BTC iShares Currency Hedged MSCI Japan ETF

Latest BTC iShares Currency Hedged MSCI Japan ETF News and Updates

Analyzing the BoJ’s Monetary Policy Enhancement Measures

The BoJ’s monetary policy was the most awaited macro event this week. It was the first major central bank to expand its easing program after the Brexit vote.

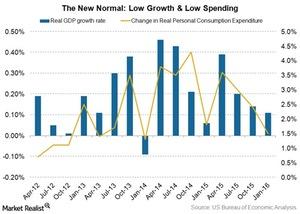

Bill Gross’s Views on Growth and Inflation

Gross believes that money has stopped generating growth and inflation. Equity prices are artificially elevated, and negative yields are guaranteeing capital losses.

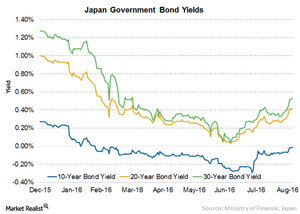

Hunting for Yield: Looking beyond Japan

Japan is the largest accessible bond market in Asia (source: Barclays Multiverse Index as of 7/29/16), but the problem is the yields for many local bonds are negative.

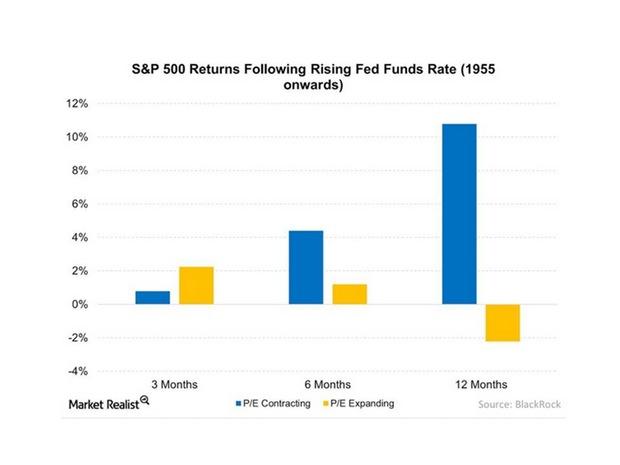

Why To Expect Muted Returns from US Equities

We can expect muted returns from US equities going forward. US stocks face the prospect of higher interest rates, albeit gradual and from unusually low levels.

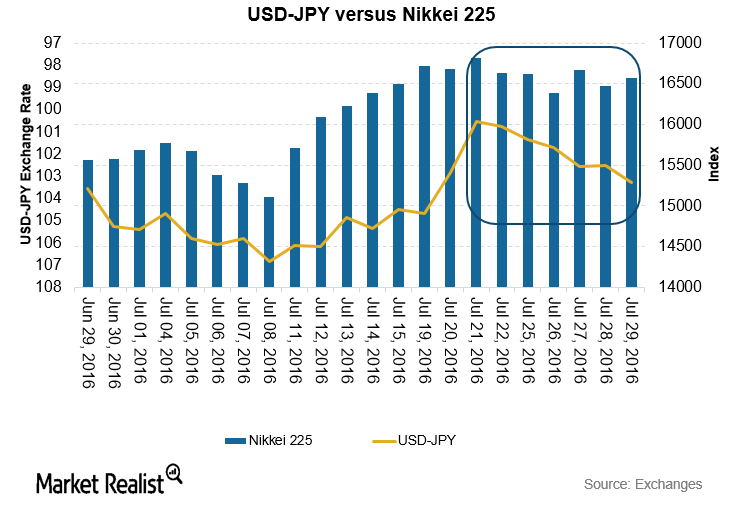

Japanese Trade Surplus Rose in June, Imports Fell More than Exports

The trade surplus for Japan increased to 692.8 billion yen for June—compared to a deficit of 60.9 billion yen in the same month last year.

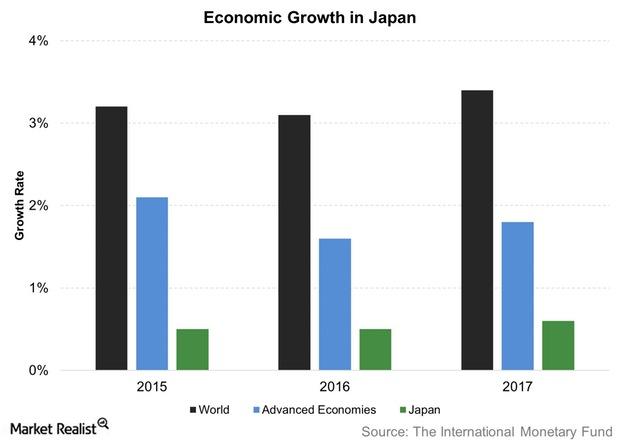

The IMF Sees Improvement in Japanese Economic Growth Forecasts

The IMF expects Japanese economic growth to be 0.5% in 2016—the same as in 2015—and to tick up to 0.6% in 2017.

Why the Bank of Japan Wants to Overshoot Its Inflation Commitment

One of the key features of Japan’s new monetary policy framework is its inflation-overshooting commitment.

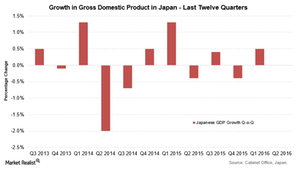

Japan’s Economy Exhibits Flat Growth, Abe Feels the Pressure

Japan’s economy showed no growth on a quarterly basis in 2Q16—compared to growth of 0.5% in the previous quarter and forecasts of a 0.2% expansion.

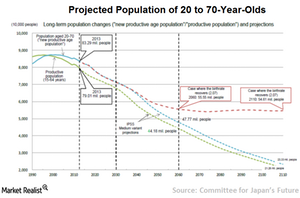

Why Structural Reforms Are Needed to Spur the Japanese Economy

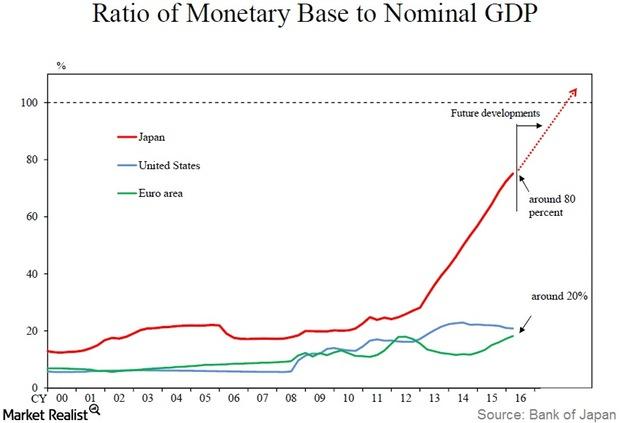

Market participants believe that the BoJ (Bank of Japan) needs to do more to beat deflation and propel the Japanese economy to sustainable long-term growth.

Why Monetary Policy Isn’t Enough to Boost the Japanese Economy

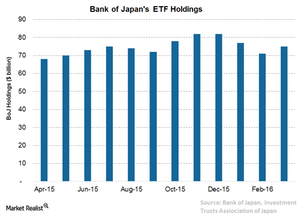

The BoJ is the one of the largest holders of Japanese (DFJ) government bonds and also a major player in equity markets.