iShares International Treasury Bond

Latest iShares International Treasury Bond News and Updates

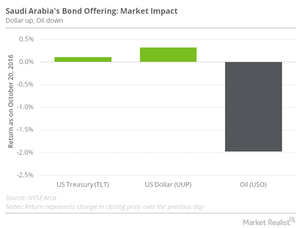

Saudi Arabia Enters International Bond Market, Raises $17.5 Billion

On October 20, the government of Saudi Arabia raised about $17.5 billion in an international bond issuance, marking the emerging market’s first foray into the international bond market.

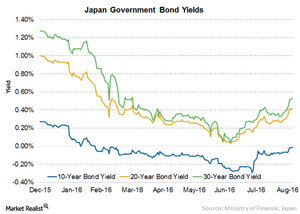

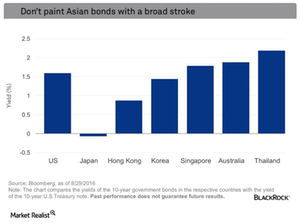

Hunting for Yield: Looking beyond Japan

Japan is the largest accessible bond market in Asia (source: Barclays Multiverse Index as of 7/29/16), but the problem is the yields for many local bonds are negative.Financials Risks you should know before investing in international bond funds

In this article, we’ll discuss some of the risks an investor must consider before investing in international bonds. Some of these risks are unique to this asset class.Financials Must-know variants in developed market international bond funds

International bond funds like the Vanguard Total International Bond Index ETF (BNDX) can have various investment styles determined by their stated choice of bond investments.

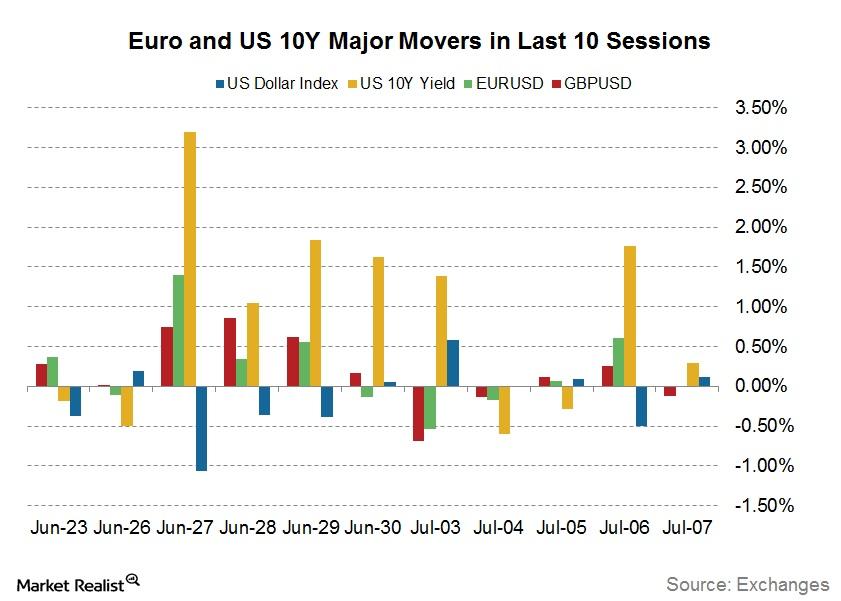

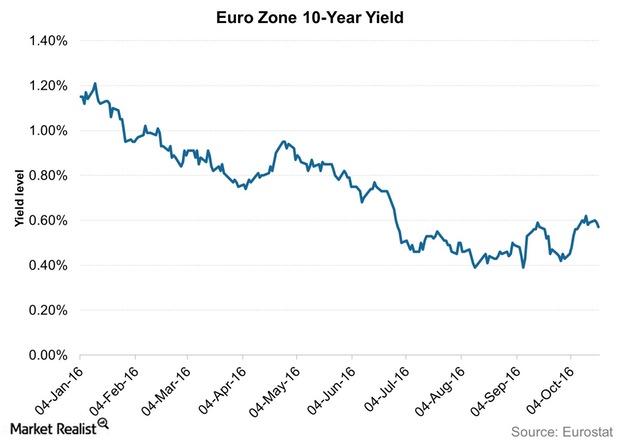

How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

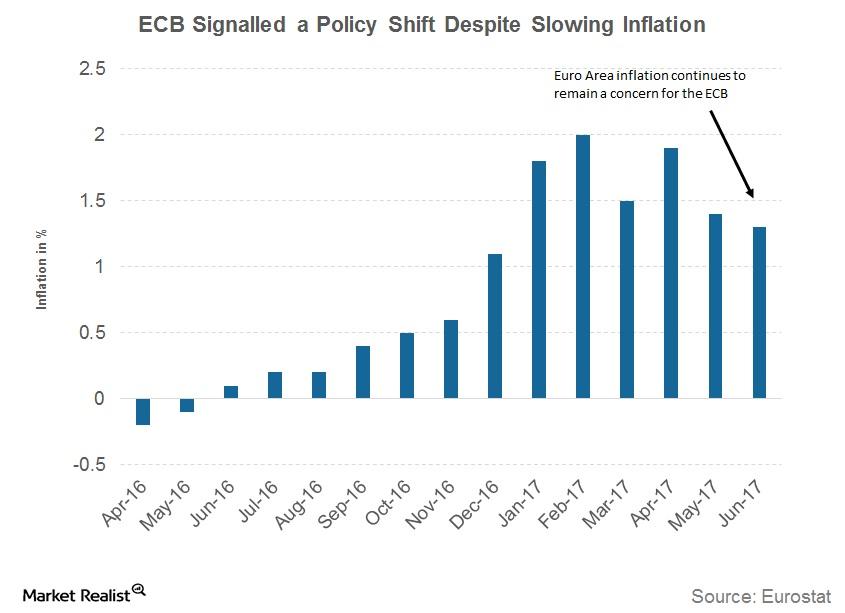

Confused Markets: Inside the ECB’s Struggle amid Miscommunication

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

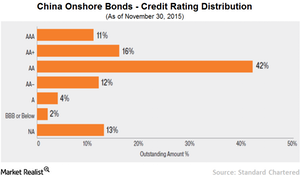

What’s Holding Back Foreign Investors from China?

Many leading bond index providers are still not including China’s onshore bonds in their benchmark indexes due to various regulatory and operational concerns.

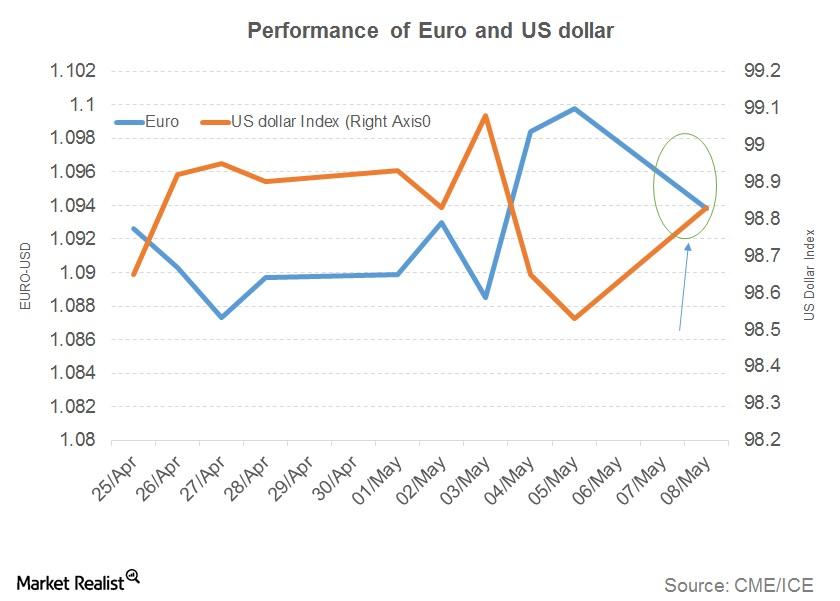

How Fixed Income, Currency Markets Reacted to the French Election

European bonds (BWX) started showing signs of celebration late May 5 as opinion polls pointed toward an Emmanuel Macron win in the French presidential election.

No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

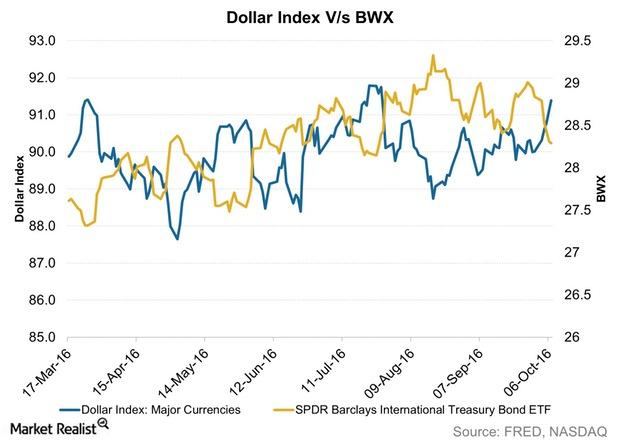

How Does a Strong Dollar Impact International Bonds?

When we talk about the relationship between the US dollar and bonds and how currency movements impact bonds, we’re essentially talking about international bonds.

Diminishing Opportunities in Asia: What You Need to Know

The balance of countries in Asia present more interesting opportunities. To better focus our discussion, I’ll concentrate on investment grade markets.