Invesco CurrencyShares Swiss Franc Trust

Latest Invesco CurrencyShares Swiss Franc Trust News and Updates

Effects of the North Korea–US Tension on Investors

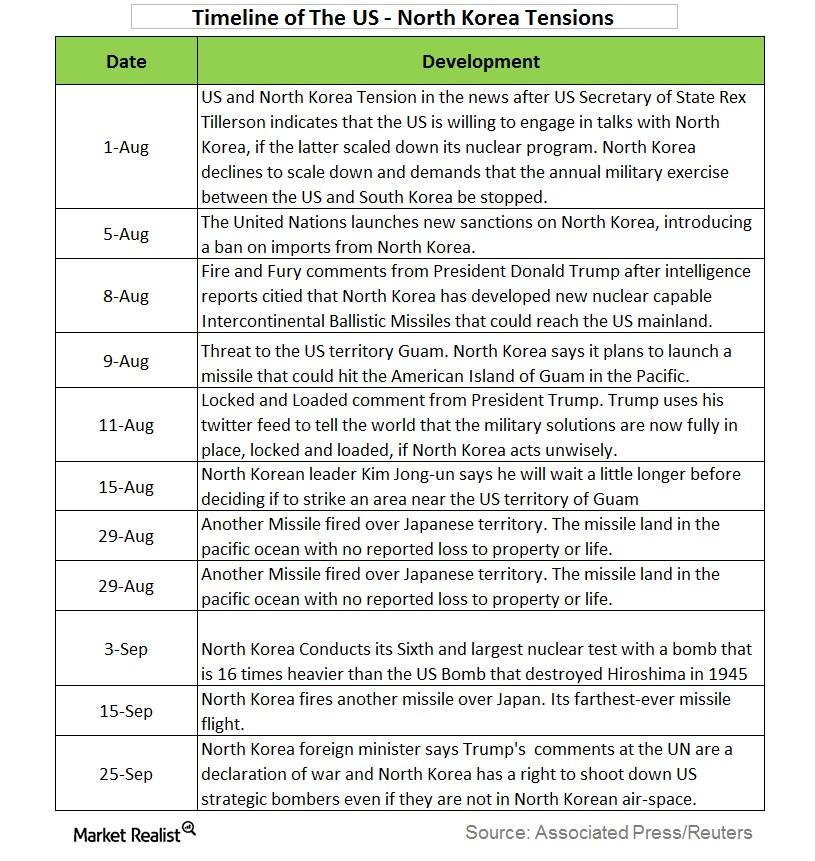

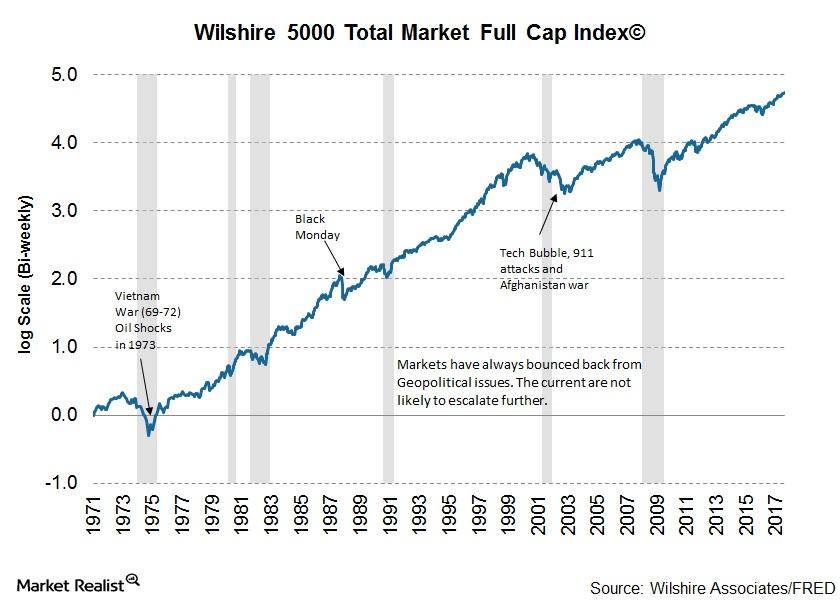

Rising North Korea tensions In the last two months, tensions between the United and North Korea have continued to escalate, with both sides refusing to back down. North Korea has initiated a series of missile and nuclear tests, worsening tension in the region, and the US president has responded to these tests with strong warnings. […]

Why the Euro Is Turning Out to Be a Preferred Safe Haven

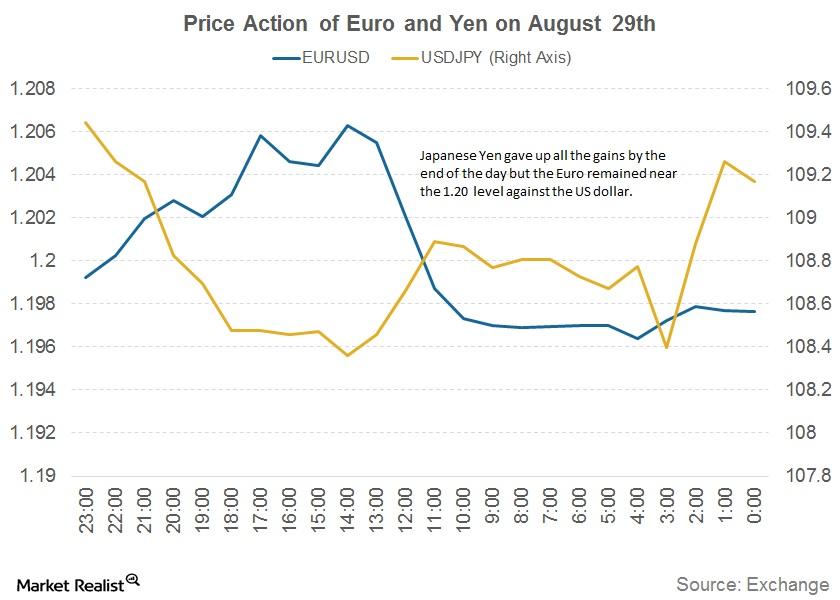

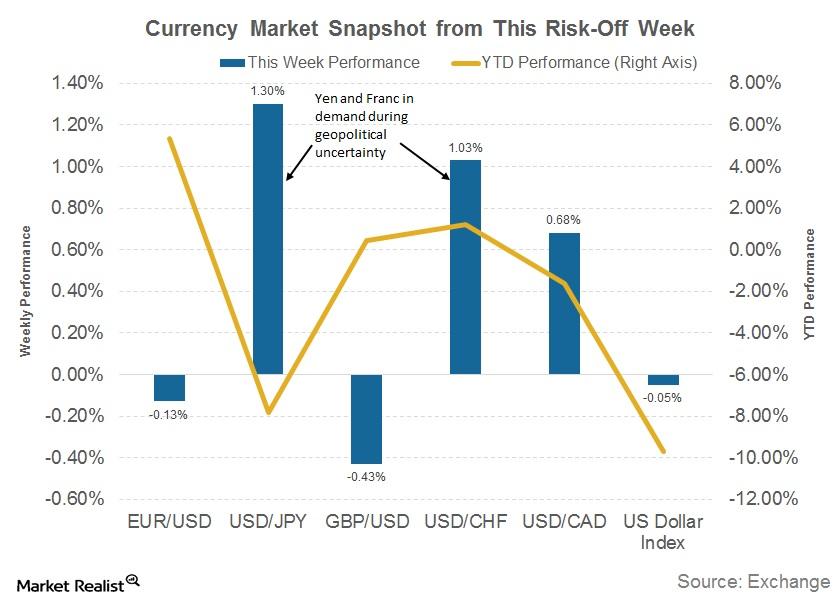

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

North Korea Tensions: Will Demand for Safe Havens Rise?

In the financial markets, there are a few financial assets whose demand increases dramatically in times of uncertainty.

Washington or Wyoming: What Will Drive Markets This Week?

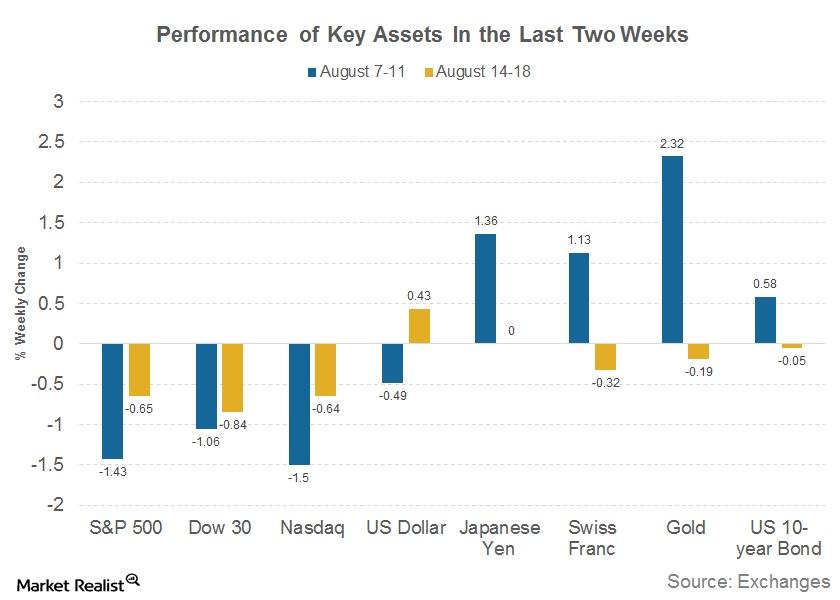

The last two weeks have been eventful for financial markets (SPY).

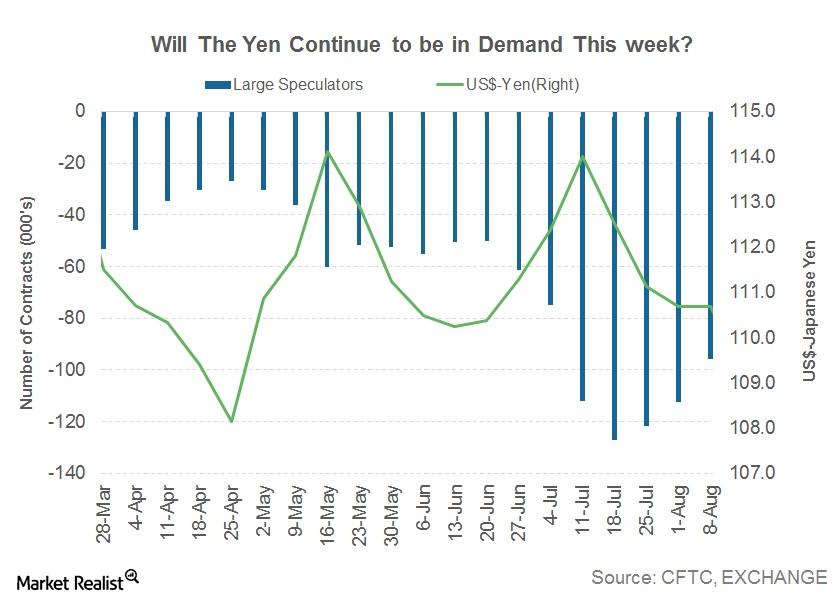

Will the Japanese Yen Appreciate Further This Week?

The Japanese yen (JYN) was back in demand as geopolitical tensions took center stage last week.

Do Financial Markets Have Another Tense Week Ahead?

Equity markets in the US and across the globe reported heavy losses as risk aversion set in.

A Lesson from Currency Markets during Geopolitical Tensions

Last week’s rising geopolitical tensions between the United States and North Korea turned the tide for the yen. The Swiss franc also appreciated.

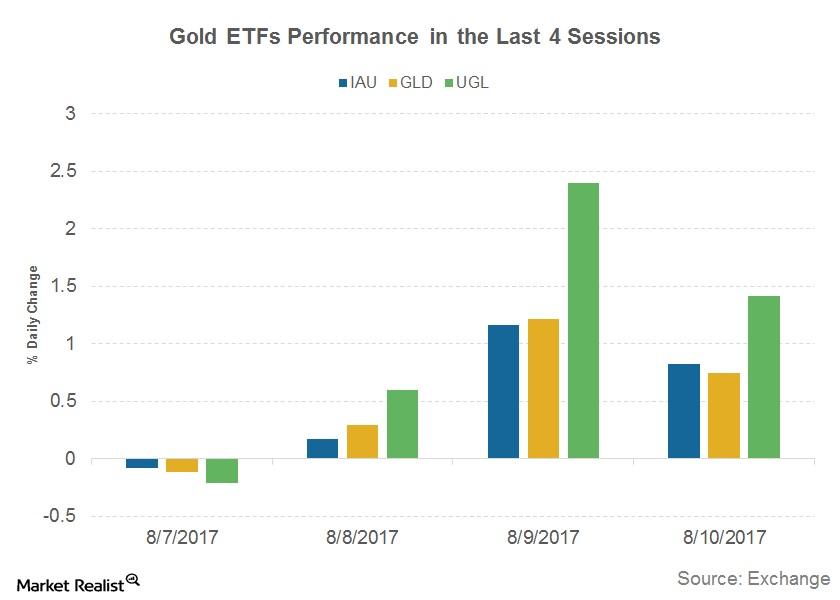

How Are Safe Havens Faring in This North Korea Fear?

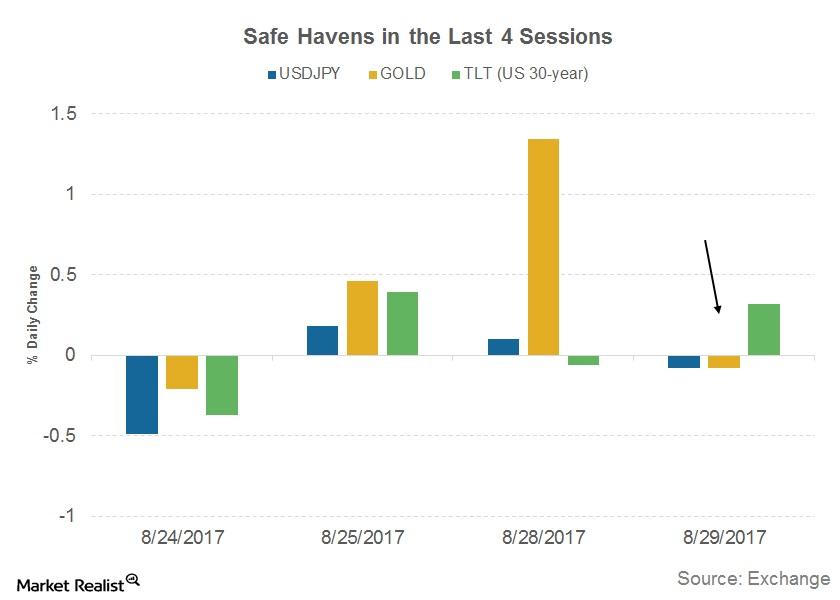

The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT).

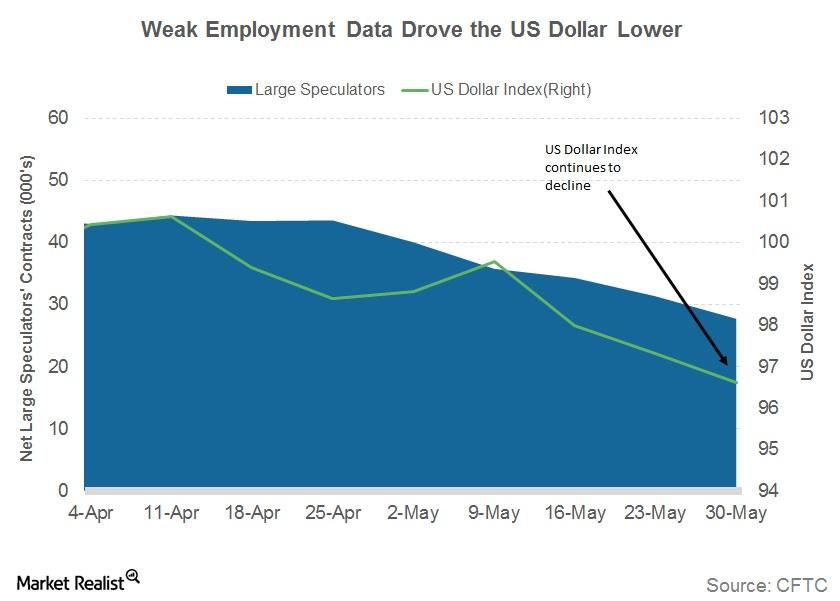

How the Weak Jobs Data Could Spell Doom for the US Dollar

The US dollar came into focus after the weak US jobs data on June 2. The payroll data was a negative surprise, with only 138,000 jobs being added in May.

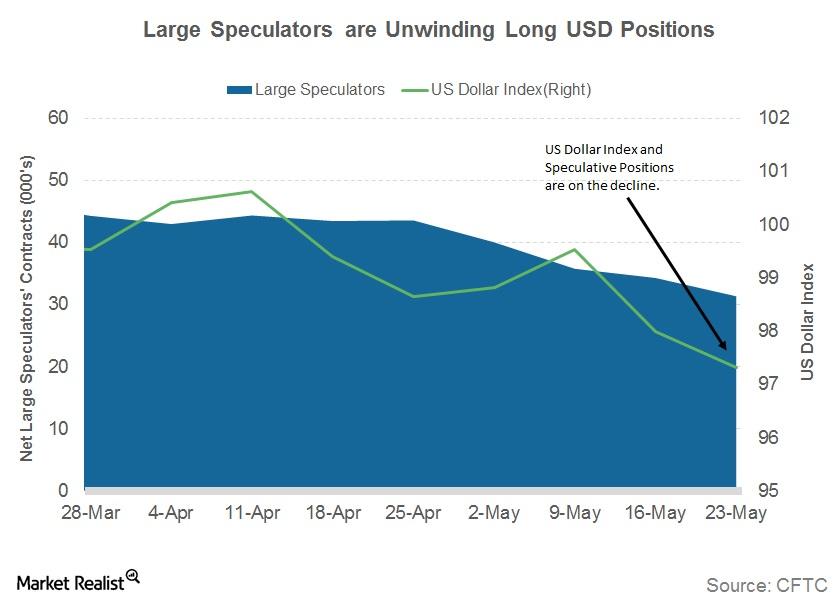

What the Falling US Dollar Could Indicate for Investors

The US dollar (UUP) has continued to lose its value with respect to its trading partners. The US Dollar Index fell 1.6% in the week ended May 26, 2017.

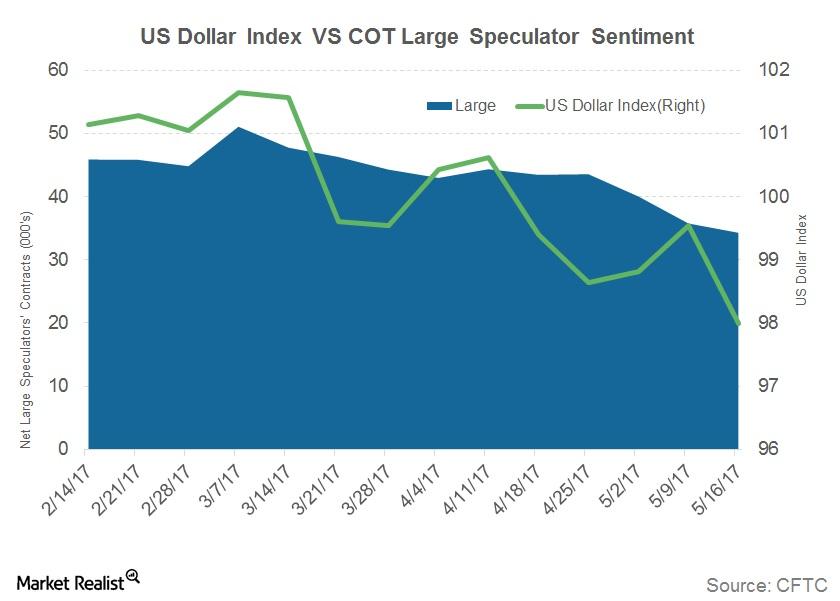

Is the US Dollar the Only Positive for US Economy Right Now?

The US dollar (UUP) continued to trend lower against its trading partners with the US Dollar Index (DXY) losing 2.1% in the week ending May 19, 2017.

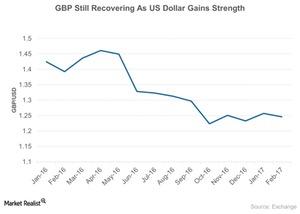

How Currencies Have Reacted since the Brexit Decision

The British pound (FXB) (GBB) is trading at 31-year low of 1.25 as of February 2017, its lowest level since 1985. The currency fell ~11% in 2016.