iShares MBS

Latest iShares MBS News and Updates

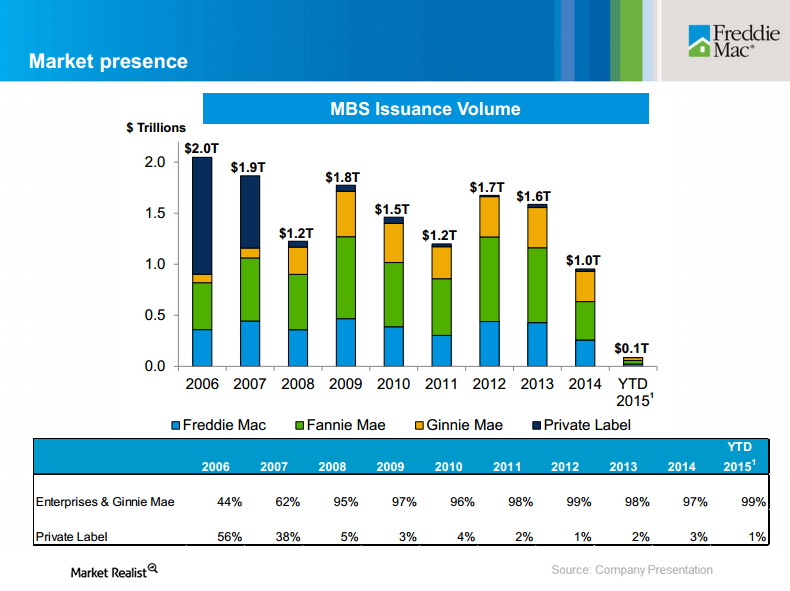

An Update on Fairholme’s Positions in Fannie Mae and Freddie Mac

Berkowitz believes that Fannie Mae and Freddie Mac entities are highly valuable and expects them to generate earnings of at least~$21 billion a year.

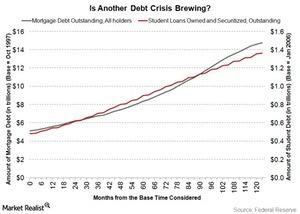

Is Student Debt the Next Bubble to Hit the US Economy?

Many are likening the current student debt situation in the United States to the mortgage debt situation that led to the 2009 financial meltdown in the US economy.

Why Student Debt May Not Affect the US Economy Like Sub-Prime

According to the White House Council of Economic Advisers, “Student debt is less likely to make a recession more severe or slow an expansion in the way that mortgage debt may have.”Financials How to measure your portfolio’s interest rate risk with convexity

Portfolio durations differ from key rate durations, as even though the durations of two portfolios may match, both portfolios may differ in the maturity profiles of the bonds they comprise, which will result in differing key rate durations.Financials Richard Fisher explains why excess reserves can create velocity

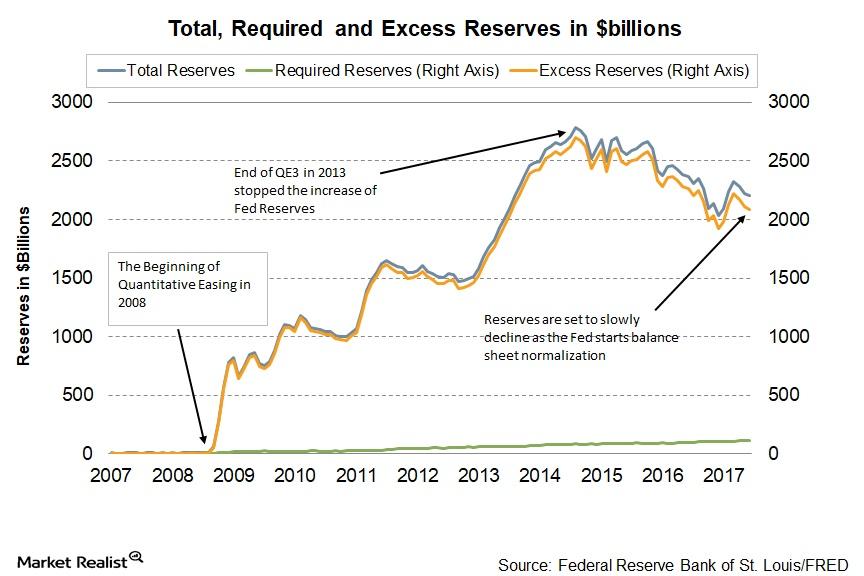

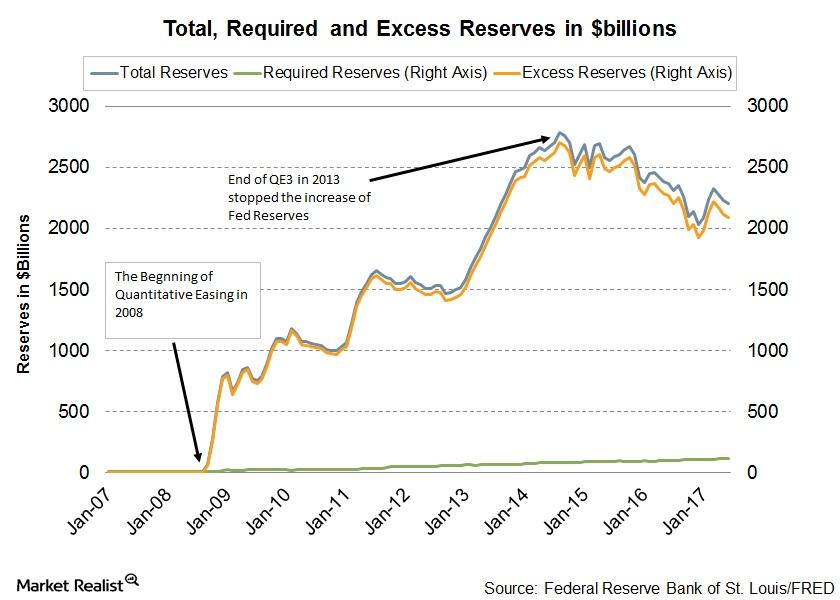

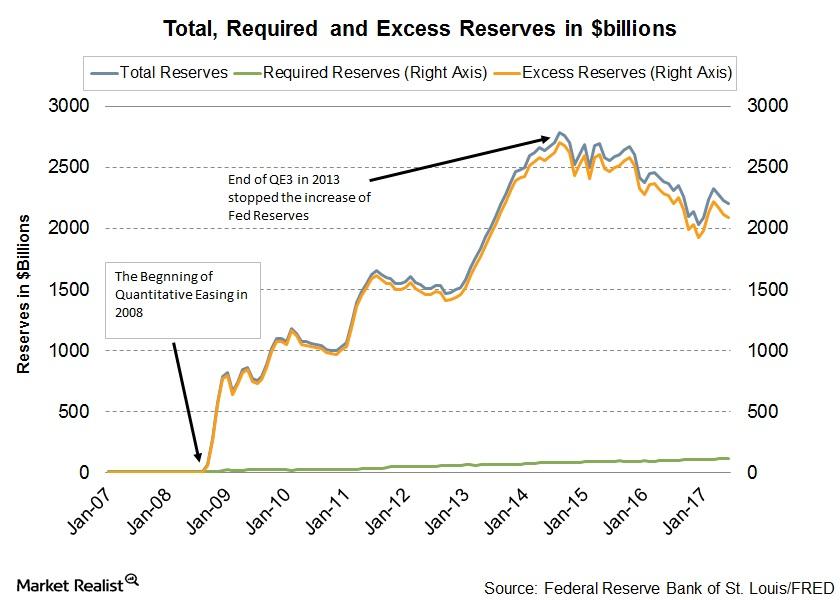

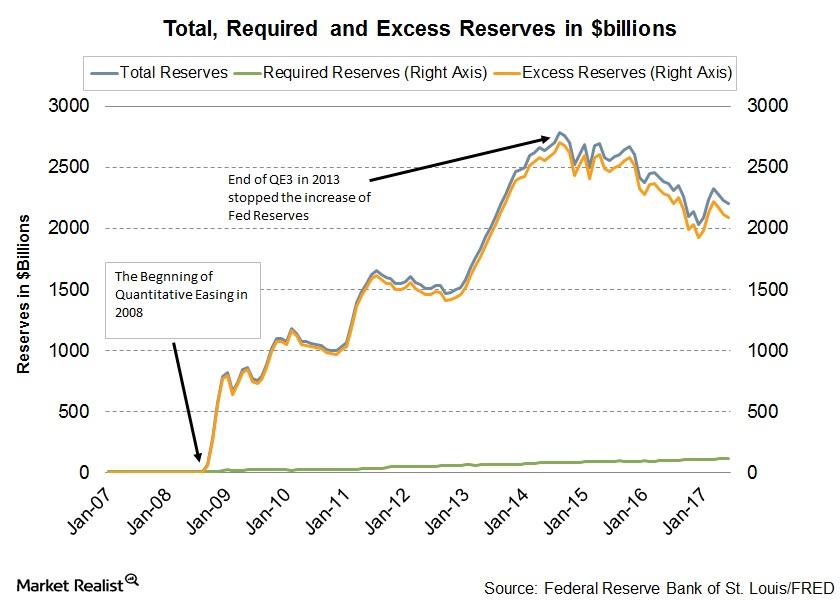

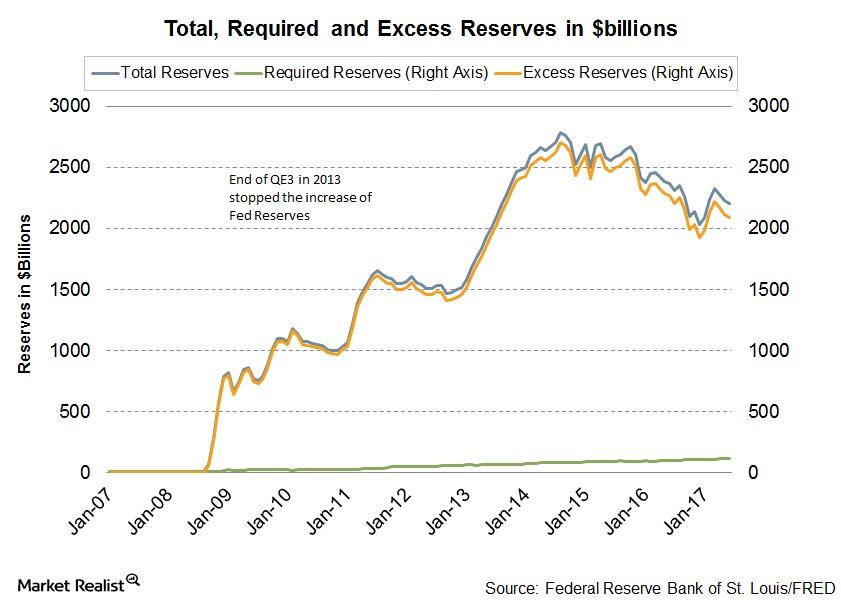

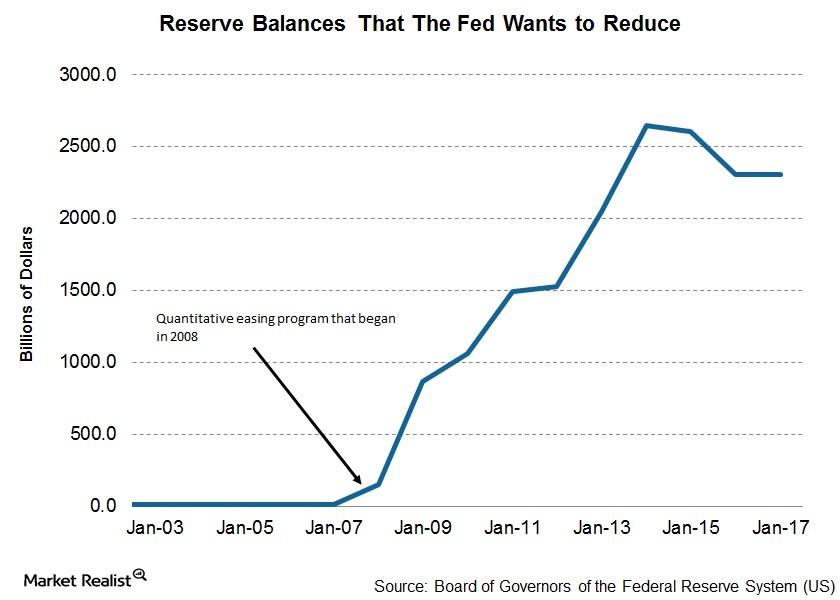

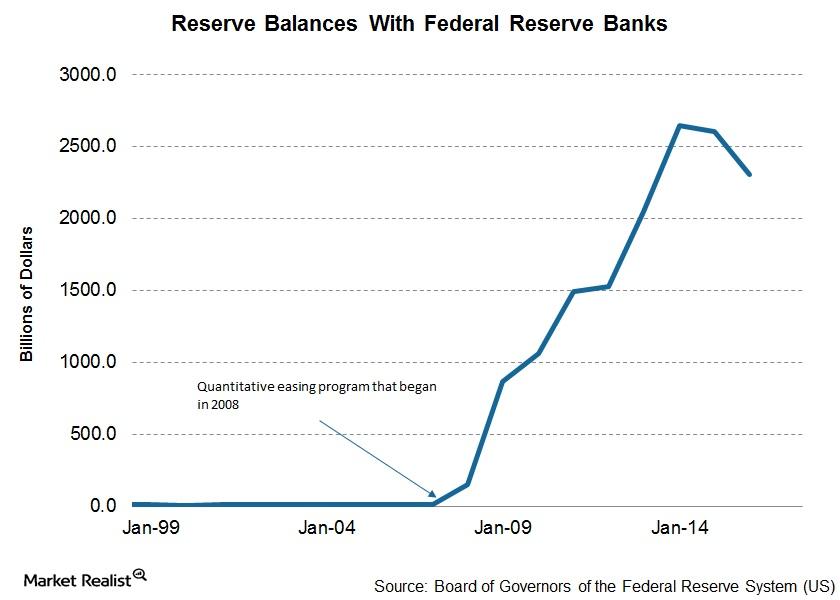

Richard Fisher also discussed the impact of quantitative easing (or QE) on excess reserve balances held by depository institutions at his speech at the London School of Economics on Monday, March 24.

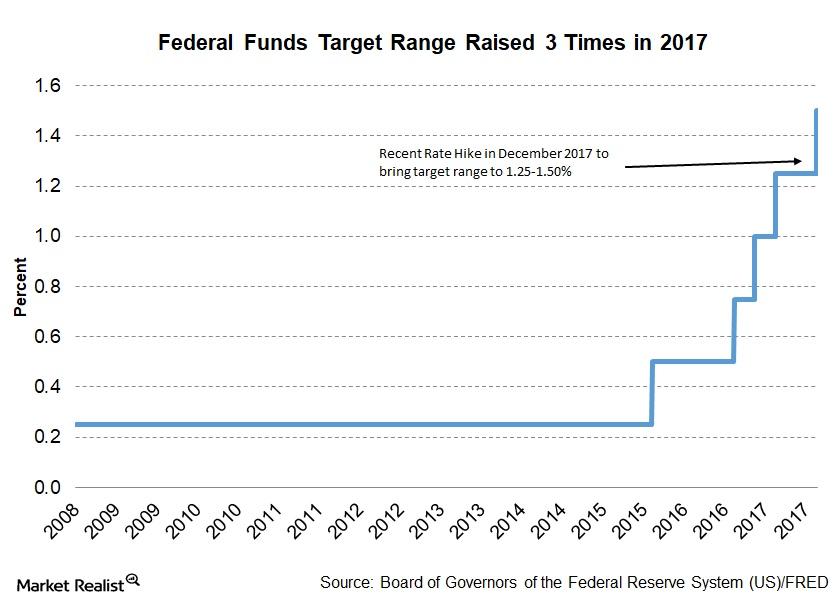

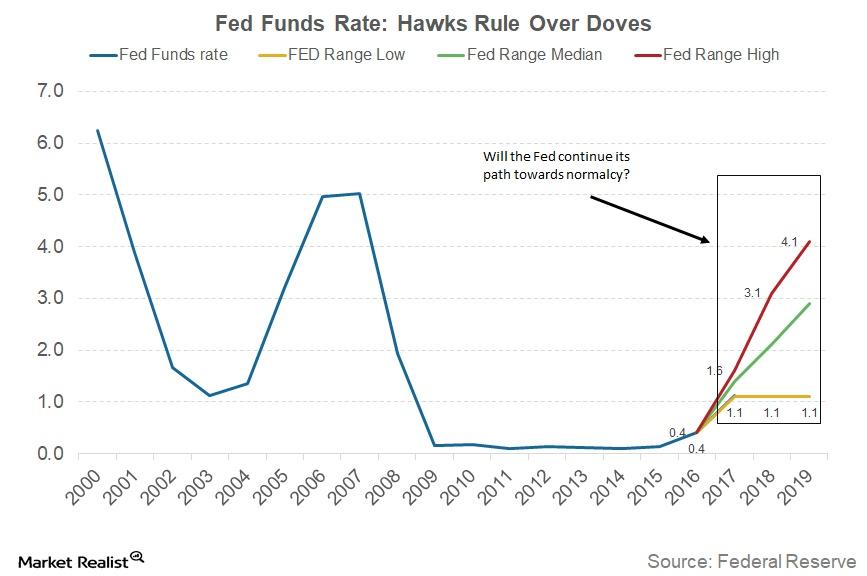

A Double Dose of Tightening from the Fed in 2017

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data.

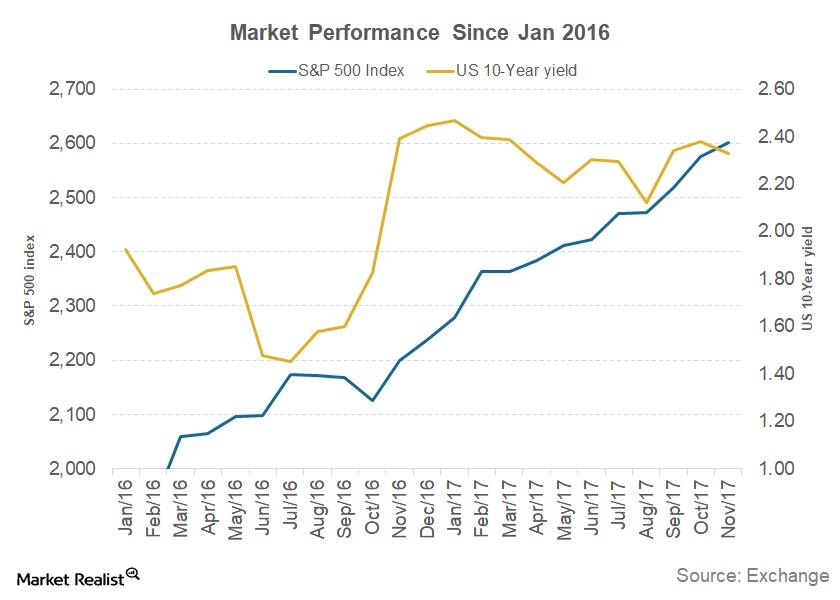

The FOMC’s View of the Equity and Bond Markets

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

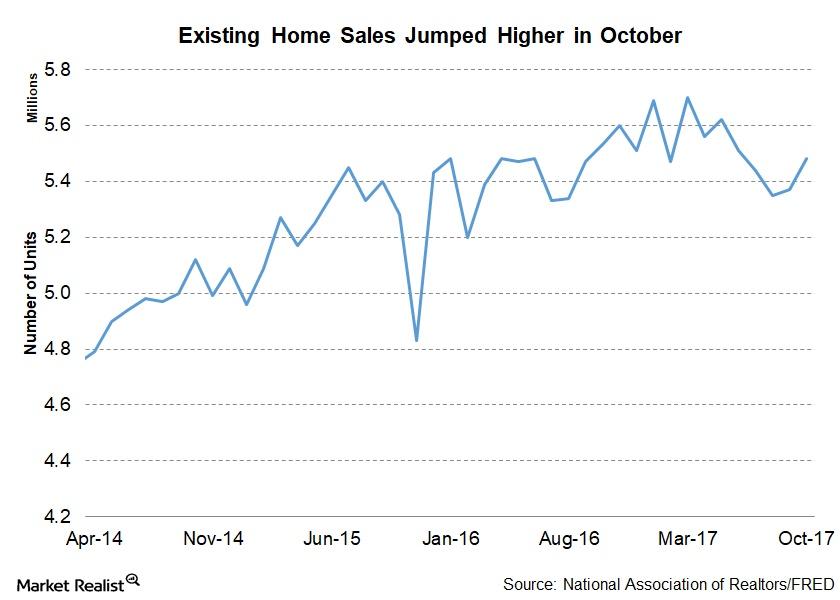

Households Think It’s a Good Time to Buy a Home

According to the latest report from NAR, existing home sales have risen 2% to a seasonally adjusted annual rate of 5.48 million in October.

Key FOMC Insights and the New Fed Chair

The US FOMC left rates unchanged after the November 2017 meeting, as expected, setting the stage for a potential rate hike in December.

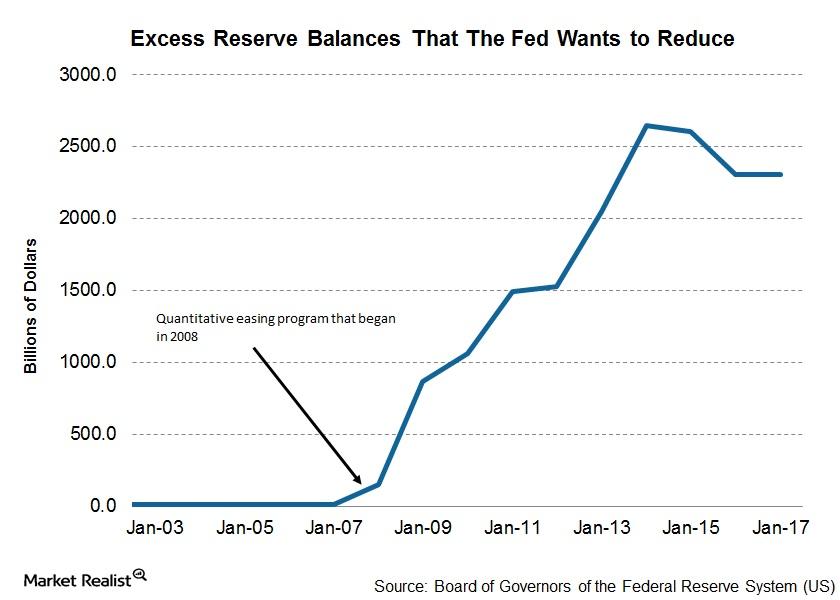

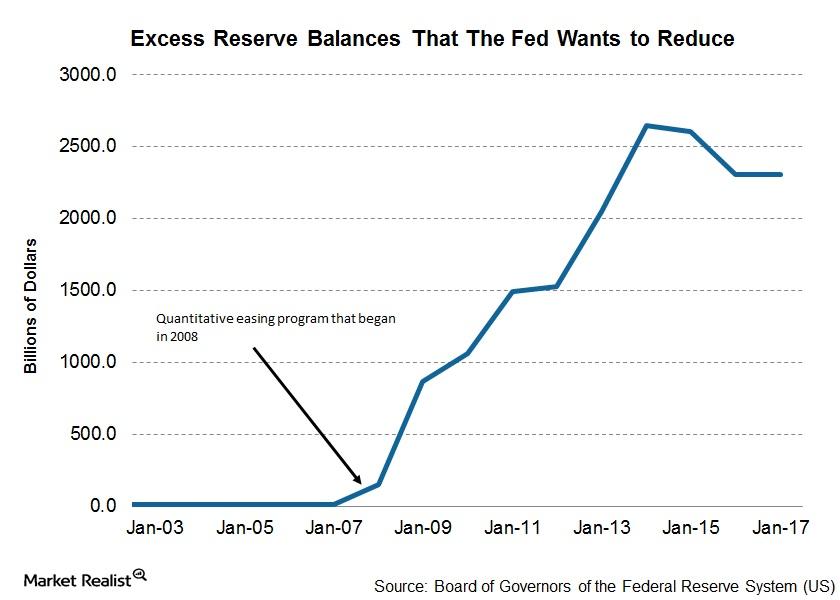

Why the Fed Has Initiated Balance Sheet Normalization

Atlanta Federal Reserve president and CEO, Raphael Bostic, recently spoke at a conference about the Fed’s balance sheet normalization program.

Why FOMC Members Aren’t Worried about the Market Reaction to Balance Sheet Trimming

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual.

Why FOMC’s John Williams Sees No Impact of Balance Sheet Unwinding on Markets

In the long run, Williams said it would be difficult to predict how markets would react to the Fed’s balance sheet unwinding program.

Why Is FOMC Starting to Unwind Its Balance Sheet without a Target?

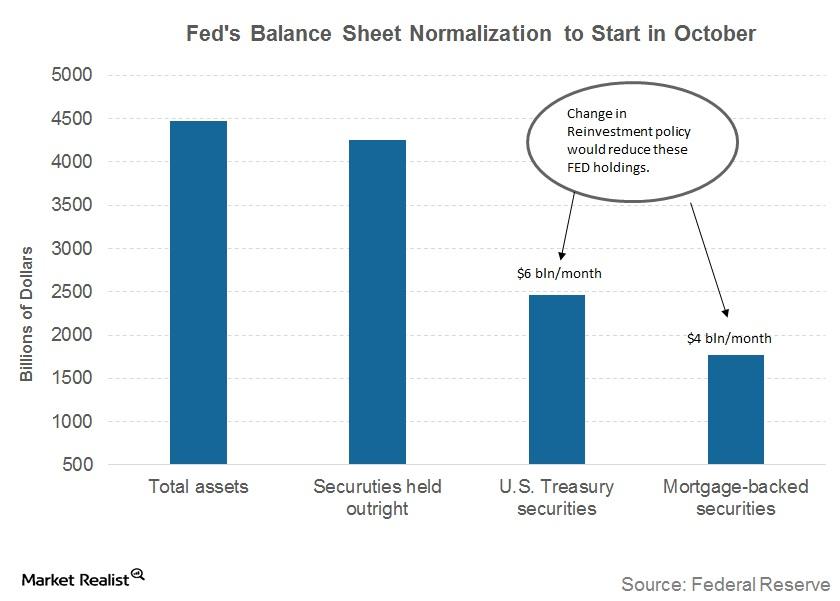

In the September 20 meeting, FOMC (US Federal Open Market Committee) finally announced the start date of its balance sheet unwinding program.

Markets Are Confident on Fed Balance Sheet Trimming Announcement

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008.

Could the Fed Announce Balance Sheet Shrinking in September?

The Fed, in its efforts to normalize policy, announced that it is starting the balance sheet unwinding program soon.

The Fed Could Announce Balance Sheet Reduction Plan in September

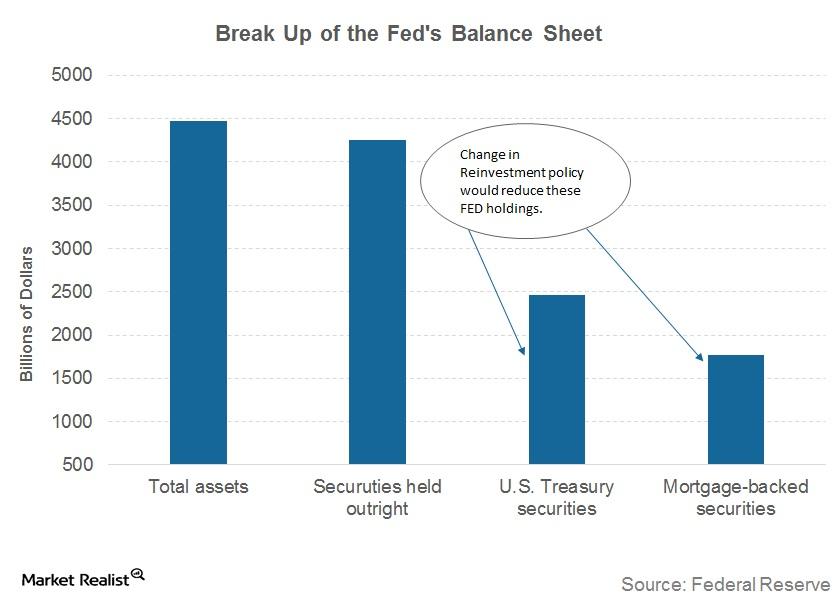

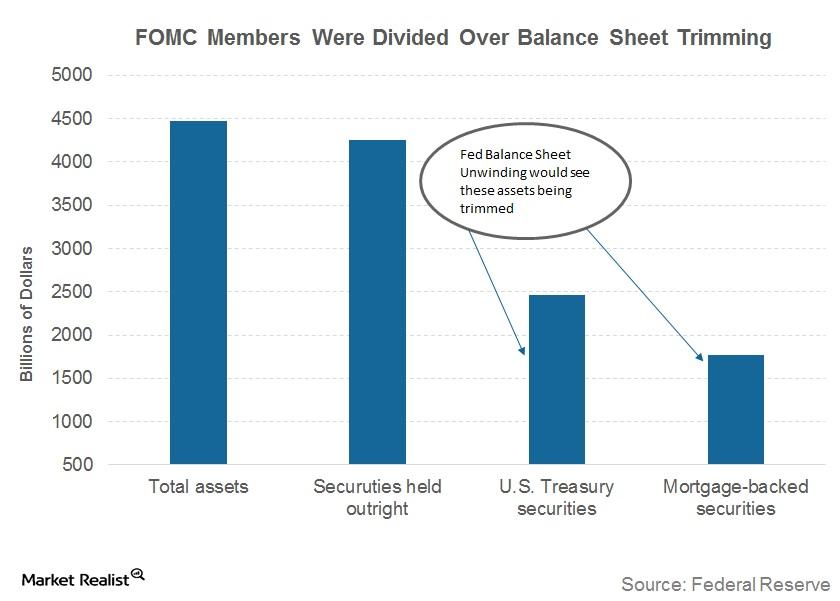

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet.

Will the US Balance Sheet Unwind Affect the Markets?

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

Will Market Shocks Really Be Minimal to Balance Sheet Unwinding?

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet.

Why FOMC Members Were Divided about Balance Sheet Shrinking

The FOMC June meeting minutes that were released on July 5, 2017, indicated that the FOMC members were divided over when to begin shrinking the Fed’s bloated balance sheet.

Fed Chair Yellen Warns about Its $4.5 Trillion Balance Sheet Unwinding

In her post-meeting press conference, Janet Yellen warned that the Fed could implement its balance sheet unwinding process soon if the economy continues to perform as expected.

Your Update on the FOMC March Meeting Minutes

The minutes from the FOMC meeting on March 14 and 15 were reported on April 5 and revealed the tone of the conversation among members to be hawkish.