Why FOMC Members Aren’t Worried about the Market Reaction to Balance Sheet Trimming

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual.

Oct. 16 2017, Updated 9:10 a.m. ET

Balance sheet reduction to start in October

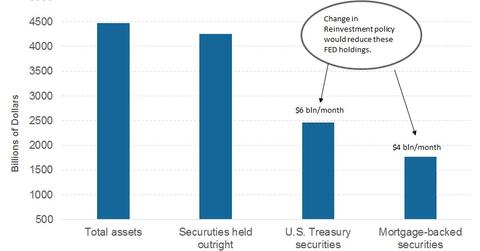

In its September meeting, FOMC (Federal Open Market Committee) members decided to begin the program to shrink its $4.5-trillion balance sheet. The Fed’s balance sheet has grown to its current size as it has purchased fixed income securities as part of its QE (quantitative easing) programs. These extraordinary monetary policy measures were taken up to support and revive the US economy after the financial crisis that began in 2007.

Details of the balance sheet trimming plan

During the QE programs, the Fed inflated its balance sheet from $2.5 trillion to the current size and now plans to slowly offload many securities. There will be gradually rising monthly offloading targets for different types of fixed income (BND) securities.

For US Treasuries (SHY) (IEI), the FOMC expects to let $6 billion to roll off monthly and increase the amount by $6 billion every quarter until it reaches $30 billion per month. For agency debt (MINT) and mortgage-backed securities (MBB), this cap would be $4 billion per month, rising by $4 billion every quarter until a cap of $20 billion per month is reached.

Minimal impact

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual. The members felt that the normalization process, which was outlined in the June FOMC meeting, has been understood by financial markets and the reaction of markets to the balance sheet trimming will likely be limited.