How Various Asset Classes Compare Using The Risk-Return Metric

The risk-return metric for ten-year Treasuries (IEF) are lowest, but also the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

Aug. 21 2020, Updated 8:26 a.m. ET

Of course, more risk also equates to higher expected returns. What’s interesting to me is how these different asset classes deliver return to investors. When an investor moves from Treasury bonds to investment-grade corporates, they are taking on an increasingly high level of default risk and are being compensated with higher expected yields. When an investor goes from high yield to developed market equities they actually receive a lower expected yield but a higher expected price appreciation, which results in a higher expected return.

Market Realist – Risk-return relations show that you need to take on more risk in order to achieve higher returns

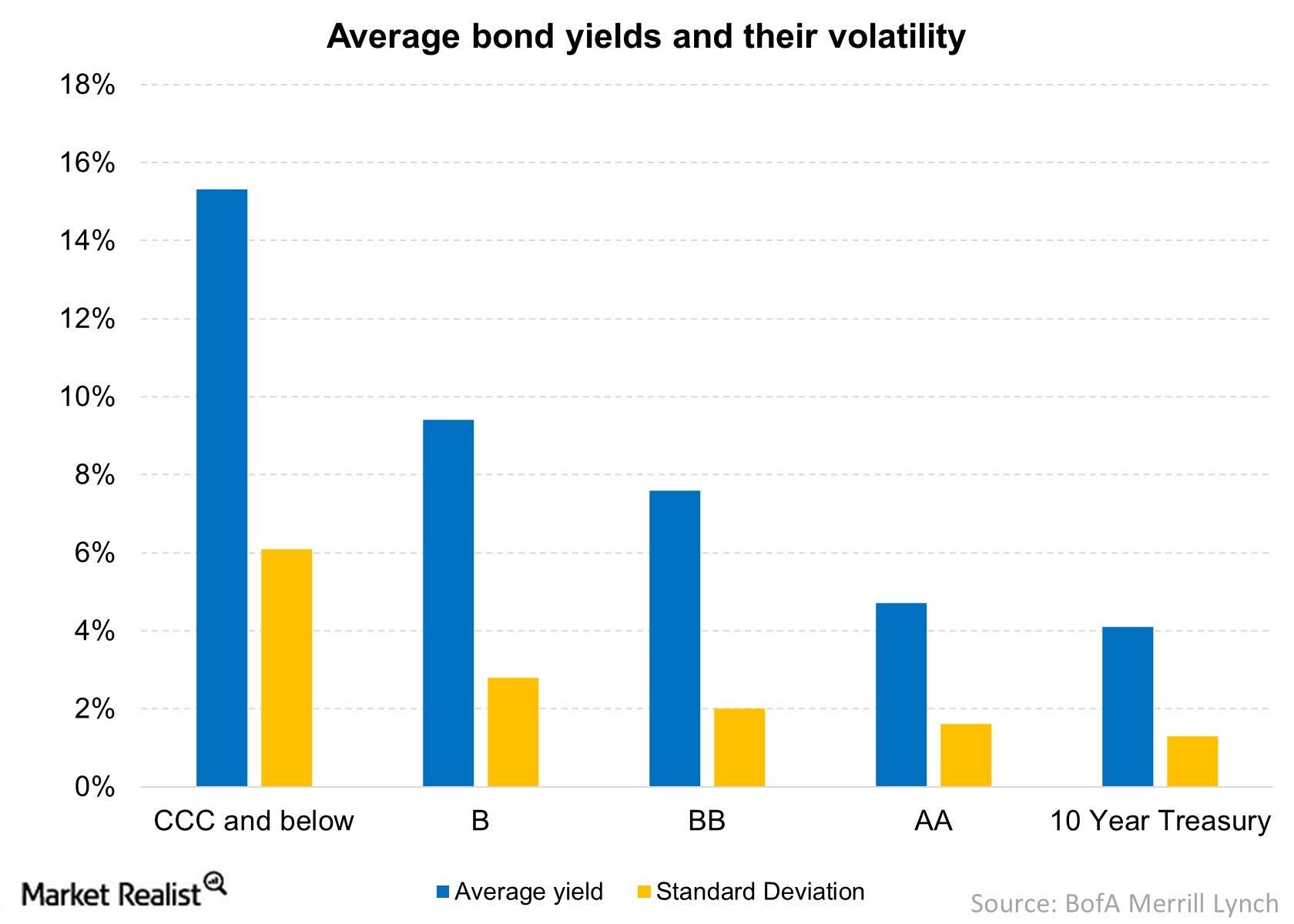

The graph shows average yields over twenty years for different classes within the bond sector, along with the standard deviation, or volatility, of their yields over the last twenty years. Volatility is a measure of the dispersion of returns, in other words, of the risk involved.

High yield bonds (HYG) that are rated CCC and below by Standard & Poor’s have an average yield of 15%. However, investing in them entails a larger risk. Their yields have a volatility of of 6.1%.

High yield bonds rated B and BB have much less risk, with standard deviations of 2.8% and 2.0%, respectively, but they also have lower average yields of 9.4% and 7.6%.

As we get to investment grade bonds (LQD)(AGG), the risk-return metric shows even smaller numbers. Bonds rated AA have an average yield of 4.7%, with a standard deviation of 1.6%.

Finally, ten-year Treasuries (IEF) are the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

How much risk you can withstand should determine which of the above you would invest in.

The riskiest asset by far, meanwhile, are equities (IVV). This asset class can, however, give you the best return in the long run.