How Are Safe Havens Faring in This North Korea Fear?

The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT).

Aug. 14 2017, Updated 9:36 a.m. ET

Investors shift to safe havens

In times of uncertainty, investor demand for safe haven assets rises. Investors flock to safety by dumping riskier assets such as equities (SPY). The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT). After news of escalated tensions between the United States and North Korea hit the markets, riskier assets that have been outperforming in the past month fell dramatically. This shift in investor behavior usually lasts for a short period of time, and once the tensions abate, investors return to riskier assets.

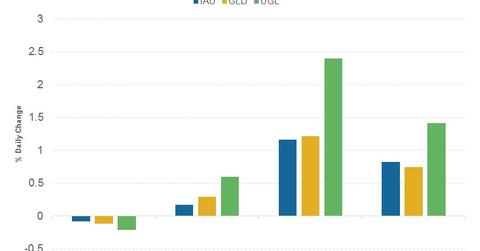

Gold back in the picture

In the past week, gold prices have risen more than 2.0% as demand for the precious metal increased in response to elevated geopolitical risks. The ETFs that track the performance of gold include the iShares Gold Trust (IAU), the SPDR Gold Shares (GLD), and the ProShares Ultra Gold (UGL). On average, these ETFs have risen more than 2.0% in the last four trading sessions, reflecting the demand for gold. If tensions between the United States and North Korea escalate further, we can expect a further increase in demand for gold as a safe haven.