Understanding the Leading Credit Index for September 2017

The Leading Credit Index is an economic model that’s modeled on the performance of six major financial market instruments.

Oct. 30 2017, Updated 7:31 a.m. ET

Understanding the Leading Credit Index

The Leading Credit Index is an economic model that’s modeled on the performance of six major financial market instruments. These constituents represent the lending conditions that are prevalent in the US economy. The availability of credit is a necessity for any industry, without which we can expect a strain on businesses and the economy.

Below are the six constituents of this index:

- Two-Year Swap (SHY) Spread (real time)

- LIBOR (London Interbank Offered Rate) three-month (SCHO) less three-month Treasury Bill (VGSH) yield spread (real time)

- Debit balances at margin account at broker-dealer (monthly)

- AAII Investors Sentiment Bullish (%) less Bearish (%) (weekly)

- Senior Loan Officers C&I (commercial and industrial) loan survey; bank tightening credit to large (SPY) and medium firms (IWM) (quarterly)

- Security Repurchases (GOVT) (quarterly) from the Total Finance-Liabilities section of the Federal Reserve’s flow of fund report.

All the above are forward-looking indicators and thus form part of the Leading Economic Index (or LEI).

Performance of the Leading Credit Index

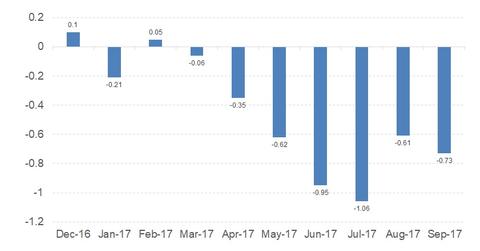

The Leading Credit Index is an inverse index for consideration in the LEI. If credit conditions improve, the impact on the economy is positive. In September, the leading credit index was reported at -0.73 compared to a revised reading of -0.61 in August. The Leading Credit Index has a weight of 8.2% on the LEI. For September, the credit index had a net positive impact of 0.06 on the Conference Board LEI.

Credit conditions continue to remain stable

Many companies depend on credit for their working capital and capex (capital expenditure) requirements. Favorable credit conditions are paramount to any economy. The Leading Credit Index has improved in September from a marginal decline in the previous month. The index is like an inflation-adjusted M2 money supply and should be monitored for any changes in credit conditions.

In the next part of this series, we’ll analyze the changes in the credit spread as the US Fed begins its balance sheet normalization program.