How Saudi Arabia’s Bond Sale Affects US Treasury Bonds

Saudi Arabia has also been involved in the sale of US Treasuries. The country is the 15th-largest holder of US Treasury bonds in the world.

Nov. 20 2020, Updated 3:15 p.m. ET

Selling US Treasury

Saudi Arabia has also been involved in the sale of US Treasuries (SHY) (TLT) (GOVT). The country is the 15th-largest holder of US Treasury bonds in the world (ACWI) (VTI).

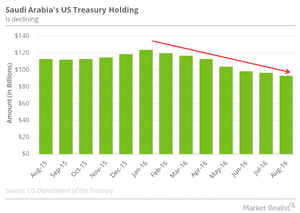

According to US Treasury data, Saudi Arabia held $93 billion worth of US Treasury securities in August 2016.

The figure stood at $116.8 billion in March 2016, a fall of 6% from the figure recorded in January 2016. Evidently, Saudi Arabia has been cashing in on its holdings of US Treasury debt since the beginning of the year. The figure still stands as the highest among the oil-producing nations. The UAE (United Arab Emirates) owns $64.1 billion of US Treasury debt, and Kuwait owns $31.3 billion.

Holders of US Treasury debt are selling the securities for a variety of reasons. China, for instance, has been selling US Treasury bonds to defend the Chinese yuan. Japan, on the other hand, has been swapping US Treasury bonds for cash and T-bills as negative rates have pushed up demand for the US dollar in the region.

Meanwhile, oil-producing nations such as Saudi Arabia have been selling US Treasury bonds to plug their budget deficit gaps following the plunge in oil prices.

The recent dip

US Treasury prices fell on October 19, 2016, ahead of Saudi Arabia’s sovereign bond sale on October 20, on concerns over credit risk. Yields on US Treasuries have been rising. Prices fell in the days ahead of the Saudi bond sale, as book runners sold Treasuries in attempts to lock in spreads between the two sovereign bonds. Bond yields and prices move in opposite directions.

Prices recovered after the bond sale. Underwriters sold US Treasuries before the sale, as hedges against the Saudi Arabian bond issues they’d underwritten. These actions were attempts to lock in rates before the offering. Underwriters subsequently bought the Treasuries back for their clients.

European and Japanese investors

For certain foreign investors, Treasuries don’t seem to be providing the margin of safety they used to. Yields may be up to 1.6%, but this isn’t enough. Paying due consideration to the exchange rate, Treasury yields are effectively negative for buyers based in Europe (VGK) and Japan (EWJ).

In his latest webcast, Bond King Jeffrey Gundlach noted that while negative yields in Europe (FEZ) (VGK) and Japan (EWJ) (HEWJ) may make US Treasuries attractive to sovereign debt investors from these regions, investors need to exercise caution, as the spread is narrowing.

The foreign exchange effect is such that effectively, investors wouldn’t get anything from their investments in US Treasury bonds. For more information, read Gundlach’s Advice to Japanese and European Investors in US Treasury. For more on Jeffrey Gundlach, read Jeffrey Gundlach Says This Is the ‘Worst Setup’ for Bond Market.