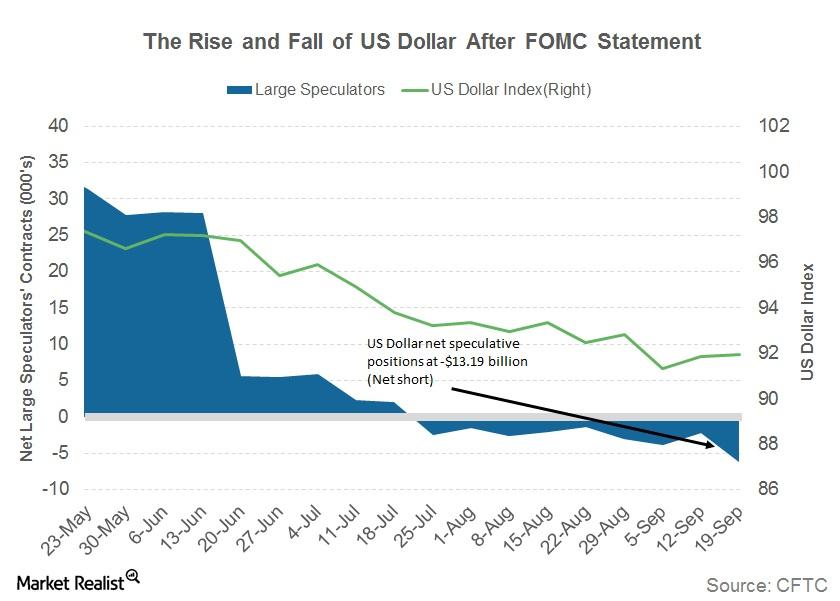

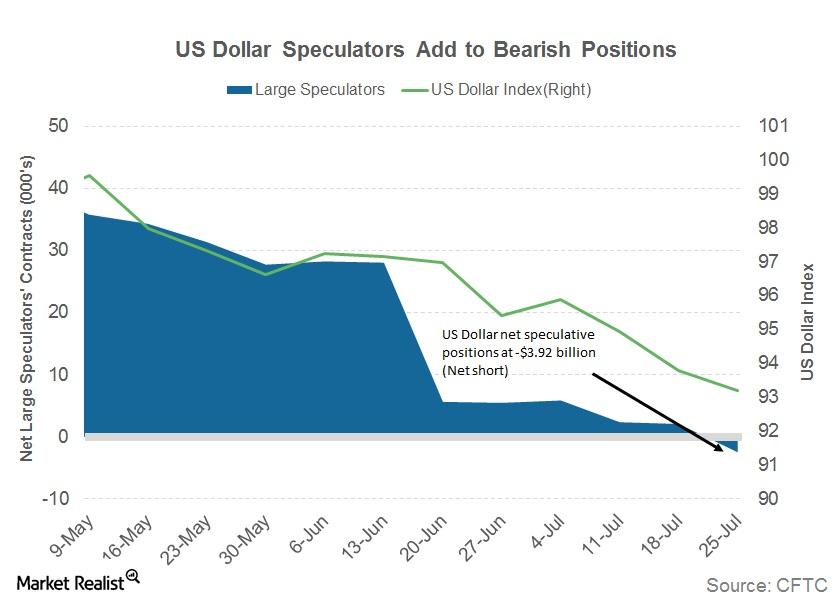

Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

Will Inflation and Unemployment Push the BOE to Raise Rates?

Inflation in the United Kingdom has been on a higher trajectory with consumer prices in the United Kingdom rising 2.9% in August year-over-year.

Why the British Pound Rallied to 15-Month High

The British pound (FXB) appreciated against the US dollar for the week ending September 15.

Why the US Dollar Saw a Sharp Rebound

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

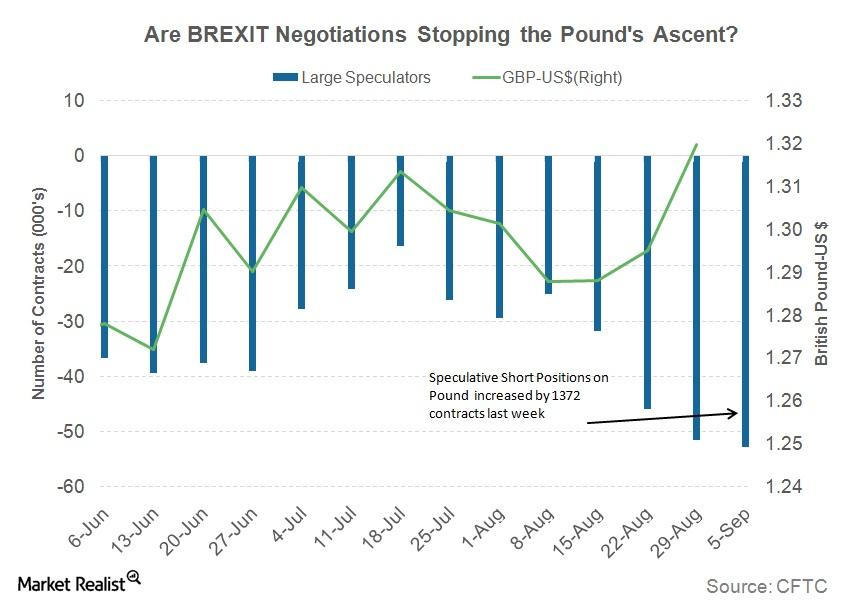

The Reason behind the Sharp Gains in the British Pound

The British pound (FXB) appreciated against the US dollar for the week ended September 8, 2017. The pound closed at 1.32, appreciating 1.9% against the US dollar.

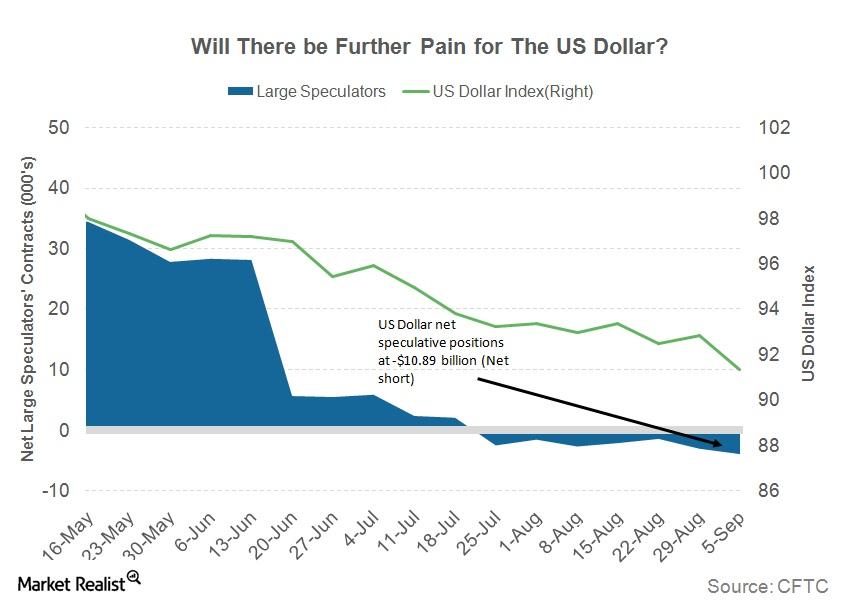

Why the US Dollar Could Be Poised for Further Losses

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

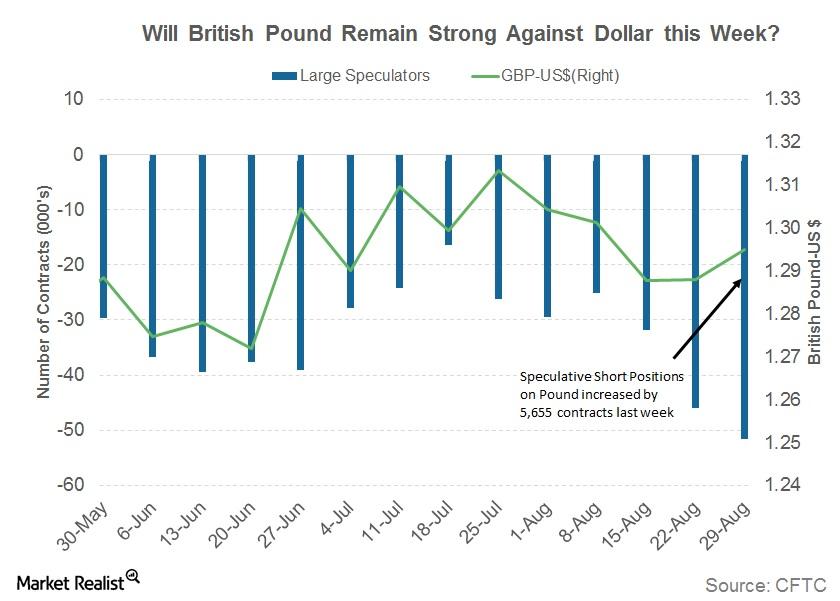

Can the British Pound Continue to Remain Strong This Week?

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017.

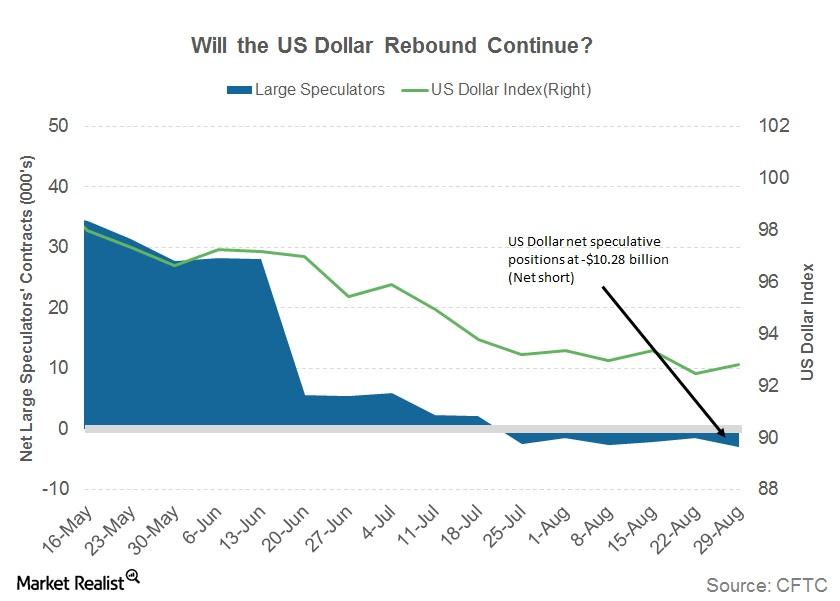

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

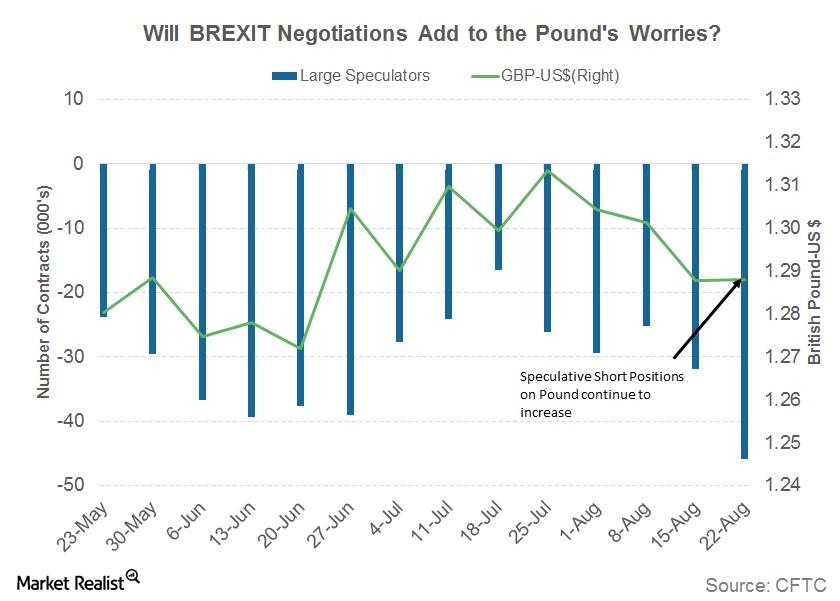

Round 3: Will Brexit Negotiations Help the British Pound?

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887.

Is the US Dollar Dying a Slow Death?

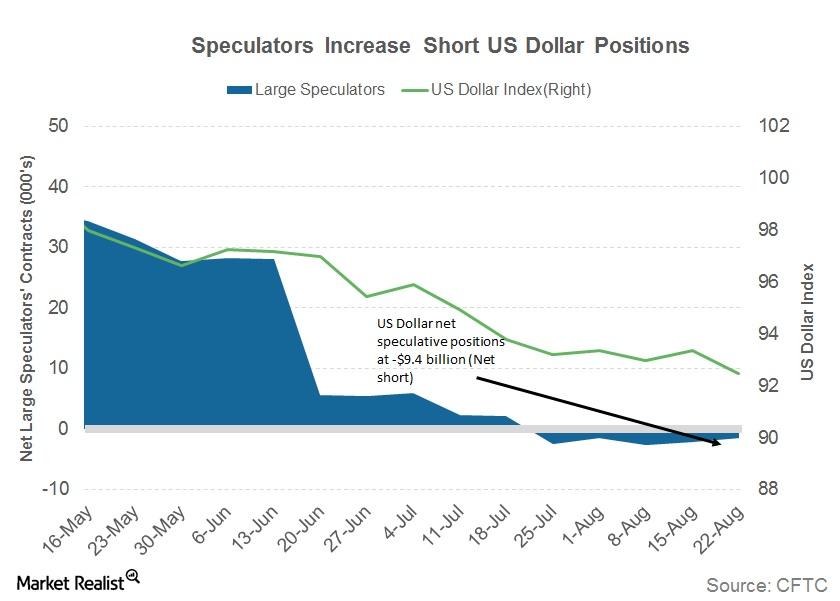

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

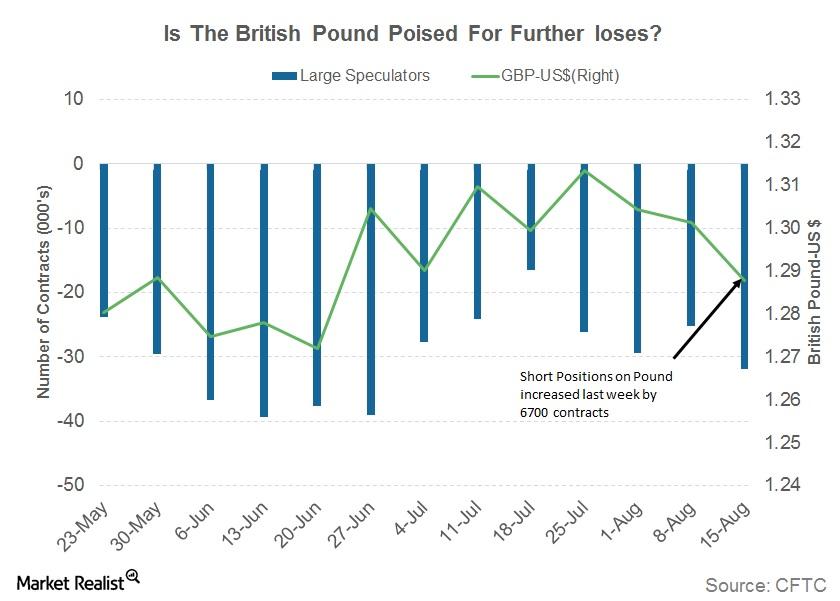

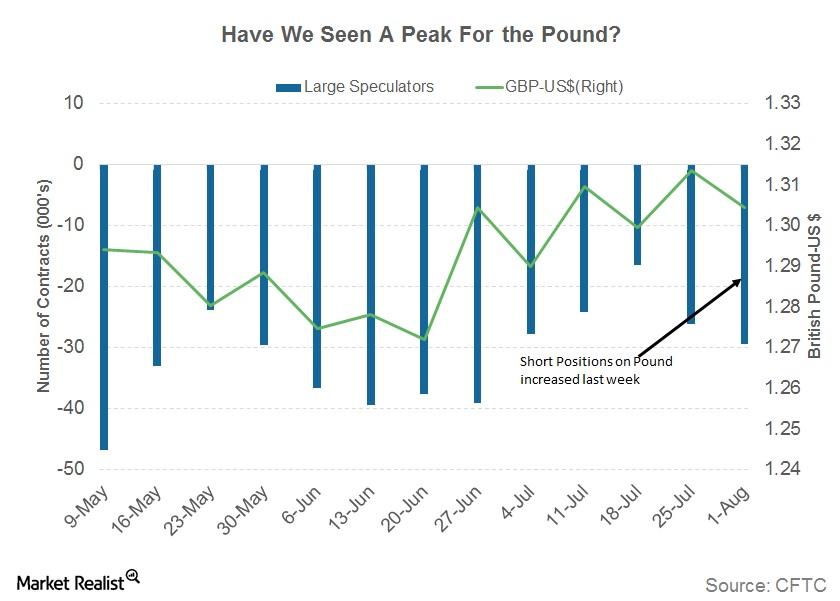

Here’s Why the British Pound Could Be Headed for Further Losses

The British pound (FXB) was one of the worst performers in the week ending August 18.

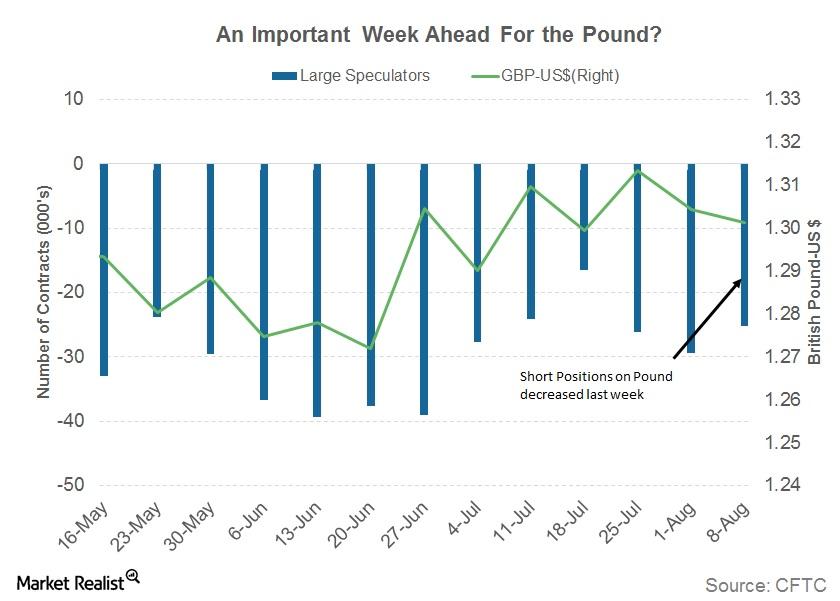

Why the British Pound Has an Important Week Ahead

The British pound (FXB) had another negative week as a dovish statement from the Bank of England continued to drag the currency lower.

A Lesson from Currency Markets during Geopolitical Tensions

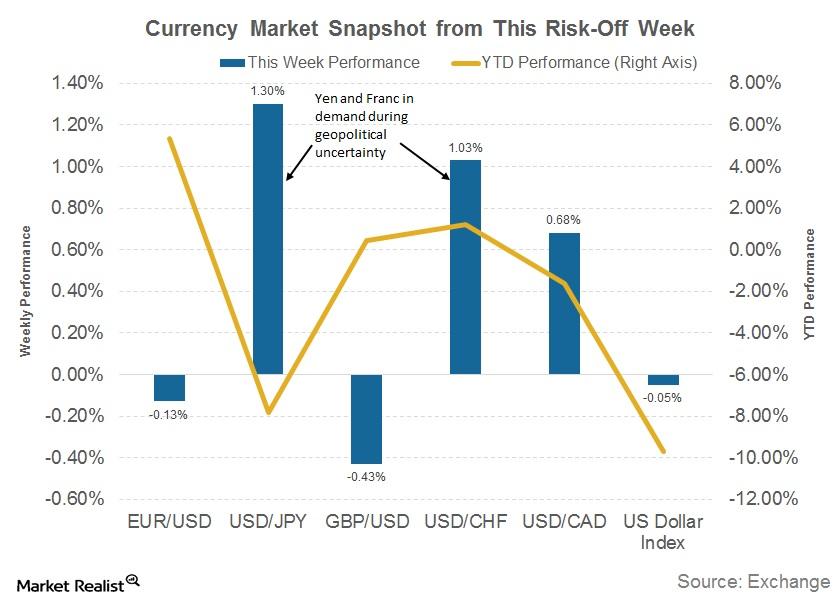

Last week’s rising geopolitical tensions between the United States and North Korea turned the tide for the yen. The Swiss franc also appreciated.

Chart in Focus: A Look at the British Pound

The British pound recorded another multi-month high of 1.3266 against the US dollar before the Bank of England announced its inflation report and interest rate decision on August 3.

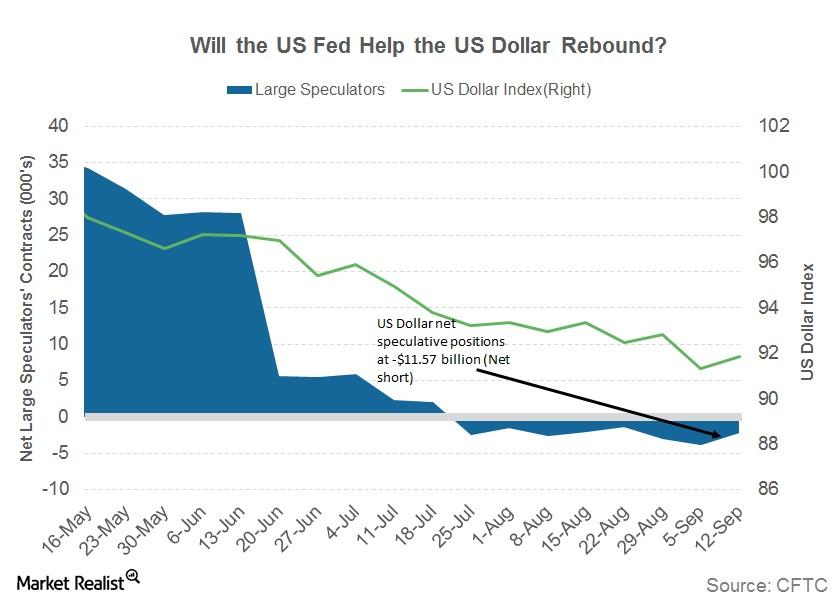

What to Expect from the US Dollar

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

International Monetary Fund Sees Renewed Brexit Pain for the UK

International Monetary Fund slashes UK growth forecast In its World Economic Outlook update, released on July 23, the International Monetary Fund (or IMF) downgraded its growth outlook for the United Kingdom. The IMF said that it expects the UK economy (EWU) to grow at a rate of 1.7% this year, compared with its previous forecast […]

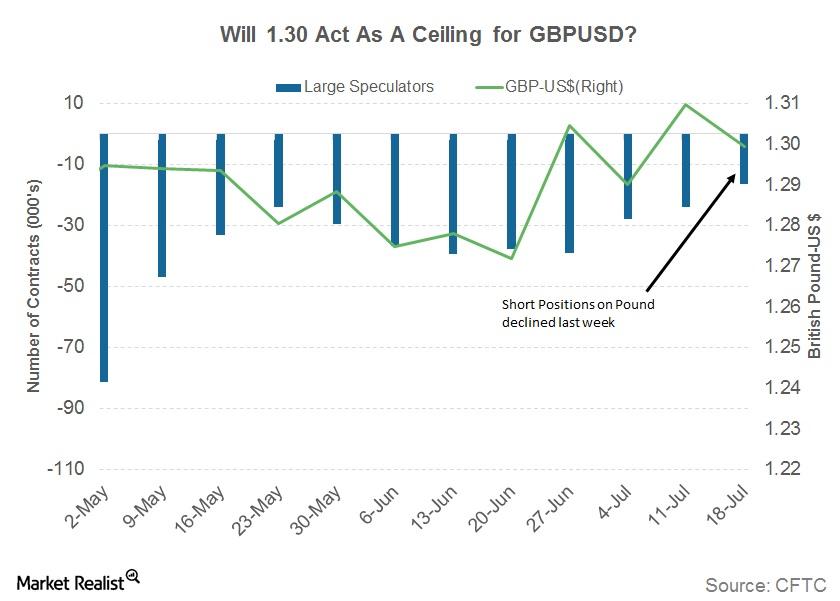

Why the British Pound Failed to Stay above 1.30

Investors not confident the Bank of England will raise rates The British pound (FXB) has had a roller coaster ride over the last few weeks, as mixed signals were given by the Bank of England. After a hawkish tone at its June meeting, the Bank of England has turned dovish in recent weeks. The British pound […]

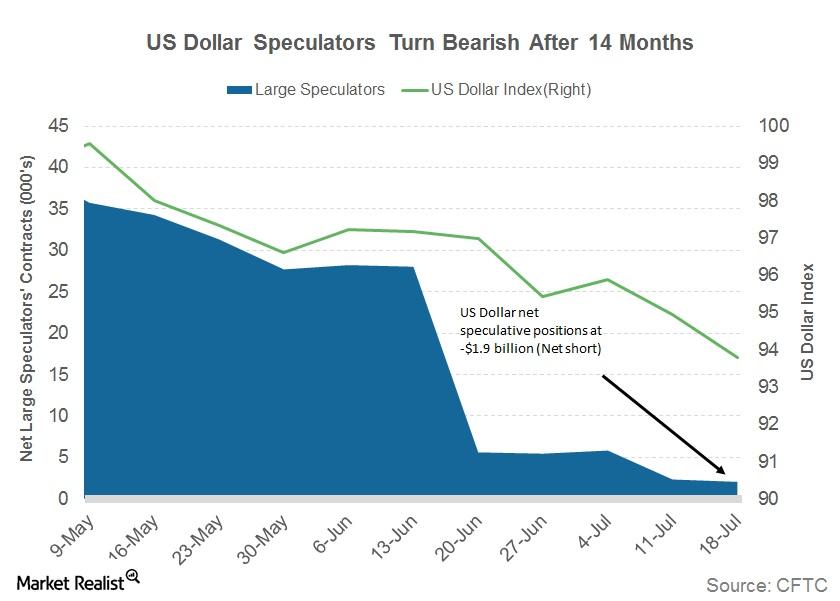

This Is Why the US Dollar Could Slide Further

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

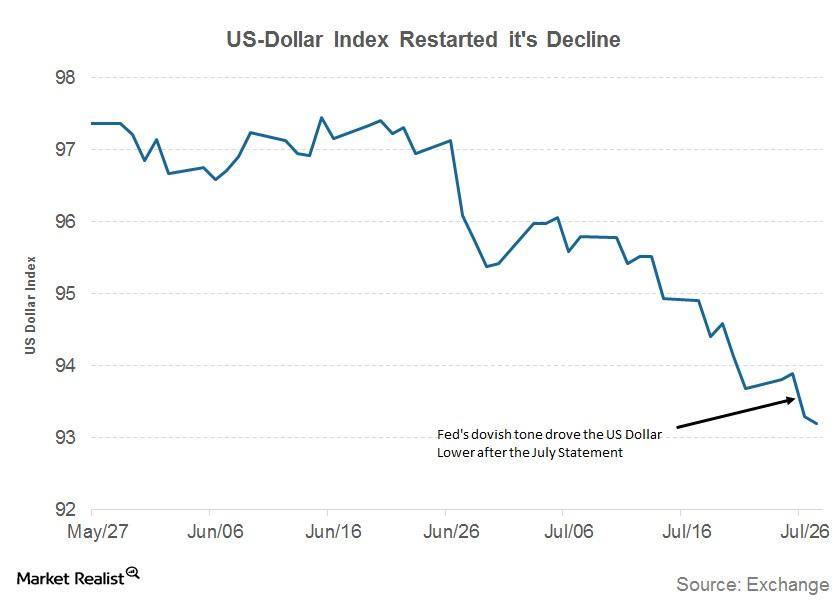

Why the US Dollar Took a Hit after the FOMC’s July Statement

Most of the statement released by the Federal Open Market Committee (or FOMC) following its two-day monetary policy meeting was in line with the market’s expectations.

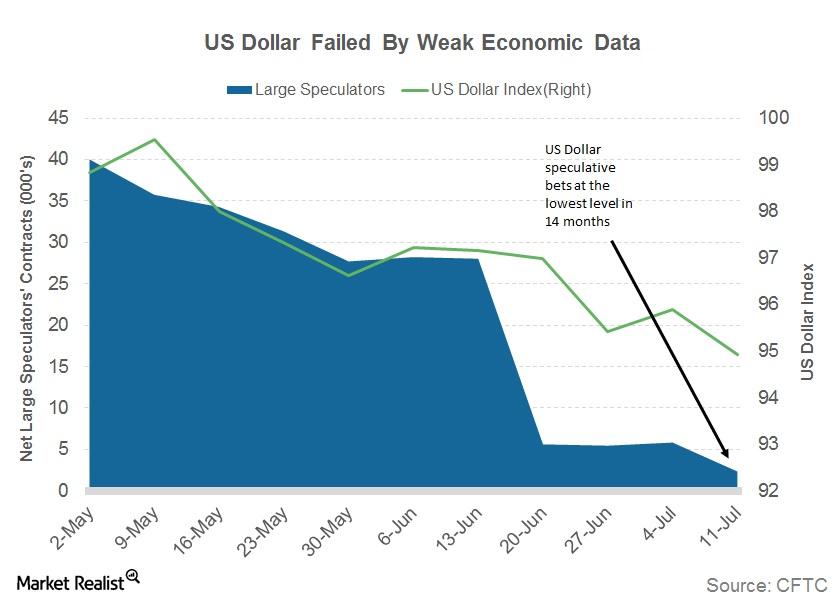

Have Yellen and US Economy Failed the US Dollar?

The US Dollar Index (UUP) closed at 94.9, depreciating by 0.90% last week.Macroeconomic Analysis Is the British Pound Facing the Risk of Stagnation?

Economic data from the United Kingdom showed unexpected signs of a slowdown last week, with weaker-than-expected data reported in trade, production, and house prices.

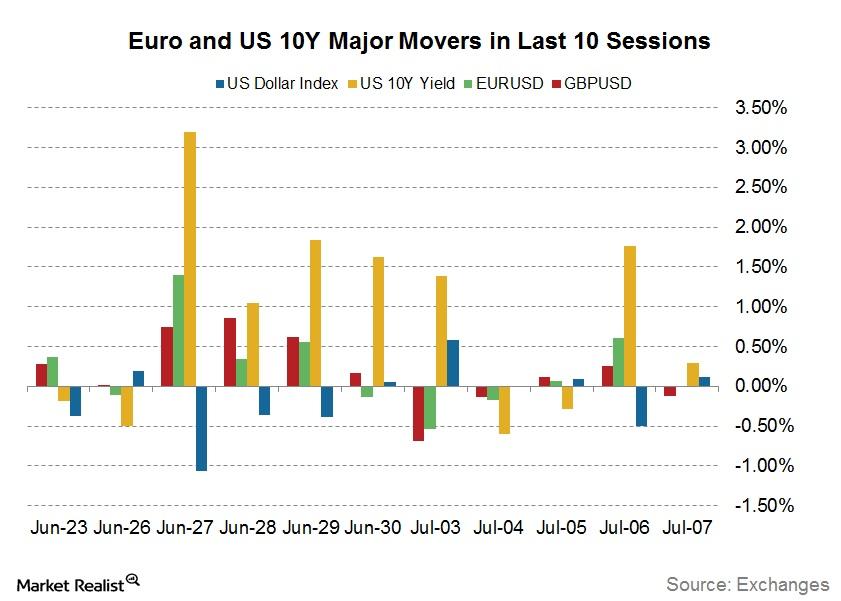

How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.