What Could Happen if the US Debt Ceiling Isn’t Raised

The failure of US Congress to raise the debt ceiling would result in a partial government shutdown. The US Treasury wouldn’t be able to issue any government debt, and it could end up borrowing from its retirement savings fund.

Jan. 19 2018, Updated 7:35 a.m. ET

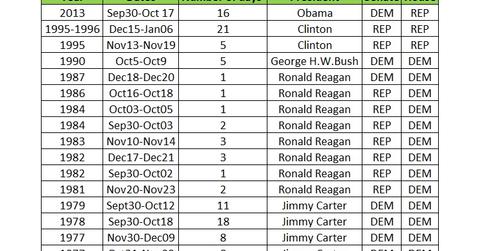

The history of US government shutdowns

The failure of US Congress to raise the debt ceiling would result in a partial government shutdown. The US Treasury wouldn’t be able to issue any government debt, and it could end up borrowing from its retirement savings fund. The Treasury has to rely only on incoming revenue to pay for federal expenses, which include police, administration, and even schools.

Previous examples of a US government shutdown:

- In 2013, the Republican Party blocked funding for Obamacare by rejecting the debt ceiling increase, and a shutdown began in October 2013. This government was shut down for 17 days until the debt ceiling was raised on October 17, 2013.

- In 1995, the US government was shut down twice under President Clinton between November 14 and 19, 1995, and December 15, 1995, to January 6, 1996.

What happens during a US government shutdown?

A US government shutdown would mean neither salaries nor pensions for federal employees, no social security payments, and the closure of federal buildings and services. The US Treasury could default on its interest payments on Treasury bills (SCHO).

How could financial markets react to a US government shutdown?

When the US government shuts down, investors—especially in the fixed income (BND) market—could panic as the value of the bonds they hold could plummet and bond yields could rise. The cost of borrowing could rise, making it difficult for businesses to borrow.

International investors holding US government (GOVT) debt would dump their holdings, which would cause the bond market to collapse and the US dollar (UUP) to plummet. Equity (SPY) markets, historically, haven’t been impacted to a greater extent by government shutdowns, but an extended government shutdown could impact them as well.